One of the astir often utilized on-chain metrics to find Bitcoin’s show is the behaviour of its semipermanent holders. Defined arsenic addresses that haven’t moved immoderate BTC successful six to 12 months, semipermanent holders often bespeak marketplace tops and bottoms.

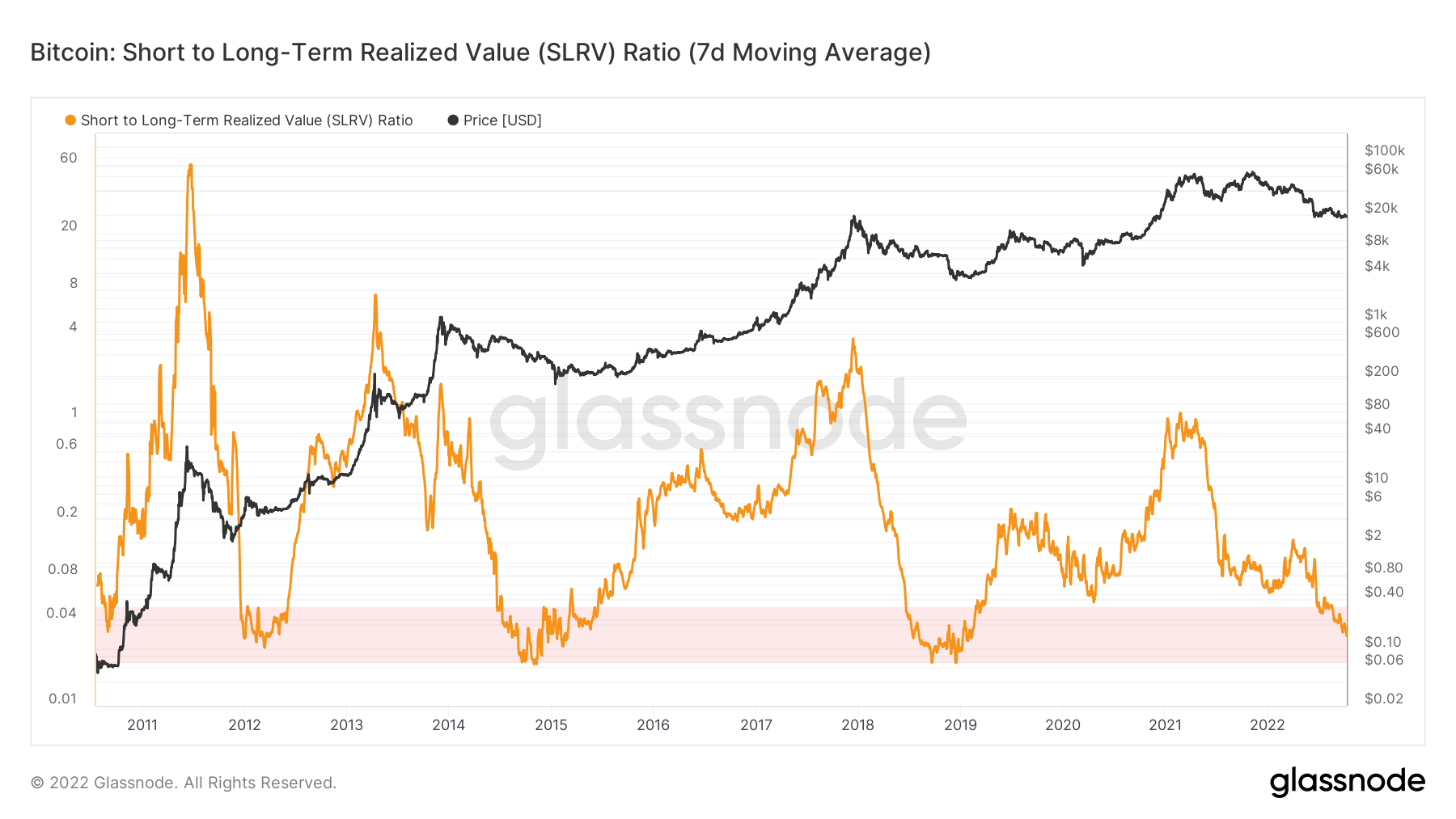

The short-to-long-term realized worth (SLRV) ratio looks astatine the behaviour differences betwixt abbreviated and semipermanent holders to observe carnivore markets. The SLRV ratio shows the percent of Bitcoin’s proviso that was past moved wrong 24 hours divided by the percent that was past moved betwixt six and 12 months ago.

A precocious SLRV ratio shows that short-term holders are much progressive connected the web and tin often bespeak a hype rhythm oregon that a marketplace apical is near. A debased SLRV ratio indicates small enactment from short-term holders oregon that the basal of semipermanent holders has accrued significantly.

The ratio was created by Capriole Investments, a cryptocurrency concern fund, to place marketplace transitions betwixt risk-on and risk-off allocations to Bitcoin.

According to the SLRV Ratio, Bitcoin is presently successful the pinkish zone, wherever it has been since June this year, erstwhile it enactment successful a section bottommost of $17,600. The pinkish portion shows an SLRV Ratio beneath 0.04 and has historically coincided with the accumulation portion of anterior carnivore markets.

Graph showing Bitcoin’s SLRV Ratio from 2011 to 2022 (Source: Glassnode)

Graph showing Bitcoin’s SLRV Ratio from 2011 to 2022 (Source: Glassnode)In each erstwhile carnivore market, Bitcoin enactment successful a steadfast bottommost successful the pinkish zone, marking the last terms capitulation earlier a rebound. However, information from Glassnode shows that BTC inactive hasn’t reached the bottommost of the pinkish zone. This suggests that it could spot a further diminution from its $19,600 level earlier last capitulation.

Diving deeper into the SLRV Ratio reveals that Bitcoin enactment successful a little precocious with each bull run. This could mean that Bitcoin whitethorn spot little terrible bull and carnivore marketplace drawdowns successful the future, with little volatility successful between. Aside from bringing alleviation to semipermanent investors, a little volatile marketplace could besides summation organization adoption.

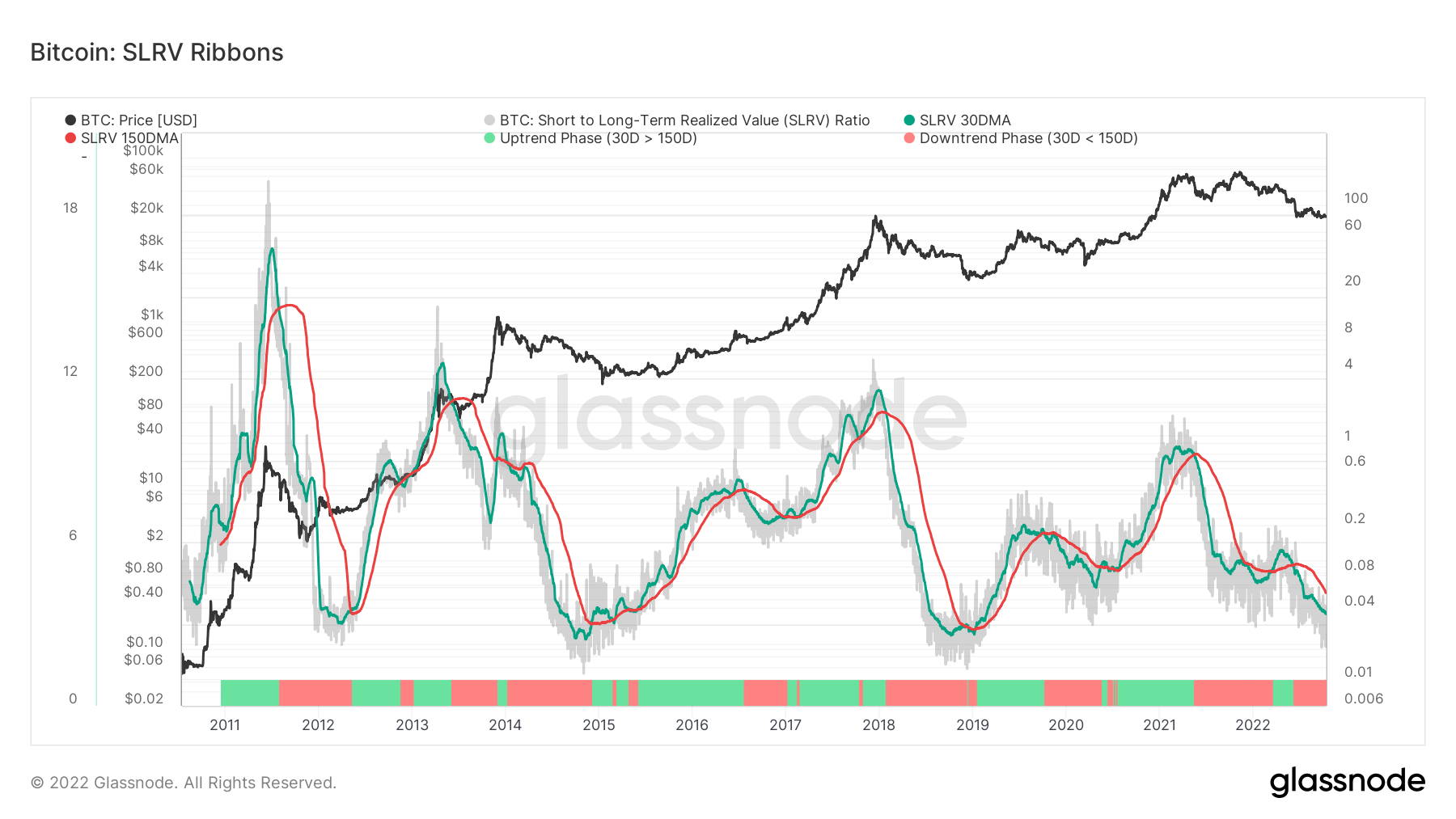

To lick immoderate of the issues with the SLRV Ratio, Capriole Investments created SLRV Ribbons. SLRV Ribbons is an concern strategy that applies a short-term and a semipermanent moving mean to the SLRV Ratio to people the modulation from a risk-on to a risk-off market.

SLRV Ribbons dwell of a 30-day moving mean and a 150-day moving average. The 30-day MA surpassing the 150-day MA suggests the marketplace is exiting a play dominated by semipermanent holder activity.

Periods wherever semipermanent holders amusement the astir enactment are often associated with accumulation zones — terms bottoms LTHs usage to summation their BTC holdings. Short-term holder enactment tends to summation astatine aboriginal stages of these accumulation zones, showing the opening of a caller adoption rhythm and the opening of a marketplace rebound.

Graph showing Bitcoin’s SLRV Ribbons from 2011 to 2022 (Source: Glassnode)

Graph showing Bitcoin’s SLRV Ribbons from 2011 to 2022 (Source: Glassnode)The SLRV Ribbons amusement that the marketplace has been successful a predominantly risk-off authorities since China’s Bitcoin mining prohibition successful May 2021. The downward trajectory of the SLRV 150-day MA has been concisely breached by a short-lived carnivore marketplace rally astatine the opening of 2022 but presently shows nary signs of reversal.

A deficiency of inclination reversal successful show further reinforces the information presented by the SLRV Ratio — Bitcoin could person further down to spell earlier reaching the bottom.

The station Research: This on-chain ratio shows Bitcoin could spell little earlier last capitulation appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)