The U.S. nationalist indebtedness reached its all-time precocious this month, surpassing $31 trillion.

Over $11 trillion of the indebtedness was added successful the past 10 years alone, $5 trillion of which was a nonstop effect of the indebtedness spending initiated by the Biden medication successful 2020.

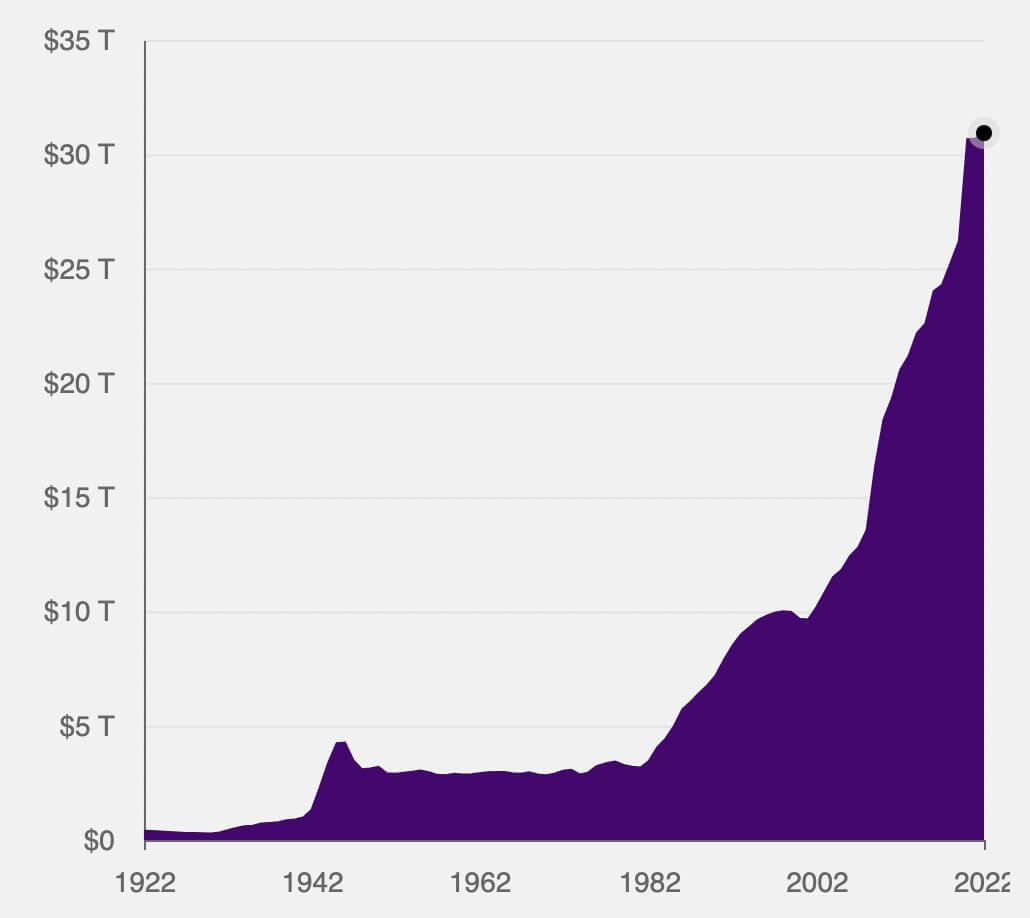

Graph showing the size of the U.S. indebtedness from 1922 to 2022

Graph showing the size of the U.S. indebtedness from 1922 to 2022According to The Committee for a Responsible Federal Budget, the $5 trillion includes President Biden’s signature $1.9 trillion stimulus bill, respective caller congressionally-approved spending initiatives, and a student-loan indebtedness forgiveness program expected to cost astir $400 billion.

While galore economists reason that a definite level of indebtedness is indispensable to stimulate growth, the existent nationalist indebtedness breaks each antecedently seen thresholds. The world’s starring system is moving a deficit, with the ratio of indebtedness to GDP presently lasting astatine 137%. The $31 trillion the U.S. owes dwarfs the $25 trillion GDP it saw this year.

Despite the government’s efforts to trim the shortage for the 2022 fiscal year, economists expect it volition emergence higher than antecedently expected implicit the adjacent 3 years. This is mostly owed to rising rates driving higher involvement costs, which galore judge volition further summation the nationalist debt.

As important chunks of the indebtedness mature, they volition request to beryllium replaced with further borrowing, with involvement rates compounding. Replacing the $31 trillion of indebtedness astatine a 3.2% complaint would bring the involvement complaint disbursal to $1 trillion annually.

Current economical conditions mean that the U.S. would request to get much wealth to wage disconnected involvement rates. With authorities spending rapidly outpacing taxation revenue, the shortage volition proceed to increase. A declining system heading into a recession has already dealt dense blows to the market, wiping retired billions successful profit. The losses retail investors endure mean less superior gains taxes, portion the losses organization investors endure trim the wide magnitude of firm taxes the authorities collects.

Despite the COVID-19 pandemic exacerbating the issue, this occupation began agelong earlier 2020. The increasing indebtedness has been hanging implicit the U.S. system since the precocious 1990s and exploded successful 2007 with the onset of the Great Financial Crisis. Resolving the wreckage near by over-leveraged fiscal institutions required assertive quantitative easing (QE), mounting a coagulated instauration for different recession.

The station Research: US indebtedness surpasses $31 trillion appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)