After a brutal series of events led to the illness of respective crypto-related firms successful 2022, FTX’s bankruptcy dealt a monolithic stroke to nationalist spot successful centralized crypto entities.

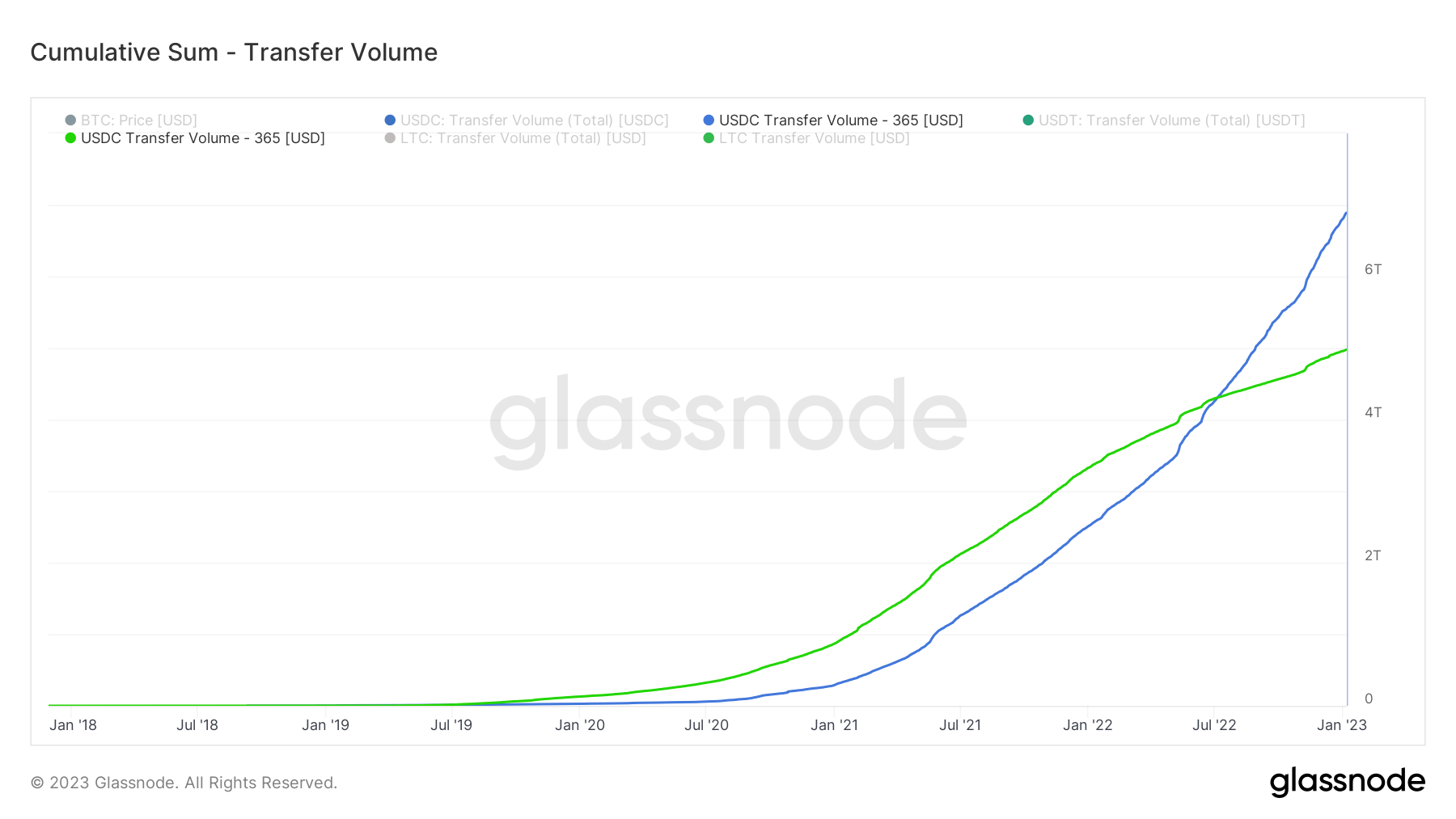

During this play of heightened marketplace volatility, crypto investors preferred Circle’s USD Coin (USDC) to Tether’s USDT. According to Glassnode’s data, portion USDT is the largest stablecoin by marketplace cap, USDC has much transportation volume.

According to the data, USDC has a transportation measurement of $15 billion, portion USDT’s measurement is $3 billion. Cumulatively, USDC outpaces USDT by $7 trillion.

Source: Glassnode

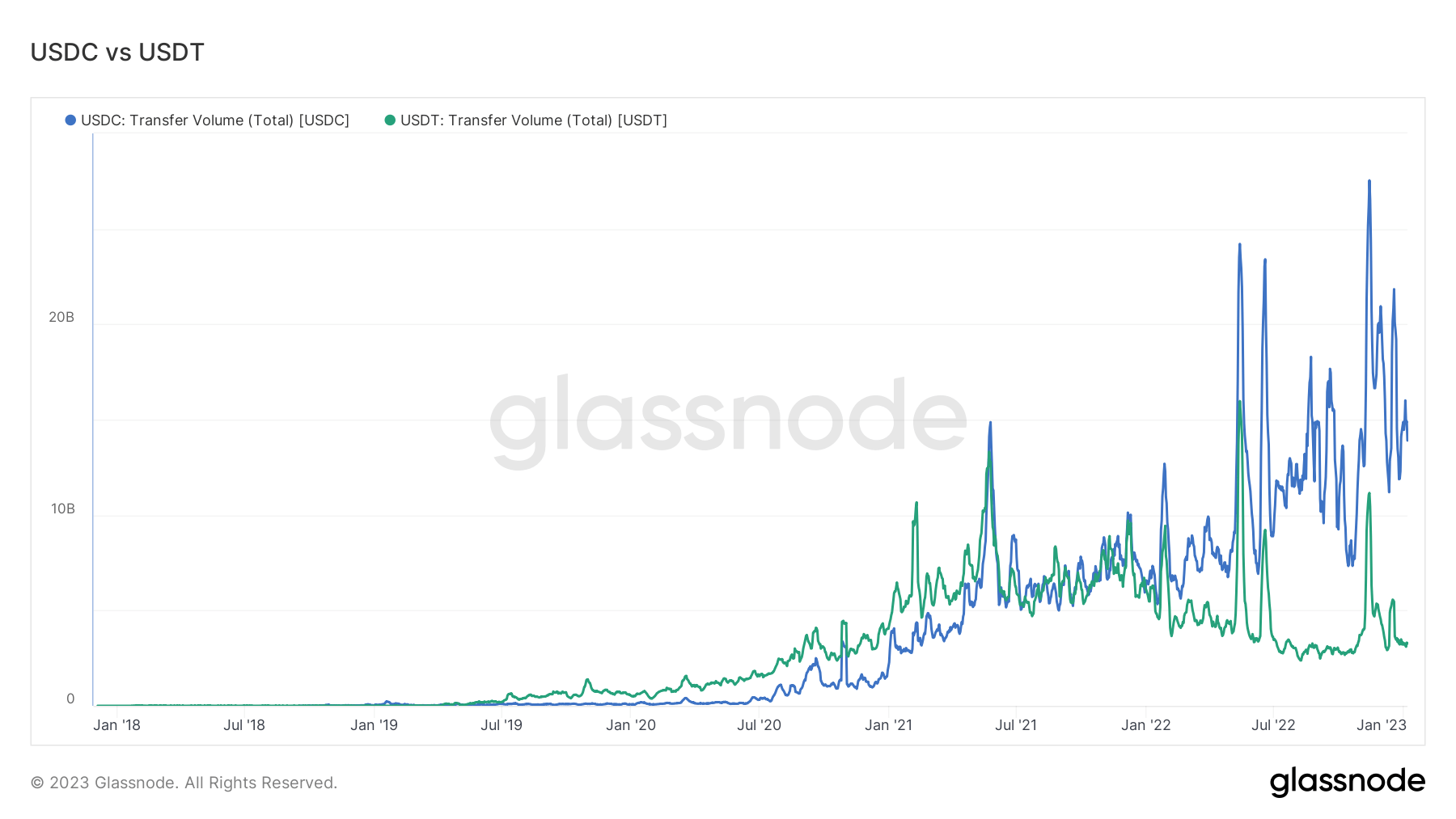

Source: GlassnodeMeanwhile, the Glassnode illustration beneath shows that the disparity successful transportation measurement was not ever similar this. USDT’s measurement outperformed that of USDC successful 2020 and aboriginal 2021. But that changed successful 2022 erstwhile the Circle-backed stablecoin’s measurement started growing.

Source: Glassnode

Source: GlassnodeAt the time, USDT began to look accrued regulatory scrutiny astir its reserves coupled with Terra’s LUNA collapse, which birthed fears of whether the stablecoin wouldn’t suffer its Dollar peg.

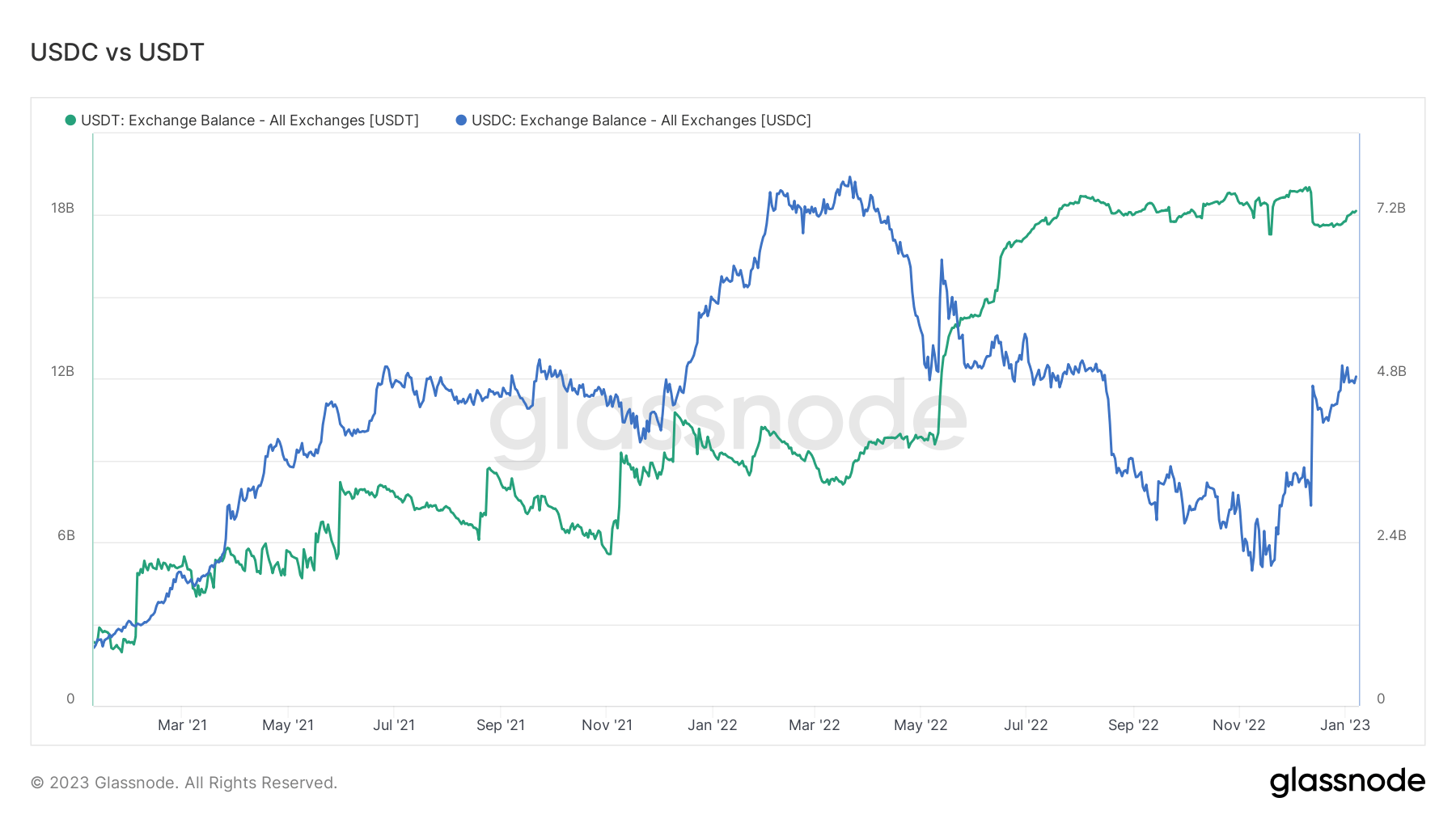

USDC’s equilibrium connected exchanges scope $5 billion

In presumption of speech balances, Glassnode information shows that USDC is opening to bask much adoption post-FTX collapse. According to the data, the USDC connected exchanges is approaching $5 billion.

Previously, USDC’s adoption successful 2022 had declined acknowledgment to Binance’s determination to person its users’ balances successful USDC and different stablecoins to its BUSD. However, with the FTX illness birthing FUD that led to grounds withdrawals from Binance, USDC’s adoption began to spot an uptrend towards the extremity of the year.

Besides that, Coinbase besides urged its users to person their USDT to USDC for free.

On the different hand, USDT’s equilibrium connected exchanges stayed level passim the play –it adjacent saw a flimsy diminution successful aboriginal January 2023.

Post FTX’s crash, USDT has seen much questions raised astir its reserves, with respective hedge funds shorting the stablecoin. However, its issuer said Tether would proceed to amusement resilience adjacent successful the look of uncertainty.

With 2023 acceptable to beryllium a risk-off year, the marketplace could apt spot further maturation among stablecoins. This could acceptable the signifier for a combat for dominance betwixt USDT and USDC.

The station Research: USDC adoption grows post-FTX collapse; USDT remains flat appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)