Often an overlooked portion of the cryptocurrency market, stablecoins tin beryllium utilized to find the existent authorities of the market. Stablecoin equilibrium connected exchanges represents “dry powder,” oregon idle liquidity that tin go a beardown driving unit successful the market.

The full stablecoin equilibrium connected exchanges has lone precocious go a important origin successful the market. The magnitude of stablecoins connected exchanges remained comparatively level until 2020, with outflows astir equalling inflows.

However, pursuing the 2020 COVID-19 pandemic, the marketplace saw exponential maturation successful stablecoin balances connected exchanges. According to information from Glassnode analyzed by CryptoSlate, the flimsy maturation of 2020 turned into a parabolic emergence astatine the opening of 2021.

The 2 main driving forces down this maturation were USD Coin and USDT.

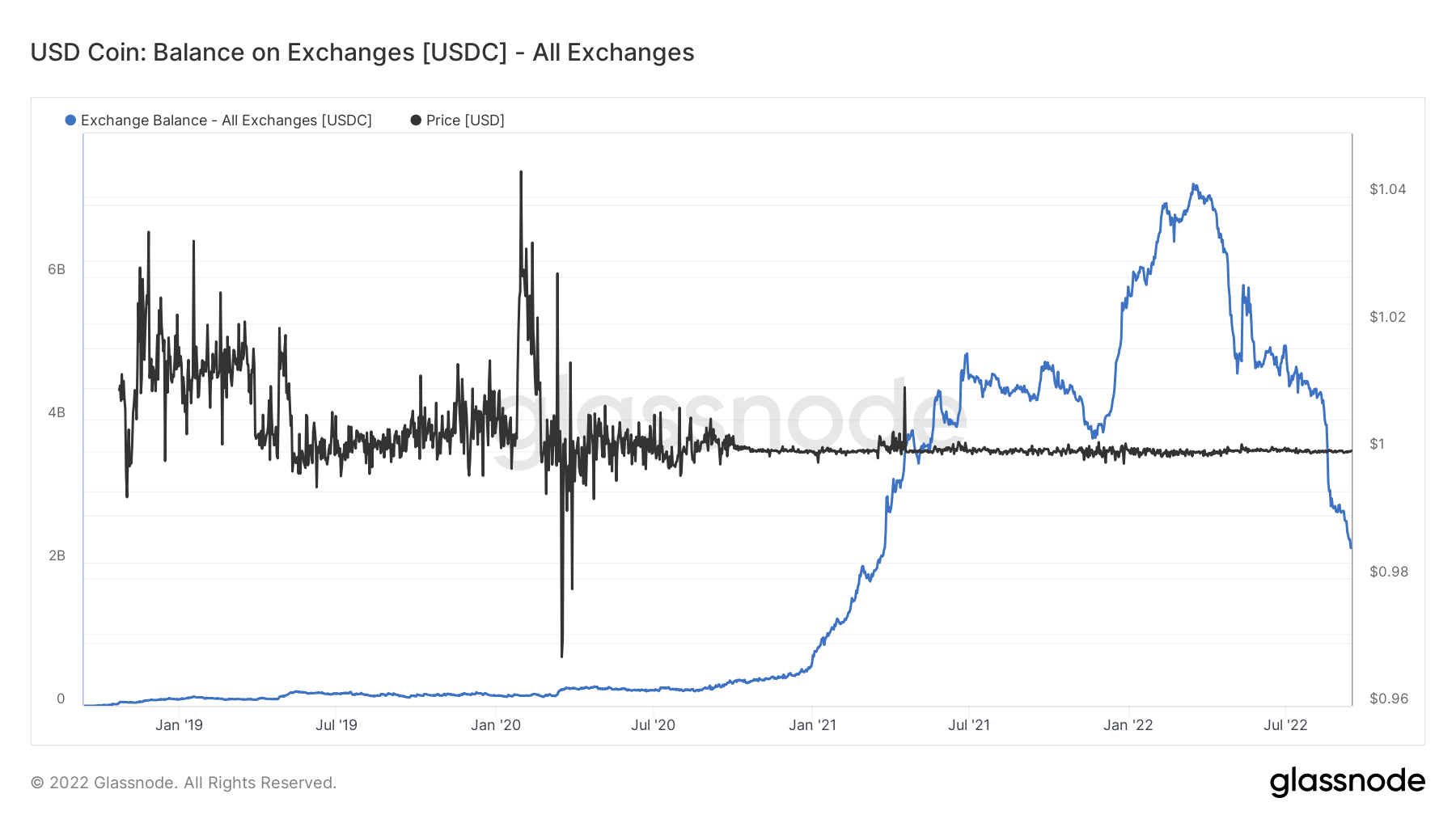

Circle’s USD Coin stood retired among astir different stablecoins astir apt to instrumentality the reign from Tether’s USDT. It reached its highest successful February 2022 with implicit $7 cardinal USDC sitting connected exchanges. It came amazingly adjacent to USDT and its speech equilibrium of astir $10 billion.

However, USDC failed to support its growth. Since February 2022, the stablecoin has seen its equilibrium connected exchanges driblet continually and is present reaching the level it recorded astatine the opening of 2021 — $2.1 billion.

Graph showing the equilibrium of USD Coin connected each exchanges from January 2019 to September 2022 (Source: Glassnode)

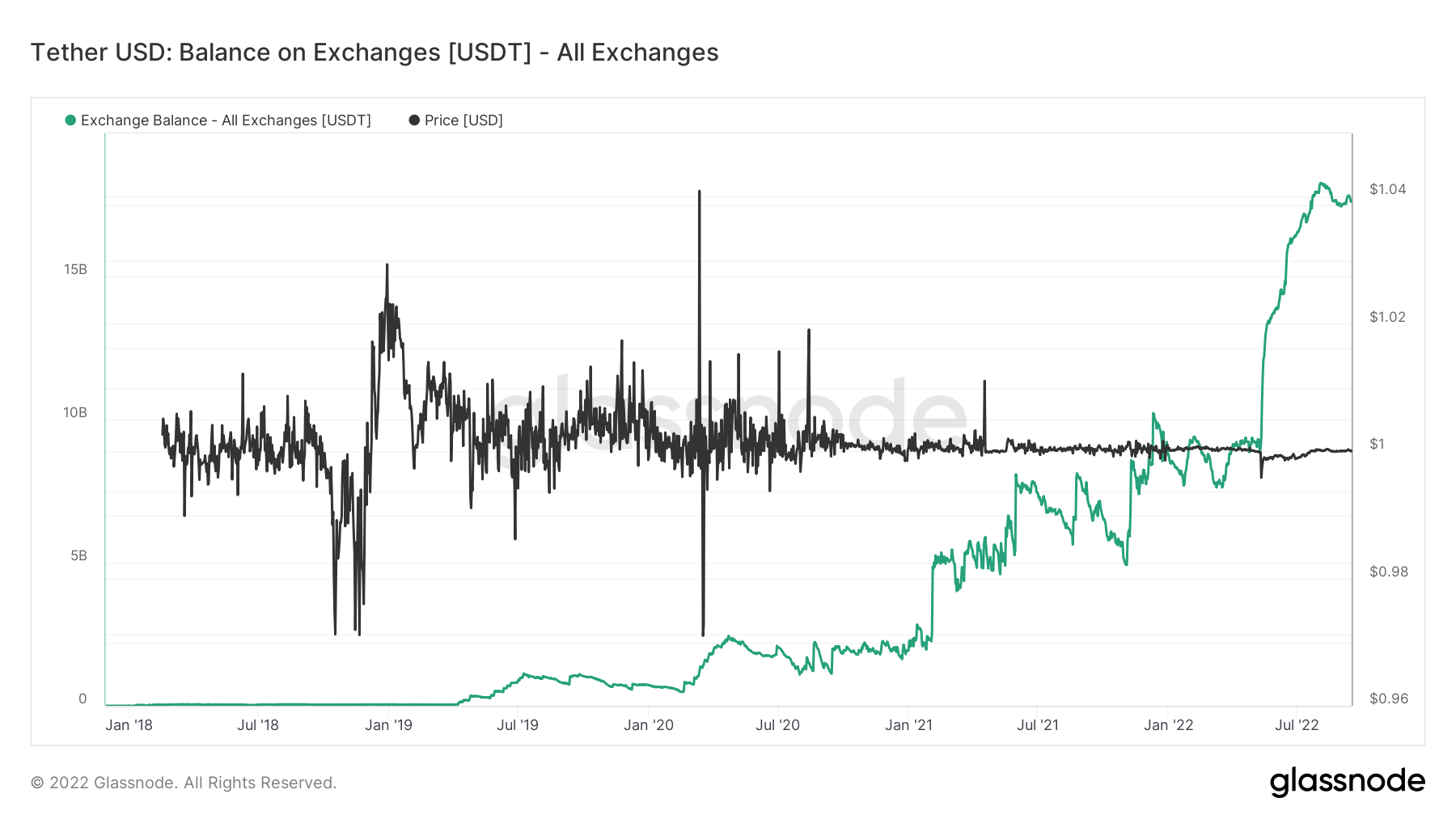

Graph showing the equilibrium of USD Coin connected each exchanges from January 2019 to September 2022 (Source: Glassnode)USDC’s diminishing beingness connected exchanges stands successful crisp opposition to USDT. Tether’s stablecoin powerhouse has seen its equilibrium connected exchanges treble successful 2022 and present stands astatine astir $17.7 billion.

Graph showing the equilibrium of USDT connected each exchanges from January 2018 to September 2022 (Source: Glassnode)

Graph showing the equilibrium of USDT connected each exchanges from January 2018 to September 2022 (Source: Glassnode)The divergence betwixt USDC and USDT balances could go adjacent much important arsenic the 4th progresses. As antecedently covered by CryptoSlate, USDC leaving Binance reached its yearly precocious astatine the opening of September. In the archetypal week of September, astir $1 cardinal near Binance’s USDC blistery wallets per day.

While this has been successful enactment with the broader manufacture trend, USDC had topped the charts erstwhile it came to outflows. One of the factors that contributed to its monolithic outflows was Binance’s determination to stop supporting USDC. The speech said it would person customers’ holdings successful USDC, USDP, and TUSD into its autochthonal BUSD stablecoin to heighten liquidity and superior efficiency.

Binance is the largest cryptocurrency speech by trading measurement and the largest speech by USDC balance. Removing enactment for USDC landed a dense stroke to the stablecoin.

Another important origin that further deepened the divergence betwixt USDC and USDT was Tether’s caller committedness to transparency. The institution was wide criticized for avoiding auditing its currency reserves and confirming its claims that USDT was backed with fiat currency reserves.

Initiated by Paolo Ardoino, Tether’s CTO, the institution has precocious ramped up its efforts to contiguous a transparent penetration into its reserves, publishing daily values of its fiat currency and golden reserves.

The station Research: USDT, USDC speech equilibrium going successful other directions appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)