Bitcoin (BTC) whales person been selling their assets aggressively portion retail investors person been accumulating the coins simultaneously passim 2022.

Bitcoin whales are defined arsenic holders with much than 1,000 BTC, portion retail traders are holders with 1 BTC oregon less.

CryptoSlate’s erstwhile probe highlighted that retail investors’ BTC holdings since 2018 person doubled to 3 cardinal from 1.5 million. On the different hand, whales person seen their BTC holdings diminution from astir 10 cardinal to 9 cardinal wrong the aforesaid clip frame.

Is this bullish oregon bearish for the market?

Several marketplace analysts clasp divergent views connected what this means for Bitcoin. However, astir hold that whale selling usually suggests a bearish motion for the BTC’s price.

In astir cases, the actions of these holders greatly power the price. Since whales person the astir supply, their dumping increases the disposable proviso and shows a diminution successful their condemnation which could power others to exit their positions.

Meanwhile, determination is besides an upside to this, which is simply a much distributed Bitcoin network. When much radical clasp BTC, the plus is much resistant to the actions of whale investors. Maartunn said this script was perfect, but achieving it could instrumentality a agelong time.

Another expert Seth Michael Steele said:

“Whales are selling, but retail is buying!!! Seems backwards but this volition beryllium bully for much organisation among investors. Bitcoin shrimp picking up slack for whales is beauteous to watch!”

Meanwhile, the caller sell-offs and accumulation could signify that Bitcoin is adjacent the bottommost of this carnivore marketplace cycle. Usually, erstwhile tiny entities are much progressive successful accumulation than tiny entities, the bottommost is near.

Source: Glassnode

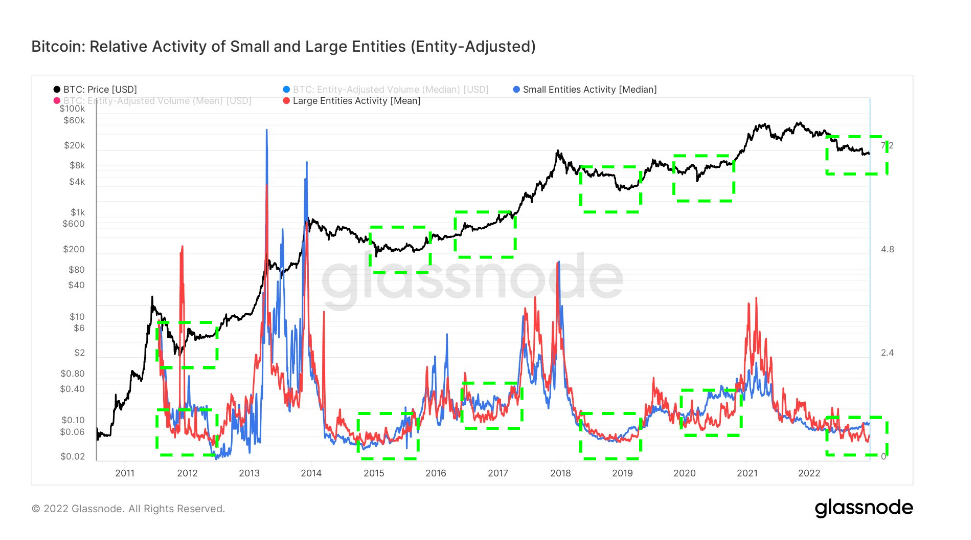

Source: GlassnodeCryptoSlate’s investigation of Glassnode’s comparative enactment of tiny and large-scale entities since 2012 showed that the marketplace bottoms whenever retail enactment outstrips whale activity. According to the supra chart, this played retired successful 2012, 2015, 2017, 2019, and 2020.

In each of the highlighted cases, retail investors accrued enactment marked the marketplace bottommost — the illustration shows that the aforesaid signifier has begun to repetition itself successful 2022.

The station Research: What does retail investors assertive Bitcoin acquisition mean for the market? appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)