Inflation has go 1 of the astir pressing planetary economical issues today. Rising prices person drastically reduced some the wide wealthiness and the purchasing powerfulness of a immense chunk of the developed world.

And portion ostentation surely is 1 of the biggest drivers of economical crisis, a bigger information looms astir the country — stagflation.

Stagflation and its effect connected the market

First coined successful 1965, the word stagflation describes an economical rhythm with a persistently precocious ostentation complaint combined with precocious unemployment and stagnant request successful a country’s economy. The word was popularized successful the 1970s arsenic the U.S. entered into a prolonged lipid crisis.

Since the 1970s, stagflation has been a repeating occurrence successful the developed world. Many economists and analysts judge that the U.S. is astir to participate a play of stagflation successful 2022, arsenic ostentation and a rising unemployment complaint go progressively hard to tackle.

One of the ways stagflation tin beryllium measured is done existent rates — involvement rates adjusted for inflation. Looking astatine existent rates shows the existent output and existent returns connected assets, revealing the existent absorption of the economy.

According to the U.S. Bureau of Labor Statistics, the user terms scale (CPI) recorded an ostentation complaint of 8.5% successful July. The July CPI posted an summation of conscionable 1.3% from its May numbers, prompting galore policymakers to disregard the severity of the existent ostentation rate.

However, existent rates overgarment a overmuch antithetic picture.

The 10-year U.S. Treasury output presently stands astatine 2.8%. With ostentation astatine 8.5%, the existent output connected owning U.S. Treasury bills is 5.7%.

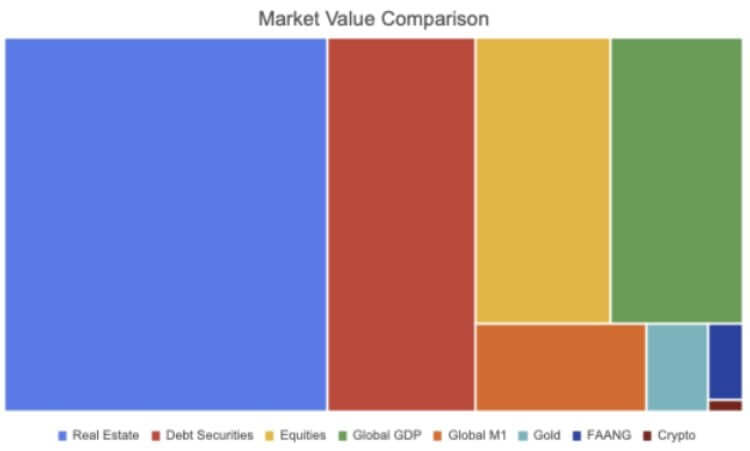

As of 2021, the size of the planetary enslaved marketplace is estimated to beryllium astir $119 trillion. According to the Securities Industry and Financial Markets Association (SIFMA), astir $46 trillion of that comes from the U.S. market. All of the fixed-income marketplace SFIMA tracks, which see mortgage-backed securities (MBS), firm bonds, municipal securities, national bureau securities, asset-backed securities (ABS), and wealth markets, presently person negative returns erstwhile adjusted for inflation.

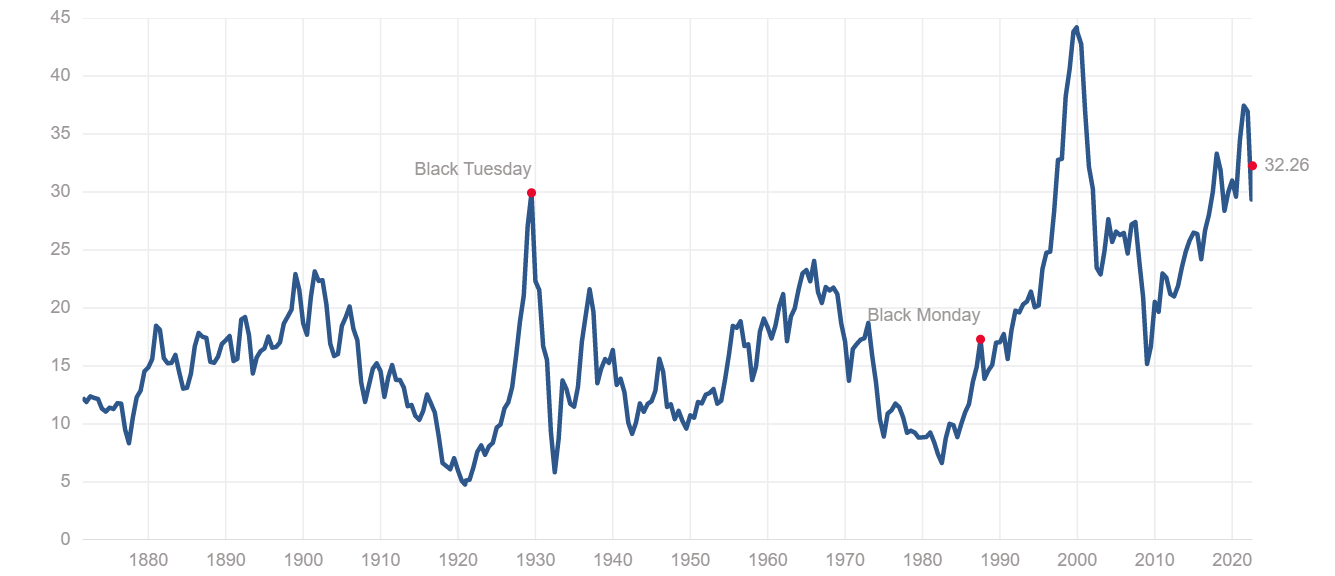

The S&P 500 scale besides falls successful the aforesaid category. The Shiller price-to-earnings (P/E) ratio puts the S&P scale successful the hugely overvalued category. The ratio shows the S&P index’s inflation-adjusted net for the erstwhile 10 years and is utilized to measurement the banal market’s wide performance. The existent Shiller P/E ratio of 32.26 is considerably higher than the levels recorded up of the fiscal situation successful 2008 and is connected par with the Great Depression successful the precocious 1920s.

Graph showing the Shiller P/E ratio from 1880 to 2022

Graph showing the Shiller P/E ratio from 1880 to 2022The existent property marketplace has besides recovered itself struggling. In 2020, the worth of the planetary existent property marketplace reached $326.5 trillion — a 5% summation from its 2019 worth and a grounds high.

An expanding colonisation that’s fueling a lodging shortage was expected to propulsion this fig adjacent higher this year. In the U.S., involvement rates person been pegged to astir zero since the 2008 fiscal crisis, making mortgages inexpensive and expanding lodging income crossed the country.

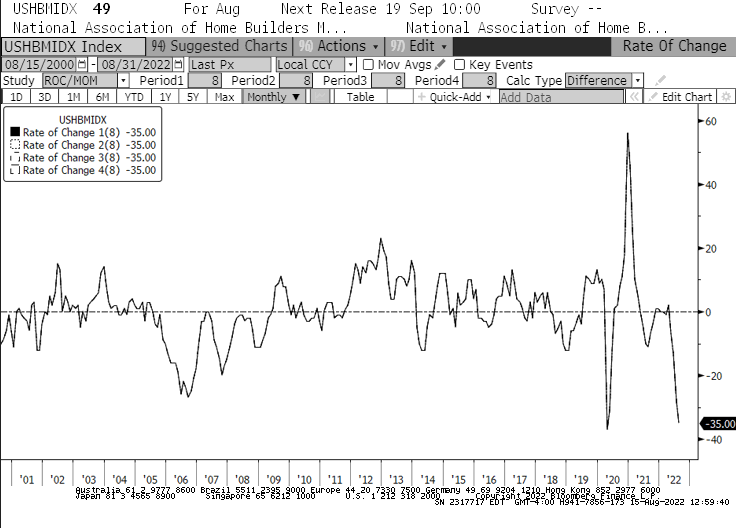

The emergence successful involvement rates we’ve seen since the opening of the twelvemonth is acceptable to alteration this. From January, the National Association of Home Builders (NAHB) lodging marketplace scale saw its fastest -35 diminution successful history. The driblet recorded successful the scale was faster than successful 2008 erstwhile the lodging bubble abruptly burst. This is besides the longest monthly diminution the NAHB scale has seen, arsenic August marked its 8th consecutive period of diminution for the archetypal clip since 2007.

Graph showing the U.S. NAHB Housing Market Index from 2001 to 2022

Graph showing the U.S. NAHB Housing Market Index from 2001 to 2022With astir each conception of the marketplace posting declines, we could spot a important fig of institutions and plus managers reconsidering their portfolios. Overvalued property, overbought equities, and antagonistic existent output bonds are each heading into a stagflationary play that could past up to respective years.

Large institutions, plus managers, and hedge funds could each beryllium forced to marque a pugnacious prime — enactment successful the market, upwind the storm, and hazard some abbreviated and semipermanent losses, oregon rebalance their portfolios with divers assets that person a amended accidental of increasing successful a stagflationary market.

Chart comparing the worth of assorted markets

Chart comparing the worth of assorted marketsEven if conscionable immoderate organization players determine to instrumentality the second route, we could spot an expanding magnitude of wealth flowing into Bitcoin (BTC). The crypto manufacture has seen unprecedented growth successful organization adoption, with assets different than conscionable Bitcoin becoming an integral portion of galore ample concern portfolios.

However, arsenic the largest and astir liquid crypto asset, Bitcoin could beryllium the people of the bulk of those investments.

The station Research: What happens to our assets successful a stagflationary environment? Will astute wealth yet determination into BTC? appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)