Assessing the wellness of the crypto marketplace requires looking astatine much than conscionable Bitcoin’s price.

Looking astatine the percent of Bitcoin holders that are successful profit, meaning they bought BTC astatine a terms little than its existent spot price, is simply a coagulated indicator of aboriginal movements.

Holders that saw their BTC summation successful worth are much apt to sell, which could effect successful a marketplace swing. Those whose holdings person depreciated successful worth are much apt to clasp their assets, starring to buying pressure.

Called realized price, this metric has historically been a coagulated but not an infallible indicator for marketplace movements.

Another mode to attack the realized terms is to absorption connected speech withdrawals. Namely, looking astatine the mean terms astatine which Bitcoin was withdrawn from exchanges provides a overmuch much reliable estimation of a market-wide outgo ground for BTC.

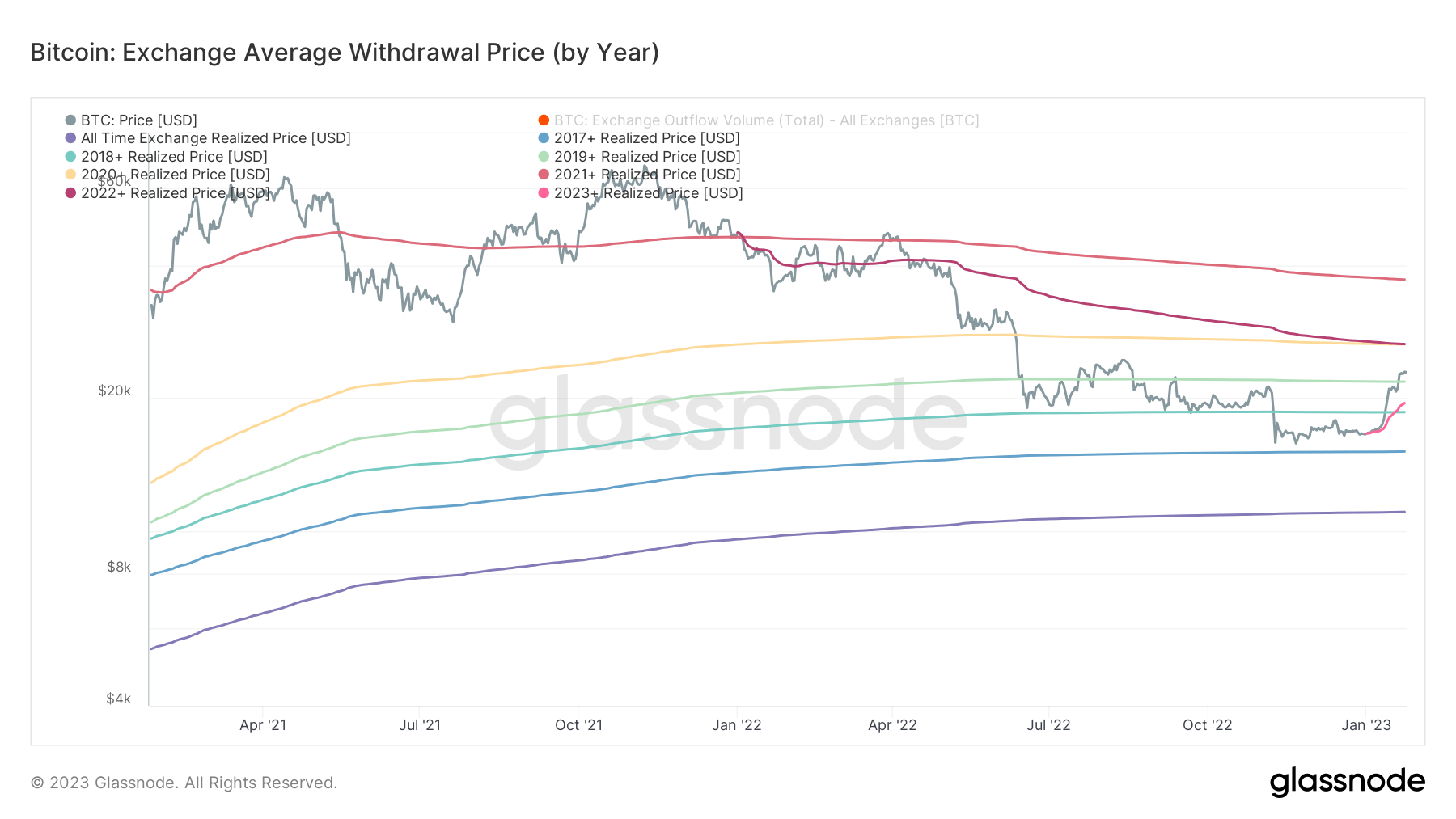

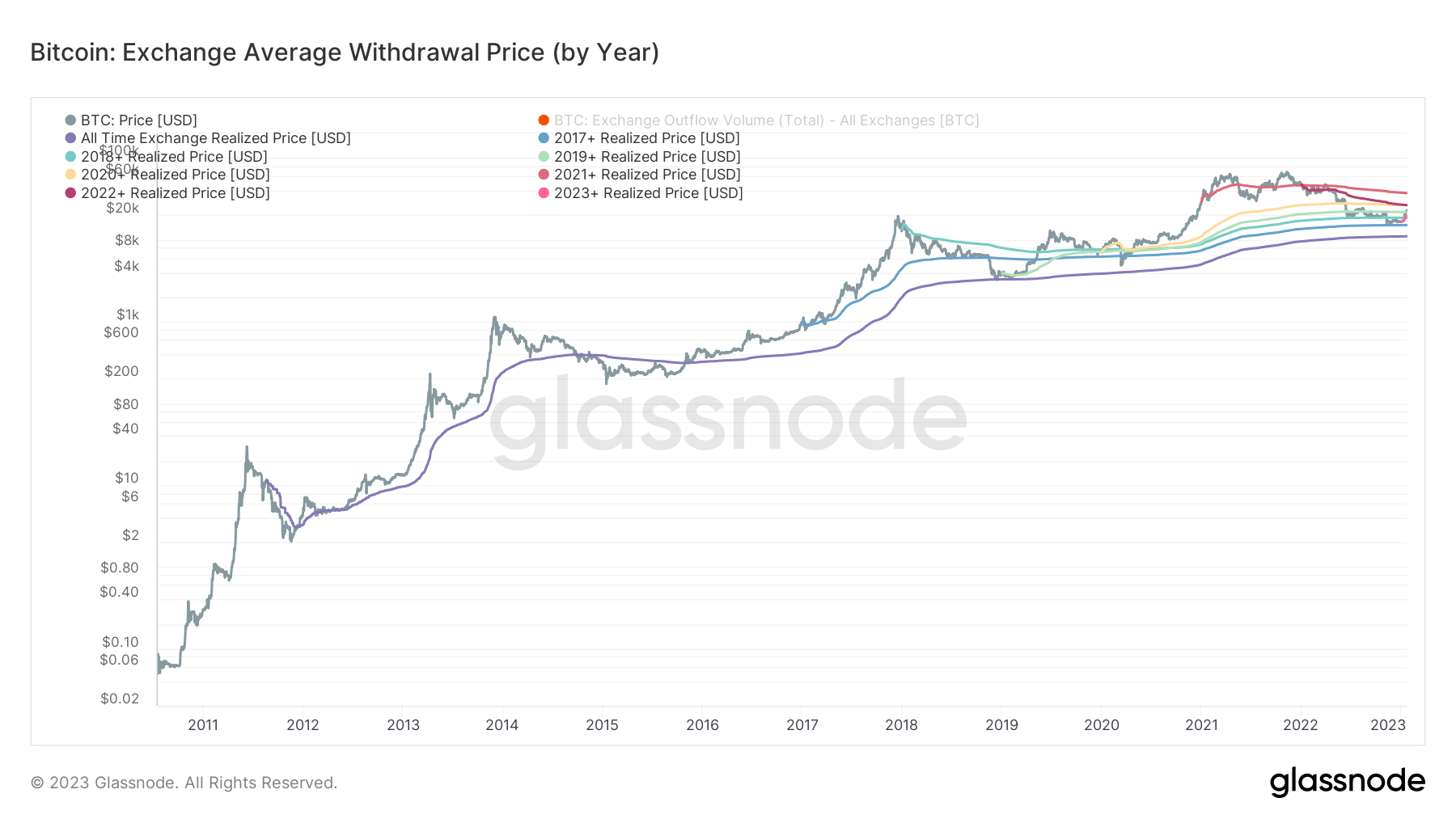

CryptoSlate investigation looked astatine the mean withdrawal prices for each twelvemonth from 2017 to 2023 and the mean withdrawal terms from 2011 to 2022.

Graph showing the speech mean withdrawal terms for Bitcoin by twelvemonth (Source: Glassnode)

Graph showing the speech mean withdrawal terms for Bitcoin by twelvemonth (Source: Glassnode)Data from Glassnode showed a curve successful the mean Bitcoin withdrawal price, ranging from $15,139 to arsenic precocious arsenic $37,232.

- 2017 = $15,139

- 2018 = $18,598

- 2019 = $21,817

- 2020 = $26,513

- 2021 = $37,232

- 2022 = $26,564

- 2023 = $19,496

The mean withdrawal terms for Bitcoin from 2011 to 2023 stands astatine $11,037.

Graph showing the speech mean withdrawal terms for Bitcoin by twelvemonth (Source: Glassnode)

Graph showing the speech mean withdrawal terms for Bitcoin by twelvemonth (Source: Glassnode)When Bitcoin reached $23,000, it broke supra aggregate cost-basis levels, including some realized terms and short-term holder realized. The long-awaited but dilatory betterment has present enactment investors that bought BTC earlier the COVID-19 pandemic successful profit.

However, those that purchased BTC during the 2020 pandemic, successful 2021, and successful 2022 saw their positions suffer value. Investors that bought the dip astatine the opening of January 2023 person already seen nett arsenic Bitcoin’s terms continued to rise passim the month.

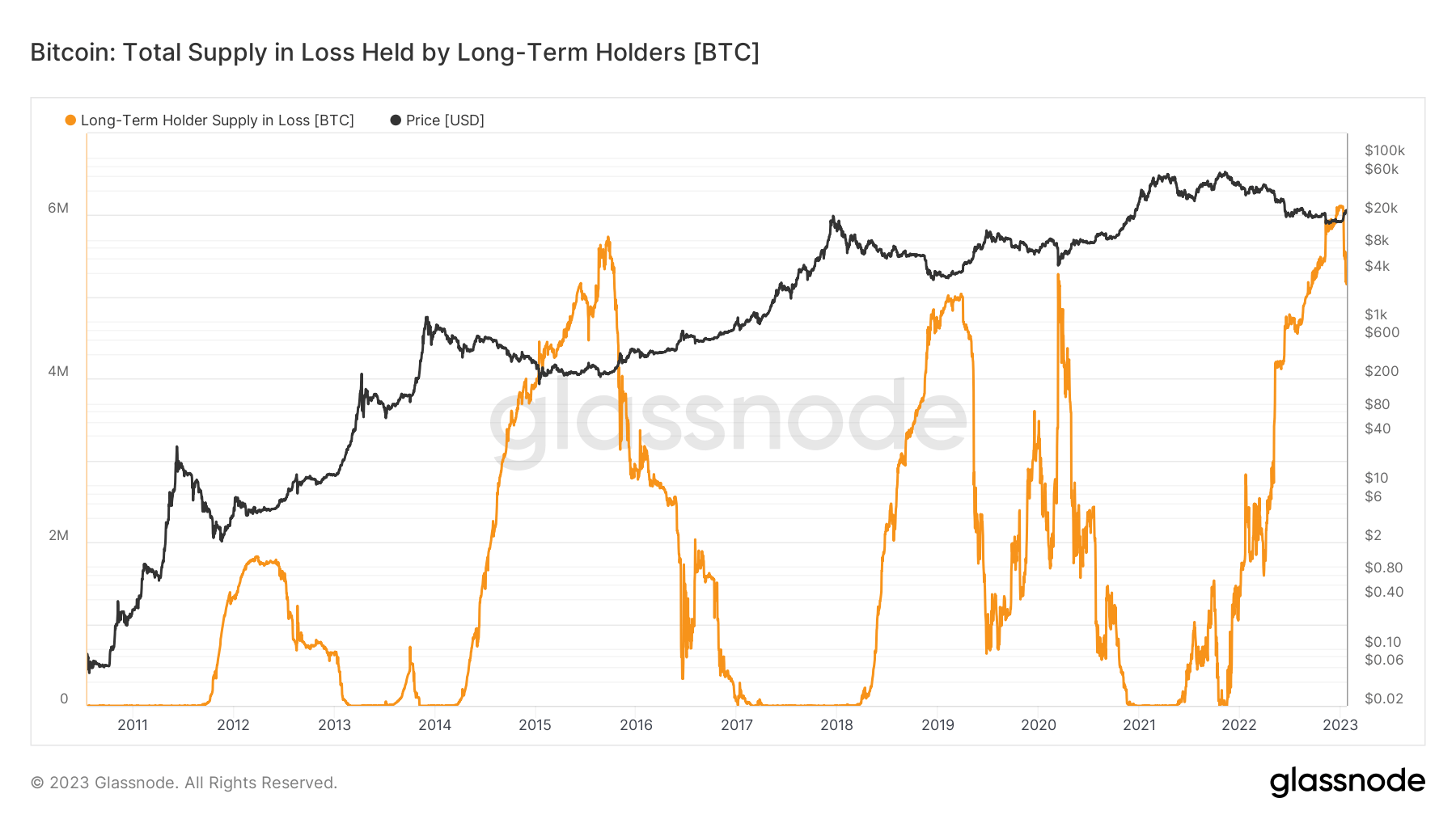

The mean withdrawal terms becomes adjacent much important erstwhile analyzed alongside semipermanent holders.

Defined arsenic those owning BTC for longer than 155 days, semipermanent holders are little apt to walk their coins. The realized terms astatine which they bought BTC has historically served arsenic a coagulated absorption indicator. However, the mean withdrawal terms for semipermanent holders mightiness beryllium an adjacent amended gauge for resistance, arsenic it represents the mean worth astatine which they transferred their coins from exchanges to wallets.

Graph showing the full proviso successful nonaccomplishment held by semipermanent holders from 2011 to 2023 (Source: Glassnode)

Graph showing the full proviso successful nonaccomplishment held by semipermanent holders from 2011 to 2023 (Source: Glassnode)At the extremity of 2022, the marketplace saw the full proviso successful nonaccomplishment held by semipermanent holders scope an all-time high. And portion the fig dropped from 6 cardinal BTC to 5 cardinal BTC since the opening of the year, it inactive shows a important information of the proviso astatine a loss.

This indicates that semipermanent holders could proceed to beryllium connected the 5 cardinal BTC until their realized terms is met, creating a coagulated absorption that could halt Bitcoin from slipping beneath its 2022 low.

The station Research: Withdrawal terms – A caller mode of assessing Bitcoin appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)