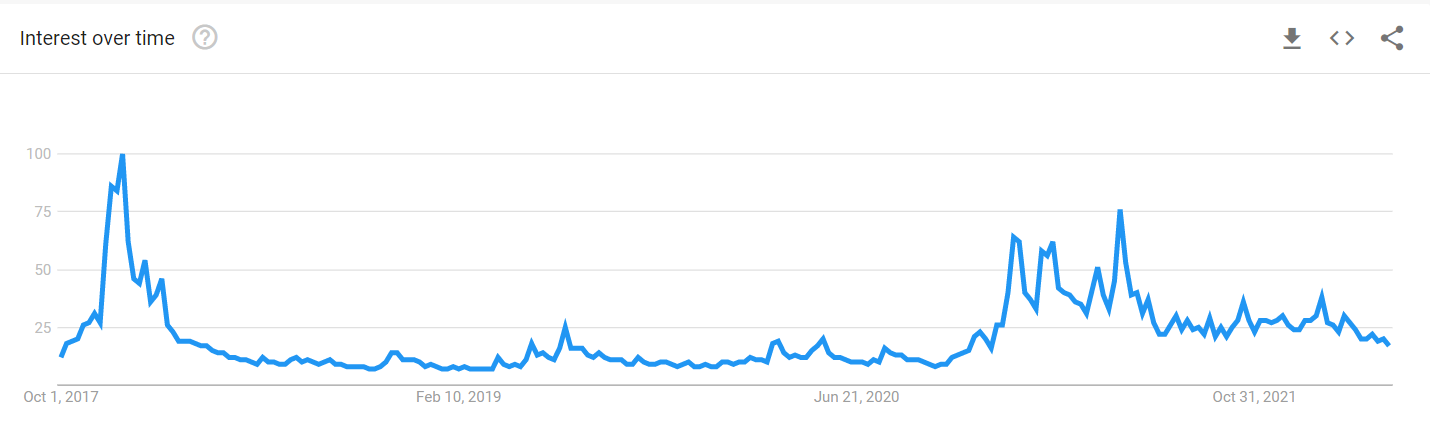

Bitcoin’s (BTC) terms surge to arsenic overmuch arsenic $69,000 past twelvemonth and a scope supra $40,000 this twelvemonth has failed to pull continual involvement from retail crowds, hunt information from Google Trends suggests.

Worldwide searches for bitcoin person reached mid-2020 levels arsenic of April 22, 2022, with readings of 17 for the week of April 17-April 23. This is simply a comparative driblet from May 2021’s readings of 76.

Google Trends allows users to comparison the comparative measurement of searches. This, however, does not mean the full fig of searches for that word is decreasing, but conscionable means its popularity is decreasing compared to different searches. A enactment trending downward means that a hunt term's popularity comparative to different fashionable presumption is decreasing.

Interest successful bitcoin was astatine its highest successful 2017. Relative to that, the hunt involvement fell successful 2021 and reached levels past seen successful 2020 this week. (Google Trends)

Data suggests astir searches for bitcoin originate from Nigeria, followed by El Salvador and Austria. These hunt queries are comparative to different presumption oregon keywords searched successful those regions, meaning Nigerians searched for bitcoin much than they searched for different keywords, but this wasn’t needfully much than wide hunt figures from, say, the U.S.

But contempt the evident waning involvement successful bitcoin, immoderate analysts accidental retail crowds are gravitating towards newer sectors and markets wrong the crypto space, specified arsenic tokens of decentralized concern (DeFi) oregon furniture 1 blockchains specified arsenic Solana and Avalanche.

“Bitcoin has risen successful terms respective times, with its concern threshold becoming higher for caller users," explained Johnny Lyu, CEO of KuCoin, successful a Telegram message. "But galore caller cryptocurrencies known arsenic altcoins person appeared since, which, according to users, tin beryllium much charismatic arsenic investments."

Lyu added the speedy beingness and popularity of memecoins person gradually shifted users' attraction from bitcoin successful examination to the past fewer years.

Egor Volotkovich, the enforcement manager of cross-chain solutions EVODeFi, seconded that sentiment. “DeFi, NFT, and blockchain gaming are areas of involvement that are present enticing investors crossed the board,” helium said.

“Retail investors are much funny successful exploring these different innovations the blockchain ecosystem present offers, which explains the declining hunt trends irrespective of the terms differentials betwixt present and the past 2 years,” Volotkovich added.

Meanwhile, immoderate similar Vasja Zupan, president of crypto speech Matrix, reason the hunt information does not correspond involvement from organization investors.

“Google Trends bash not bespeak organization and nonrecreational interest. And I judge that existent prices bespeak those groups' involvement and entering the marketplace much than axenic retail,” helium said successful an email to CoinDesk. “With Bitcoin maturing we volition spot a little retail impact, with objection of times of highest bull cycles and much power from organization demand,” Zupan added.

Firms similar concern analytics shaper MicroStrategy and electrical carmaker Tesla person purchased billions of dollars worthy of bitcoin successful the past 2 years, dissimilar erstwhile cycles successful 2018 and earlier.

Bitcoin was trading astatine conscionable implicit $40,500 astatine penning clip and is down 2.5% successful the past 24 hours, data from CoinGecko show.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)