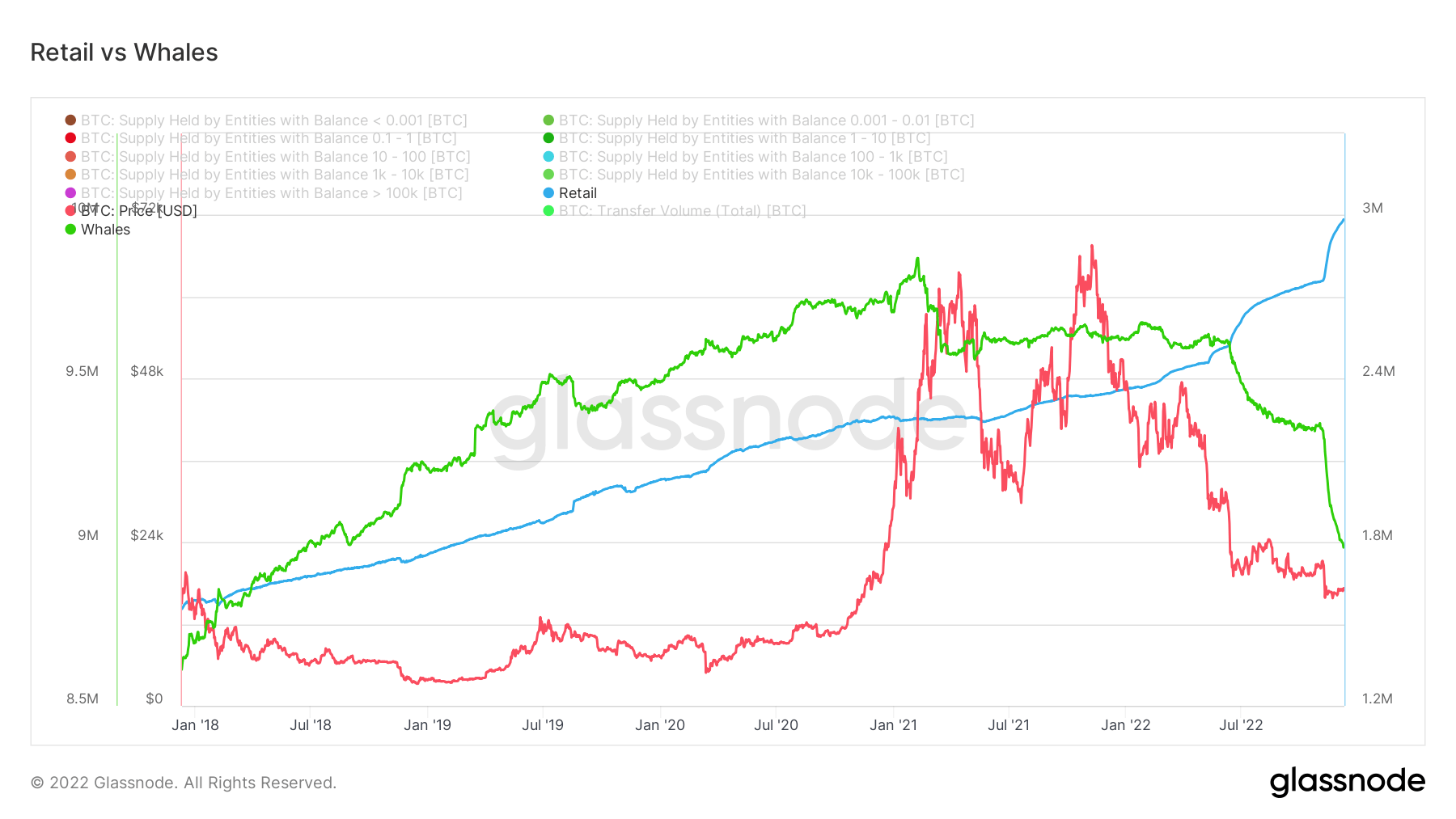

Bitcoin ownership is inactive increasing among retail investors, with 3 cardinal BTC holdings astatine present, portion whale accumulation is declining, with the caller fig astir 9 million, according to Glassnode information analyzed by CryptoSlate.

A retail capitalist is idiosyncratic who holds 1 bitcoin oregon less, and a whale is idiosyncratic who holds much than 1000 bitcoins. Bitcoin holdings by retail investors person doubled since 2018, erstwhile they held 1.5 million, whereas organization investors held 10 million.

However, the abstraction sustained respective setbacks this year, including hacks, Terra-Luna’s collapse, and the FTX’s downturn, which came with a fig of bankruptcies.

Even during the downturn sparked by Terra Luna’s illness successful May, investors continued to accumulate Bitcoin. Nevertheless, Bitcoin traded level passim Q3 arsenic sentiment turned bearish successful August.

Furthermore, Bitcoin holders holding little than 1 BTC and 1,000 BTC to 10,000 BTC entered an accumulation signifier successful precocious October. However, from mid-July onwards, those with much than 10,000 BTC person continued to sell.

This appears to beryllium the 3rd largest dump by Bitcoin whales successful past based connected transactions and accumulation, arsenic outlined successful an earlier CryptoSlate report,

Almost 80% of Bitcoin’s losses are owed to whales

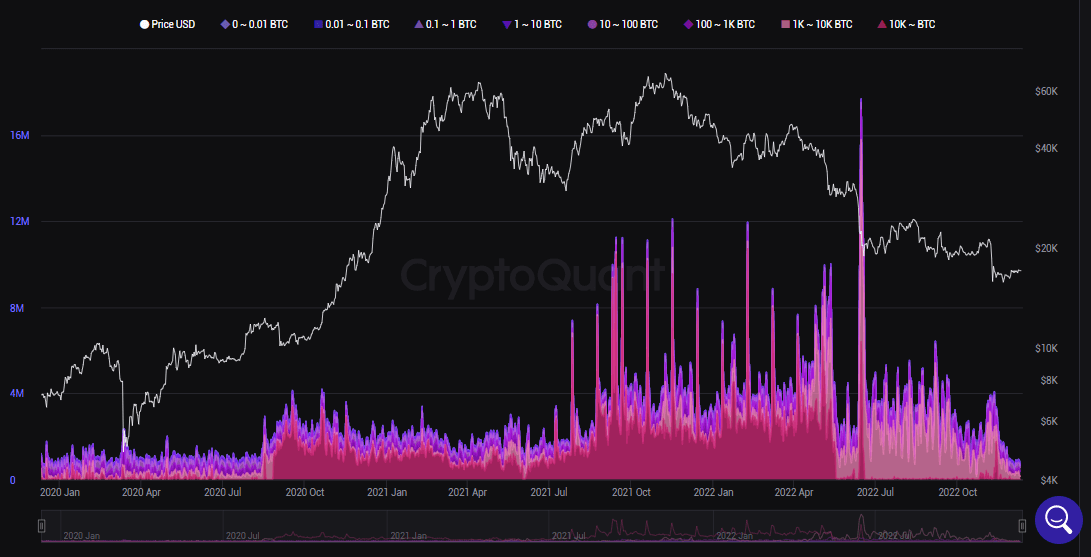

In effect to the Terra-LUNA and FTX crisis, Bitcoin whales person sold astir 365k BTC, pursuing on-chain information from CryptoQuant.

Further, on-chain information bespeak that whales holding 1k-10k BTC got escaped of their BTC holdings passim the miner capitulation signifier until November. Whales person been liable for astir 80% of the Bitcoin selloff since June.

Although BTC’s terms stands astatine $17,004, tiny investors are inactive accumulating. As of November 28, retail has added 96.2k BTC to its holdings since FTX collapsed, an all-time high.

#Bitcoin Shrimps (< 1$BTC) person added 96.2k $BTC to their holdings since FTX collapsed, an all-time precocious equilibrium increase.

This cohort present now clasp implicit 1.21M $BTC, equivalent to 6.3% of the circulating supply.

Pro Dashboard: https://t.co/HpXwoav6wO pic.twitter.com/7U4oPAAakD

— glassnode (@glassnode) November 28, 2022

Bitcoin speech outflows reached historical levels

The fig of Bitcoin addresses has spiked to its highest level successful caller times, according to Glassnode.

Following the illness of FTX, #Bitcoin investors person been withdrawing coins to self-custody astatine a historical complaint of 106k $BTC/month.

This compares with lone 3 different times:

– Apr 2020

– Nov 2020

– June-July 2022https://t.co/92aYVYU4Yt pic.twitter.com/em7CsDBWUf

— glassnode (@glassnode) November 13, 2022

With the illness of the world’s second-largest crypto exchange, FTX, much Bitcoin investors are gradually moving their holdings to self-custody solutions owed to diminished spot successful exchanges.

Bitcoin speech outflows person reached 106,000 BTC per month, adjacent to historical levels, according to the investigation platform.

Bitcoin speech outflows mostly bespeak that the cryptocurrency volition beryllium held for a agelong time. This appears to beryllium a effect of a diminution successful spot successful centralized cryptocurrency exchanges too.

Bitcoin is presently trading astatine $16,971, down 1.16% implicit the past 24 hours, according to CoinMarketCap.

The station Retail investors are increasing their BTC stack; whales’ holdings falling appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)