FTX illness has birthed renewed involvement successful self-custody among retail users, arsenic galore are present moving their Bitcoin (BTC) to acold wallets.

Glassnode data, arsenic analyzed by CryptoSlate, showed that retailers are taking retired their coins from exchanges astatine the astir assertive rate, with the withdrawals coming mostly from Crypto.com.

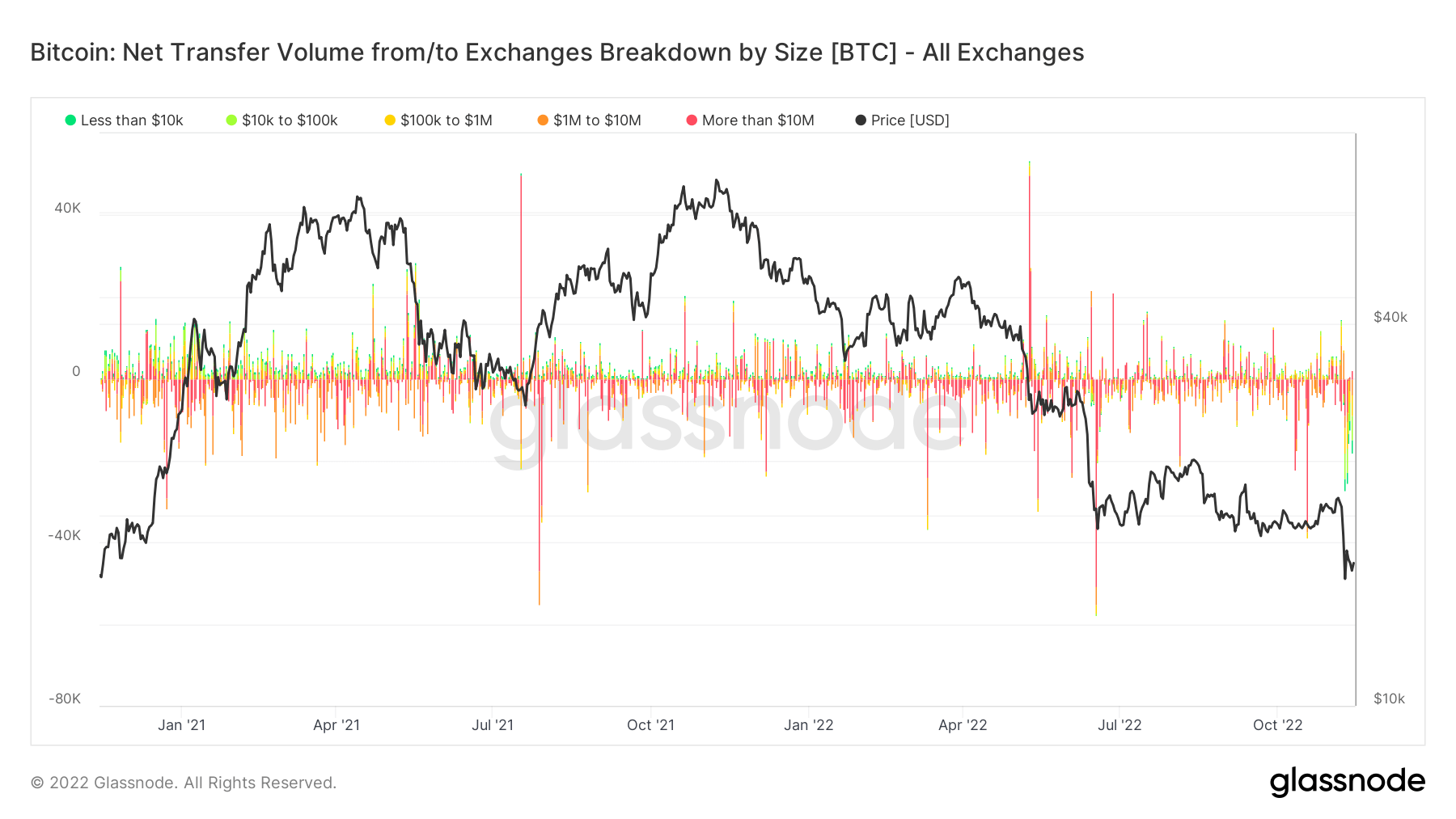

Retail Bitcoin Withdrawals (Source: Glassnode)

Retail Bitcoin Withdrawals (Source: Glassnode)Crypto.com is presently faced with expanding FUD pursuing revelations that the speech mistakenly sent 320,000 ETH to rival speech Gate.io.

While CEO Kris Marszalek has addressed these concerns and revealed that the speech was operating arsenic usual, users stay apprehensive arsenic they person been massively withdrawing their assets from the firm-Etherscan information shows that 1 of the exchange’s nationalist ETH wallet processed astir 90,000 transactions connected Nov. 13.

BTC withdrawals crossed exchanges astatine grounds high

Glassnode Insights further revealed that the aggregate BTC equilibrium crossed exchanges fell by 72,900 BTC implicit the past 7 days –one of the largest nett declines successful the past of the market. The erstwhile times the crypto manufacture witnessed this level of withdrawals were during the 2020 carnivore marketplace and 2022’s Terra LUNA-influenced crash.

BTC Exchange Balance (Source: Glassnode)

BTC Exchange Balance (Source: Glassnode)Additionally, implicit 1 cardinal ETH near exchanges implicit the past 7 days. Glassnode noted that this was the largest 30-day diminution since the DeFi summertime of September 2020, erstwhile request for ETH arsenic collateral successful astute contracts was astatine its peak.

Community stakeholders propulsion for self-custody

Several crypto stakeholders person urged the assemblage to self-custody their assets pursuing FTX’s implosion.

Binance CEO Changpeng Zhao said self-custody was a cardinal quality right. CZ advised his followers to commencement with smaller amounts successful bid to larn the ropes, arsenic mistakes present tin beryllium costly.

“Self custody is simply a cardinal quality right. You are escaped to bash it anytime. Just marque definite you bash do it right.”

Ethereum pedagogue Anthony Sassano besides shared the aforesaid view, saying lone those actively trading ample sizes should person their assets connected centralized platforms. He added, “(I) usage a prime fewer CEXs arsenic fiat on/off ramps and usage Ethereum DeFi for everything other (with self-custody of each of my assets).”

Meanwhile, the caller question of involvement successful self-custody has sent the value of the Trust Wallet token up by 113% successful 1 week to a caller all-time precocious of $2.48 connected Nov. 14. The wallet became much fashionable aft CZ tweeted astir it portion speaking astir the value of self-custody.

The station Retail traders massively retreat their BTC from exchanges appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)