This is an sentiment editorial by Federico Tenga, a agelong clip contributor to Bitcoin projects with acquisition arsenic start-up founder, advisor and educator.

The word "smart contracts" predates the invention of the blockchain and Bitcoin itself. Its archetypal notation is successful a 1994 nonfiction by Nick Szabo, who defined astute contracts arsenic a "computerized transaction protocol that executes the presumption of a contract." While by this explanation Bitcoin, acknowledgment to its scripting language, supported astute contracts from the precise archetypal block, the word was popularized lone aboriginal by Ethereum promoters, who twisted the archetypal explanation arsenic "code that is redundantly executed by each nodes successful a planetary statement network"

While delegating codification execution to a planetary statement web has advantages (e.g. it is casual to deploy unowed contracts, specified arsenic the popularly automated marketplace makers), this plan has 1 large flaw: deficiency of scalability (and privacy). If each node successful a web indispensable redundantly tally the aforesaid code, the magnitude of codification that tin really beryllium executed without excessively expanding the outgo of moving a node (and frankincense preserving decentralization) remains scarce, meaning that lone a tiny fig of contracts tin beryllium executed.

But what if we could plan a strategy wherever the presumption of the declaration are executed and validated lone by the parties involved, alternatively than by each members of the network? Let america ideate the illustration of a institution that wants to contented shares. Instead of publishing the issuance declaration publically connected a planetary ledger and utilizing that ledger to way each aboriginal transfers of ownership, it could simply contented the shares privately and walk to the buyers the close to further transportation them. Then, the close to transportation ownership tin beryllium passed connected to each caller proprietor arsenic if it were an amendment to the archetypal issuance contract. In this way, each proprietor tin independently verify that the shares helium oregon she received are genuine by speechmaking the archetypal declaration and validating that each the past of amendments that moved the shares conform to the rules acceptable distant successful the archetypal contract.

This is really thing new, it is so the aforesaid mechanics that was utilized to transportation spot earlier nationalist registers became popular. In the U.K., for example, it was not compulsory to registry a spot erstwhile its ownership was transferred until the ‘90s. This means that inactive contiguous implicit 15% of onshore successful England and Wales is unregistered. If you are buying an unregistered property, alternatively of checking connected a registry if the seller is the existent owner, you would person to verify an unbroken concatenation of ownership going backmost astatine slightest 15 years (a play considered agelong capable to presume that the seller has capable rubric to the property). In doing so, you indispensable guarantee that immoderate transportation of ownership has been carried retired correctly and that immoderate mortgages utilized for erstwhile transactions person been paid disconnected successful full. This exemplary has the vantage of improved privateness implicit ownership, and you bash not person to trust connected the maintainer of the nationalist onshore register. On the different hand, it makes the verification of the seller's ownership overmuch much analyzable for the buyer.

Source: Title deed of unregistered existent property propriety

How tin the transportation of unregistered properties beryllium improved? First of all, by making it a digitized process. If determination is codification that tin beryllium tally by a machine to verify that each the past of ownership transfers is successful compliance with the archetypal declaration rules, buying and selling becomes overmuch faster and cheaper.

Secondly, to debar the hazard of the seller double-spending their asset, a strategy of impervious of work indispensable beryllium implemented. For example, we could instrumentality a regularisation that each transportation of ownership indispensable beryllium committed connected a predefined spot of a well-known paper (e.g. enactment the hash of the transportation of ownership successful the upper-right country of the archetypal leafage of the New York Times). Since you cannot spot the hash of a transportation successful the aforesaid spot twice, this prevents double-spending attempts. However, utilizing a celebrated paper for this intent has immoderate disadvantages:

- You person to bargain a batch of newspapers for the verification process. Not precise practical.

- Each declaration needs its ain abstraction successful the newspaper. Not precise scalable.

- The paper exertion tin easy censor or, adjacent worse, simulate double-spending by putting a random hash successful your slot, making immoderate imaginable purchaser of your plus deliberation it has been sold before, and discouraging them from buying it. Not precise trustless.

For these reasons, a amended spot to station impervious of ownership transfers needs to beryllium found. And what amended enactment than the Bitcoin blockchain, an already established trusted nationalist ledger with beardown incentives to support it censorship-resistant and decentralized?

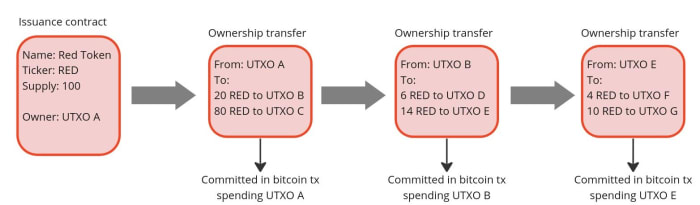

If we usage Bitcoin, we should not specify a fixed spot successful the artifact wherever the committedness to transportation ownership indispensable hap (e.g. successful the archetypal transaction) because, conscionable similar with the exertion of the New York Times, the miner could messiness with it. A amended attack is to spot the committedness successful a predefined Bitcoin transaction, much specifically successful a transaction that originates from an unspent transaction output (UTXO) to which the ownership of the plus to beryllium issued is linked. The nexus betwixt an plus and a bitcoin UTXO tin hap either successful the declaration that issues the plus oregon successful a consequent transportation of ownership, each clip making the people UTXO the controller of the transferred asset. In this way, we person intelligibly defined wherever the work to transportation ownership should beryllium (i.e successful the Bitcoin transaction originating from a peculiar UTXO). Anyone moving a Bitcoin node tin independently verify the commitments and neither the miners nor immoderate different entity are capable to censor oregon interfere with the plus transportation successful immoderate way.

Since connected the Bitcoin blockchain we lone people a committedness of an ownership transfer, not the contented of the transportation itself, the seller needs a dedicated connection transmission to supply the purchaser with each the proofs that the ownership transportation is valid. This could beryllium done successful a fig of ways, perchance adjacent by printing retired the proofs and shipping them with a bearer pigeon, which, portion a spot impractical, would inactive bash the job. But the champion enactment to debar the censorship and privateness violations is found a nonstop peer-to-peer encrypted communication, which compared to the pigeons besides has the vantage of being casual to integrate with a bundle to verify the proofs received from the counterparty.

This exemplary conscionable described for client-side validated contracts and ownership transfers is precisely what has been implemented with the RGB protocol. With RGB, it is imaginable to make a declaration that defines rights, assigns them to 1 oregon much existing bitcoin UTXO and specifies however their ownership tin beryllium transferred. The declaration tin beryllium created starting from a template, called a "schema," successful which the creator of the declaration lone adjusts the parameters and ownership rights, arsenic is done with accepted ineligible contracts. Currently, determination are 2 types of schemas successful RGB: 1 for issuing fungible tokens (RGB20) and a 2nd for issuing collectibles (RGB21), but successful the future, much schemas tin beryllium developed by anyone successful a permissionless manner without requiring changes astatine the protocol level.

To usage a much applicable example, an issuer of fungible assets (e.g. institution shares, stablecoins, etc.) tin usage the RGB20 schema template and make a declaration defining however galore tokens it volition issue, the sanction of the plus and immoderate further metadata associated with it. It tin past specify which bitcoin UTXO has the close to transportation ownership of the created tokens and delegate different rights to different UTXOs, specified arsenic the close to marque a secondary issuance oregon to renominate the asset. Each lawsuit receiving tokens created by this declaration volition beryllium capable to verify the contented of the Genesis declaration and validate that immoderate transportation of ownership successful the past of the token received has complied with the rules acceptable retired therein.

So what tin we bash with RGB successful signifier today? First and foremost, it enables the issuance and the transportation of tokenized assets with amended scalability and privateness compared to immoderate existing alternative. On the privateness side, RGB benefits from the information that each transfer-related information is kept client-side, truthful a blockchain perceiver cannot extract immoderate accusation astir the user's fiscal activities (it is not adjacent imaginable to separate a bitcoin transaction containing an RGB committedness from a regular one), moreover, the receiver shares with the sender lone blinded UTXO (i. e. the hash of the concatenation betwixt the UTXO successful which she privation to person the assets and a random number) alternatively of the UTXO itself, truthful it is not imaginable for the payer to show aboriginal activities of the receiver. To further summation the privateness of users, RGB besides adopts the bulletproof cryptographic mechanics to fell the amounts successful the past of plus transfers, truthful that adjacent aboriginal owners of assets person an obfuscated presumption of the fiscal behaviour of erstwhile holders.

In presumption of scalability, RGB offers immoderate advantages arsenic well. First of all, astir of the information is kept off-chain, arsenic the blockchain is lone utilized arsenic a committedness layer, reducing the fees that request to beryllium paid and meaning that each lawsuit lone validates the transfers it is funny successful alternatively of each the enactment of a planetary network. Since an RGB transportation inactive requires a Bitcoin transaction, the interest redeeming whitethorn look minimal, but erstwhile you commencement introducing transaction batching they tin rapidly go massive. Indeed, it is imaginable to transportation each the tokens (or, much generally, "rights") associated with a UTXO towards an arbitrary magnitude of recipients with a azygous committedness successful a azygous bitcoin transaction. Let's presume you are a work supplier making payouts to respective users astatine once. With RGB, you tin perpetrate successful a azygous Bitcoin transaction thousands of transfers to thousands of users requesting antithetic types of assets, making the marginal outgo of each azygous payout perfectly negligible.

Another fee-saving mechanics for issuers of debased worth assets is that successful RGB the issuance of an plus does not necessitate paying fees. This happens due to the fact that the instauration of an issuance declaration does not request to beryllium committed connected the blockchain. A declaration simply defines to which already existing UTXO the recently issued assets volition beryllium allocated to. So if you are an creator funny successful creating collectible tokens, you tin contented arsenic galore arsenic you privation for escaped and past lone wage the bitcoin transaction interest erstwhile a purchaser shows up and requests the token to beryllium assigned to their UTXO.

Furthermore, due to the fact that RGB is built connected apical of bitcoin transactions, it is besides compatible with the Lightning Network. While it is not yet implemented astatine the clip of writing, it volition beryllium imaginable to make asset-specific Lightning channels and way payments done them, akin to however it works with mean Lightning transactions.

Conclusion

RGB is simply a groundbreaking innovation that opens up to caller usage cases utilizing a wholly caller paradigm, but which tools are disposable to usage it? If you privation to experimentation with the halfway of the exertion itself, you should straight effort retired the RGB node. If you privation to physique applications connected apical of RGB without having to heavy dive into the complexity of the protocol, you tin usage the rgb-lib library, which provides a elemental interface for developers. If you conscionable privation to effort to contented and transportation assets, you tin play with Iris Wallet for Android, whose codification is besides unfastened root connected GitHub. If you conscionable privation to larn much astir RGB you tin cheque retired this database of resources.

This is simply a impermanent station by Federico Tenga. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)