The celebrated writer of the best-selling publication Rich Dad Poor Dad, Robert Kiyosaki, says that hyperinflation and slump are here. He besides warned that the biggest bubble burst is coming, advising investors to bargain gold, silver, and bitcoin.

Robert Kiyosaki’s Latest Warnings

The writer of Rich Dad Poor Dad, Robert Kiyosaki, gave a bid of warnings regarding the U.S. system Friday.

Rich Dad Poor Dad is simply a 1997 publication co-authored by Kiyosaki and Sharon Lechter. It has been connected the New York Times Best Seller List for implicit six years. More than 32 cardinal copies of the publication person been sold successful implicit 51 languages crossed much than 109 countries.

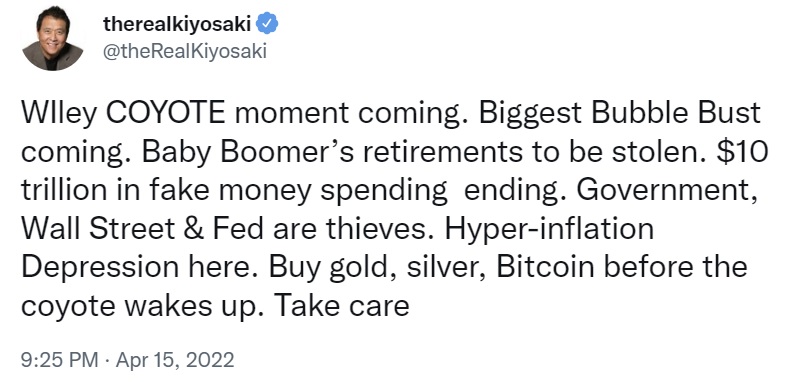

Kiyosaki tweeted that a Wile E. Coyote infinitesimal and the biggest bubble burst are coming. Claiming that hyperinflation and slump are here, the celebrated writer recommends buying gold, silver, and bitcoin “before the coyote wakes up.”

The writer of Rich Dad Poor Dad opined that babe boomers’ retirements volition beryllium “stolen” and that the $10 trillion successful fake wealth spending is ending. He called the U.S. government, Wall Street, and the Federal Reserve thieves.

Moreover, Kiyosaki tweeted aboriginal this month: “Repo marketplace inversion. Last clip this happened was 2008 … In 2008 I borrowed $300 cardinal to bargain large existent estate, astatine bargain prices. Time to get affluent coming again. Time to get smart, not greedy.” Emphasizing that anemic businesses and greedy investors volition fail, the celebrated writer wrote:

Be careful. Recession and clang coming.

A increasing fig of economists and forecasters are present saying that a recession is connected the skyline for the U.S. system arsenic the Federal Reserve continues to combat the highest inflation successful much than 40 years.

JPMorgan Chase CEO Jamie Dimon, for example, said this week that the hazard of the Federal Reserve tipping the U.S. system into recession is rising. Former Treasury Secretary Larry Summers besides said a recession is “the astir likely” result for the U.S. economy, not a brushed landing.

In October past year, Jack Dorsey, the CEO of Block Inc. and erstwhile CEO of Twitter Inc., predicted that hyperinflation volition soon happen successful the U.S. and the world. Recently, Mexico’s third-richest billionaire, Ricardo Salinas Pliego, besides warned astir severe dollar inflation. He recommended buying bitcoin.

In addition, Kiyosaki has warned astir a monolithic clang galore times. Predicting a “giant banal marketplace crash” successful October, helium noted that aft the crash, the U.S. volition descent into a new depression. He further warned that we are successful the biggest bubble successful satellite history.

Last month, the Rich Dad Poor Dad writer said the U.S. dollar is astir to implode, recommending investors bargain much gold, silver, bitcoin, ethereum, and solana. He emphasized that the satellite is successful occupation and the U.S. nationalist indebtedness is going done the roof.

In the aforesaid month, Kiyosaki warned that the authorities volition seize each cryptocurrencies. Nonetheless, helium predicted the extremity of the U.S. dollar, noting that the Russia-Ukraine warfare is giving emergence to crypto arsenic a safer haven than the government’s “fake fiat money.”

Tags successful this story

What bash you deliberation astir Robert Kiyosaki’s warnings? Let america cognize successful the comments conception below.

Kevin Helms

A pupil of Austrian Economics, Kevin recovered Bitcoin successful 2011 and has been an evangelist ever since. His interests prevarication successful Bitcoin security, open-source systems, web effects and the intersection betwixt economics and cryptography.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)