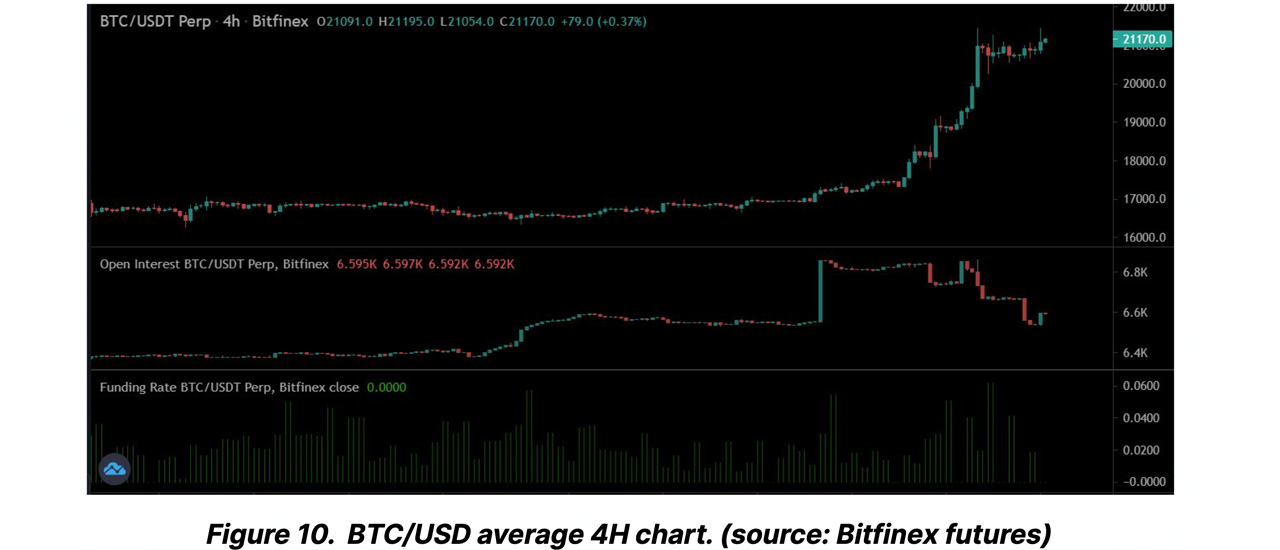

The apical 2 crypto assets person risen importantly successful the past 7 days, with bitcoin jumping 22.6% and ethereum expanding 18.6% against the U.S. dollar. According to marketplace data, some crypto assets saw the largest summation connected Saturday, Jan. 14, 2023. The abrupt spike successful worth caused the highest ratio of abbreviated liquidations vs agelong liquidations since July 2021, according to a caller Alpha study from Bitfinex.

Bitfinex Analysts See a Cautious Approach From Bulls arsenic Market Remains Highly Illiquid Despite Price Surge

Bitcoin (BTC) and ethereum (ETH) prices person risen importantly against the U.S. dollar, causing a cascade of abbreviated liquidations connected Jan. 14. The cryptocurrency speech Bitfinex discussed the substance successful its astir caller Alpha study #37. When a trader opens a abbreviated presumption against bitcoin oregon ethereum, they expect the terms of the crypto assets to diminution successful the future.

However, if bitcoin’s terms climbs quickly, abbreviated traders either get liquidated oregon indispensable bargain backmost the bitcoin astatine a higher price. When the terms of BTC oregon ETH rises excessively much, abbreviated sellers are liquidated, meaning their abbreviated presumption is closed by the crypto derivatives exchange. According to Bitfinex researchers, a important fig of liquidations took spot connected Jan. 14.

“Short liquidations fueled the full summation successful bitcoin and ethereum,” Bitfinex analysts said successful the Alpha report. “Short liquidations astatine $450 cardinal outweighed agelong liquidations by a ratio of 4.5. On Jan. 14, the marketplace saw the highest ratio of abbreviated liquidations vs agelong liquidations since July 2021,” the analysts added. They besides mentioned that the liquidation figures and abbreviated vs agelong liquidation ratio was adjacent much terrible among altcoins.

Bitfinex analysts further elaborate that a retraction successful bitcoin’s terms inactive remains probable. “While it is emblematic for carnivore markets to person a implicit wipeout of shorts,” the expert noted. “The full rally has been built connected the backbone of continuous marketplace shorts keeping backing debased and prices being pushed up by forced liquidations and moving stops. So, a pullback successful bitcoin terms remains a possibility.”

The Alpha study adds:

Although the determination mightiness beryllium interpreted arsenic organic, it is wholly engineered by constricted traders successful the market, which is evident from the marketplace extent remaining the aforesaid week-on-week. The terms interaction from marketplace orders is besides the aforesaid arsenic past week for [bitcoin], and determination is small alteration for altcoins. This means that adjacent with the limb up, the marketplace remains highly illiquid, and with the crisp autumn successful unfastened involvement implicit the weekend, a pullback mightiness beryllium expected with a cautious attack from bulls.

Crypto Supporters Debate the Gartner Hype Cycle Position and ‘Disbelief’ Phase

When the liquidations took spot 3 days ago, Bitfinex reported that Bybit experienced the largest abbreviated unfastened involvement wipeout since its inception. “The antagonistic backing rates beneath $16,000, followed by expanding aggregated long-side unfastened involvement for [bitcoin], were the driving unit down the terms surge,” the researchers explained.

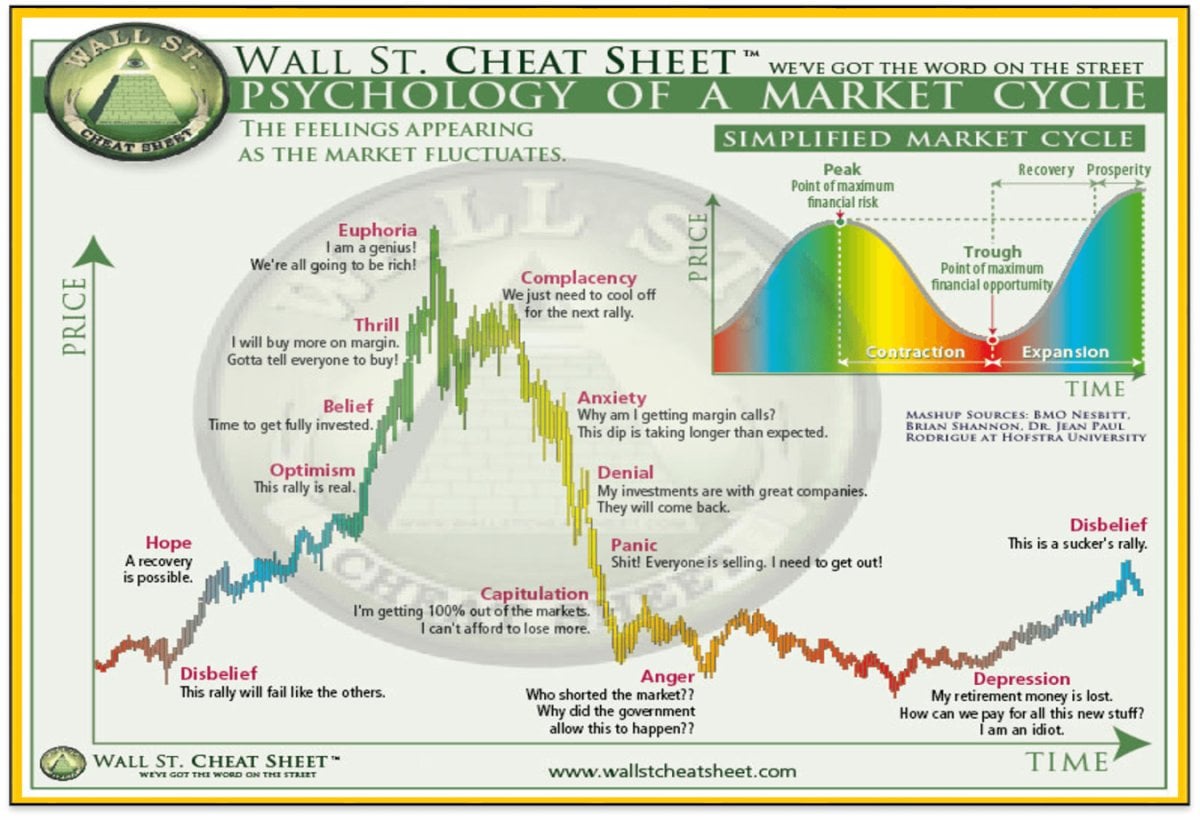

The caller emergence successful bitcoin and ethereum prices has caused galore radical to speculate whether the crypto bottommost is in. On Jan. 16, 2023, bitcoin expert Willy Woo shared an illustrated representation of the Gartner Hype Cycle and said, “I fishy we are successful the ‘disbelief’ signifier of the cycle.”

Gartner Hype Cycle oregon the Psychology of a Market Cycle illustration shared by bitcoin expert Willy Woo connected Jan. 16, 2023.

Gartner Hype Cycle oregon the Psychology of a Market Cycle illustration shared by bitcoin expert Willy Woo connected Jan. 16, 2023.A fig of radical disagreed with Woo’s sentiment astir being successful the ‘disbelief’ signifier of the cycle. Crypto proponent “Colin Talks Crypto” replied to Woo, saying, “No way.” Colin further stressed that it would “mean the emblematic carnivore marketplace got massively shortened, (which is highly unlikely, particularly successful today’s mediocre macro climate).” The crypto protagonist and Youtuber added:

It would mean a bitcoin 4-year rhythm someway magically became a 2-year rhythm oregon something.

Tags successful this story

Alpha report, Altcoins, Bear Market, Bitcoin, Bitcoin (BTC), BitFinex, Bitfinex analysts, Bitfinex research, BTC Futures, BTC Options, BTC Shorts, Bybit, Colin Talks Crypto, crypto assets, crypto derivatives exchange, Crypto proponent, Disbelief phase, Ethereum, Gartner Hype Cycle, Long liquidations, Macro climate, Market Data, Market depth, Market orders, Open Interest, short bitcoin, short BTC, Short liquidations, Short position, shorting bitcoin, trader, Willy Woo, youtuber

What bash you deliberation astir the Bitfinex Alpha study and the abbreviated liquidations that took spot this week? Do you deliberation we are successful the ‘disbelief’ signifier of the Gartner Hype Cycle? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

2 years ago

2 years ago

English (US)

English (US)