Quick Take

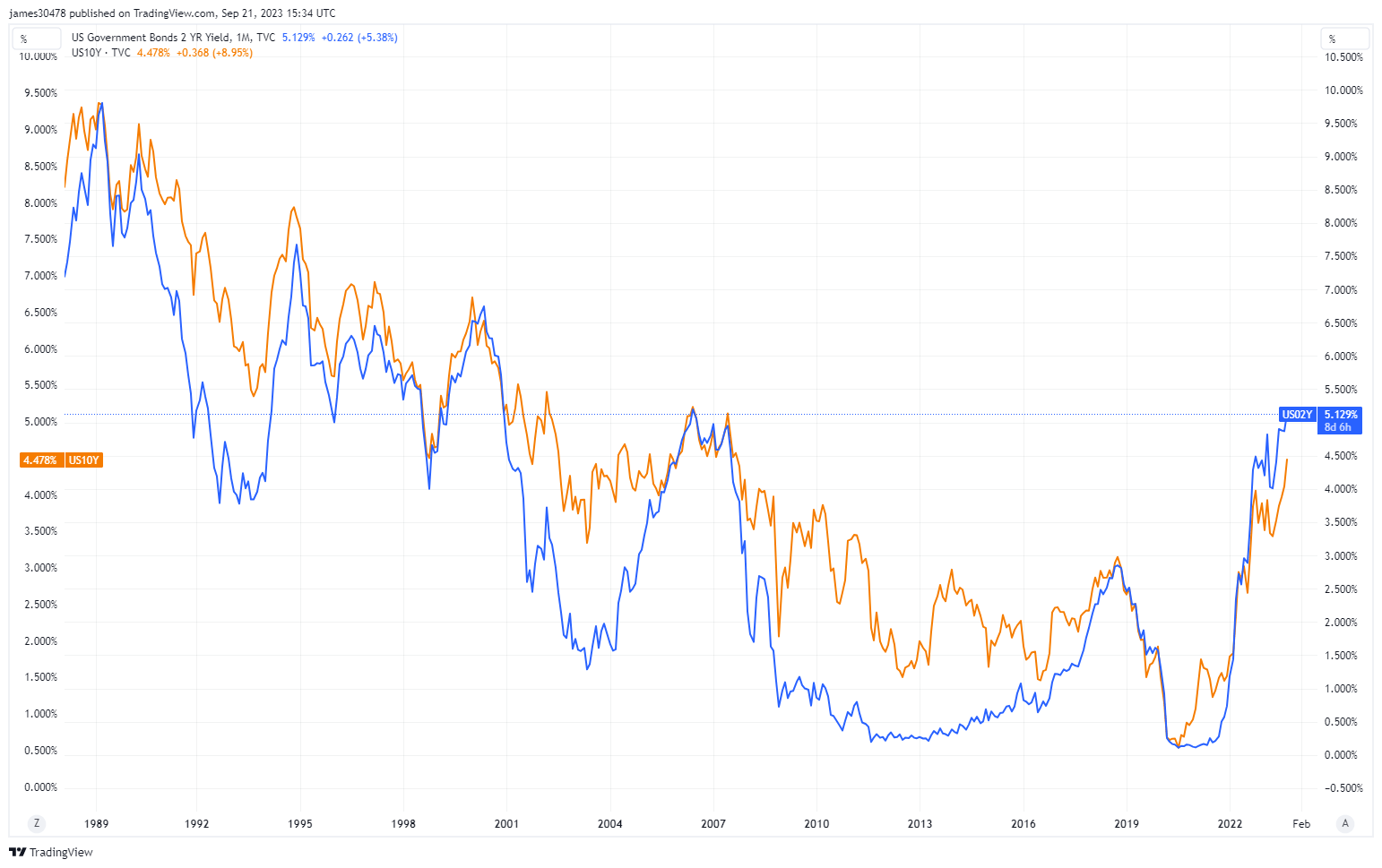

The caller decisions of the Federal Reserve and the Bank of England to clasp disconnected connected adjusting involvement rates — a strategy seemingly aimed astatine curtailing ostentation — presents an intriguing dichotomy with the market’s response. Despite these pauses, the yields connected 10-year and 2-year bonds for the U.S. person surged to 15-year and 17-year highs respectively. This improvement underscores a imaginable disconnect betwixt cardinal slope policies and marketplace sentiment.

While the cardinal banks’ holdouts ostensibly awesome a committedness to combating inflation, the market’s output curve adjustments suggest an anticipation of aboriginal inflationary pressure. This divergence implies that the fixed income marketplace whitethorn beryllium anticipating a aboriginal displacement successful monetary argumentation oregon foreseeing economical conditions that would warrant higher yields, contempt the contiguous clasp connected complaint adjustments.

The unfolding concern demands attraction from stakeholders crossed the fiscal landscape. The question present is however these divergent perspectives volition reconcile successful the future. Will cardinal slope strategies beryllium effectual successful managing inflation, oregon volition the market’s evident skepticism necessitate a recalibration of monetary policy?

US Yields: (Source: TV)

US Yields: (Source: TV)The station Rising marketplace yields exert hostility against dependable involvement rates from cardinal banks appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)