Last week, Bitcoin rode the bullish wave it got connected past autumn and broke supra the coveted $52,000 level. Bitcoin regaining astir each of its losses since the illness of FTX is simply a important milestone for the manufacture that has been struggling to get retired of a carnivore marketplace for the amended portion of the past year.

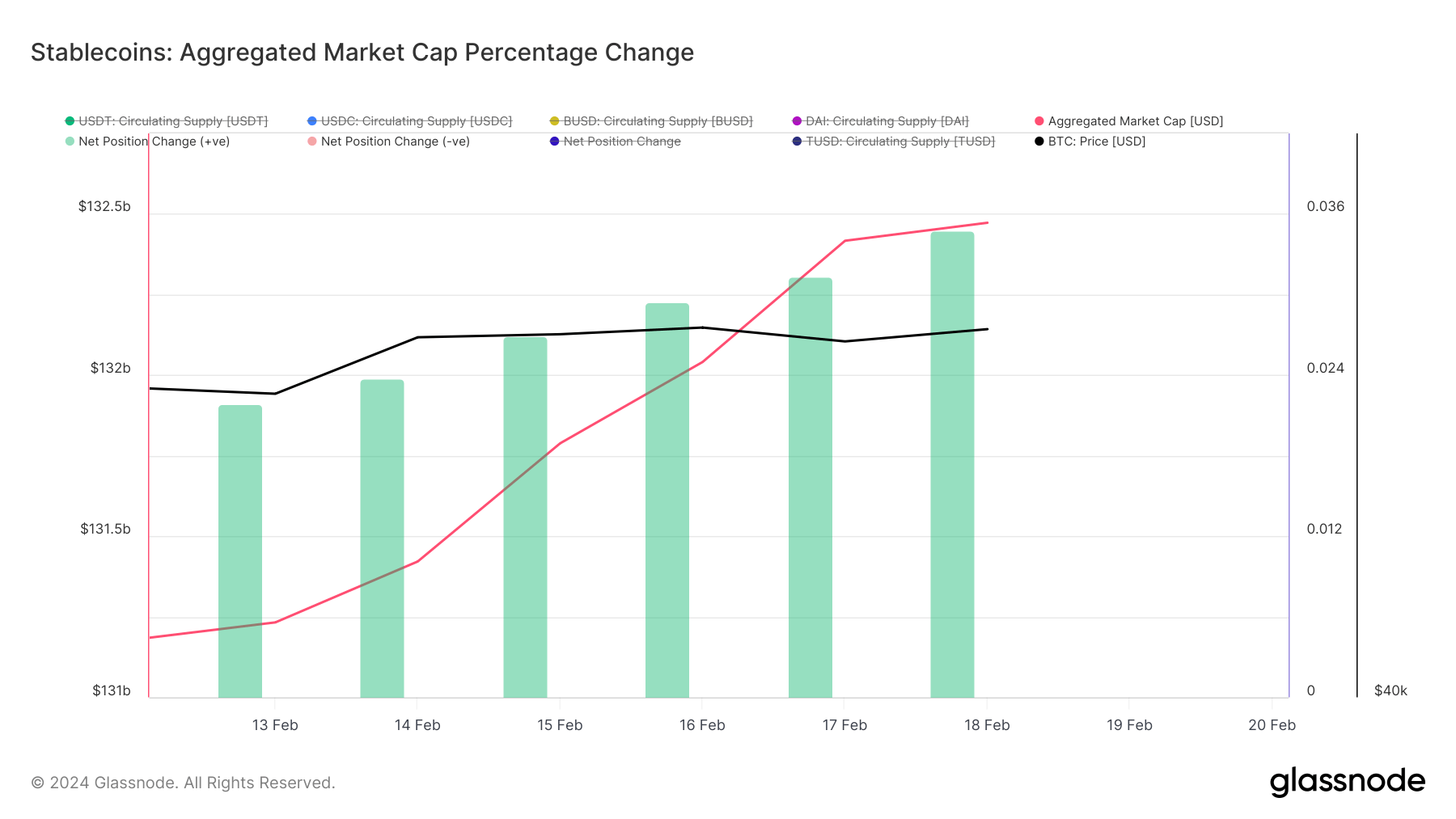

Bitcoin’s upward momentum has been followed by an summation successful the aggregated marketplace headdress of large stablecoins, astir notably USDT, USDC, BUSD, and DAI. The 4 stablecoin giants saw their aggregate marketplace headdress turn from $131.232 cardinal to $132.472 cardinal betwixt Feb. 13 and Feb. 18, showing a increasing demand.

Stablecoins are a span betwixt fiat currencies and the crypto market, making up the bulk of crypto trading pairs and, therefore, the bulk of marketplace liquidity. The summation successful marketplace headdress reflects a higher adoption complaint of stablecoins and reaffirms them arsenic a preferred mean for interacting with cryptocurrencies.

Zooming retired shows a 3.475% summation successful the proviso of the apical 4 stablecoins implicit the past 30 days. This summation successful proviso tin effect from aggregate factors, but it’s astir apt a market-wide propulsion to determination assets (be it fiat oregon crypto) into stablecoins to hole for trading. This suggests that the marketplace is anticipating enactment successful the coming weeks and preparing for quicker introduction oregon exit from Bitcoin.

Graph showing the proviso of USDT, USDC, BUSD, and DAI (red) and its 30-day percent alteration (green) from Feb. 13 to Feb. 19, 2024 (Source: Glassnode)

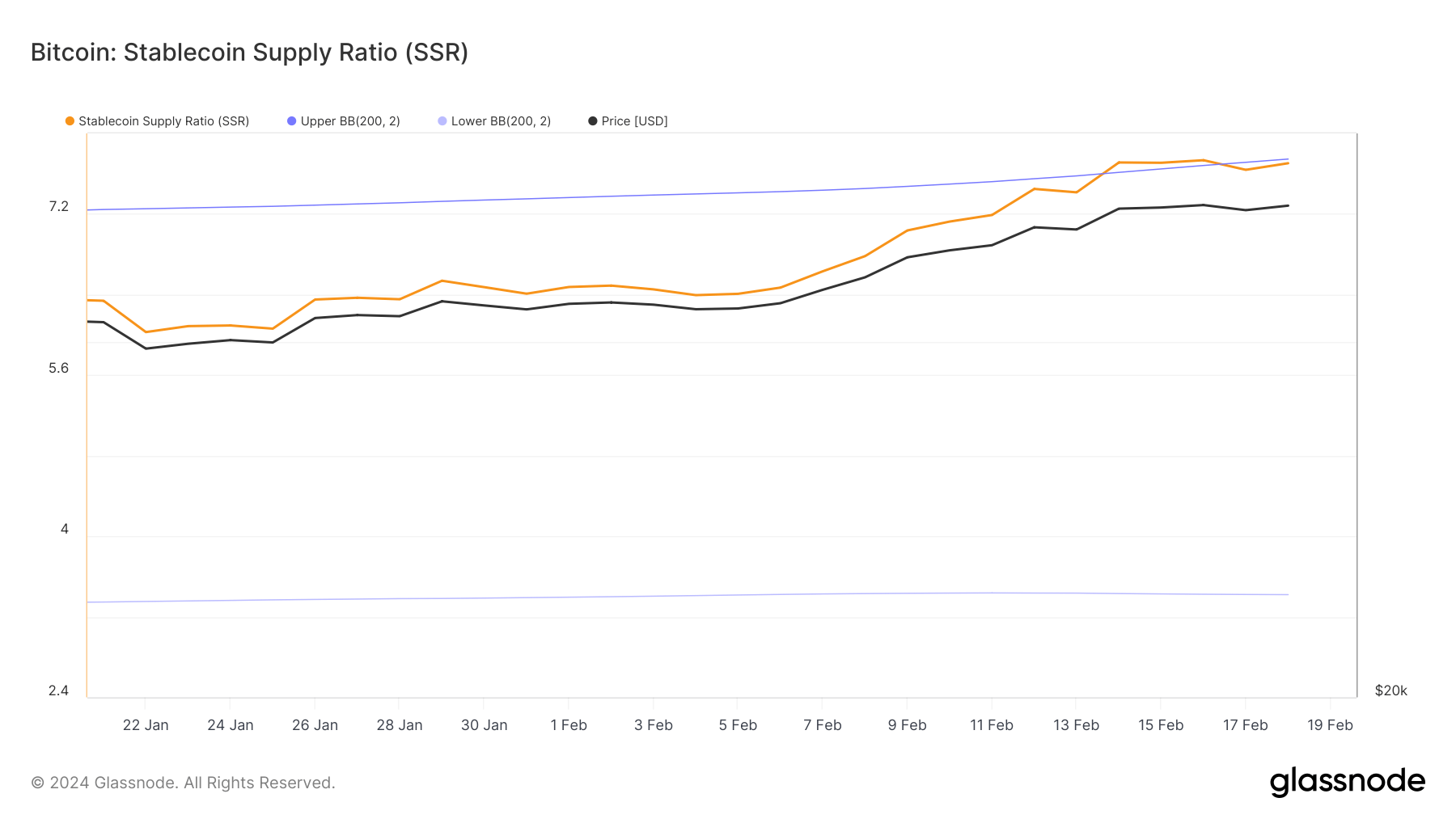

Graph showing the proviso of USDT, USDC, BUSD, and DAI (red) and its 30-day percent alteration (green) from Feb. 13 to Feb. 19, 2024 (Source: Glassnode)This is further supported by a notable stablecoin proviso ratio (SSR) increase. The SSR is simply a captious metric that measures the proviso of stablecoins comparative to Bitcoin’s marketplace cap, showing however heavy marketplace liquidity is and the market’s imaginable buying power. A higher SSR indicates that determination are much stablecoins comparative to Bitcoin, truthful the imaginable buying powerfulness could thrust Bitcoin’s terms up if the stablecoin proviso were to beryllium exchanged into Bitcoin.

The SSR being supra the precocious Bollinger set from Feb. 14 to Feb. 16 signals an antithetic summation successful imaginable buying power, perchance indicating that investors were preparing to determination into Bitcoin oregon different cryptocurrencies, which is accordant with the observed terms summation successful Bitcoin during this period.

Graph showing the stablecoin proviso ratio (SSR) from Jan. 21 to Feb. 19. 2024 (Source: Glassnode)

Graph showing the stablecoin proviso ratio (SSR) from Jan. 21 to Feb. 19. 2024 (Source: Glassnode)The summation successful Bitcoin’s price, alongside a increasing marketplace headdress and proviso of large stablecoins, suggests an influx of superior into the market. For stablecoins, the observed trends item their captious relation successful the ecosystem, acting not lone arsenic harmless havens during times of volatility but besides arsenic indispensable tools for superior deployment into Bitcoin.

Last week’s trends amusement conscionable however connected the stablecoin marketplace is to Bitcoin and however movements successful the proviso and marketplace headdress of stablecoins tin service arsenic indicators of forthcoming market activity.

The station Rising stablecoin proviso shows an influx of superior into the crypto market appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)