By Omkar Godbole (all times ET unless stated otherwise)

Just 10 days aft the U.S. Department of Commerce started posting economical information connected a enactment of blockchains, the reliability of its information is being questioned by immoderate observers.

On Tuesday, the U.S. Bureau of Labor Statistics disclosed a startling figure: The system created astir 1 cardinal less jobs than reported successful the twelvemonth ended March. The grounds revision calls into question earlier optimism astir the spot of the labour market, casting uncertainty connected each risk-on positions traders took successful the past twelvemonth oregon so.

Markets interpreted the downward revisions arsenic different motion the Fed volition present assertive easing successful the coming months. One fashionable Polymarket trader is betting that the Fed volition chopped rates by 50 ground points connected Sept. 17.

Bitcoin (BTC) is trading supra $112,000, having reached lows of astir $110,800 during North American trading hours yesterday. European stocks are higher with the S&P 500 futures pointing to a affirmative unfastened aboriginal Wednesday.

Still, caution whitethorn beryllium warranted for 2 reasons: The U.S. shaper terms and user terms indices owed successful the adjacent 24 hours are apt to amusement that ostentation remains elevated and good supra the Fed's 2% target. Stagflation concerns whitethorn grip the market, weakening the lawsuit for assertive Fed easing, if these information sets stroke past expectations.

The 2nd crushed is that the liquidity tightening is underway.

"Liquidity is tightening arsenic the Treasury General Account rises and the reverse repo installation drains, pushing reserve balances lower," Mott Capital Management said. "With SOFR climbing, spreads widening, and recognition accent showing up, the marketplace whitethorn soon look renewed unit connected hazard assets."

This is astir apt the crushed wherefore enactment options tied to bitcoin and ether proceed to commercialized pricier than calls connected Deribit, reflecting downside concerns.

In different news, crypto staking level Kiln said it is exiting its Ethereum validators owed to an exploit incidental that affected SwissBorg.

Real-world plus protocols proceed to grow, with a full worth locked of present implicit $15 billion.

Lastly, a azygous entity earned $200 cardinal from the MYX airdrop. Talk astir windfall gain. Stay alert!

What to Watch

- Crypto

- Sept. 10, 9:15 a.m.: Comptroller of the Currency Jonathan V. Gould volition talk about integer assets astatine the CoinDesk: Policy & Regulation Conference successful Washington.

- Sept. 11: REX Shares and Osprey Funds’ Dogecoin ETF shares to start trading connected Cboe BZX Exchange nether ticker DOJE.

- Macro

- Sept. 10, 8 a.m.: Brazil August CPI. Inflation complaint YoY Est. 5.1%, MoM Est. -0.15%.

- Sept. 10, 8:30 a.m.: U.S. August PPI YoY Est. 3.3%, MoM Est. 0.3%. Core YoY Est. 3.5%, MoM Est. 0.3%.

- Earnings (Estimates based connected FactSet data)

- None scheduled.

Token Events

- Governance votes & calls

- Goldfinch DAO is voting connected the Goldfinch Foundation’s yearly fund of $400,000 and 200,000 GFI. Voting ends Sept. 10.

- Compound DAO is voting connected extending its COMP output strategy. Voting ends Sept. 11.

- Hyperliquid to ballot connected who issues its USDH stablecoin. Voting takes spot Sept. 14.

- Unlocks

- Sept. 11: Aptos (APT) to unlock 2.2% of its circulating proviso worthy $50.89 million.

- Token Launches

- Sept. 10: Linea (LINEA) to beryllium listed connected Binance Alpha, KuCoin, MEXC, KuCoin, Bitget OKX, CoinW, and others.

- Sept. 10: Kong (KONG) to beryllium listed connected KuCoin.

Conferences

The CoinDesk Policy & Regulation Conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB15 for 15% disconnected your registration.

- Day 4 of 4: Future Proof Festival (Huntington Beach, California)

- Day 2 of 2: Fintech Week London 2025

- Day 2 of 2: WOW Summit Hong Kong 2025

- Day 2 of 5: Boston Blockchain Week (Quincy, Massachusetts)

- Sept. 10: CoinDesk Policy & Regulation Conference (New York)

- Sept. 10: Future of Finance (New York)

Token Talk

By Oliver Knight

- The crypto marketplace has entered "altcoin season" contempt sentiment remaining successful bearish territory.

- CoinMarketCap's altcoin play index has ticked up to 59/100, topping August's precocious of 57 arsenic superior continues to rotate into the much speculative tokens.

- Market quality level Santiment noted that portion prices are moving to the upside, sentiment is becoming much negative.

- "Traders person changed their tunes, swinging much and much antagonistic with expectations of bitcoin falling backmost beneath $100K, Ethereum backmost beneath $3.5K, and altcoins going done a retrace period," Santiment wrote connected X.

- Altcoins stay unperturbed with mantle (MNT) and pyth (PYTH) starring the way, gaining 15% and 10%, respectively, implicit the past 24 hours.

- Bitcoin (BTC), the largest cryptocurrency successful presumption of marketplace cap, continues to languish astir $112,500.

- Previous altcoin seasons person occurred erstwhile bitcoin consolidates arsenic traders rotated superior to speculative assets without the hazard of missing retired connected a large BTC move.

- Bitcoin has been trading betwixt $107,000 and $113,000 for much than 2 weeks aft failing to interruption beyond $124,000.

Derivatives Positioning

By Omkar Godbole

- BTC's futures unfastened involvement (OI) has remained dependable implicit the past 24 hours arsenic traders beryllium connected the sidelines up of tomorrow's U.S. CPI release.

- OI successful ETH, SOL and HYPE has accrued by implicit 2%, portion XRP, SUI, ADA, and ENA person seen superior outflows.

- Annualized backing rates for apical coins but TRX and XLM are hovering astatine oregon supra 10%, indicating a bullish bias but thing retired of ordinary. In different words, determination are nary signs of excess leverage buildup oregon overheating.

- On the CME, notional unfastened involvement successful BTC options has climbed to a grounds $5.6 billion, portion enactment successful futures remains subdued.

- On Deribit, BTC and ETH puts retired to December expiry proceed to commercialized astatine a premium to calls, indicating lingering downside concerns.

- Block flows astatine OTC table Paradigm featured a agelong presumption successful the ether $4,000 enactment expiring connected Sept. 26.

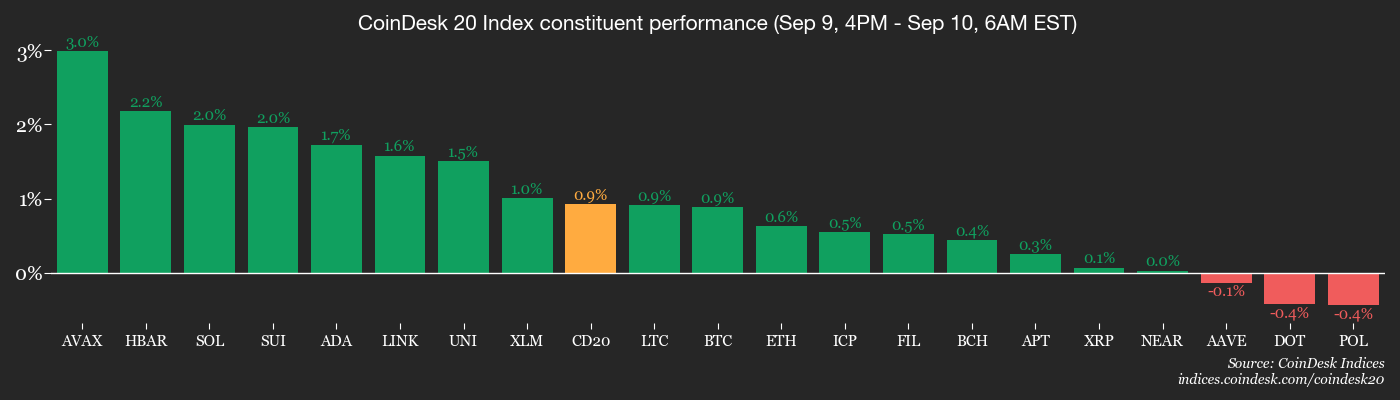

Market Movements

- BTC is up 0.68% from 4 p.m. ET Tuesday astatine $112,296.28 (24hrs: -0.35%)

- ETH is up 0.47% astatine $4,325.02 (24hrs: -0.54%)

- CoinDesk 20 is up 0.87% astatine 4,128.56 (24hrs: -0.59%)

- Ether CESR Composite Staking Rate is up 3 bps astatine 2.87%

- BTC backing complaint is astatine 0.0103% (11.2785% annualized) connected KuCoin

- DXY is unchanged astatine 97.76

- Gold futures are up 0.1% astatine $3,686.00

- Silver futures are up 0.65% astatine $41.61

- Nikkei 225 closed up 0.87% astatine 43,837.67

- Hang Seng closed up 1.01% astatine 26,200.26

- FTSE is up 0.25% astatine 9,265.34

- Euro Stoxx 50 is up 0.25% astatine 5,382.08

- DJIA closed connected Tuesday up 0.43% astatine 45,711.34

- S&P 500 closed up 0.27% astatine 6,512.61

- Nasdaq Composite closed up 0.37% astatine 21,879.49

- S&P/TSX Composite closed up 0.12% astatine 29,063.01

- S&P 40 Latin America closed unchanged astatine 2,800.26

- U.S. 10-Year Treasury complaint is up 1.3 bps astatine 4.087%

- E-mini S&P 500 futures are up 0.14% astatine 6,530.75

- E-mini Nasdaq-100 futures are unchanged astatine 23,886.50

- E-mini Dow Jones Industrial Average Index are down 0.26% astatine 45,640.00

Bitcoin Stats

- BTC Dominance: 58.19% (unchanged)

- Ether-bitcoin ratio: 0.03848 (-0.38%)

- Hashrate (seven-day moving average): 992 EH/s

- Hashprice (spot): $52.47

- Total fees: 4.61 BTC / $517,036

- CME Futures Open Interest: 134,650 BTC

- BTC priced successful gold: 30.7 oz

- BTC vs golden marketplace cap: 8.68%

Technical Analysis

- Dogecoin printed a Doji candle Tuesday, which indicates deficiency of willingness among bulls and bears to pb the terms action.

- The emergence of Doji has neutralized the bullish outlook stemming from the descending trendline breakout confirmed Sunday.

- Tuesday's precocious of 25 cents is the caller level to bushed for the bulls.

Crypto Equities

- Coinbase Global (COIN): closed connected Tuesday astatine $318.78 (+5.49%), +0.56% astatine $320.57 successful pre-market

- Circle (CRCL): closed astatine $117.99 (+4.92%), +1.07% astatine $119.25

- Galaxy Digital (GLXY): closed astatine $26.58 (+9.74%), +1.35% astatine $26.94

- Bullish (BLSH): closed astatine $53.81 (+7.36%), unchanged successful pre-market

- MARA Holdings (MARA): closed astatine $15.93 (+4.8%), +0.75% astatine $16.05

- Riot Platforms (RIOT): closed astatine $15.21 (+13.17%), +0.85% astatine $15.34

- Core Scientific (CORZ): closed astatine $14.53 (+4.31%), +2.96% astatine $14.96

- CleanSpark (CLSK): closed astatine $9.67 (+5.45%), +1.03% astatine $9.77

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $33.13 (+11.59%)

- Exodus Movement (EXOD): closed astatine $26.75 (+1.71%), unchanged successful pre-market

Crypto Treasury Companies

- Strategy (MSTR): closed astatine $328.53 (-0.42%), +0.69% astatine $330.80

- Semler Scientific (SMLR): closed astatine $28.07 (-0.78%)

- SharpLink Gaming (SBET): closed astatine $16.69 (+6.51%), +0.48% astatine $16.77

- Upexi (UPXI): closed astatine $5.5 (-2.83%), +3.45% astatine $5.69

- Mei Pharma (MEIP): closed astatine $2.78 (-7.33%), +4.32% astatine $2.90

ETF Flows

Spot BTC ETFs

- Daily nett flows: $23 million

- Cumulative nett flows: $54.85 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily nett flows: $44.2 million

- Cumulative nett flows: $12.69 billion

- Total ETH holdings ~6.36 million

Source: Farside Investors

Chart of the Day

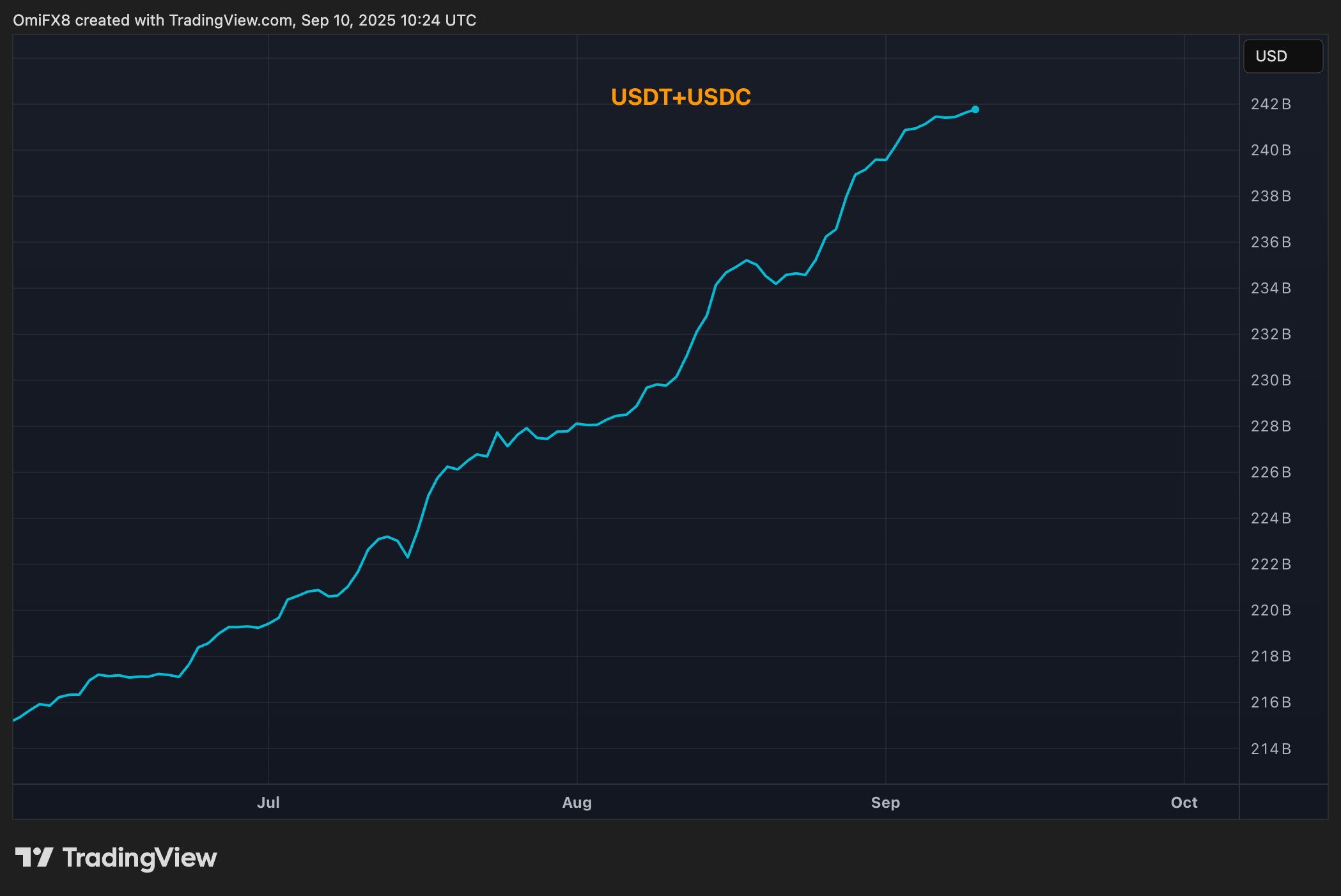

- The combined marketplace headdress of the 2 largest stablecoins, Tether's USDT and Circle Internet's USDC, continues to acceptable caller highs, indicating persistent request for dollar-linked assets contempt Fed complaint chopped bets.

- The Fed is expected to chopped rates astatine its Sept. 17 meeting.

While You Were Sleeping

- Bitcoin Retakes $112K, SOL hits 7-Month High arsenic Economists Downplay Recession Fears (CoinDesk): The U.S. chopped 911,000 jobs from payroll estimates for the twelvemonth ended March 2025, unsettling markets, but economists said the revision signaled slower labour unit maturation alternatively than recession oregon stagflation.

- Gold Pushes Toward Record arsenic Traders Wait for Inflation Prints (Bloomberg): Gold rose, fueled by rate-cut expectations, cardinal slope buying, ETF inflows, Israel’s onslaught successful Doha and President Trump urging the EU to articulation him successful caller tariffs connected India and China.

- Judge Blocks Trump From Removing Fed Governor Lisa Cook (The Wall Street Journal): Judge Jia Cobb said Cook was apt to prevail since removals indispensable beryllium based lone connected a Fed governor’s behaviour portion successful office, alternatively than unproven, pre-appointment allegations.

- Metaplanet to Raise $1.4B successful International Share Sale, Stock Jumps 16% (CoinDesk): Metaplanet is selling the shares astatine 553 yen each, with NAKA committing to bargain $30 cardinal worth.

- Poland Says It Shot Down Russian Drones That Entered Its Airspace (The New York Times): Poland’s subject said Russian drones crossed its airspace during strikes connected Ukraine, prompting Poland and NATO aerial forces to deploy warplanes and adjacent skies implicit Warsaw.

2 months ago

2 months ago

English (US)

English (US)