By Omkar Godbole (All times ET unless indicated otherwise)

Two years ago, I posted connected X that the caller mean for U.S. ostentation successful the post-COVID satellite is overmuch higher than the Federal Reserve’s 2% target. The market’s absorption to Tuesday’s hotter-than-expected U.S. halfway CPI report suggests a increasing fig of investors present stock that view.

The information for July showed that annualized halfway CPI topped the 3% people for the archetypal time, chiefly owed to the effects of President Trump's tariffs. The Fed has lone erstwhile chopped involvement rates erstwhile halfway ostentation was supra 3%.

Even so, bitcoin (BTC) roseate by implicit 1% connected Wednesday, and ether, often envisaged arsenic an net bond, jumped by implicit 8%. U.S. stocks besides rallied arsenic traders seemingly disregarded the ostentation fig and continued to terms successful a September complaint cut.

This dynamic suggests that the 2% ostentation people is apt dead. The U.S. Treasury Secretary said Tuesday that the Fed should see a 50 basis-point chopped successful September.

This script is bullish for assets with inflation-hedge appeal, specified arsenic bitcoin and gold, arsenic it implies that cardinal banks are consenting to place higher ostentation to chopped rates.

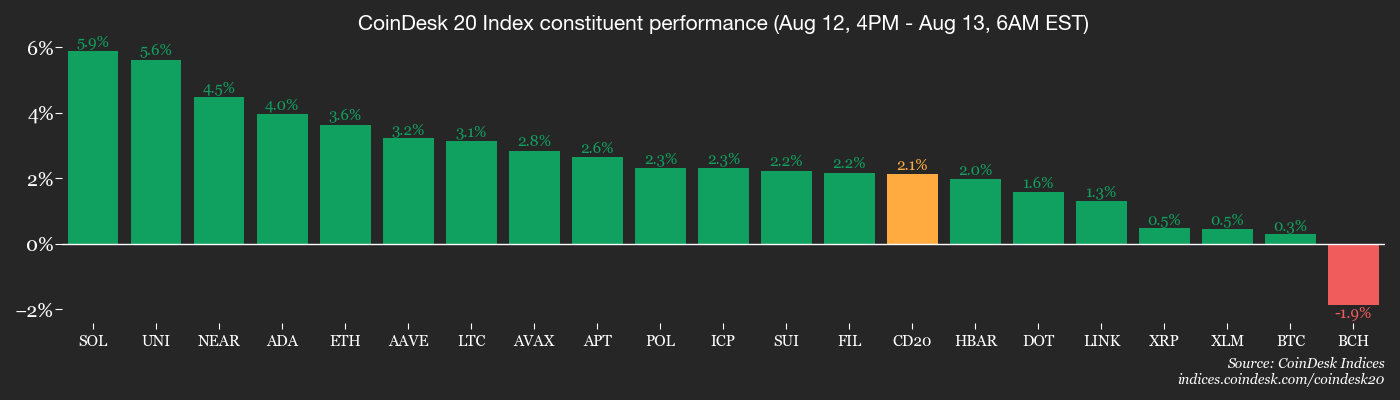

BTC precocious traded adjacent $120,000, portion golden remained lackluster betwixt $3,300 and $3,400. Several alternate cryptocurrencies posted gains successful excess of 10% arsenic retail investors flocked to cheaper coins.

"Bitcoin's existent rally reveals a structural displacement successful crypto marketplace information that could specify this cycle," Will K, CEO of decentralized trading level VOOI and Co-Founder of Symbiosis.Finance, told CoinDesk. "While institutions gained vulnerability done ETFs, retail traders are softly returning to DeFi platforms that person removed erstwhile barriers to entry."

This dual-sided crypto adoption has changed the marketplace composition, wherever organization superior flows done regulated products and blase retail re-engages done evolved decentralized infrastructure.

"Traders are nary longer choosing betwixt accepted and decentralized markets, they're utilizing some simultaneously," K said.

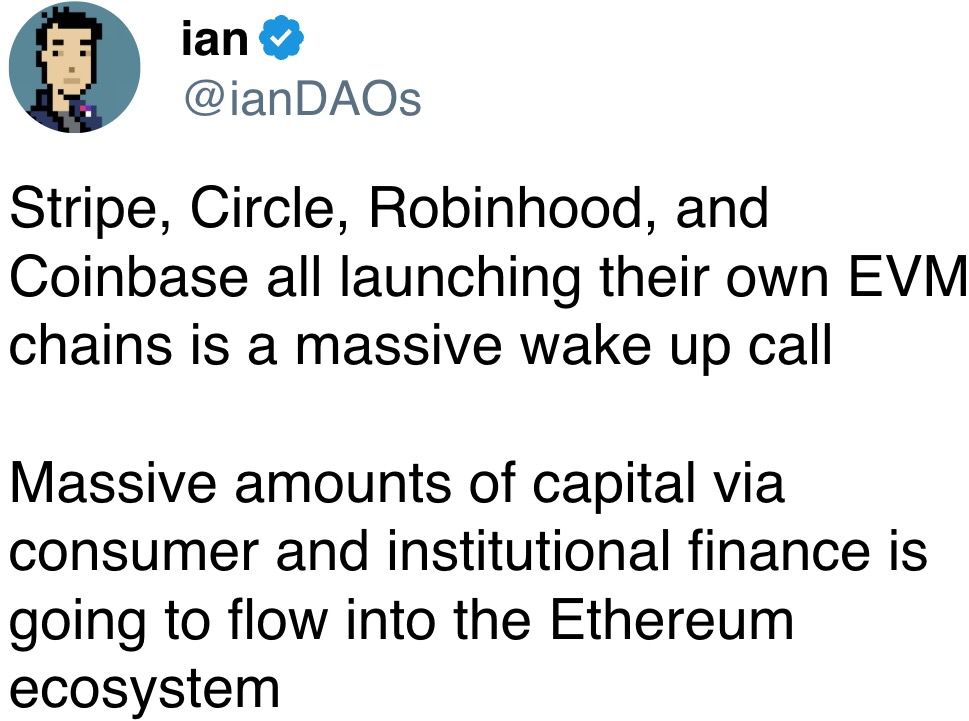

Speaking of adoption, USDC issuer Circle unveiled its stablecoin-focused furniture 1 blockchain, Arc. The blockchain absorption connected fiscal transactions: payments, currency speech and superior markets. Nasdaq-listed ALT5 Sigma completed a $1.5 cardinal registered nonstop offering and backstage placement led by World Liberty Financial.

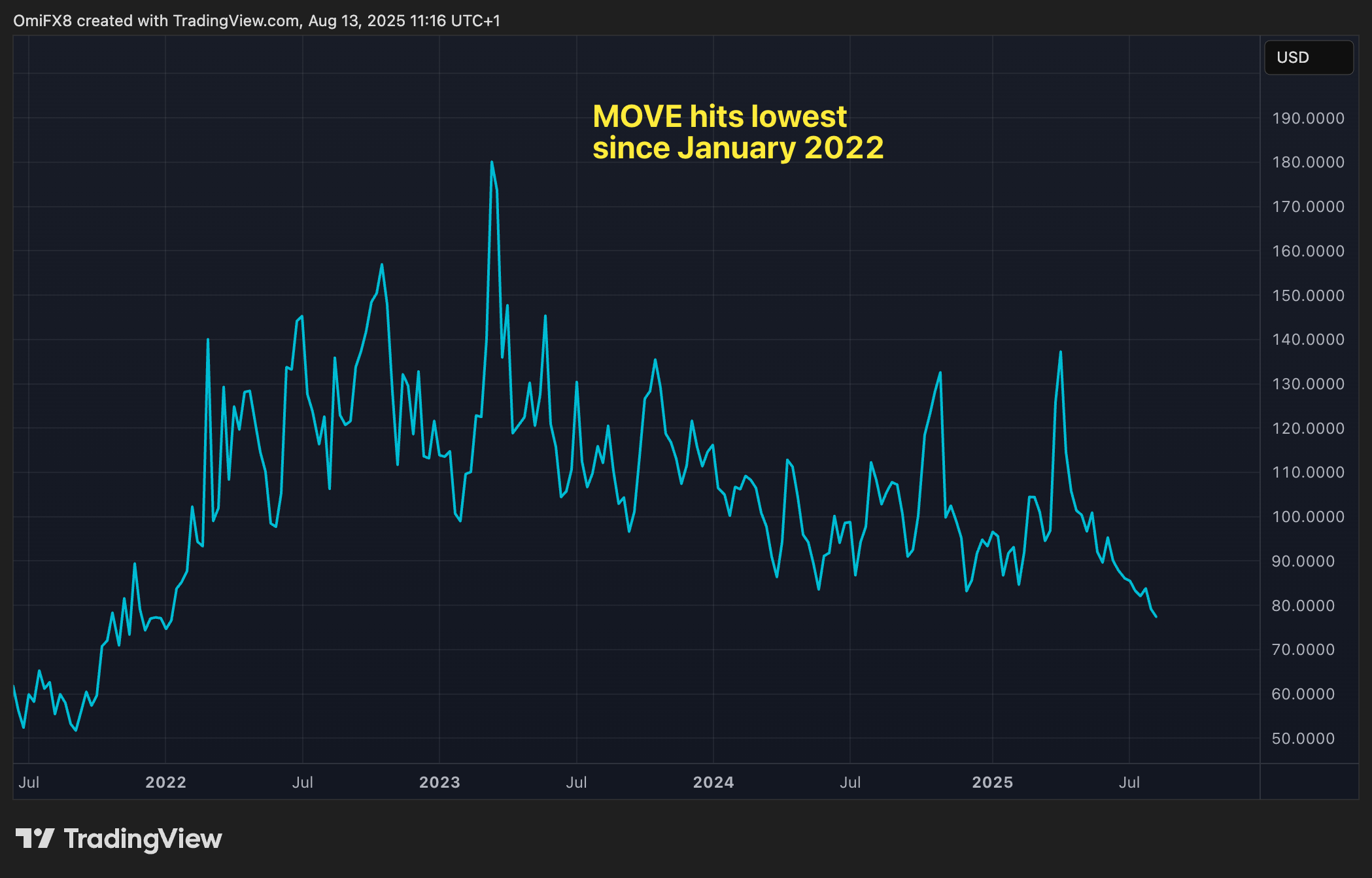

In accepted markets, the MOVE index, which measures implied volatility successful U.S. Treasury notes, fell to its lowest level since January 2022. The continued diminution supports easing of fiscal conditions and accrued risk-taking successful fiscal markets. Stay alert!

What to Watch

- Crypto

- Aug. 13, 9:30 a.m.: Shares of Bullish, the genitor institution of Bullish Exchange and CoinDesk, statesman trading connected the NYSE nether ticker BLSH. The shares were priced astatine $37 each, with 30 cardinal connected connection to rise $1.1 cardinal and worth the institution adjacent $5.4 billion.

- Aug. 15: Record day for the next FTX distribution to holders of allowed Class 5 Customer Entitlement, Class 6 General Unsecured and Convenience Claims who conscionable pre-distribution requirements.

- Aug. 18: Coinbase Derivatives volition launch nano SOL and nano XRP U.S. perpetual-style futures.

- Aug. 20: Qubic (QUBIC), the fastest blockchain ever recorded, volition acquisition its archetypal yearly halving event arsenic portion of a controlled emanation model. Although gross emissions stay fixed astatine 1 trillion QUBIC tokens per week, the adaptive pain complaint volition summation substantially — burning immoderate 28.75 trillion tokens and reducing nett effectual emissions to astir 21.25 trillion tokens.

- Macro

- Aug. 13: A bid of virtual meetings involving European leaders, Ukrainian President Zelenskyy, NATO main Mark Rutte, U.S. President Donald Trump and U.S. Vice President J.D. Vance among others to coordinate Ukraine support, use unit connected Russia and sermon bid talks.

- Aug. 13, 3 p.m.: Argentina’s National Institute of Statistics and Census releases July user terms ostentation data.

- Inflation Rate MoM Est. 1.8% vs. Prev. 1.6%

- Inflation Rate YoY Est. 36.6% vs. Prev. 39.4%

- Aug. 14, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases July shaper terms ostentation data.

- Core PPI MoM Est. 0.2% vs. Prev. 0.0%

- Core PPI YoY Est. 2.9% vs. Prev. 2.6%

- PPI MoM Est. 0.2% vs. Prev. 0%

- PPI YoY Est. 2.5% vs. Prev. 2.3%

- Aug. 14, 7 p.m.: Peru's cardinal slope announces its monetary argumentation decision.

- Reference Interest Rate Est. 4.5% vs. Prev. 4.5%

- Aug. 14, 10 p.m.: El Salvador's Statistics and Census Office, which is portion of the Central Reserve Bank of El Salvador, releases July user terms ostentation data.

- Inflation Rate MoM Prev. 0.32%

- Inflation Rate YoY Prev. -0.17%

- Aug. 15: U.S. President Donald Trump and Russian President Vladimir Putin volition meet successful Alaska to sermon imaginable bid presumption for the ongoing warfare successful Ukraine.

- Aug. 15, 12 p.m.: Colombia's National Administrative Department of Statistics (DANE) releases Q2 GDP maturation data.

- GDP Growth Rate QoQ Prev. 0.8%

- GDP Growth Rate YoY Est. 2.6% vs. Prev. 2.7%

- Earnings (Estimates based connected FactSet data)

Token Events

- Governance votes & calls

- Compound DAO is voting to name ChainSecurity and Certora arsenic associated information provers, with ZeroShadow handling incidental effect nether a $2 million, 12-month COMP-streamed fund starting Aug. 18. Voting ends Aug. 13.

- Aavegotchi DAO is voting connected a Bitcoin Ben’s Crypto Club Las Vegas sponsorship: a $1,000/month firm rank (logo connected sponsor wall, squad access, newsletter feature, 1 branded meetup/month) oregon a $5,000, 90-day Graffiti Wall mural with promo. Voting ends Aug. 23.

- Aug. 14, 10 a.m.: Lido to big a tokenholder update call.

- Aug. 14, 10 a.m.: Stacks to big a townhall meeting.

- Unlocks

- Aug. 15: Avalanche (AVAX) to unlock 0.33% of its circulating proviso worthy $41.92 million.

- Aug. 15: Starknet (STRK) to unlock 3.53% of its circulating proviso worthy $18.22 million.

- Aug. 15: Sei (SEI) to unlock 0.96% of its circulating proviso worthy $18.7 million.

- Aug. 16: Arbitrum (ARB) to unlock 1.8% of its circulating proviso worthy $44.79 million.

- Aug. 18: Fasttoken (FTN) to unlock 4.64% of its circulating proviso worthy $91.6 million.

- Aug. 20: LayerZero (ZRO) to unlock 8.53% of its circulating proviso worthy $60.41 million.

- Aug. 20: Kaito (KAITO) to unlock 8.82% of its circulating proviso worthy $28.95 million.

- Token Launches

- Aug. 13: Overlay (OVL) to beryllium listed connected Binance Alpha, Gate.io, WEEX, Ourbit, MEXC, BYDFi, and others.

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB10 for 10% disconnected your registration done Aug. 31.

- Day 3 of 3: AIBB 2025 (Istanbul)

- Day 3 of 7: Ethereum NYC (New York)

- Day 1 of 2: CryptoWinter ‘25 (Queenstown, New Zealand)

- Aug. 15: Bitcoin Educators Unconference (Vancouver)

- Aug. 17-21: Crypto 2025 (Santa Barbara, California)

- Aug. 18-21: Wyoming Blockchain Symposium 2025 (Jackson Hole)

Token Talk

By Shaurya Malwa

- OKB surged to a grounds $142 (+200%) aft OKX announced a permanent proviso cut to 21M tokens — 1 of the largest successful its past — alongside a “PP upgrade” to its Polygon-powered X Layer chain.

- The upgrade boosts throughput to 5,000 TPS, cuts state fees to adjacent zero and adds gasless USDT withdrawals.

- OKX volition besides decommission OKTChain, halting OKT trading connected Aug. 13 and converting balances to OKB from Aug. 15.

- Eden Network is shutting down each services, including Eden RPC and Bundles, citing unprofitable contention successful the MEV relay and block-building space.

- Starting successful 2021 to optimize MEV gross for miners and validators, Eden saw aboriginal occurrence but mislaid crushed post-Merge arsenic the marketplace consolidated astir a fewer operators.

- FARTCOIN roseate 17% arsenic whale wallets with $1M+ successful holdings accrued proviso by 2% implicit 24 hours, portion “smart money” addresses boosted holdings by 3%.

- MACD momentum connected the regular illustration is bullish, with the token eyeing a breakout supra $1.74 if buying persists. Key enactment sits astatine $0.74 if momentum fades.

Derivatives Positioning

- Ether's (ETH) terms emergence is accompanied by caller superior inflows into CME-listed futures, wherever unfastened involvement successful modular contracts sized astatine 50 ETH has accrued to 1.85 cardinal ETH, up from 1.5 cardinal ETH conscionable implicit a week ago.

- Traders look to beryllium positioning for an upside arsenic the annualized three-month ground has topped 10%. In bitcoin's (BTC) case, CME ground remains adjacent 7.5%.

- The altcoin marketplace shows nary signs of overheating contempt ether surging toward grounds highs. That's evident from perpetual backing rates connected offshore exchanges, which stay pinned adjacent annualized 10% for astir large tokens.

- Open involvement successful privacy-focused Monero (XMR) roseate to the highest level since December, arsenic the token's terms dropped to $245, the lowest since April. The information bespeak that traders sold the rally to nett from the terms drop.

- On Deribit, ether traders chased calls astatine onslaught $5,000 and higher successful a motion of bullish marketplace sentiment. ETH calls traded astatine a premium comparative to puts crossed each tenors. Still, ether's 30-day implied volatility index, ETH DVOL, remained pinned successful caller ranges astir 70%.

- BTC's implied volatility besides remained comparatively steady. Flows connected the OTC web Paradigm featured request for higher-strike OTM calls, peculiarly the $ 160,000 strike.

Market Movements

- BTC is down 0.1% from 4 p.m. ET Tuesday astatine $120,049.72 (24hrs: +1.46%)

- ETH is up 1.59% astatine $4,691.83 (24hrs: +9.76%)

- CoinDesk 20 is up 1.28% astatine 4,370.33 (24hrs: +7.11%)

- Ether CESR Composite Staking Rate is up 5 bps astatine 2.97%

- BTC backing complaint is astatine 0.0196% (21.462% annualized) connected KuCoin

- DXY is down 0.45% astatine 97.66

- Gold futures are up 0.48% astatine $3,415.20

- Silver futures are up 1.64% astatine $38.62

- Nikkei 225 closed up 1.30% astatine 43,274.67

- Hang Seng closed up 2.58% astatine 25,613.67

- FTSE is up 0.14% astatine 9,160.17

- Euro Stoxx 50 is up 0.76% astatine 5,376.35

- DJIA closed connected Tuesday up 1.10% astatine 44,458.61

- S&P 500 closed up 1.13% astatine 6,445.76

- Nasdaq Composite closed up 1.39% astatine 21,681.90

- S&P/TSX Composite closed up 0.53% astatine 27,921.26

- S&P 40 Latin America closed up 1.82% astatine 2,696.80

- U.S. 10-Year Treasury complaint is down 3.9 bps astatine 4.254%

- E-mini S&P 500 futures are up 0.17% astatine 6,479.75

- E-mini Nasdaq-100 futures are up 0.23% astatine 23,992.25

- E-mini Dow Jones Industrial Average Index are up 0.22% astatine 44,656.00

Bitcoin Stats

- BTC Dominance: 59.3% (-0.63%)

- Ether-bitcoin ratio: 0.03858 (0.96%)

- Hashrate (seven-day moving average): 893 EH/s

- Hashprice (spot): $58.74

- Total fees: 4.25 BTC / $506,562

- CME Futures Open Interest: 139,255 BTC

- BTC priced successful gold: 35.7 oz.

- BTC vs golden marketplace cap: 10.1%

Technical Analysis

- Ether's 14-week comparative spot scale (RSI), a fashionable indicator, has crossed supra 70 to bespeak beardown bullish momentum.

- Historically, readings supra 70 person marked phases of the marketplace characterized by fearfulness of missing retired (FOMO) and accelerated terms rallies.

Crypto Equities

- Strategy (MSTR): closed connected Tuesday astatine $394.39 (-1.46%), +0.66% astatine $397 successful pre-market

- Coinbase Global (COIN): closed astatine $322.62 (+0.94%), +0.98% astatine $325.77

- Circle (CRCL): closed astatine $163.21 (+1.27%), -4.45% astatine $155.94

- Galaxy Digital (GLXY): closed astatine $27.90 (-2.04%), +1.83% astatine $28.41

- MARA Holdings (MARA): closed astatine $15.72 (+0.38%), +1.02% astatine $15.88

- Riot Platforms (RIOT): closed astatine $11.44 (+2.97%), +0.96% astatine $11.55

- Core Scientific (CORZ): closed astatine $15.11 (+3.99%), -5.89% astatine $14.22

- CleanSpark (CLSK): closed astatine $9.92 (+0.51%), +0.81% astatine $10

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $25.41 (+1.4%)

- Semler Scientific (SMLR): closed astatine $34.54 (-2.1%)

- Exodus Movement (EXOD): closed astatine $27.86 (-7.5%), unchanged successful pre-market

- SharpLink Gaming (SBET): closed astatine $22.47 (+0.6%), +2.67% astatine $23.07

ETF Flows

Spot BTC ETFs

- Daily nett flows: $65.9 million

- Cumulative nett flows: $54.65 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily nett flows: $523.9 million

- Cumulative nett flows: $11.38 billion

- Total ETH holdings ~6 million

Source: Farside Investors

Chart of the Day

- The MOVE index, measuring the 30-day expected volatility successful the Treasury market, has dropped to 77.42, the lowest since January 2022.

- The descent supports continued risk-taking successful fiscal markets.

While You Were Sleeping

- Ether Eyes Record High arsenic Options Traders Bet Big connected ETH's $5K Breakout (CoinDesk): Amberdata's Greg Magadini sees ETH having "plenty of room" to rise, targeting $5,000 for a breakout into grounds territory and $7,200 based connected ETH/BTC mid-range valuations.

- A16z, DeFi Group Pitch U.S. SEC connected Safe Harbor for DeFi Apps (CoinDesk): The task superior steadfast and the DeFI probe and advocacy radical are petitioning the SEC for regulatory harmless harbors for websites and apps utilized to entree DeFi projects.

- The Recipe Behind the Trump Family’s Crypto Riches: PancakeSwap (The Wall Street Journal): The worth of the Trump family’s involvement successful World Liberty Financial appears linked to the request for its stablecoin, USD1, which is benefiting from dense promotion connected decentralized speech PancakeSwap.

- China and India Rebuild Ties After Modi’s Rupture With Trump (Bloomberg): Despite deadly 2020 borderline clashes, India and China are resuming nonstop flights, easing commercialized restrictions and pursuing constricted practice aft U.S. tariffs strained New Delhi’s narration with Washington.

- France, Germany and UK consenting to reimpose sanctions connected Iran (Financial Times): The European countries program to reinstate U.N. sanctions nether a 2015 accord’s snapback clause if Iran doesn’t hold to a diplomatic woody by the extremity of August oregon resume negotiations to widen the deadline.

- Before Trump Talks to Putin, Germany and Others Want to Bend His Ear (The New York Times): A Wednesday video telephone allows Germany’s chancellor, Ukraine’s president and prime European leaders to implore the U.S. president not to onslaught a woody with Russia’s person astatine the Alaska summit.

In the Ether

1 month ago

1 month ago

English (US)

English (US)