Crypto quality seeped backmost into mainstream headlines past week with the disclosure of a $624 cardinal heist from Axie Infinity’s Ronin Network. The onslaught targeted the Ronin Bridge, which enables users to walk funds betwixt the Ronin web and Ethereum.

To immoderate successful the crypto world, the Ronin onslaught was grounds that the aboriginal of crypto, adjacent if it is to beryllium “multichain,” is improbable to beryllium “cross-chain.” With teams fleeing Ethereum for much centralized blockchains that are faster and cheaper, the Ronin onslaught besides served arsenic a reminder of decentralization’s importance.

Ronin is simply a sidechain, oregon parallel network, to Ethereum. Sky Mavis, the institution down the wildly fashionable play-to-earn crippled Axie Infinity, created Ronin successful 2020 aft realizing Ethereum’s basal furniture was excessively dilatory and costly to grip each the transactions required to powerfulness specified a game.

When you look nether the hood, bridges similar Ronin’s typically enactment by locking up cryptocurrency successful astute contracts connected 1 chain, and past re-issuing those tokens successful “wrapped” signifier connected a destination chain. So for example, if you were to usage the Ronin Bridge to determination ether (ETH) from Ethereum to Ronin, ETH would get locked up connected Ethereum to service arsenic 1:1 backing for wrapped ether (WETH) issued connected Ronin.

With truthful overmuch wealth locked up successful 1 place, bridges person go fashionable targets for thieves. The Ronin attacker pulled disconnected March’s exploit by obtaining 5 of the 9 validator keys that are liable for securing the Ronin network. By holding a bulk of the keys, the attacker was capable to maliciously retreat piles of cryptocurrency consecutive from the Ronin Bridge into a rogue Ethereum wallet.

Once the afloat grade of the Ronin onslaught became public, it rapidly took its throne atop the infamous Rekt leaderboard, which started ranking attacks connected DeFi protocols successful 2020 successful presumption of wealth lost.

Ronin was not the first, nor is it apt to beryllium the last, crypto span looted for immense sums of cryptocurrency. Joining Ronin successful the 2nd and 3rd slots of Rekt’s leaderboard are 2 much attacks connected crypto bridges. In 3rd spot is February’s $311 cardinal exploit of the Wormhole bridge. And successful 2nd spot is the August 2021 onslaught connected the Poly Network bridge, wherever a hacker famously stole $611 cardinal lone to springiness it each back.

With yet different crypto span getting exploited for hundreds of millions of dollars, galore successful the crypto assemblage person quipped that the Ronin exploit is further grounds that “cross-chain” crypto is doomed to fail.

“The cardinal information limits of bridges are really a cardinal crushed why, portion I americium optimistic astir a multi-chain blockchain ecosystem … I americium pessimistic astir cross-chain applications,” Buterin wrote.

Sending assets crossed cross-chain bridges volition ne'er transportation the aforesaid information guarantees arsenic transacting wrong idiosyncratic blockchain ecosystems, helium explained successful the 900-word post.

Much of Buterin’s critique of cross-chain bridges stems from the information that they are peculiarly susceptible to 51% attacks similar the 1 that afflicted the Ronin network. If a span is attacked connected 1 blockchain and drained of funds, users connected the different extremity of the span – connected a wholly antithetic blockchain – are besides affected, since they volition beryllium near holding tokens that are nary longer backed by anything.

“If determination are 100 chains, past determination volition extremity up being dapps with galore interdependencies betwixt those chains, and 51% attacking adjacent 1 concatenation would make a systemic contagion that threatens the system of that full ecosystem,” Buterin wrote.

Sky Mavis tried to standard up its quality to run connected Ethereum by gathering retired a sidechain (Ronin). But scaling a furniture 1 blockchain via a sidechain – which volition ever necessitate a span – volition arguably ne'er beryllium arsenic harmless arsenic scaling via solutions similar rollups, which inherit their information guarantees from a furniture 1 chain.

The worth of decentralization

In summation to highlighting the shortcomings of cross-chain bridges, the Ronin onslaught validated different halfway thesis among Ethereum devotees – 1 which is shared by bitcoiners and crypto-idealists successful wide – which is that existent decentralization is vitally important to the occurrence of immoderate crypto ecosystem.

Decentralization often gets lumped successful with the authorities and ideology of crypto’s Twitterati – framed arsenic a committedness to propulsion powerfulness distant from institutions and middlemen and springiness it backmost to the small guy.

While appealing to some, arguments astir the philosophical virtues of decentralization are a turn-off to those who deliberation blockchains are conscionable arsenic corruptible arsenic immoderate different technology. Moreover, much and much crypto projects are emerging that propulsion decentralization to the wind, believing (perhaps rightfully) that today’s users don’t attraction astir decentralization truthful agelong arsenic they tin transact rapidly and cheaply – a shortcoming of Ethereum arsenic it presently exists.

The Ronin onslaught reminds america that decentralization, careless of what users mightiness think, is of applicable information value for big-money applications. Sky Mavis moved from Ethereum to Ronin to velocity transactions and chopped costs. It achieved these goals (Ronin processed implicit 500% much transactions than Ethereum astatine its peak), but its centralized proof-of-authority model, wherever conscionable 9 validators were successful complaint of securing the full network, near it susceptible to attack.

Ethereum has large scalability shortcomings, and its dilatory gait migrating to Ethereum 2.0 has near country for much centralized chains similar Ronin to look retired of sheer necessity. Nevertheless, arsenic “the Merge” inches closer, past month’s Ronin onslaught showed wherefore the hard enactment of decentralization astatine standard remains important.

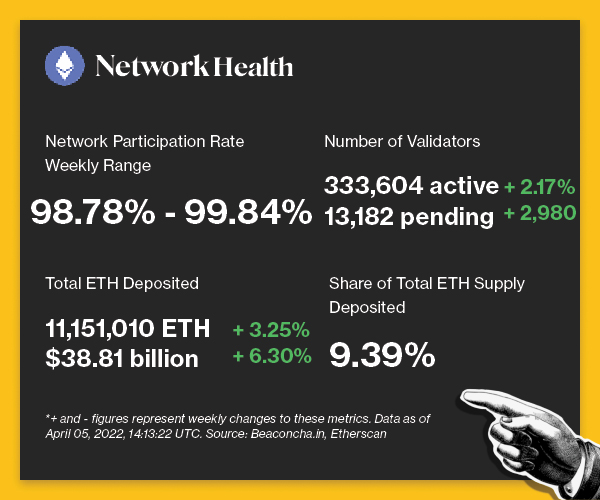

The pursuing is an overview of web enactment connected the Ethereum Beacon Chain implicit the past week. For much accusation astir the metrics featured successful this section, cheque retired our 101 explainer connected Eth 2.0 metrics.

Valid Points Network Health 4.05

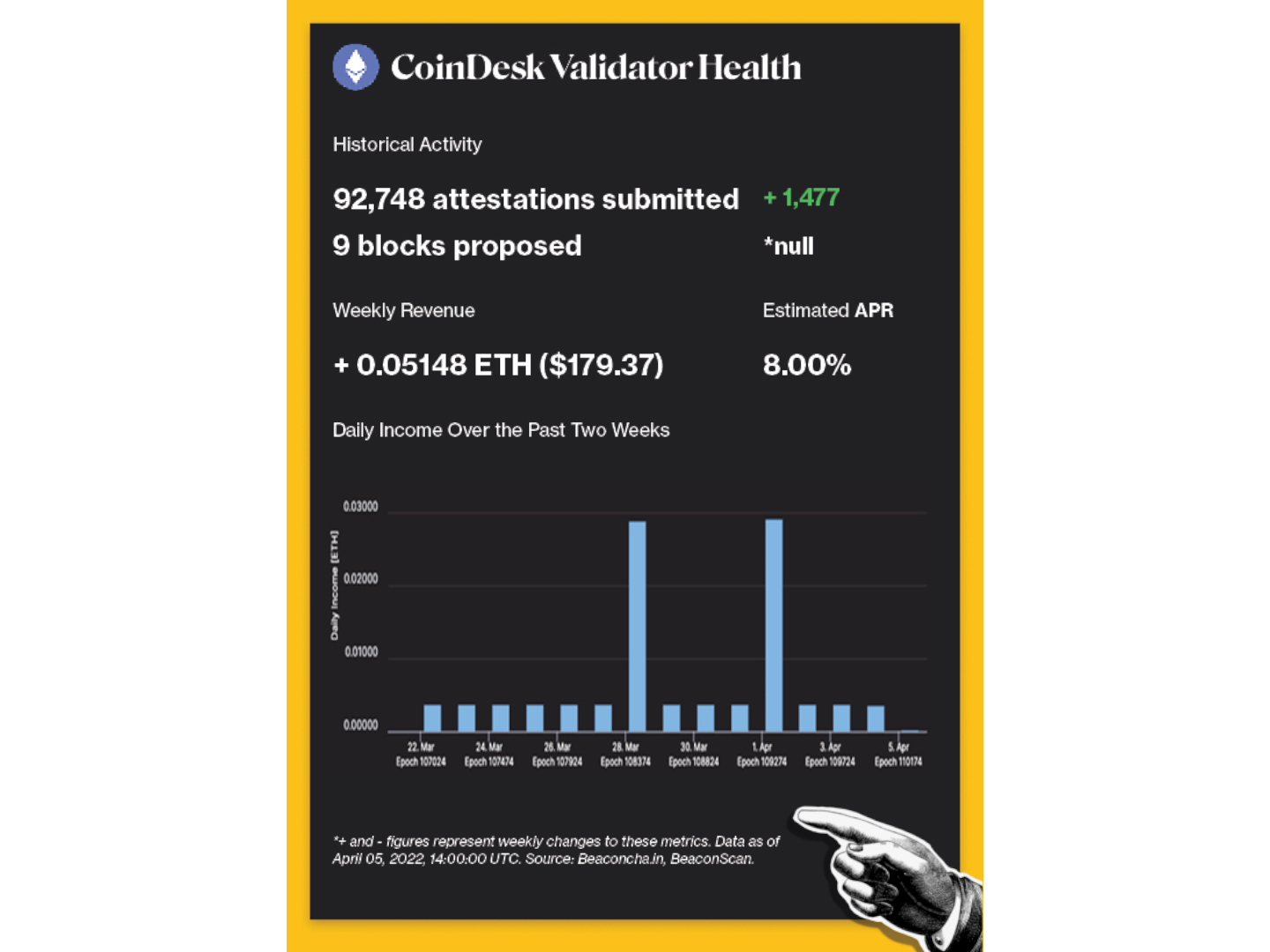

CoinDesk Validator Health 4.05

Disclaimer: All profits made from CoinDesk’s Eth 2.0 staking task volition beryllium donated to a foundation of the company’s choosing erstwhile transfers are enabled connected the network.

WHY IT MATTERS: Of the $155 million, $60 cardinal volition beryllium dedicated for liquidity mining rewards for decentralized exchanges, and the different $95 cardinal volition beryllium allocated for infrastructure-focused grants, according to HBAR Foundation Director Elaine Song’s interrogation with CoinDesk. These funds awesome Hedera’s strategy to pull decentralized concern projects that are usable for the mean retail user.

Several DeFi protocols were exploited for millions past week.

WHY IT MATTERS: Coming blistery disconnected the heels of Axie Infinity’s Ronin Network $624 cardinal exploit, Ola Finance was exploited for $3.6 cardinal successful a re-entrancy attack, while Inverse Finance suffered a $15.6 cardinal attack. The caller crypto exploits not lone item however attackers are utilizing precocious methods to execute their strategies, but they besides punctual america however thefts of ample sums of wealth are commonplace successful DeFi.

The U.K. government announced plans to marque Britain a planetary crypto plus hub.

WHY IT MATTERS: Plans see recognizing stablecoins arsenic a valid signifier of payment, commissioning the Royal Mint to make a non-fungible token this summertime and exploring the transformative benefits of distributed ledger exertion successful U.K. fiscal markets. “This is portion of our program to guarantee the U.K. fiscal services manufacture is ever astatine the forefront of exertion and innovation,” Chancellor of the Exchequer Rishi Sunak said.

Abra, a crypto brokerage platform, opened Abra Capital Management (ACM) to tribunal high-net-worth clients who privation a portion of the enactment successful integer assets.

WHY IT MATTERS: ACM's intent is to springiness clients entree to actively managed structured products and concern funds. Three of the 5 funds volition people yield-generating opportunities successful stablecoins, bitcoin (BTC) and ether (ETH). ACM is different awesome of capitalist request for vulnerability to this young plus class.

Valid Points Factoid 4.05

Valid Points incorporates accusation and information astir CoinDesk’s ain Eth 2.0 validator successful play analysis. All profits made from this staking task volition beryllium donated to a foundation of our choosing erstwhile transfers are enabled connected the network. For a afloat overview of the project, cheque retired our announcement post.

You tin verify the enactment of the CoinDesk Eth 2.0 validator successful existent clip done our nationalist validator key, which is:

0xad7fef3b2350d220de3ae360c70d7f488926b6117e5f785a8995487c46d323ddad0f574fdcc50eeefec34ed9d2039ecb.

Search for it connected immoderate Eth 2.0 artifact explorer site.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Valid Points, our play newsletter breaking down Ethereum’s improvement and its interaction connected crypto markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)