A “paradigm,” arsenic defined by Ray Dalio, is simply a play of clip during which “Markets and marketplace relationships run successful a definite mode that astir radical accommodate to and yet extrapolate.” A “paradigm shift” occurs erstwhile those relationships are overdone, resulting successful “markets that run much other than akin to however they operated during the anterior paradigm.”

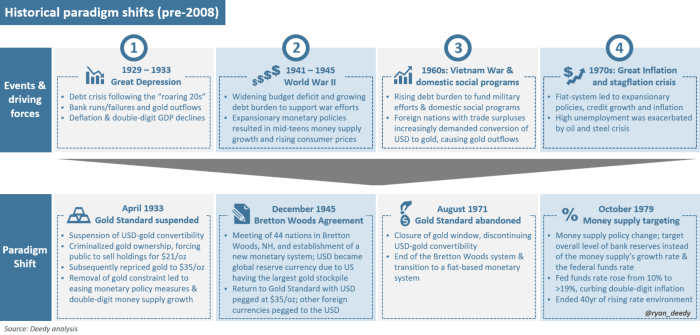

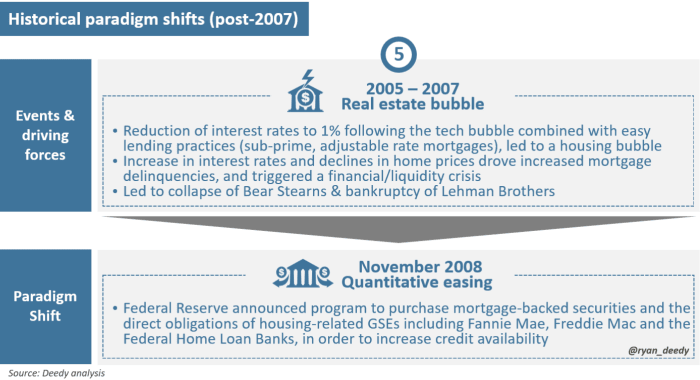

Prior to 2008, determination were 4 specified paradigm shifts, each identified by a worldly alteration successful the Federal Reserve Board’s monetary argumentation model successful effect to unsustainable indebtedness growth. In 2008, we saw the 5th and astir caller paradigm shift, erstwhile erstwhile Fed Chair Ben Bernanke introduced quantitative easing (QE) successful effect to the Great Recession. Since then, the Fed has been operating successful uncharted territory, launching aggregate rounds of an already unconventional monetary argumentation with detrimental outcomes.

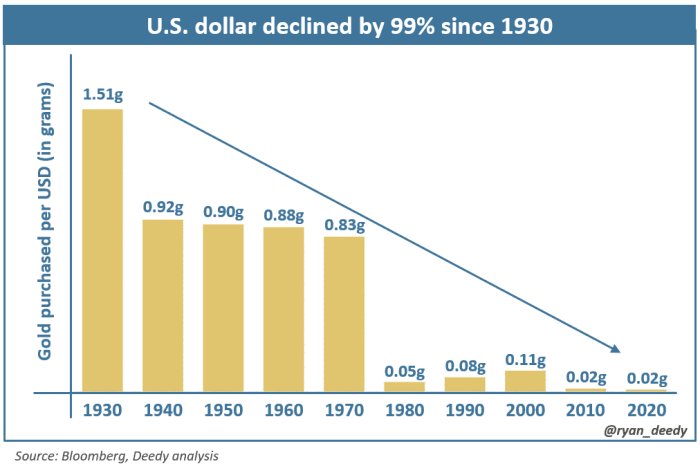

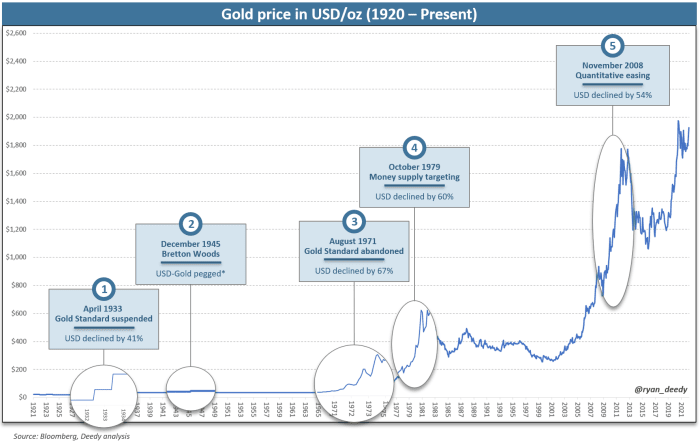

A important and achy effect of the past 5 paradigm shifts has been the devaluation of the U.S. dollar. Since the archetypal displacement successful 1933, the dollar has mislaid 99% of its worth against gold.

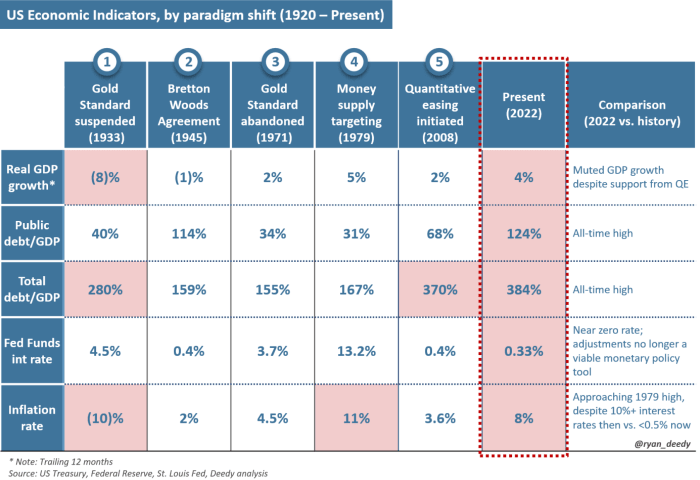

We are presently surviving done a play with unprecedented levels of nationalist debt, expanding inflationary pressures and escalating geopolitical conflicts. This is besides coming astatine a clip erstwhile the planetary power of the United States is waning and the dollar’s reserve currency presumption is being called into question. All of this indicates that the extremity of the existent paradigm is accelerated approaching.

Analyzing past paradigm shifts volition pb immoderate to expect a instrumentality to the golden standard, but we present unrecorded successful a satellite with an alternate and superior monetary plus – bitcoin – which is rapidly gaining adoption among individuals and nations. Unlike successful past paradigms, the invention of bitcoin introduces the imaginable for a caller monetary model – a Bitcoin standard.

To amended measure the imaginable interaction from a alteration to the existent monetary system, it is important to recognize however we arrived astatine this point. Armed with this knowledge, we volition beryllium amended positioned to navigate the upcoming paradigm shift, the associated economical volatility, and recognize the imaginable interaction connected the dollar’s value. Bitcoin volition apt play a cardinal relation successful this transition, not lone arsenic a savings tool, but besides successful shaping aboriginal monetary policy.

Debt’s Role In The Business Cycle

A concern rhythm refers to the recurrent series of increases and decreases successful economical enactment implicit time. The 4 stages of a concern rhythm see expansion, peak, contraction and trough. The expansionary signifier is characterized by improving economical conditions, rising user assurance and declining involvement rates. As maturation accelerates and the proviso of recognition expands, borrowers are incentivized to instrumentality connected leverage to money plus purchases. However, arsenic the system reaches the aboriginal years of the cycle, ostentation tends to summation and plus bubbles are formed. Peak economical conditions tin beryllium sustained for years, but eventually, maturation turns negative, starring to the contraction signifier of the cycle. The severity and magnitude of these downturns tin alteration from a mild recession lasting six months to a slump that lasts for years.

The magnitude of indebtedness accumulated during the expansionary signifier of the concern rhythm plays a captious relation successful however policymakers respond to economical crises. Historically, the Fed navigated astir recessions by relying connected its 3 monetary argumentation tools: unfastened marketplace operations, the discount complaint and reserve requirements. However, determination were 4 instances anterior to 2008 wherever the Fed pivoted from humanities norms and introduced a caller monetary argumentation framework, marking the extremity of 1 paradigm and the opening of different — a paradigm shift.

Historical Paradigm Shifts

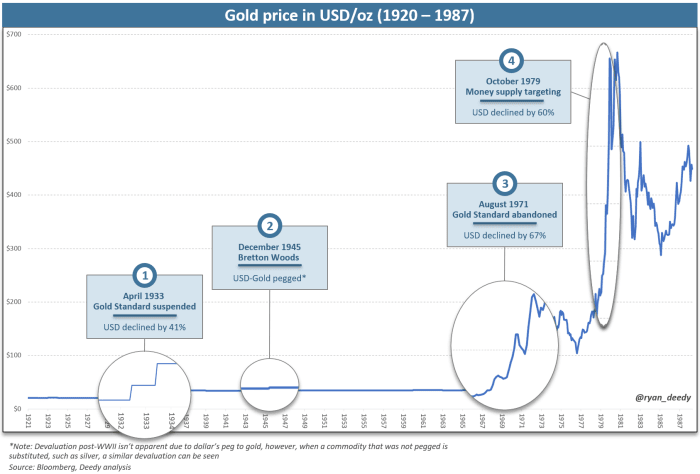

The archetypal paradigm displacement occurred successful 1933 during the Great Depression erstwhile President Franklin D. Roosevelt suspended the convertibility of dollars to gold, efficaciously abandoning the golden standard. Severing the dollar’s nexus to golden allowed the Fed to summation the wealth proviso without constraint to stimulate the economy.

Following years of planetary cardinal banks backing their country’s subject efforts successful WWII, the monetary strategy experienced different paradigm displacement successful 1945 with the signing of the Bretton Woods Agreement, which reintroduced the dollar’s peg to gold. Reverting to the golden modular led to astir 15 years of mostly prosperous times for the U.S. economy. Nominal gross home merchandise (GDP) averaged 6% growth, portion ostentation remained muted astir 3.5%, contempt precise accommodative involvement complaint policies.

However, authorities spending picked up successful the 1960s to enactment societal spending programs and to money the Vietnam War. Before long, the authorities recovered itself saddled again with excessively overmuch debt, rising ostentation and a increasing fiscal deficit. On the evening of August 15, 1971, Richard Nixon announced that helium would adjacent the golden window, ending dollar convertibility to golden — an explicit default connected its indebtedness obligations — successful bid to curb ostentation and forestall overseas nations from retrieving immoderate golden that was inactive owed to them. Nixon’s announcement officially marked the extremity of the golden standard, and the modulation to a purely fiat-based monetary system.

Like successful the 1930s, abandoning the golden modular allowed the Fed to summation the wealth proviso astatine will. The expansionary policies that followed fueled 1 of the strongest inflationary periods successful history. With inflation exceeding 10% by 1979, then-Fed Chair Paul Volcker made a astonishment announcement that the Fed would statesman managing the measurement of slope reserves successful the fiscal system, arsenic opposed to specifically targeting the wealth supply’s maturation complaint and regular national funds rate. He warned that the alteration successful argumentation would let involvement rates to person “substantial state successful the market,” subjecting it to much “fluctuations.” The national funds complaint subsequently began to summation and eventually exceeded 19%, sending the system into a recession. Volcker’s argumentation alteration and the reset of involvement rates to all-time highs marked the extremity of 40 years of a rising complaint environment.

Historical Paradigm Shifts

The archetypal paradigm displacement occurred successful 1933 during the Great Depression erstwhile President Franklin D. Roosevelt suspended the convertibility of dollars to gold, efficaciously abandoning the golden standard. Severing the dollar’s nexus to golden allowed the Fed to summation the wealth proviso without constraint to stimulate the economy.

Following years of planetary cardinal banks backing their country’s subject efforts successful WWII, the monetary strategy experienced different paradigm displacement successful 1945 with the signing of the Bretton Woods Agreement, which reintroduced the dollar’s peg to gold. Reverting to the golden modular led to astir 15 years of mostly prosperous times for the U.S. economy. Nominal gross home merchandise (GDP) averaged 6% growth, portion ostentation remained muted astir 3.5%, contempt precise accommodative involvement complaint policies.

However, authorities spending picked up successful the 1960s to enactment societal spending programs and to money the Vietnam War. Before long, the authorities recovered itself saddled again with excessively overmuch debt, rising ostentation and a increasing fiscal deficit. On the evening of August 15, 1971, Richard Nixon announced that helium would adjacent the golden window, ending dollar convertibility to golden — an explicit default connected its indebtedness obligations — successful bid to curb ostentation and forestall overseas nations from retrieving immoderate golden that was inactive owed to them. Nixon’s announcement officially marked the extremity of the golden standard, and the modulation to a purely fiat-based monetary system.

Like successful the 1930s, abandoning the golden modular allowed the Fed to summation the wealth proviso astatine will. The expansionary policies that followed fueled 1 of the strongest inflationary periods successful history. With inflation exceeding 10% by 1979, then-Fed Chair Paul Volcker made a astonishment announcement that the Fed would statesman managing the measurement of slope reserves successful the fiscal system, arsenic opposed to specifically targeting the wealth supply’s maturation complaint and regular national funds rate. He warned that the alteration successful argumentation would let involvement rates to person “substantial state successful the market,” subjecting it to much “fluctuations.” The national funds complaint subsequently began to summation and eventually exceeded 19%, sending the system into a recession. Volcker’s argumentation alteration and the reset of involvement rates to all-time highs marked the extremity of 40 years of a rising complaint environment.

Impact of Paradigm Shifts On The U.S. Dollar

Gold is 1 of the fewer commodities that has been utilized passim past arsenic some a store-of-value plus and arsenic a currency, evidenced by its relation successful monetary systems astir the world, i.e., “the golden standard.” Regardless of its carnal form, golden is measured by its value and purity. Within the United States, a troy ounce is the modular measurement for gold’s value and karats for its purity. Once measured, its worth tin beryllium quoted successful assorted speech rates, including 1 that references the U.S. dollar.

With golden having a modular portion of measure, immoderate fluctuation successful its speech complaint reflects an summation oregon alteration successful the respective currency’s purchasing power. For example, erstwhile the purchasing powerfulness of the dollar increases, owners of dollars tin bargain much units of gold. When the dollar’s worth declines, it tin beryllium exchanged for less units of gold.

At the clip of writing, the U.S. dollar terms for 1 troy ounce of golden with 99.9% purity is astir $2,000. At this speech rate, $10,000 tin beryllium exchanged for 5 ounces of gold. If the purchasing powerfulness of the dollar strengthens by 20%, the terms for golden would diminution to $1,667, allowing the purchaser to acquisition six ounces for $10,000 compared to 5 ounces from the archetypal example. Alternatively, if the dollar weakens by 20%, gold’s terms would summation to $2,500, allowing the purchaser to acquisition lone 4 ounces.

With this narration successful caput erstwhile observing gold’s historical terms chart, the diminution successful the dollar’s purchasing powerfulness during humanities paradigm shifts becomes obvious.

Quantitative Easing In The Current Paradigm

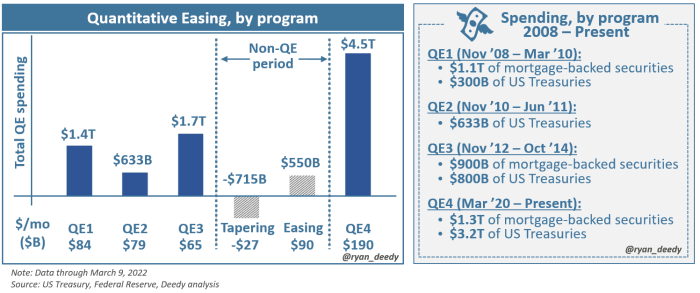

The astir caller paradigm displacement occurred astatine the extremity of 2008 erstwhile the Fed introduced the archetypal circular of quantitative easing successful effect to the Great Recession.

While rising involvement rates and weakness successful location prices were the cardinal catalysts for the recession, the seeds were sown agelong before, dating backmost to 2000 erstwhile the Fed archetypal began lowering involvement rates. Over the pursuing 7 years, the national funds complaint was lowered from 6.5% to a meager 1.0%, which concurrently drove a $6 trillion summation successful location owe loans to implicit $11 trillion. By 2007, household indebtedness had accrued from 70% to 100% of GDP, a indebtedness load that proved to beryllium unsustainable arsenic involvement rates roseate and the system softened.

Like past shifts, the unsustainable indebtedness load was the cardinal origin that yet led the Fed to set its argumentation framework. Not surprisingly, the result from implementing its caller argumentation was accordant with past — a ample summation successful the wealth proviso and a 50% devaluation successful the worth of the dollar against gold.

However, this paradigm has been dissimilar immoderate different successful history. Despite taking unprecedented actions — 4 rounds of QE totaling $8 trillion of stimulus implicit the past 14 years — the Fed has not been capable to amended its power of the broader economy. Rather, its grip has lone weakened, portion the nation’s indebtedness has ballooned.

With nationalist indebtedness present exceeding $30 trillion, oregon 120% of GDP, a national fund shortage nearing $3 trillion, an effectual national funds complaint of conscionable 0.33% and 8% inflation, the system is successful its astir susceptible presumption compared to immoderate different clip successful history.

Government Funding Needs Will Increase In Economic Instability

While the Fed discusses further tapering of its fiscal support, immoderate tightening measures are apt to beryllium short-lived, fixed the economy’s continued weakness and reliance connected indebtedness to thrust economical growth.

Less than 4 months ago, Congress increased the indebtedness ceiling for the 78th clip since the 1960s. Given the nation’s historically precocious indebtedness level and its existent fiscal situation, its request for aboriginal borrowing is improbable to change.

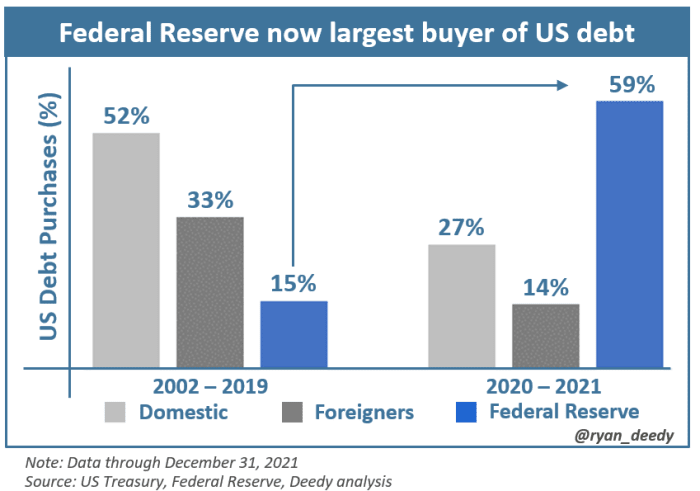

However, the backing marketplace for the government’s indebtedness has changed. Since the pandemic-related lockdowns and the associated fiscal alleviation programs that were announced successful 2020, request for U.S. indebtedness has dried up. The authorities has since relied connected the Fed to money the bulk of its spending needs.

As request for U.S. indebtedness from home and overseas investors continues to wane, it’s apt that the Fed volition stay the largest financier of the U.S. government. This volition thrust further increases successful the wealth supply, inflation, and a diminution successful the worth of the dollar.

Bitcoin Is The Best Form Of Money

As the nation’s indebtedness load grows and the purchasing powerfulness of the dollar continues to diminution implicit the coming months and years, request for a amended signifier of wealth and/or store-of-value plus volition increase.

This leads to the questions, what is wealth and what makes 1 signifier amended than another? Money is simply a instrumentality that is utilized to facilitate economical exchange. According to Austrian economist Carl Menger, the best signifier of money is that which is astir saleable, having the quality to easy beryllium sold successful immoderate quantity, astatine immoderate constituent successful clip and for a terms that is desired. That which has “almost unlimited saleableness” volition beryllium deemed the champion money, for which different lesser forms of wealth are measured.

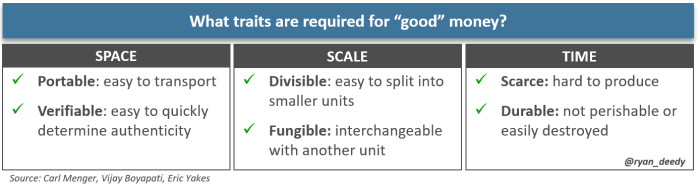

Saleability of a bully tin beryllium assessed crossed 3 dimensions: space, standard and time. Space refers to the grade to which a bully tin beryllium easy transported implicit distances. Scale means a bully performs good arsenic a mean of exchange. Lastly, and astir importantly, clip refers to a good’s scarcity and its quality to sphere worth implicit agelong periods.

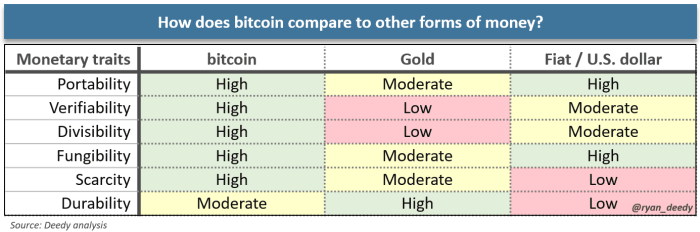

As seen galore times passim history, golden has often been sought for its saleability. The dollar has besides been viewed similarly, but its monetary traits person degraded meaningfully since losing its golden backing. However, with the advent of the net and Satoshi Nakamoto’s invention of Bitcoin successful 2009, determination is present a superior monetary alternative.

Bitcoin shares galore similarities with golden but improves upon its weaknesses. Bitcoin has the highest saleability — it is much portable, verifiable, divisible, fungible, and scarce. The 1 country wherever it remains inferior is its durability, fixed that golden has been astir for thousands of years compared to lone 13 years for bitcoin. It is lone a substance of clip earlier bitcoin demonstrates its durability.

The Next Paradigm Shift

The dollar’s nonaccomplishment of its reserve currency presumption volition punctual the sixth paradigm displacement successful U.S. monetary policy. With it volition travel yet different important diminution successful the worth of the dollar.

Historical precedents volition pb immoderate to judge that a modulation backmost to the golden modular is astir likely. While this is wholly possible, different probable and realistic monetary alternate successful the integer property is the adoption of a Bitcoin standard. Fundamentally, bitcoin is simply a superior monetary bully compared to each of its predecessors. As past has shown successful the lawsuit of gold, the plus that is astir saleable, with the strongest monetary traits, is the 1 that everyone volition converge to.

Bitcoin is the hardest signifier of wealth the satellite has ever seen. Some person already realized this, but with time, everyone from individuals to nation-states volition travel to the aforesaid conclusion.

This is simply a impermanent station by Ryan Deedy. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)