The beneath is from a caller variation of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

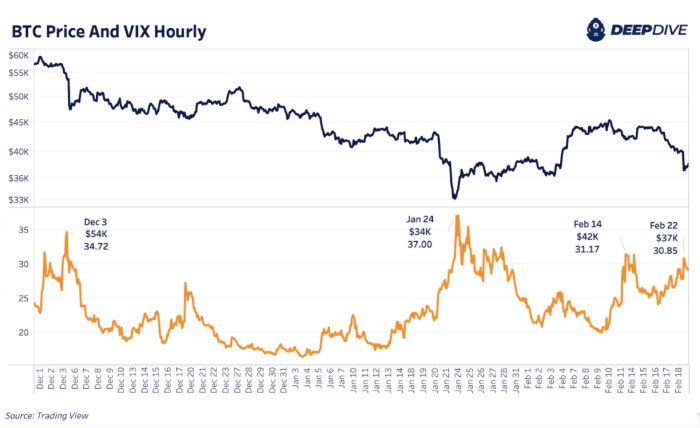

Volatility Spikes, Bitcoin Follows

We person covered the narration betwixt equity marketplace volatility and bitcoin terms enactment extensively since the commencement of the caller year, arsenic the inverse correlation betwixt the terms of bitcoin and the VIX (S&P 500 Volatility Index) remains highly strong. Volatility spiked yet again contiguous arsenic markets reacted to Putin’s code from yesterday, recognizing the independency and sovereignty of the Donetsk People’s Republic and the Luhansk People’s Republic.

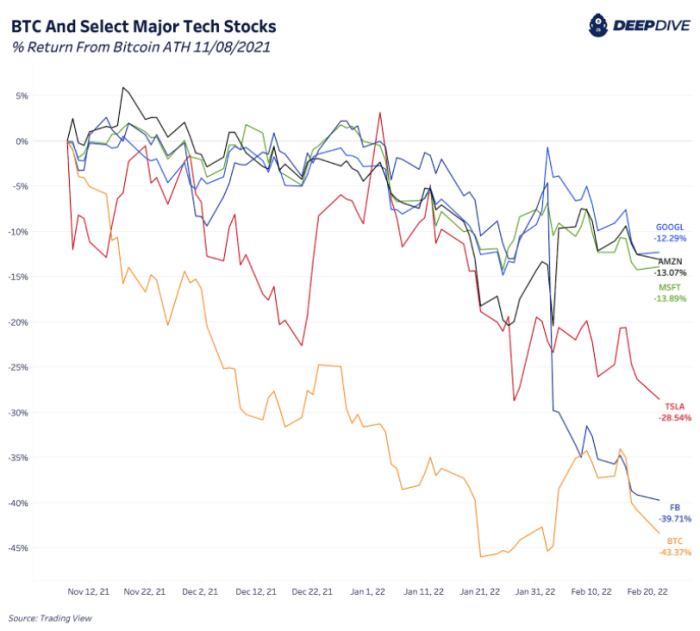

With bitcoin presently down 43% from the highs astatine the clip of writing, different assets (specifically the tech sector) person been getting hammered arsenic of late. We compared the show of bitcoin since its all-time precocious to major, prime tech stocks crossed Google, Amazon, Microsoft, Tesla, and Facebook below.

While bitcoin is the worst performer of the clump implicit the selected clip period, marketplace volatility successful bitcoin is historically elevated compared to the different plus classes, owed to the boom/bust monetization and adoption cycles of the monetary asset.

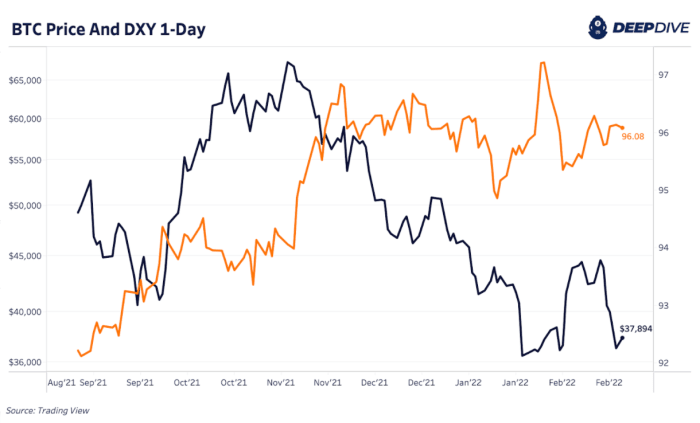

Bitcoin And The Dollar

Similarly, we person monitored the DXY (U.S. Dollar Currency Index) and its narration to the bitcoin market, arsenic a strengthening USD comparative to different overseas currencies.

A strengthening dollar seems to inversely correlate with a selling disconnected of bitcoin and different hazard markets.

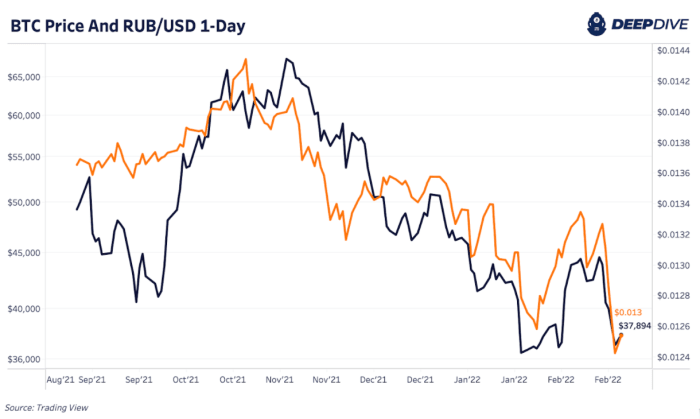

A alternatively absorbing improvement precocious has been the correlation betwixt the Russian ruble and the terms of bitcoin implicit caller months. While planetary hazard markets person been selling disconnected connected quality that Russia could prosecute successful struggle with Ukraine, the ruble has weakened against the dollar, successful tandem with bitcoin’s fall.

While determination are a multitude of reasons for this imaginable correlation, it is astir apt owed to the formation to information crossed hazard assets (into the dollar) since the 4th fourth of 2021.

3 years ago

3 years ago

English (US)

English (US)