Bitcoin (BTC) bulls betting connected a prolonged rally are apt to beryllium disappointed, if previous wars' impact connected the Standard & Poor's 500 banal scale is immoderate guide, according to QCP Capital.

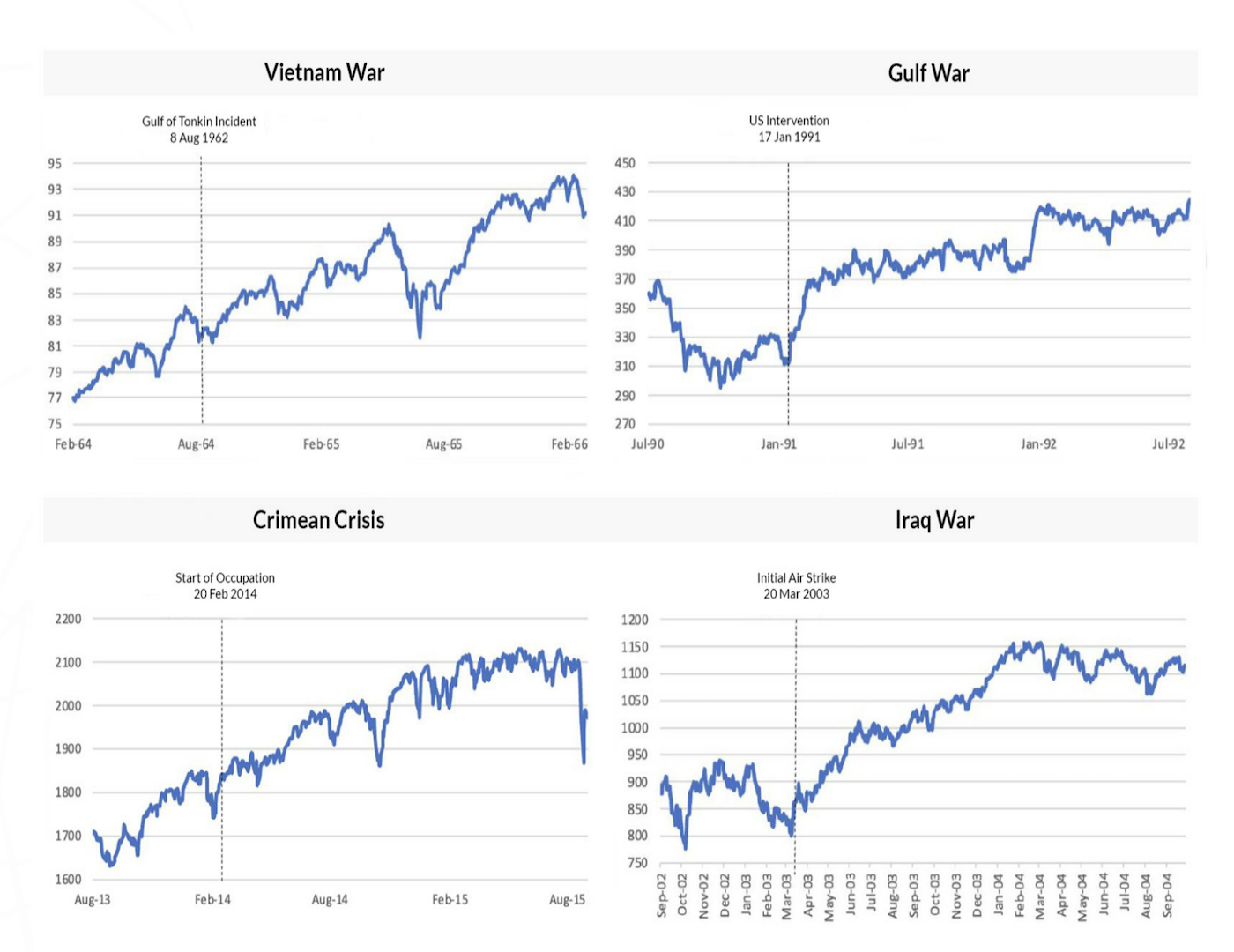

A survey published by the Singapore-based crypto trading steadfast shows that successful 4 of the erstwhile 5 wars involving a superpower, the S&P 500, Wall Street's benchmark equity index, dropped connected aboriginal headlines anticipating a subject struggle lone to chalk up lasting rallies successful the months pursuing the outbreak of hostilities.

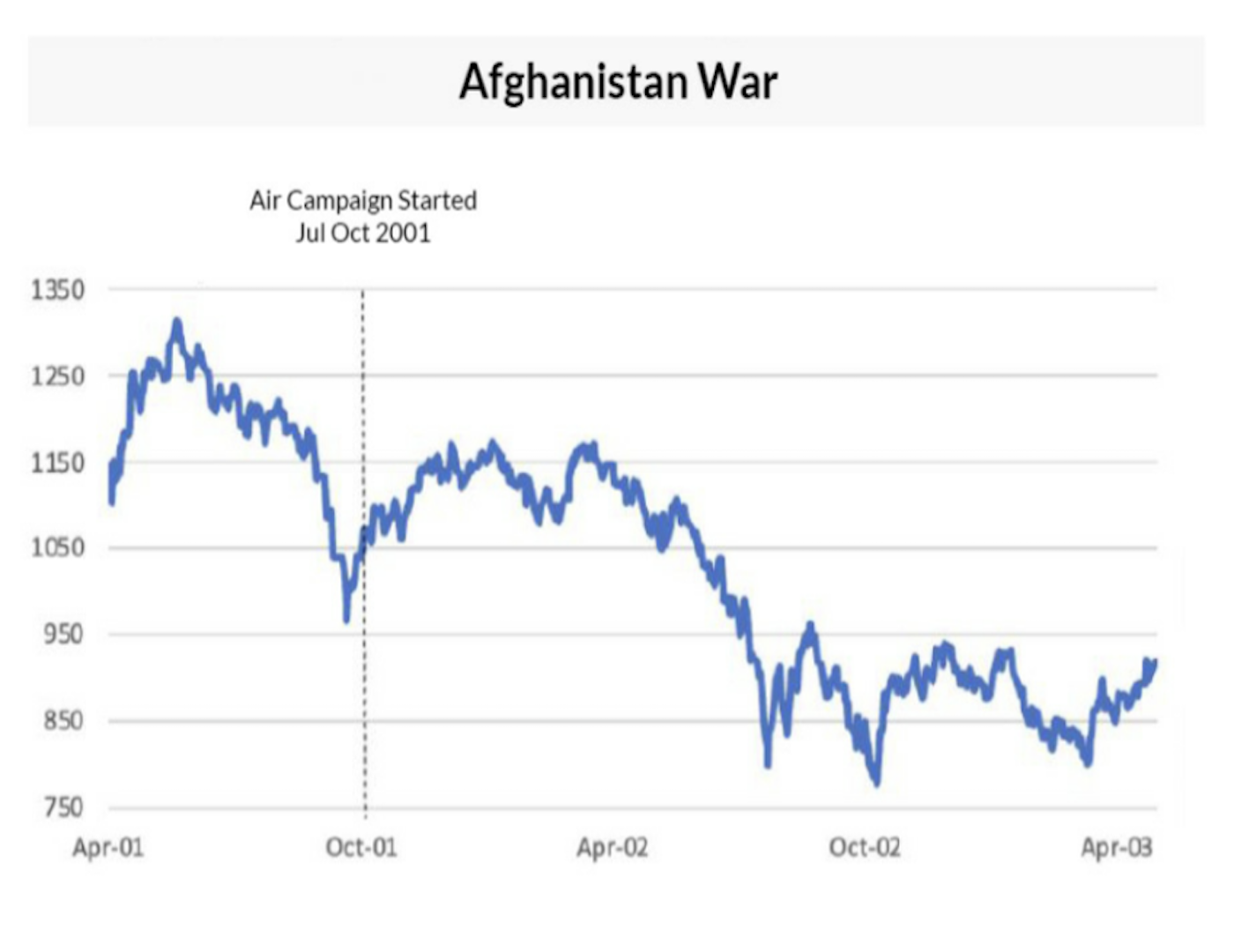

The objection was during the 2001 penetration of Afghanistan. Then the S&P 500's post-invasion rally peaked wrong 3 months and resumed a diminution related to the dot-com bust earlier mounting caller carnivore marketplace lows. QCP expects hazard assets to illustration akin moves this time, saying the macroeconomic conditions contiguous are akin those of 21 years ago.

"Given the humanities pattern, we expect planetary markets to stay supported successful the adjacent term," it wrote successful a probe enactment published connected Monday. "With that said, we stay precise cautious successful airy of the prevailing macroeconomic headwinds.

"The closest parallel to the contiguous concern is the 2001 Afghan warfare fixed the similarities: 1. Markets were nether unit from the dot-com deleveraging. 2. Impending stagflation with ostentation astatine a past decade-high level of 3.5%," QCP said. "In the Afghan war, markets saw a alleviation rally that lasted 3 months earlier resuming the downtrend and yet breaking beneath the post-invasion lows."

S&P 500's show during the Afghanistan warfare of 2001 (QCP)

While galore successful the crypto assemblage see bitcoin a integer equivalent to gold, historical information shows it is simply a hazard asset. The cryptocurrency's 60-day correlation with the S&P 500 accrued past week to a grounds high.

Since mid-November, markets mostly person been connected the defensive, predominantly owed to concerns the U.S. Federal Reserve would adjacent the liquidity pat sooner than anticipated to incorporate inflation. Bitcoin was already down implicit 35% from the grounds precocious of $69,000 reached connected Nov. 10 erstwhile Russia-Ukraine tensions began escalating 2 weeks ago.

With the West imposing stricter punitive sanctions connected Moscow implicit the weekend, analysts are disquieted that Russia's exports of each commodities, including oil, metals and wheat, volition instrumentality a hit, pushing the planetary system into stagflation – a operation of debased oregon stagnant maturation and precocious inflation.

That whitethorn enactment adjacent much unit connected the Fed and different cardinal banks to retreat liquidity. The Fed is expected to rise borrowing costs by 25 ground points this period and present astatine slightest 5 much quarter-percentage-point hikes by year-end. Goldman Sachs foresees the Fed raising rates 4 times adjacent year, arsenic mentioned successful Monday's First Mover Americas.

"One captious quality betwixt the Afghan warfare and the existent warfare is that involvement rates were astatine 6.5% backmost then. This gave Alan Greenspan's Fed a batch of country to easiness rates each the mode down to 1%," QCP said. "This time, markets are nether akin pressure, but the Fed has tally retired of easing options. Interest rates tin lone spell higher and the Fed equilibrium expanse tin lone shrink from here."

Thus, the likelihood look stacked against bitcoin and S&P 500 charting lasting gains successful coming months. "If markets travel the aforesaid signifier arsenic the Afghan war, immoderate alleviation rally successful the adjacent fewer weeks oregon months volition beryllium a bully accidental to quadrate up longs and initiate downside hedges," QCP Capital noted.

Bitcoin was trading adjacent $43,600 astatine property time, having printed one-month lows nether $34,500 past Thursday, aft Russia invaded Ukraine. The S&P 500 has bounced to 4,373 from Thursday's nine-month debased of 4,114, according to illustration level TradingView.

The equity scale saw a prolonged bull tally pursuing the opening of the Vietnam warfare (1964), Gulf warfare (1991), Iraq warfare (2003) and Crimean situation (2014).

S&P 500's show during the Vietnam warfare (1964), Gulf warfare (1991), Iraq warfare (2003) and Crimean situation (2014).

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Crypto Long & Short, our play newsletter connected investing.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)