Amid the latest bankruptcy lawsuit filed by FTX Trading Ltd., U.S. regulators privation to ace down connected crypto exchanges, and a people enactment suit has been issued against erstwhile FTX CEO Sam Bankman-Fried (SBF) and 12 celebrities. However, this is not FTX’s and Alameda Research’s archetypal rodeo with the U.S. tribunal strategy and fiscal investigations. After FTX launched successful 2019 and pursuing the merchandise of the speech token FTT, FTX and Alameda faced a suit filed connected November 2, 2019, that accused the companies and executives of engaging successful racketeering practices and crypto marketplace manipulation.

2019 Lawsuit Accused FTX and Alameda Execs of Breaking Racketeering Laws and ‘Aiding and Abetting Price Manipulation’

FTX, Alameda Research, Sam Bankman-Fried (SBF), and the firm’s associated executives person been successful the spotlight for 2 weeks aft Alameda Research’s equilibrium expanse was leaked and Binance’s CEO Changpeng Zhao (CZ) mentioned Binance was dumping each of its FTT tokens. Now FTX Trading Ltd. and much than 130 associated companies person filed for Chapter 11 bankruptcy protection and the firms are presently being investigated by authorities from assorted jurisdictions.

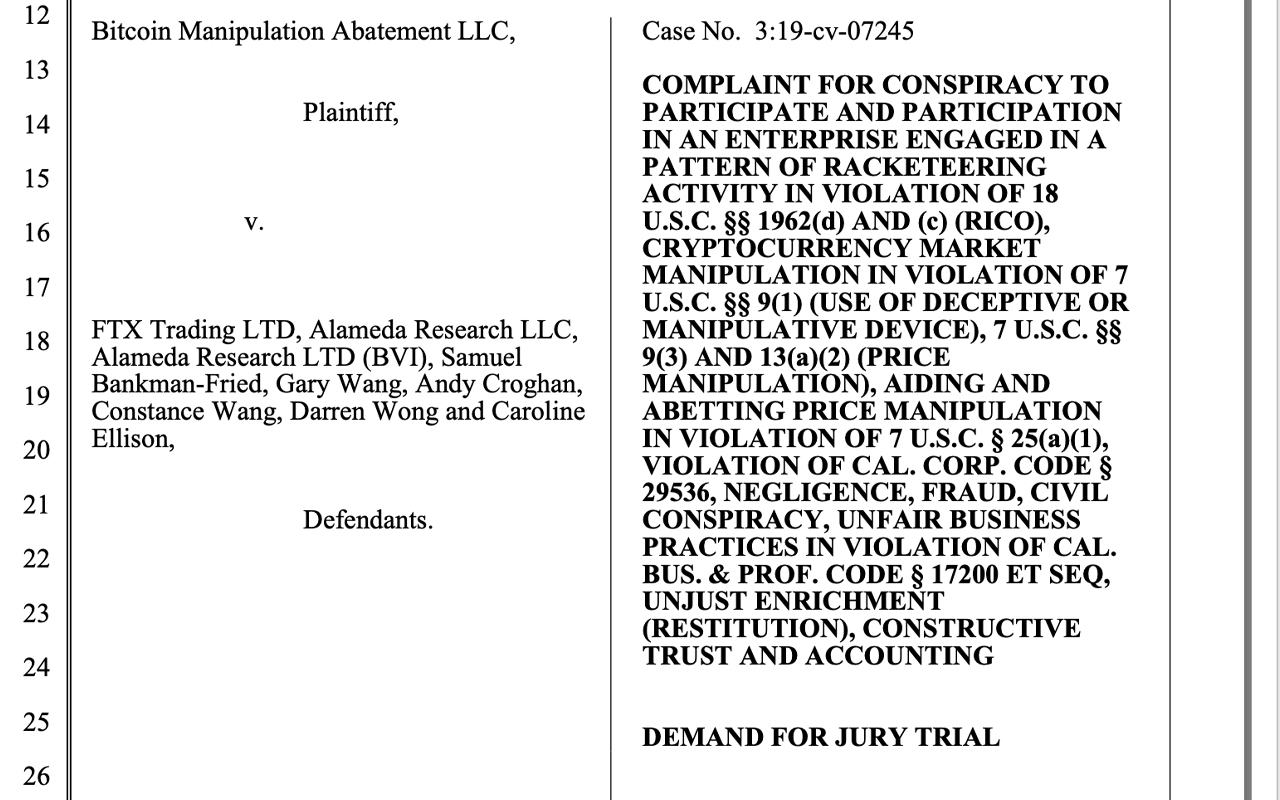

While investigators polish disconnected their magnifying glasses and lawyers prep their written defenses, a batch of radical are unaware that FTX was accused of racketeering, selling unregistered securities, and crypto marketplace manipulation 3 years ago. The lawsuit filed connected Nov. 2, 2019, was registered by attorneys for Bitcoin Manipulation Abatement LLC (BMA).

The suit accused FTX, Alameda Research, SBF, Gary Wang, Andy Croghan, Constance Wang, Darren Wong, and Caroline Ellison of engaging successful breaking racketeering laws and “aiding and abetting terms manipulation.” Interestingly, the suit says that FTX was allowed to thrive acknowledgment to “Alameda’s unlicensed over-the-counter (OTC) wealth transmitting business.”

The suit alleged that the “racketeering enactment exceeded $150,000,000, which were misappropriated from galore cryptocurrency traders.” The grounds BMA highlights successful the suit is an alleged effort by Alameda to manipulate the bitcoin futures market, and much specifically the Binance SAFU futures market.

According to BMA, connected Sept. 15, 2019, 255 bitcoins were dumped connected the BTC futures marketplace successful a “two-minute clip interval.” BMA further claims that SBF changed his residence determination connected online profiles from Berkeley California to Hong Kong aft the Sept. 15, 2019 incidental occurred. The suit besides accuses FTX and Alameda Research of being a singular entity, alternatively than 2 abstracted companies.

“As was admitted by suspect Bankman-Fried, suspect Alameda was kept concealed by [the] defendants, and each of them, starting from its conception connected November 20, 2017, and until 2018, aft the defendants, and each of them, made a concern determination to grow and [the] concern determination to grow and heighten their automated OTC concern for bitcoin and different cryptocurrencies,” the suit filing detailed.

Court Filing Says Binance CEO CZ Was Aware of the September 2019 Incident

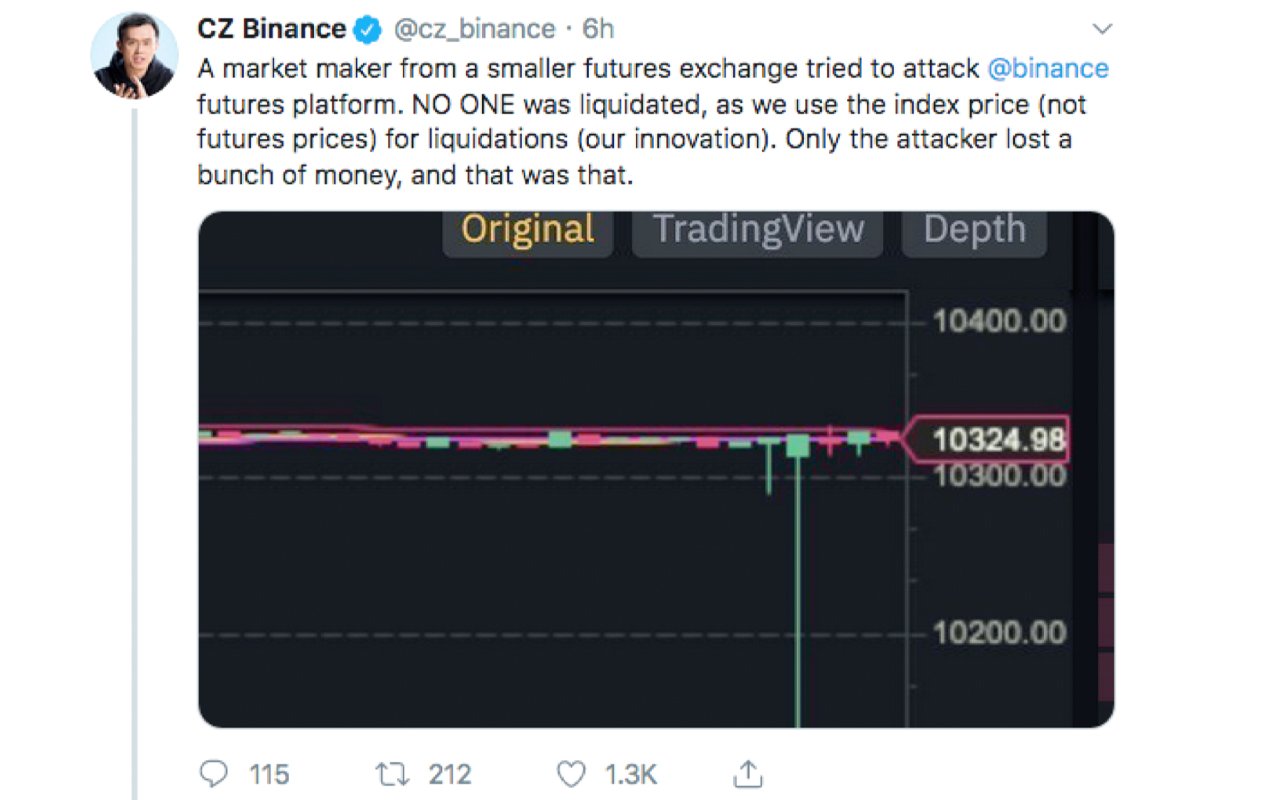

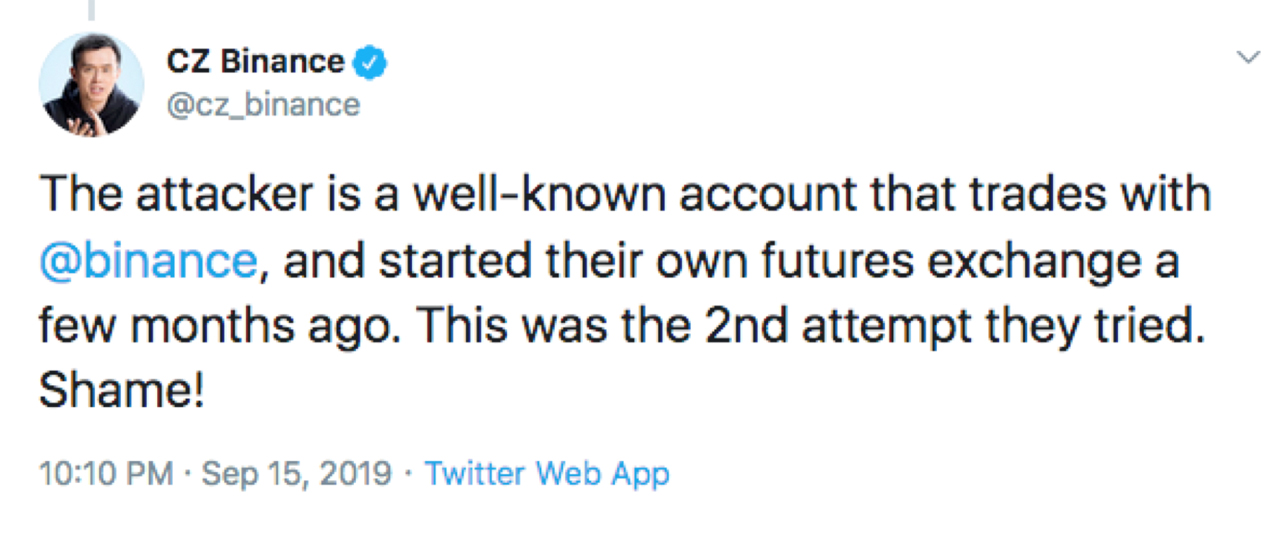

The tribunal filing besides suggests that the CEO of Binance, Changpeng Zhao (CZ), was alert of the Sept. 15, 2019 futures commercialized that BMA dubbed arsenic “illicit terms manipulation.” The filing shares a fig of tweets that CZ made erstwhile the incidental happened successful September 2019, and a fig of crypto supporters judge that was the lawsuit that created the archetypal atrocious humor betwixt FTX and Binance executives.

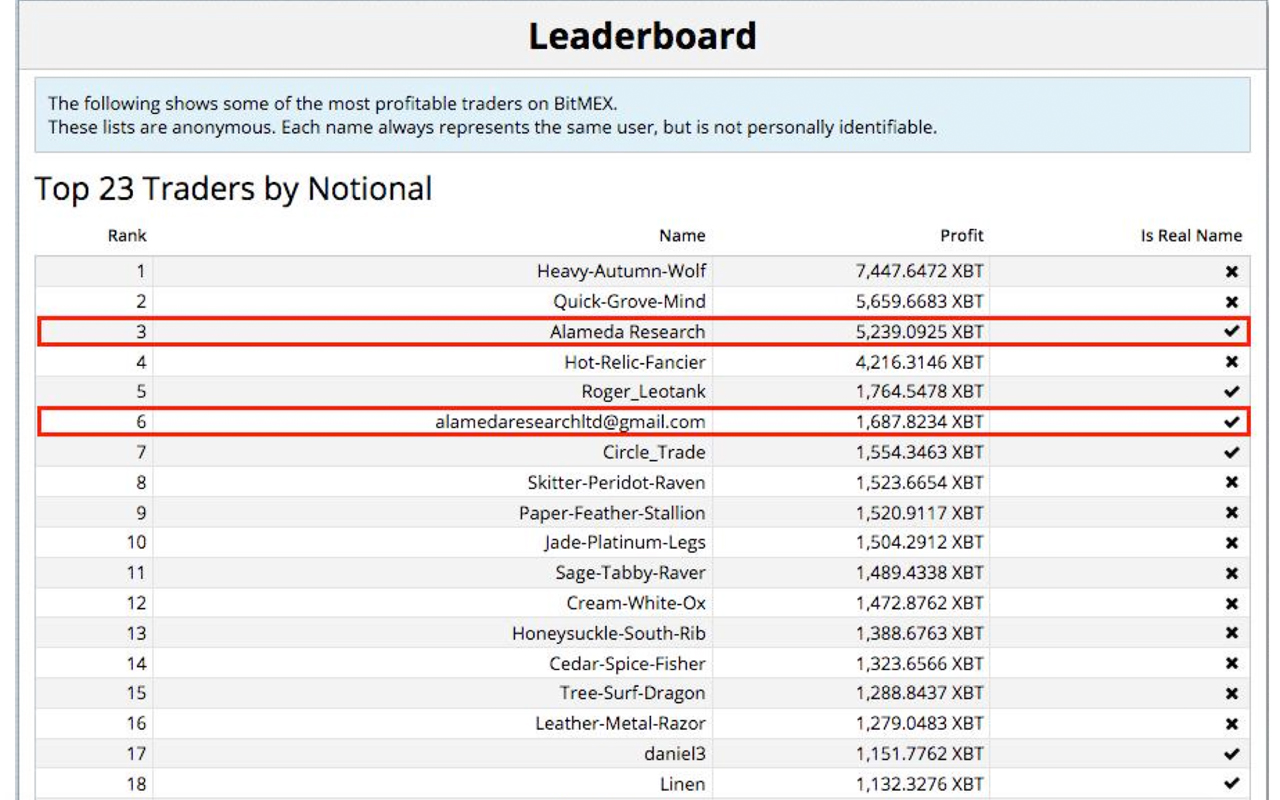

However, connected Sept. 15, 2019, CZ tweeted that helium chatted with “the client,” and helium said it was an mishap owed to a atrocious parameter connected their side. The Binance enforcement mentioned it was “not intentional” and it was “all bully now.” The suit besides shows that Alameda Research was featured connected the apical traders database connected the crypto derivatives speech Bitmex.

Moreover, BMA’s suit accused Alameda of regularly utilizing and switching aggregate trading accounts. In 2019, Bitmex’s trader leaderboard indicated that Alameda’s BTC trades equated to $154 million, and it was the third-best trader by notional measurement connected the leaderboard.

The suit accused SBF, FTX, Alameda, and associated executives of unlicensed wealth transmission, racketeering, selling unregistered securities, ligament fraud, terms manipulation, and “at slightest 2 acts of interstate proscription of stolen property.” BMA’s lawyers said that each 1 of the defendants were “liable, jointly and severally” and successful the “amount of triple of BMA’s losses, which is $41,189,266.80.”

The filing concludes that BMA “is entitled to punitive damages successful the sum of $150,000,000.” After the filing was registered connected Nov. 2, 2019, a summons was reportedly issued to FTX, Andy Croghan, Caroline Ellison, Constance Wang, Gary Wang, Darren Wong, Alameda Research, and SBF connected Nov. 5. At the time, FTX execs denied a summons occurred. Despite each the allegations against FTX, Alameda, and its associated executives the lawsuit did not past precise long.

Case Against FTX and Alameda Execs Closes Quickly With Prejudice and by Voluntary Dismissal

By Dec. 16, 2019, a announcement of voluntary dismissal was submitted to the court, and the lawsuit was closed with prejudice. SBF had tweeted astir the lawsuit being dismissed connected societal media, and the erstwhile FTX CEO’s tweet led to a blog post titled the “nuisance suit” astir the suit dismissal. The blog station claims executives were not served and a “complaint written by a lawyer against Alameda has been circulating connected the Internet.”

The blog station contended astatine the clip that the “nuisance suit” was a gag created by a “troll,” and that the suit provided zero grounds to bolster the case. “The nuisance suit is riddled with laughable inaccuracies, including mistaking the full concern exemplary of Alameda,” the blog post’s writer insists. The blog post’s writer further adds:

The troll has nary grounds of immoderate wrongdoing, and volition not further observe immoderate — due to the fact that determination was nary wrongdoing to observe grounds of. Instead helium attempts to mention the investigation of sh**posted conspiracy theories connected Twitter retired of a hopeless effort to construe immoderate benignant of suit.

FTX was overmuch smaller erstwhile the suit was filed and did not go the $32 billion-dollar behemoth until 2 years later. The BMA suit got precise small media attraction compared to what FTX and its related companies are seeing today. The blog station shared by SBF connected Nov. 3, 2019, concludes by insisting that “Alameda nor immoderate of the different named defendants person ever manipulated the marketplace for bitcoin oregon different cryptocurrencies.”

Much similar a myriad of theories reported connected implicit the past fewer years, the BMA suit was shrugged disconnected arsenic a “conspiracy theory,” and SBF became 1 of crypto’s apical influencers and was compared to fiscal moguls similar J.P. Morgan a fewer weeks earlier his speech collapsed.

Tags successful this story

2019, 2019 Lawsuit, alameda, Alameda Research, Andy Croghan, Binance CEO, Bitcoin Manipulation Abatement, BitMex, BMA, Caroline Ellison, Case Dismissed, Changpeng Zhao, Charges, Constance Wang, Cryptocurrencies, CZ, Darren Wong, Dismissed, Dismissed Case, Fraud, ftx, FTX Bankruptcy, FTX collapse, ftx lawsuit, FTX Sam Bankman-Fried, Gary Wang, Hong Kong, price manipulation, racketeering, Sam Bankman-Fried, sbf, Trades

What bash you deliberation astir the suit filed against FTX, Alameda, and SBF backmost successful November 2019? Let america cognize your thoughts astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)