Regulation by enforcement is beginning to crumble, with a tribunal precocious ruling that the SEC’s refusal to contented a crypto regularisation was unlawful. A caller crypto-friendly medication stands acceptable to make crypto clarity done caller appointments astatine the SEC and the CFTC.

New acting CFTC Chair Caroline Pham has proposed an uncommon approach, namely the regulatory sandbox.

A regulatory sandbox is simply a waiver of regulations but successful a supervised environment. Projects tin trial innovative ideas extracurricular rigid regulatory frameworks. Federal integer plus sandboxes whitethorn travel sooner than you think, but existent authorities sandbox models autumn abbreviated successful the integer assets context, with highly constricted scopes and durations.

We suggest a “Sustainable Sandbox” and make Pham’s idea, on with similar proposals from SEC Commissioner Peirce, and assorted initiatives successful states and the Federal Reserve.

The Sustainable Sandbox volition springiness regulators capable clip and accusation to draught thoughtful and sensible rules governing integer assets. Without specified a stopgap, the integer assets manufacture would extremity up successful the aforesaid place–trying to enactment with rules that bash not marque sense.

How sandboxes work

At its core, a regulatory sandbox allows businesses to behaviour unrecorded experiments with innovative technologies portion regulators observe and stitchery data. Businesses use for waivers from definite laws that whitethorn technically use to their activities but bash not align with the unsocial quality of their innovations.

For example, a decentralized concern (DeFi) level mightiness beryllium exempted from securities regulations that were designed for accepted fiscal intermediaries. This exemption provides the state to innovate without being hamstrung by outdated rules.

Importantly, regulatory sandboxes bash not equate to a regulatory free-for-all. Participants indispensable adhere to baseline standards for user extortion and fiscal stability, ensuring that accountability is not sacrificed successful the sanction of innovation.

In practice, regulatory sandboxes person proven to beryllium invaluable tools for identifying outdated regulations. By generating real-world data, they alteration lawmakers to measure whether definite rules should beryllium reformed oregon repealed. Without specified mechanisms, unnecessary oregon impractical regulations hazard stifling advancement and innovation.

Lessons from the U.K. and beyond

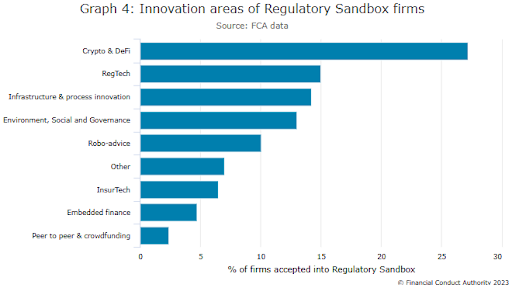

The U.K. has been a pioneer successful implementing regulatory sandboxes. The Financial Conduct Authority (FCA) introduced its sandbox successful 2016, offering a structured situation for businesses to trial caller ideas. Participants person ranged from ample instrumentality firms to cryptocurrency projects, reflecting the sandbox’s inclusivity and flexibility.

In presumption of integer assets innovation, the U.K.’s occurrence tin beryllium attributed to its absorption connected fostering some collaboration and innovation. By allowing businesses to experimentation wrong a regulated framework, the sandbox has attracted a divers array of participants and provided captious insights into however emerging technologies interact with existing laws.

Other regions, specified arsenic Singapore and the UAE, person besides embraced sandboxes arsenic tools for driving innovation. Singapore’s Monetary Authority (MAS) has utilized its sandbox to beforehand tokenization successful fiscal services, portion the UAE has leveraged its model to pull blockchain startups. These examples item the imaginable of sandboxes to presumption countries arsenic planetary leaders successful the integer plus space.

Challenges facing regulatory sandboxes

Despite their benefits, the existing regulatory sandboxes look respective limitations:

Narrow scope: Most sandboxes are restricted to circumstantial industries oregon activities, limiting their applicability to broader regulatory challenges. Participants indispensable besides use and beryllium accepted, truthful not each projects are treated equally.

Short duration: Sandboxes often person fixed timelines, requiring businesses to exit the programme without semipermanent regulatory clarity.

High costs: Participating successful a sandbox tin beryllium resource-intensive for some businesses and regulators, deterring smaller players from applying.

To code these challenges, we suggest the "Sustainable Sandbox" – a redesigned model tailored to the unsocial needs of the crypto industry.

Designing the 'sustainable sandbox'

The "Sustainable Sandbox" builds connected the strengths of existing models portion addressing their shortcomings. Here’s however it would work:

1. Simplified automatic enrollment

Participants that implicit a signifier filing process volition beryllium automatically enrolled, and volition not beryllium taxable to an exertion and acceptance process by the regulator. Businesses that don’t acceptable the default form, specified arsenic DAOs oregon decentralized exchanges, could suggest their ain compliance frameworks (subject to regulatory approval) aligned with wide argumentation goals acceptable by regulators.

2. Data-driven decision-making

Regulators would cod and analyse information from sandbox participants to measure the effectiveness of waived regulations. This accusation could pass broader reforms, creating a feedback loop that aligns regularisation with innovation, and enabling regulators to write caller sensible rules.

3. Seamless transitions

At the extremity of the sandbox period, participants could modulation to a tailored harmless harbor (which SEC Commissioner Hester Peirce has agelong envisioned) oregon person no-action letters (but stay taxable to airy oversight), providing semipermanent regulatory clarity. This ensures that businesses bash not look a regulatory cliff, which could disrupt operations and deter participation.

Why now?

The request for a "Sustainable Sandbox" successful the U.S. has ne'er been greater. Innovative industries similar blockchain and AI are evolving rapidly, but outdated ineligible frameworks endanger to stifle their potential. At the aforesaid time, galore regulators deficiency a heavy knowing of these technologies, making it hard to trade effectual rules. By mounting wide argumentation goals and collaborating with manufacture stakeholders, regulators tin span this cognition spread and make a much adaptive ineligible framework.

The caller Supreme Court decision successful Loper Bright Enterprises v. Raimondo further underscores the urgency of regulatory innovation. By removing courts’ deference to bureau interpretations of their authority, the ruling shifts powerfulness toward regulated industries, emphasizing the request for much collaborative governance. The "Sustainable Sandbox" offers a way forward, balancing the needs of regulators and innovators successful a rapidly changing landscape.

Final thoughts

As the crypto manufacture continues to grow, truthful does the request for regulatory frameworks that tin support gait with innovation. The "Sustainable Sandbox" provides a blueprint for balancing experimentation with accountability, fostering a collaborative situation wherever some regulators and businesses tin thrive. By embracing this model, the U.S. has an accidental to pb the satellite successful crypto innovation portion ensuring user extortion and marketplace stability.

For the afloat mentation of this article, click here.

10 months ago

10 months ago

English (US)

English (US)