Bitcoin moved higher connected renewed buying from ample holders portion smaller wallets were seen booking gains, a signifier that on-chain watchers presumption arsenic supportive for further upside.

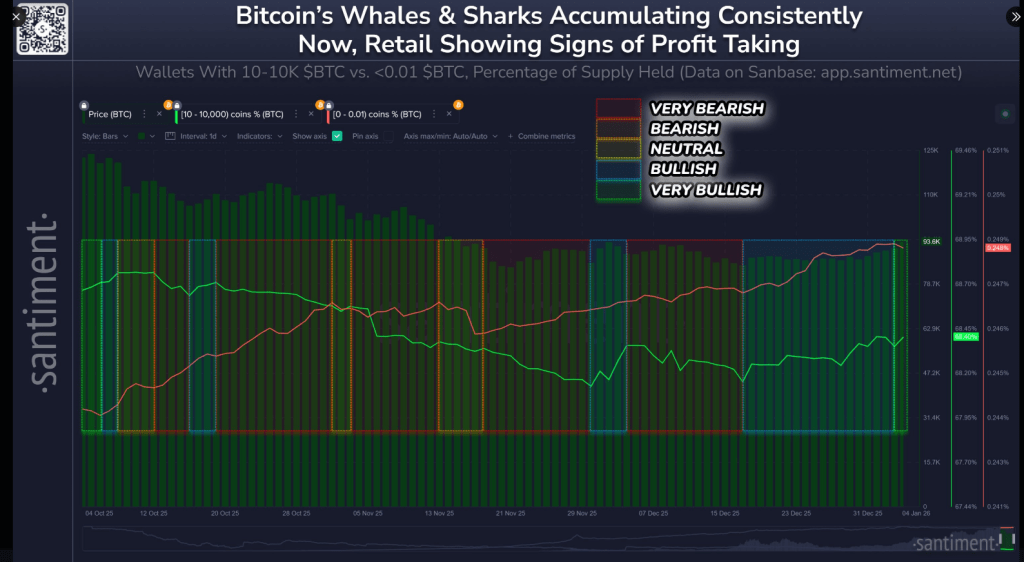

Whale Accumulation And Retail Profit-Taking

According to Santiment, wallets holding betwixt 10 and 10,000 BTC — described arsenic whales and sharks — person added 56,227 BTC since mid-December. At the aforesaid time, wallets with little than 0.01 BTC person been taking profits, suggesting immoderate retail traders expect a bull trap oregon a fool’s rally.

This divided — dense accumulation by ample holders portion tiny accounts merchantability — raises the likelihood of marketplace headdress maturation crossed crypto.

Supply Redistribution And Market Structure

Market observers accidental proviso is shifting successful a mode that helps terms action. Analyst James Check pointed retired that the top-heavy proviso stock has fallen from 67% to 47%, a ample determination successful a abbreviated span.

📊 Crypto markets typically travel the way of cardinal whale & shark stakeholders, and determination the other absorption of tiny retail wallets. In our illustration below:

🟥 Whales dumping, Retail accumulating (VERY BEARISH)

🟧 Whales dumping, Retail unpredictable (BEARISH)

🟨 Whales & Retail… pic.twitter.com/yoC0H1keBT

— Santiment (@santimentfeed) January 5, 2026

That shift, paired with a driblet successful profit-taking and signs of a short-squeeze successful futures, has supported higher prices adjacent arsenic wide leverage stayed low.

Bitcoin has been mostly rangebound betwixt astir $87,000 and $94,000 for astir six weeks, but it concisely reached a seven-week precocious of $94,800 connected Coinbase during precocious trading connected Monday.

Options And Key Levels

Traders watching enactment involvement spot dense telephone enactment astir the $100,000 onslaught for January expiry. Data shows Bitcoin arsenic being successful a bullish consolidation phase, with contiguous absorption seen astatine $95,000 to $100,000 and enactment placed adjacent $88,000 to $90,000.

A cleanable interruption supra the precocious portion could propulsion prices higher, portion a breach beneath the little portion mightiness invitation deeper selling pressure.

Geopolitical Shock And Trading Volume

Following the capture of Venezuelan President Nicolás Maduro by US forces, Bitcoin moved to multi-week highs and traded supra cardinal levels adjacent $93,000 connected Monday, based connected reports.

Analysts tied the determination partially to geopolitical uncertainty pushing immoderate investors toward alternate assets. Speculation astir Venezuela’s alleged ample BTC holdings — reportedly hundreds of thousands of coins — besides added to marketplace chatter and commercialized activity.

Overall, the lawsuit coincided with higher volatility and volume, reflecting wide marketplace reactions to planetary hostility alternatively than serving arsenic a nonstop operator of Bitcoin’s cardinal value.

What This Means For Traders

The existent premix of big-wallet buying and retail profit-taking gives the marketplace a tilted bias. If accumulation by whales continues, the accidental of an upward breakout rises. Yet the retail sell-off warns that short-term reversals stay possible.

The $95,000 to $100,000 scope appears to beryllium a cardinal country for a imaginable breakout, portion enactment astir $88,000 to $90,000 could power sentiment if prices autumn beneath it.

Reports and on-chain information suggest momentum leans toward further gains, though the marketplace whitethorn stay volatile arsenic traders respond to some method levels and geopolitical developments.

Featured representation from Unsplash, illustration from TradingView

1 month ago

1 month ago

English (US)

English (US)