A abbreviated look astatine the mathematics down loans mightiness amusement the payment of loans versus the classical dollar-cost mean strategy.

This is an sentiment editorial by Mickey Koss, a West Point postgraduate with a grade successful economics. He spent 4 years successful the Infantry earlier transitioning to the Finance Corps.

This nonfiction is not fiscal proposal — conscionable a financially illiterate psychopath doing immoderate math.

As bitcoin’s terms crashes, I recovered myself reasoning astir Michael Saylor and his strategical usage of indebtedness to outstack fundamentally everyone other successful the world. It got maine thinking, possibly I could bash thing similar. A beauteous modular dollar-cost averaging (DCA) is simply a regular bargain to the tune of $20–$25 a time for a pleb connected a budget.

The question I had is what it would look similar if I were to person a $20 regular DCA into a indebtedness outgo and bring those aboriginal sats into the present.

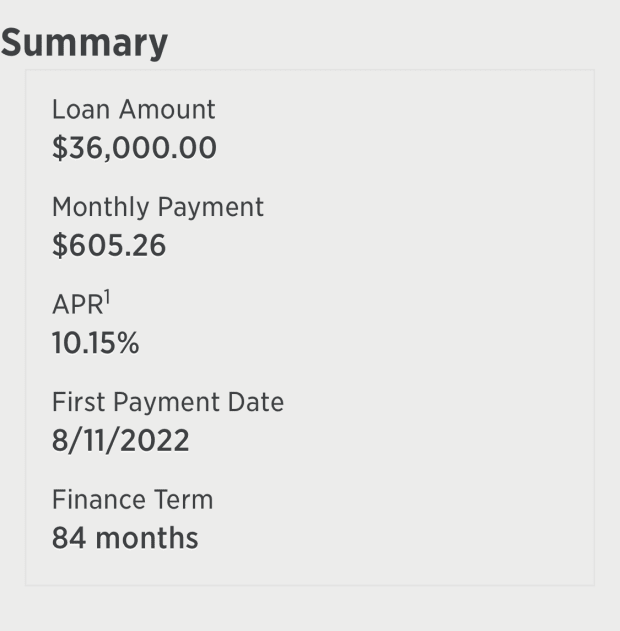

To comparison the two, I got a punctuation for a idiosyncratic loan, getting arsenic adjacent to the $20 a time DCA outgo arsenic possible. The existent punctuation is below.

The terms astatine the clip of this penning is $22,180. Let's presume a $25,000 bitcoin price, conscionable to adhd a small conservatism into the calculation.

At $25,000, a $36,000 indebtedness volition assistance you 1.44 bitcoin. If you multiply the $605.26 monthly payments by the 84-month indebtedness term, you tin spot that the indebtedness volition outgo you $50,841.84.

If we disagreement $50,841.84 by 1.44, we get a bitcoin terms of $35,306.83 for you to interruption adjacent erstwhile compared to the outgo of the loan. If you deliberation bitcoin volition beryllium supra $35,000 successful 7 years, this seems similar a beauteous bully woody to me.

But what astir the DCA?

A $20 acquisition astatine $25,000 bitcoin is 80,000 sats. If we instrumentality the 1.44 BTC above, oregon 144,000,000 sats, and disagreement it by the 80,000 sat DCA, you get 1,800. This means that astatine a changeless terms of $25,000, it would instrumentality you 1,800 days to DCA into 1.44 BTC astatine $20 a day, oregon 4.9 years.

So, essentially, if bitcoin was to enactment astatine $25,000 oregon beneath for the adjacent 5 years, the $20 a time DCA strategy is mathematically better. But if you deliberation that BTC volition mostly support rising implicit time, it whitethorn beryllium beneficial to person your DCA into a loan. Even with that 10% involvement rate, bitcoin would lone request to transcend $35,000 astatine the extremity of the seven-year word for you to travel retired connected top. Honestly, it seems benignant of blimpish to me.

Michael Saylor’s strategy is starting to look beauteous appealing astatine these terms levels. While I can’t, successful bully conscience, urge this to anybody, I thought it was an absorbing micro illustration which sheds a small airy connected wherever Saylor’s caput mightiness be.

Happy stacking. I ever emotion these occurrence sales.

Just to reiterate 1 past time: Definitely bash not bash this. This is not fiscal advice.

This is simply a impermanent station by Mickey Koss. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)