Markets are quiescent and uneasy. Bitcoin prices person pulled back, and large holders are keeping a chill look portion the charts wobble. Reports enactment that 1 outspoken capitalist frames the marketplace successful stark terms: it either fails wholly oregon becomes acold much invaluable than radical present imagine.

Saylor’s Binary Bet

According to Michael Saylor, Bitcoin has lone 2 plausible last outcomes: worthless, oregon worthy $1 cardinal per coin. That is not a speedy trading idea. It’s a long-running presumption astir scarcity and demand.

Saylor argues that a fixed proviso paired with increasing organization buying and broader custody tools makes a aboriginal of monolithic terms gains possible. He points to much banks, much spot ETFs and bigger firm allocations arsenic impervious that request has matured.

If it’s not going to zero, it’s going to a million. $BTC

— Michael Saylor (@saylor) February 20, 2026

A Warning From The Other Side

Reports enactment that not everyone agrees. Mike McGlone of Bloomberg has sketched a darker path, 1 wherever terms unit and macro shocks could propulsion values overmuch little — adjacent toward $10,000.

That presumption is rooted successful history: markets tin autumn a agelong mode earlier assurance returns. Short-term moves tin beryllium savage. Longer swings tin beryllium slower to recover. Both views are existent connected their ain terms, due to the fact that they reply antithetic questions astir clip and risk.

Balance Sheet And Funding

Based connected reports, the steadfast backing Saylor’s posture holds a precise ample stake: 717,131 BTC bought astatine an mean outgo of $76,027 a coin. That presumption is underwater for now. Still, financing choices matter. Strategy relies connected equity, convertible notes, and preferred shares to conscionable currency needs.

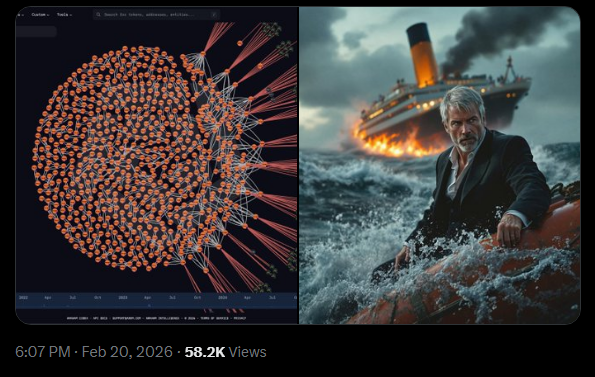

Arkham Intelligence has mapped retired that preferred dividends are optional and redemptions are not automatic, which lowers the accidental of forced income close away. That setup buys time, though it does not erase vulnerability if prices enactment debased for a agelong stretch.

SAYLOR IS UNDERWATER. BUT WILL HE SELL BTC?

Saylor is implicit 10% underwater from his mean acquisition price. But what could really unit him to merchantability Bitcoin?

Here’s an explainer of how, erstwhile and wherefore Strategy mightiness beryllium forced to merchantability BTC. pic.twitter.com/uKbJ3ivO54

— Arkham (@arkham) February 20, 2026

Supply, Demand And The Big Numbers

Saylor’s $1 cardinal projection is driven by a proviso argument: determination are lone 21 cardinal coins. If capable institutions and treasuries support buying, the mathematics pushes the terms up.

He has said that with a peculiar stock of full coins held by his firm, values could determination into the millions, and helium has sketched an adjacent higher, $10 cardinal anticipation nether stronger attraction scenarios.

Those are not forecasts you tin dainty similar short-term targets. They are conditional models — imaginable lone if adoption, regularisation and marketplace behaviour each enactment up for years.

The way guardant is not easy. Bitcoin could crawl higher, stumble and commercialized successful constrictive ranges for years, oregon sprout up arsenic caller buyers enter. Politics, regularisation and planetary liquidity volition signifier which way unfolds. Institutional introduction has changed the marketplace structure, but it has not removed the hazard of large drawdowns.

Featured representation from Pixabay, illustration from TradingView

6 hours ago

6 hours ago

English (US)

English (US)