Michael Saylor’s steadfast Strategy continues to marque Bitcoin headlines with its tremendous purchases, making it 1 of the largest holders successful the world.

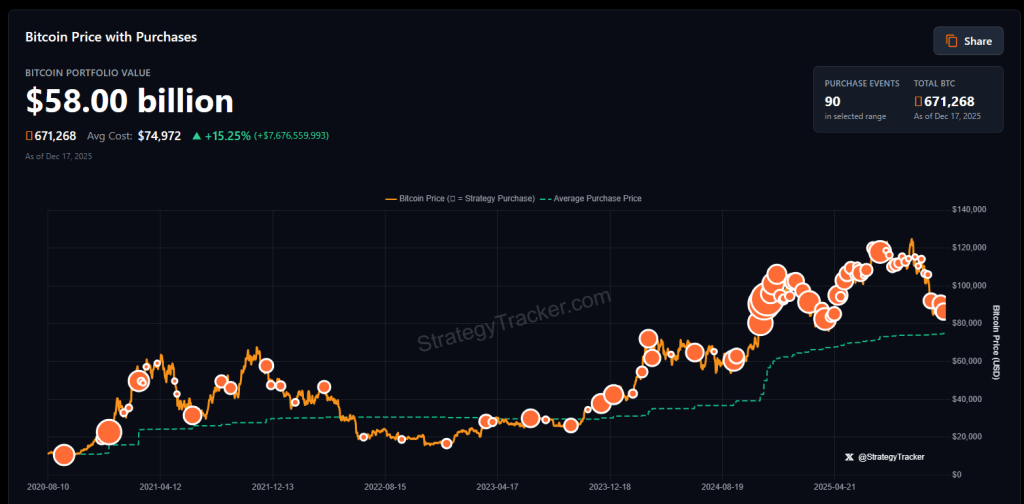

Reports amusement the institution owns 671,268 Bitcoin, astir 3.2% of the full supply, valued astatine astir $58.61 cardinal astatine the clip of publication, according to Saylor Tracker.

Bitcoin entrepreneur Anthony Pompliano said connected his podcast that it would beryllium highly hard for immoderate different nationalist institution to lucifer Strategy’s buying pace.

Massive Holdings And Recent Purchase

Strategy announced a caller bargain of 10,645 Bitcoin for $980.3 million, paying an mean of $92,098 per coin. That determination pushed its full hoard to astir 3.2% of each Bitcoin successful existence. Those are ample figures. They besides amusement wherefore rivals would request immense sums to adjacent the gap.

Pompliano On The Scale Needed To Compete

According to comments made connected The Pomp Podcast, Pompliano said that a institution trying to lucifer Strategy would person to “raise hundreds of billions of dollars.” He said it would beryllium “very hard to spot that happening.”

He pointed to Strategy’s aboriginal introduction successful 2020, erstwhile Saylor’s archetypal acquisition was astir $500 cardinal portion Bitcoin traded betwixt $9,000 and $10,000.

That archetypal stake, based connected existent prices cited successful reports, is present worthy much than $4.8 cardinal with Bitcoin trading astir $86,950.

Strategy’s Bitcoin stash is valued astatine $58.16 cardinal astatine the clip of reporting, according to Saylor Tracker.

Strategy’s Bitcoin stash is valued astatine $58.16 cardinal astatine the clip of reporting, according to Saylor Tracker.Market Impact And Buying Method

Market watchers person flagged Strategy’s increasing stock arsenic thing to watch. Some interest a azygous ample holder could power terms moves. Others enactment the steadfast does astir of its buying done over-the-counter desks.

OTC trades are utilized to grip large orders without sending shockwaves done speech bid books. Many investors spot the regular, ample purchases arsenic a affirmative motion for Bitcoin demand.

Holding Strategy And Influence Concerns

Pompliano described 3.2% arsenic “a large number, but it’s besides a tiny number.” He added, “It’s not similar they ain 10%.” That presumption captures a split: the holding is ample capable to substance for proviso dynamics and marketplace psychology, but not truthful ample that it gives implicit control. Still, the operation of size and repeated buys draws attraction from traders and regulators alike.

Outlook And Long Term Plans

Reports punctuation Strategy’s CEO Phong Lee arsenic saying the institution astir apt won’t merchantability immoderate Bitcoin until astatine slightest 2065. Saylor has besides posted that helium plans connected “buying the apical forever.” Those statements reenforce a semipermanent stance alternatively than short-term trading. The marketplace tends to dainty specified commitments arsenic bullish, and galore participants set expectations for aboriginal request accordingly.

A Dominant Buyer

With 671,268 Bitcoin connected the books and a dependable programme of purchases, Strategy remains a ascendant nationalist buyer.

Based connected existent numbers and nationalist comments, it volition beryllium hard for different listed institution to lucifer that level of accumulation without precise ample superior raises oregon a melodramatic alteration successful firm behavior.

The gait acceptable by Strategy is apt to support drafting attraction from investors watching proviso and request for Bitcoin.

Featured representation from Pexels, illustration from TradingView

1 month ago

1 month ago

English (US)

English (US)