Former FTX CEO Sam Bankman-Fried (SBF) launched a Substack study successful which helium elaborate his mentation of accounts of what happened astatine FTX.

SBF claimed that “no funds were stolen” and attributed the illness to Alameda’s inability to hedge against a marketplace clang adequately.

SBF betterment program for FTX

SBF took to Twitter earlier connected Jan. 12 to reason that FTX could inactive recover — SBF’s Substack report supports these claims.

The erstwhile CEO — who is presently confined to his parent’s location according to the terms of his bail — aligned the nonaccomplishment of FTX to “somewhere betwixt that of Voyager and Celsius.”

He gave 3 reasons for the “implosion,” stating Alameda had $100 cardinal successful assets, which we subjected to some a marketplace clang and “an extreme, quick, targeted clang precipitated by the CEO of Binance.”

“a) Over the people of 2021, Alameda’s equilibrium expanse grew to astir $100b of Net Asset Value, $8b of nett borrowing (leverage), and $7b of liquidity connected hand.

b) Alameda failed to sufficiently hedge its marketplace exposure. Over the people of 2022, a bid of ample wide marketplace crashes came–in stocks and successful crypto–leading to a ~80% alteration successful the marketplace worth of its assets.

c) In November 2022, an extreme, quick, targeted clang precipitated by the CEO of Binance made Alameda insolvent.”

Similarities to the interaction of the Three Arrows Capital (3AC) illness connected exchanges specified arsenic Celsius and Voyager were made to Alameda’s relation successful the downfall of FTX.

However, SBF did not straight code the statement that Alameda should ne'er person had entree to lawsuit funds successful the archetypal spot erstwhile making the comparison.

FTX.US solvency

SBF made a beardown connection regarding the authorities of FTX.US, claiming that:

“It’s ridiculous that FTX US users haven’t been made full and gotten their funds backmost yet.”

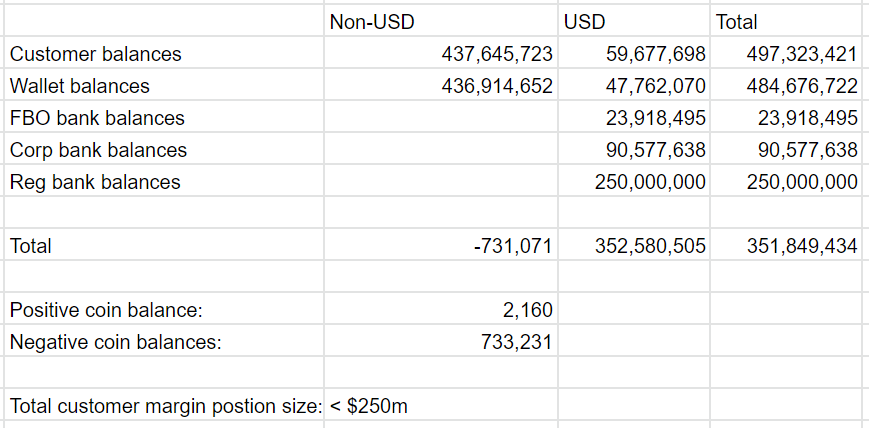

FTX.US allegedly had implicit $350 cardinal currency “beyond lawsuit balances,” according to SBF.

Below is simply a transcript of the spreadsheet shared by the erstwhile CEO successful the report. The figures correspond the company’s authorities astatine the clip of SBF’s removal.

Source: Sambf.Substack

Source: Sambf.SubstackThe imaginable for FTX.US customers to beryllium made full has been consistently backed by SBF, arsenic helium claimed the U.S. limb of the institution has ne'er been insolvent.

Legal conspiracy

SBF continued his communicative that the ineligible firms progressive successful the insolvency person conspired to unit done bankruptcy proceedings to garner ineligible fees.

“[Sullivan & Crowell] and the [General Council] were the superior parties strong-arming and threatening maine into naming the campaigner they themselves chose arsenic CEO of FTX.”

While ineligible steadfast Sullivan & Crowell maintained that it “had a constricted and mostly transactional narration with FTX,” SBF revealed that helium was adjacent capable to the steadfast to enactment retired of its offices erstwhile helium was successful New York.

U.S. Senators — including Sen. Elizabeth Warren — person publicized their concerns implicit Sullivan & Crowell’s engagement successful the lawsuit going forward.

A missive published by a radical of Senators stated determination were “concerns astir the impartiality” of the firm.

“Put bluntly, the steadfast is simply not successful a presumption to uncover the accusation needed to guarantee assurance successful immoderate probe oregon findings.”

SBF denies stealing from customers

In the report, SBF backed his ‘not guilty’ plea by publically stating that helium did not bargain idiosyncratic funds and is consenting to usage his Robinhood shares to marque customers whole.

“I didn’t bargain funds, and I surely didn’t stash billions away. Nearly each of my assets were and inactive are utilizable to backstop FTX customers.”

In contradiction to the claims that SBF appropriated idiosyncratic deposits to money risky bets by Alameda Research, the erstwhile CEO pointed to planetary marketplace conditions arsenic the basal origin of the collapse.

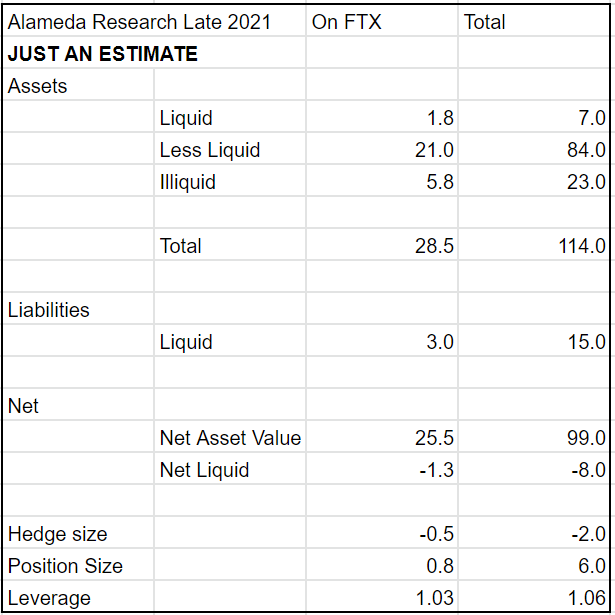

The array beneath showcases Alameda’s equilibrium expanse successful billions, according to SBF.

Source: Sambf.Substack

Source: Sambf.SubstackBased connected the information, SBF alleges that its holdings of “SOL unsocial was capable to screen the nett borrowing.”

SBF argued that Alameda’s “~$8b illiquid position… seemed tenable and not precise risky.” However, aft a 94% diminution successful nett plus worth during 2022, “the 100 cardinal of assets had lone a fewer cardinal dollars of hedges,” which was insufficient to enactment its needs.

Instead of taking immoderate existent ownership of the events, SBF recounted a database of macro factors that affected Alameda’s position, including taking a changeable astatine erstwhile Alameda co-CEO, Sam Trabucco.

“–BTC crashed 30%

–BTC crashed different 30%

–BTC crashed different 30%

–rising involvement rates curtailed planetary fiscal liquidity

–Luna went to $0

–3AC blew out

–Alameda’s co-CEO quit

–Voyager blew out

–BlockFi astir blew out

–Celsius blew out

–Genesis started shutting down

–Alameda’s borrow/lending liquidity went from ~$20b successful precocious 2021 to ~$2b by precocious 2022”

Alongside these events, SBF cited liquidity issues successful the crypto markets arsenic liable for Alameda’s troubles.

“Liquidity dried up–in borrow-lending markets, nationalist markets, credit, backstage equity, venture, and beauteous overmuch everything else. Nearly each liquidity root successful crypto–including astir each of the borrow-lending desks–blew retired implicit the people of the year.”

With the country acceptable to showcase Alameda’s beardown presumption of astir $10 cardinal successful nett plus worth successful October 2022 successful a turbulent carnivore market, SBF continued the nonfiction to spell connected the violative against Binance CEO CZ.

November 2022

SBF began a conception titled ‘The November Crash’ by singling retired C.Z.’s tweets and P.R. run against FTX.

“Then came CZ’s fateful tweet, pursuing an highly effectual months-long PR run against FTX–and the crash.”

Until November 2022, SBF claimed that Alameda’s hedges “to the grade they existed, had worked.” However, what happened adjacent was allegedly targeted straight astatine FTX and Alameda.

“The November clang was a targeted onslaught connected assets held by Alameda, not a wide marketplace move.”

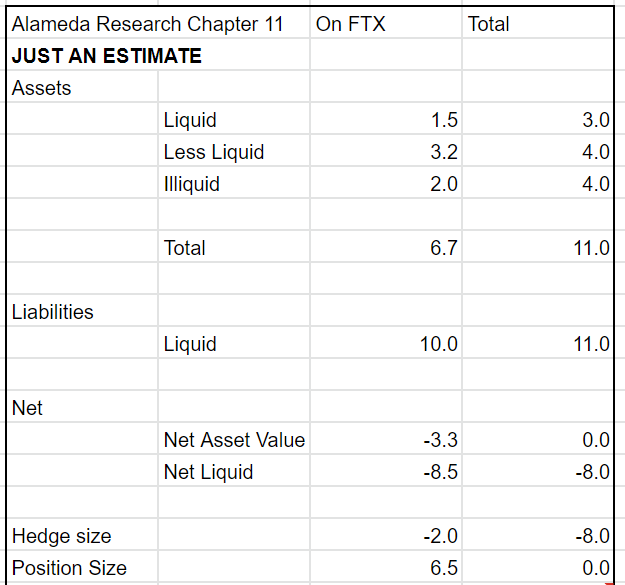

It was connected Nov. 7, 2022 and Nov. 8, 2022 that SBF believes that Alameda archetypal became “clearly insolvent.” The array beneath details Alameda’s equilibrium expanse astatine the clip of the Chapter 11 filing, according to SBF.

Source: Sambf.Substack

Source: Sambf.SubstackOnce Alameda became insolvent, SBF argued that the pursuing slope tally tipped the equilibrium causing the radical to collapse. At this constituent successful the report, SBF yet acknowledges the nonstop nexus betwixt Alameda and FTX arsenic helium confirmed that “Alameda had a borderline presumption unfastened connected FTX; and the tally connected the slope turned that illiquidity into insolvency.”

However, SBF failed to code whether the Alameda borderline presumption was related to lawsuit funds oregon FTX-owned assets. In fact, SBF appears to beryllium positioning the lawsuit to marque comparisons with 3AC, against which nary transgression charges person been filed. SBF is facing up to 100 years successful jailhouse for his engagement successful the collapse.

“No funds were stolen. Alameda mislaid wealth owed to a marketplace clang it was not adequately hedged for–as Three Arrows and others person this year. And FTX was impacted, arsenic Voyager and others were earlier.”

SBF ended the study by stating that helium had intended to item the report’s contented astatine the U.S. House Financial Services Committee connected Dec. 13, 2022, but was incapable owed to his arrest.

SBF has promised much accusation successful the future. In addition, updates volition apt beryllium made to the caller substack account, which tin beryllium recovered here.

The station SBF claims ‘no funds were stolen,’ blames CZ for illness successful elaborate study connected FTX collapse appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)