In opposition to Sam Bankman Fried’s caller claims that helium wasn’t alert of Alameda’s position, Forbes precocious released its connection with SBF erstwhile drafting their billionaires’ list, indicating that helium was good versed successful Alameda’s finances.

During his caller interview with the New York Times, the ex-CEO said Alameda made risky investments connected the FTX level due to the fact that it had excessively overmuch leverage and that helium did not recognize what the institution was doing.

“It’s not a institution I run. It’s not a institution I person tally for the past mates of years. And Alameda’s finances I was not profoundly alert of. I was lone surface-level alert of Alameda’s finances,” SBF stated during the interview.

Amid these developments, interestingly, a fewer billionaires came to Bankman-Fried’s defense.

Call maine crazy, but I deliberation @sbf is telling the truth.

— Bill Ackman (@BillAckman) November 30, 2022

Along with Bill Ackman, FTX capitalist O’Leary, besides a spokesperson for the exchange, expressed his enactment for Bankman-Fried.

I mislaid millions arsenic an capitalist successful @FTX and got sandblasted arsenic a paid spokesperson for the steadfast but aft listening to that interrogation I’m successful the @billAckman campy astir the kid! https://t.co/5lWzTT7JEv

— Kevin O'Leary aka Mr. Wonderful (@kevinolearytv) December 1, 2022

Forbes’ caller revelations astir SBF archer a antithetic story

Bankman-Fried sent Forbes documents showing his ownership stakes successful Alameda (90%) and FTX (about 50%) and screenshots of wallets holding cryptocurrencies successful January 2021.

SBF says helium was "not profoundly alert of" Alameda's finances

Forbes says helium sent them details of Alameda's holdings arsenic precocious arsenic Augusthttps://t.co/SVR3XJuvc5 pic.twitter.com/PHek7Tx7qv

— db (@tier10k) December 2, 2022

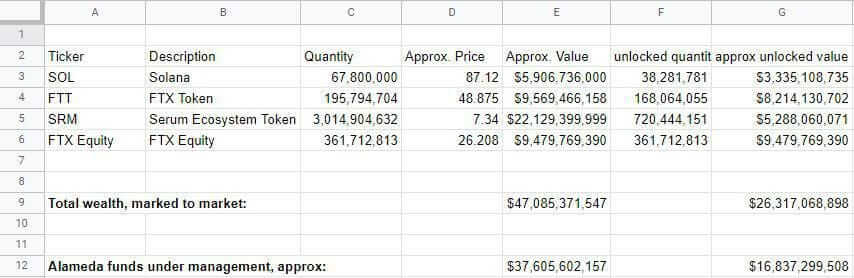

According to the revelations, helium sent a Google Sheet listing his assets, including FTX equity, 67.8 cardinal Solana tokens, 193.2 cardinal FTT tokens, and 3 cardinal Serum tokens.

Following that, Forbes besides caught periodic modifications to the Google expanse erstwhile calculating the yearly World’s Billionaires list.

As crypto prices rose, Alameda accrued its stock of FTT tokens to 195.8 million. As a result, the “Alameda funds nether management, approx.” enactment work $37,605,602,157.

“A abstracted column, listing lone tokens that were unlocked–meaning capable to beryllium transacted–pegs Alameda’s full funds astatine a much humble $14.7 billion. Updates similar this arrived periodically–practically whenever Forbes asked for them,” Forbes stated

The Google Sheet was past modified successful September 2021 to see an updated tab, “Alameda’s funds nether management,” which had grown to $37.6 billion, $16.8 billion, counting lone unlocked tokens.

It was successful March 2022 that Bankman-Fried updated the spreadsheet again with further details astir Alameda’s ownership share. FTT holdings were down to 176 cardinal tokens; Solana was down to 53 million.

SBF again guided Forbes done his nett worthy 2 months earlier FTX collapsed, providing a array of FTX and FTX U.S.’ largest shareholders. On a caller tab successful the spreadsheet, Alameda’s holdings were besides shown, with 53 million, 3 billion, and 176 cardinal shares of Solana, Serum, and FTT, respectively.

At the time, Bankman-Fried’s absorption stock of Alameda’s funds totaled $8.6 billion, oregon $6.4 billion, counting lone unlocked tokens.

Some Twitter users person taken shots astatine the erstwhile CEO of FTX pursuing the caller revelations:

Helping Forbes make representation of nett worthy is simply a immense reddish flag. Most billionaires privation to support their wealthiness arsenic stealthy arsenic possible.

— Ben Davenport (@bendavenport) December 2, 2022

Forbes stated.

“The level of item Bankman-Fried provided to Forbes implicit the years shows that helium had elaborate cognition of immoderate of Alameda’s holdings and astatine slightest immoderate cognition of the transactions it was making, particularly successful 2021, contempt stepping backmost from moving the hedge money aft cofounding FTX successful 2019.”

The station SBF had elaborate info connected Alameda’s finances arsenic precocious arsenic March, Forbes reveals appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)