Having an exclusive regulator oversee cryptocurrency developments successful the U.S. mightiness not beryllium the champion strategy, according to Securities and Exchange Commission (SEC) Commissioner Hester Peirce. She told CoinDesk TV in a Thursday interrogation that the SEC has adapted to caller technologies implicit the years, and it shouldn’t beryllium antithetic with crypto.

“I person a mates of problems with it,” Peirce said. “Typically successful Washington, erstwhile you physique different regulator, each you get is each the existing regulators positive one.”

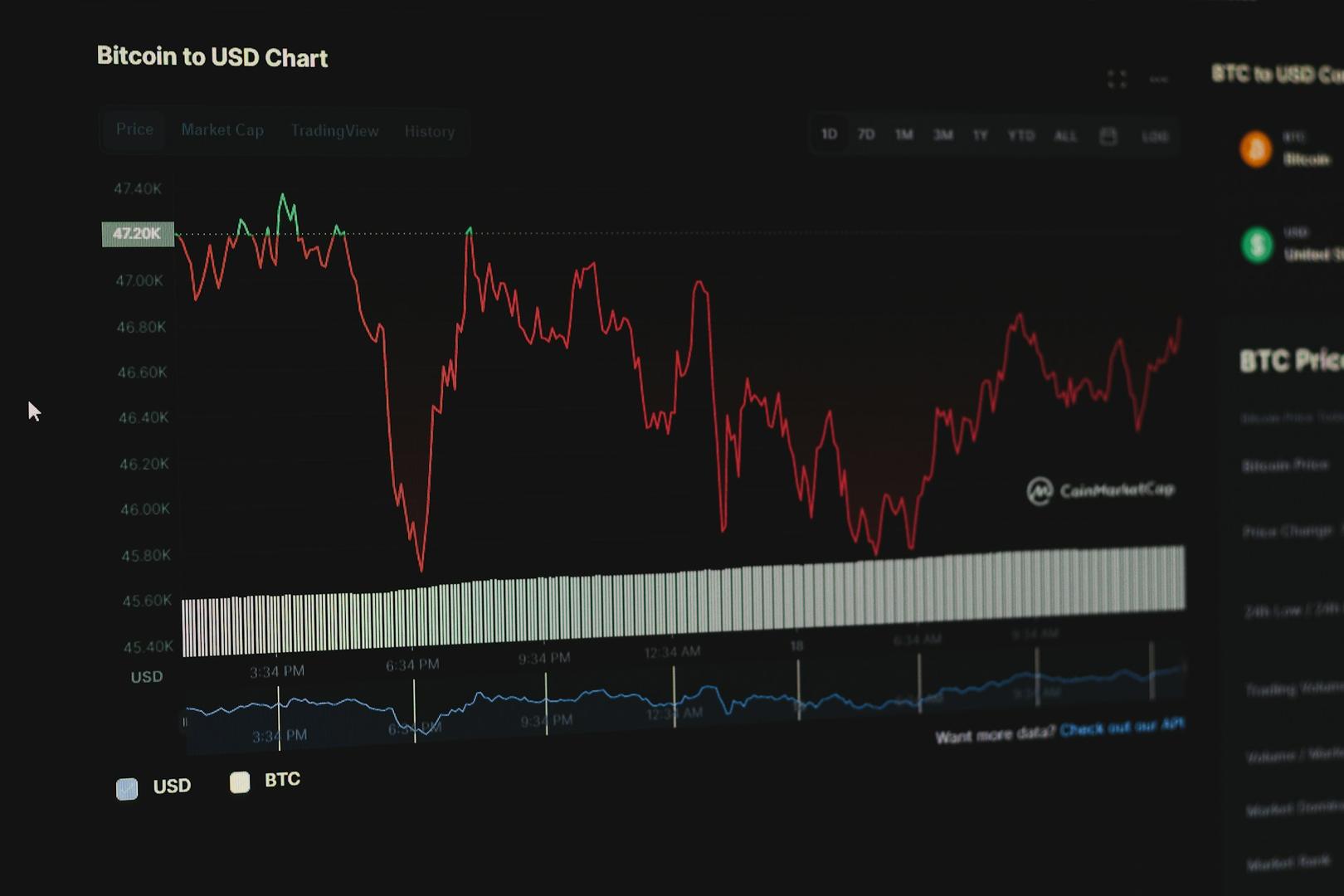

Regulation was astatine the forefront of Bitcoin and cryptocurrency discussions successful 2021 arsenic bigger players started jumping connected the Bitcoin bandwagon past year. Larger investors usually request a higher level of regulatory clarity arsenic sizable investments could mean sizable risks successful an uncertain environment.

Earlier this month, a cohort of main executives of salient cryptocurrency-related companies joined the U.S. House of Representatives to sermon however the caller exertion could autumn nether the existing regulatory model arsenic legislators tried to wrapper their minds astir caller concepts of the decentralized network. Many executives, including Coinbase Inc. CFO Alesia Haas, clamored for caller authorities to beryllium developed arsenic they argued existing laws couldn’t encompass the caller tech.

A mates of weeks aft the hearing, Senator Cynthia Lummis announced that she had started moving connected a draught measure connected the matter, seeking to encompass everything from categorization to taxation of cryptocurrencies. The measure would beryllium presented to her colleagues adjacent twelvemonth and see a connection to make a regulatory assemblage exclusively for Bitcoin and crypto.

A cardinal facet of Bitcoin regularisation this twelvemonth related to exchange-traded funds (ETFs). In October, the SEC approved the archetypal bitcoin-linked ETF successful the U.S., the derivatives-based ProShares Bitcoin Strategy ETF. Despite the archetypal excitement, which led the offering to go the fastest ever to scope $1 cardinal successful assets, accrued costs and progressive absorption issues drove investors distant from the conveyance arsenic the ProShares ETF invests successful futures contracts of bitcoin alternatively than successful the plus itself. The phenomena near galore asking for a spot offering to commercialized successful U.S. markets.

The archetypal filing with the SEC for a spot bitcoin ETF dates backmost to 2013 erstwhile the Winklevoss twins filed to connection an exchange-traded money successful the U.S. that would put successful bitcoin directly. The connection was denied by the commission, which followed suit successful galore akin filings implicit the years. Last week, the SEC denied 2 spot bitcoin ETF filings, from Valkyrie and Kryptoin, earlier the stipulated deadline.

“I’m conscionable hopeful that we acceptable our minds to enactment astatine gathering thing that makes consciousness successful presumption of regulatory clarity, alternatively of ever conscionable falling backmost connected enforcement,” said Peirce.

Despite SEC Chairman Gary Gensler having said aggregate times why specified proposals person been rejected, the existent reasons look opaque. The watchdog brag has called for Bitcoin firms and platforms to speech with the committee and “get registered,” arsenic concerns implicit its abilities to guarantee capitalist extortion and forestall fraud and manipulation person led the SEC to contradict each azygous connection that arrived connected its table to date. Peirce herself, an SEC insider, said she doesn’t recognize wherefore determination isn’t a spot bitcoin ETF trading successful the U.S. yet arsenic she argues the arguments being made to warrant the denials person been outdated for immoderate time.

“I can’t judge we’re inactive talking astir this arsenic if, you know, we’re waiting for 1 to happen,” Peirce said. “We’ve issued a bid of denials adjacent recently, and those proceed to usage reasoning that I deliberation was outdated astatine the time.”

Although small has been done to determination a spot bitcoin ETF connection guardant by the SEC, regularisation is trying to support up with Bitcoin present much than ever and 2022 could beryllium a twelvemonth that things commencement to alteration and specified an offering becomes disposable to U.S. investors. An support mightiness travel simply owed to crippled theory, arsenic the SEC’s scrutiny led banking elephantine Fidelity to launch its bitcoin money successful Canada aft frustrated attempts to bash it locally. Filers request to conscionable investors’ request for a convenient conveyance for direct, alternatively than indirect, vulnerability to the bitcoin terms and it volition beryllium up to the SEC to determine whether these products volition beryllium disposable successful America oregon elsewhere.

“Chair Gensler has said helium wants to spot platforms registering with us,” Peirce said. “So possibly that’s what it takes for a spot merchandise to get approved.”

Despite the U.S. thirst for a spot bitcoin ETF, the information is specified an offering isn’t strictly indispensable and should beryllium avoided by astir investors. Retail investors tin get amended vulnerability to the bitcoin terms by buying and custodying BTC themselves, a mode successful which they besides get to payment from the peer-to-peer network’s resistance to manipulation and censorship – thing they wouldn’t get from a bitcoin ETF. Institutional investors, connected the different hand, could leverage MicroStrategy’s playbook and get existent bitcoin without moving the market. For different cohorts which can’t bargain and clasp bitcoin themselves, It mightiness beryllium a substance of having their concern policies accommodate to Bitcoin alternatively than the innovative wealth crook to acceptable existing concern practices.

4 years ago

4 years ago

English (US)

English (US)