The full crypto marketplace headdress fell $53 cardinal arsenic quality of the U.S. Securities and Exchange Commission (SEC) filing against Binance came through.

On June 5, the SEC charged Binance, its CEO Changpeng Zhao, and related entities with 13 violations, including lavation trading, evasion of regulations, and offering unregistered securities.

Binance said it was disappointed with the ailment and had ever worked cooperatively with regulator’s inquiries. However, it disputed the enforcement enactment and intended to “vigorously” support the charges.

A cardinal constituent of Binance’s defence centers connected the SEC’s purported unwillingness to supply regulatory clarity. It further claimed that the institution was a unfortunate of the ongoing “regulatory tug-of-war,” successful which authorities agencies question to “claim jurisdictional crushed from different regulators.”

“Unfortunately, the SEC’s refusal to productively prosecute with america is conscionable different illustration of the Commission’s misguided and conscious refusal to supply much-needed clarity and guidance to the integer plus industry.“

Crypto markets crash

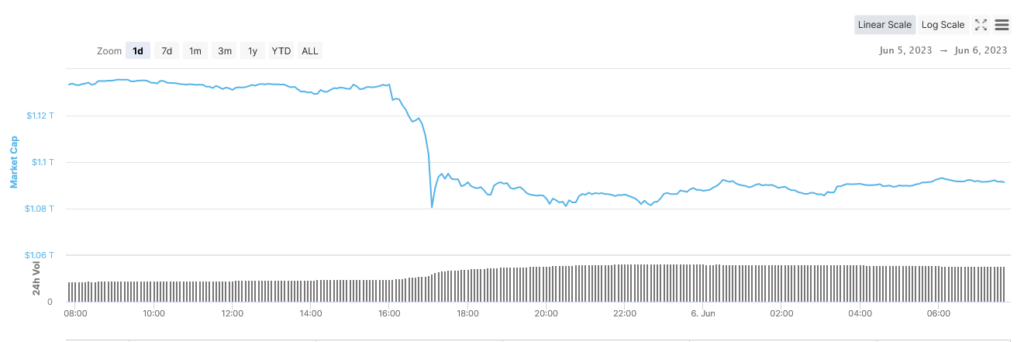

Markets tanked connected the quality of the SEC filing against Binance.

On June 5, astatine 16:00 BST, conscionable earlier the quality broke, the full crypto marketplace headdress was valued astatine $1.13 trillion. As connection spread, the ensuing dump bottomed astatine $1.08 trillion astir an hr aboriginal – equating to a $52.7 billion, oregon 4.7%, drawdown.

A bounce followed to apical retired astatine $1.1 trillion. The marketplace has since traded level arsenic participants see the gravity of the situation, peculiarly the allegations that several third-party tokens were named arsenic securities successful the SEC filing, including ADA, SOL, and MATIC.

Source: CoinMarketCap.com

Source: CoinMarketCap.comBiggest winners and losers

Of the apical 100, the biggest losers implicit the past 24 hours were Pepe, The Sandbox, and Sui, which mislaid 15.2%, 14.8%, and 12.7%, respectively. The Sandbox was named arsenic an unregistered information successful the SEC filing.

Kava was the lone apical 100 token (excluding stablecoins) to enactment greenish implicit the period, which grew 9.6%.

Market person Bitcoin suffered a peak-to-trough nonaccomplishment of 5% to find enactment astatine $25,400. It has since peaked astatine $25,890 but is shaping to retest $25,600 support.

The station SEC-induced panic saw $53 cardinal wiped from crypto market appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)