Participants successful liquid staking, including depositors and providers, bash not request to interest astir securities instrumentality disclosures, the U.S. Securities and Exchange Commission said successful a unit connection connected Tuesday.

The statement, published by the Division of Corporation Finance, is circumstantial to liquid staking, wherever participants deposit "covered crypto assets" into a third-party staking protocol provider, which successful crook provides receipt tokens to the depositors.

Liquid staking allows users to fastener up tokens successful proof-of-stake blockchains portion inactive maintaining entree to their funds done derivative tokens. These tokens tin past beryllium utilized for assorted DeFi activities. Currently, liquid staking crossed each blockchains has astir $67 cardinal successful total-value-locked (TVL), with $31.7 cardinal successful Lido, according to DefiLlama data.

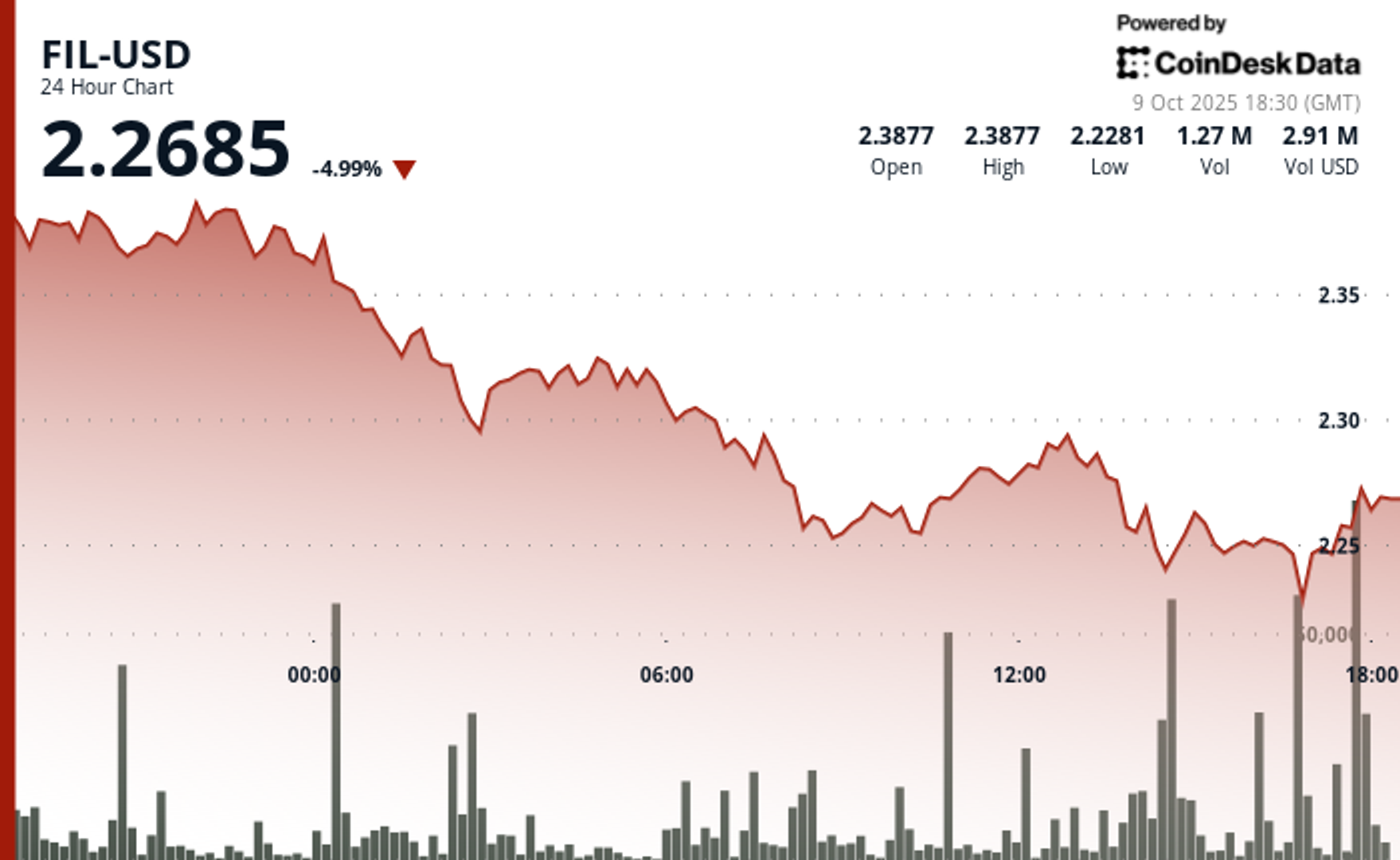

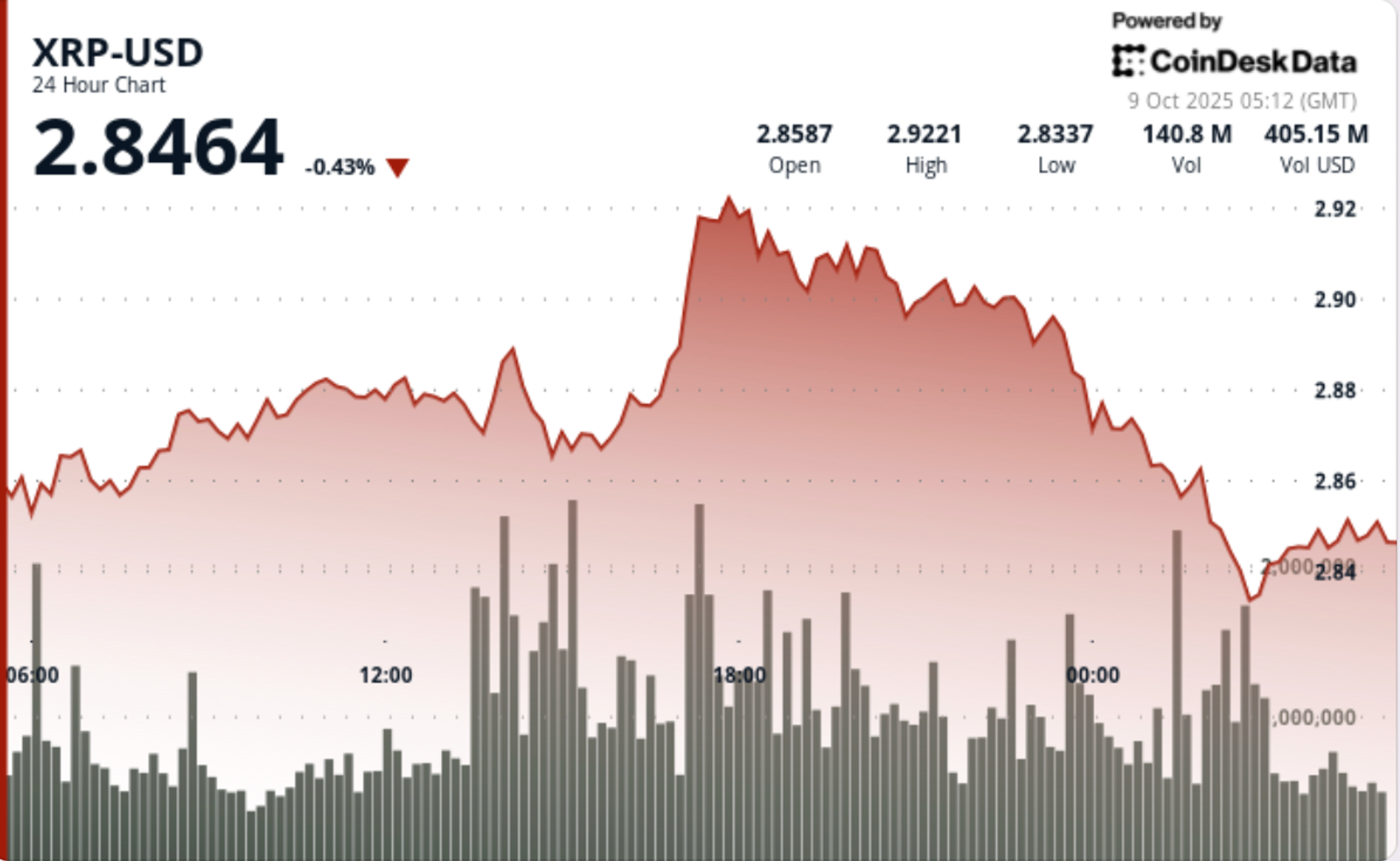

Tokens tied to a fig of liquid staking protocols, including Lido, Jito and Rocket Pool, went up marginally aft the SEC connection was published, but are inactive down connected the day's trading, CoinGecko showed.

To beryllium sure, the SEC had antecedently published different unit statement addressing different forms of staking. Similar to the erstwhile statement, Tuesday's enactment connected liquid staking is not the aforesaid arsenic binding guidance from the Commissioners oregon regulations that person gone done the SEC's ceremonial rulemaking process.

However, the caller connection does awesome however the bureau is reasoning astir the contented and suggests that immoderate crypto manufacture subordinate who follows the guidance volition not beryllium sued by the regulator.

Tuesday's connection is circumstantial to what liquid staking providers do, "including their roles successful transportation with the earning and organisation of rewards, slashing, and the minting, issuing and redeeming of Staking Receipt Tokens," arsenic good arsenic different ancillary services. The main caveat is that the deposited crypto assets cannot beryllium "part of oregon taxable to an concern contract."

"In a Liquid Staking arrangement, the Liquid Staking Provider (whether a Node Operator oregon not) does not supply entrepreneurial oregon managerial efforts to Depositors for whom it provides this service," the connection said.

"These arrangements are akin to those discussed successful the Protocol Staking Statement with respect to 'Custodial Arrangements.' The Liquid Staking Provider does not determine whether, when, oregon however overmuch of a Depositor’s Covered Crypto Assets to involvement and is simply acting arsenic an cause successful transportation with staking the Covered Crypto Assets connected behalf of the Depositor," the connection said.

Join the crypto argumentation speech Sept. 10 successful D.C. — Register present for CoinDesk: Policy & Regulation.

2 months ago

2 months ago

English (US)

English (US)