According to speech data, inflows to trading venues topped 9,000 Bitcoin connected Nov. 21 arsenic prices slid to $80,600 connected Coinbase — the weakest showing successful 7 months.

Reports amusement that astir 45% of those deposits came successful chunks of 100 BTC oregon more, and connected 1 time ample transfers reached 7,000 BTC.

The mean deposit size successful November roseate to 1.23 BTC, the largest monthly fig successful a year. Those numbers constituent to much than casual rebalancing; they constituent to coins being moved wherever they tin beryllium sold.

Binance Stablecoins Hit Record

According to marketplace coverage, Binance’s stablecoin holdings climbed to a grounds $51 billion. At the aforesaid time, BTC and Ether inflows to exchanges swelled to astir $40 cardinal this week, with Binance and Coinbase starring the move.

Traders often parkland funds successful dollar-pegged tokens erstwhile they privation to hold connected the sidelines. That build-up means currency is available, but it is sitting idle until sellers either measurement backmost oregon buyers crook up again.

Bitcoin speech inflows are rising arsenic the terms drops to ~87K, a seven-month low.

Large deposits (100+ BTC) present marque up 45% of each inflows, hitting 7K BTC connected Nov 21.

Large holders are progressively sending BTC to exchanges, reinforcing the existent downtrend. pic.twitter.com/UpN4rAL0FH

— CryptoQuant.com (@cryptoquant_com) November 26, 2025

Analysts Eye Further Pullback

Some marketplace watchers pass the caller betterment could beryllium lone a pause, flagging remaining borderline positions and suggested a trial of little levels.

They said a wick into the $70k–$80k portion would beryllium 1 mode to wide retired the past pockets of exposure.

10x Research enactment absorption levels astatine $92,000 and $101,000 arsenic the cardinal ranges to ticker during immoderate rebound.

For context, Bitcoin had clawed backmost supra $90,000 and was trading somewhat higher astatine the clip of reporting, but it remains down astir 28% from the all-time precocious northbound of $126,000 reached successful October.

Short-Term Bounce, Not A Full Recovery

Meanwhile, marketplace moves successful stocks and crypto person shown mixed signals. The S&P 500 and the Nasdaq were pushing gains arsenic investors stake connected a US Fed complaint cut, and that helped hazard assets.

Yet reports from strategists amusement the accustomed close link betwixt Bitcoin and the Nasdaq has weakened, with Bitcoin’s diminution steeper successful caller weeks.

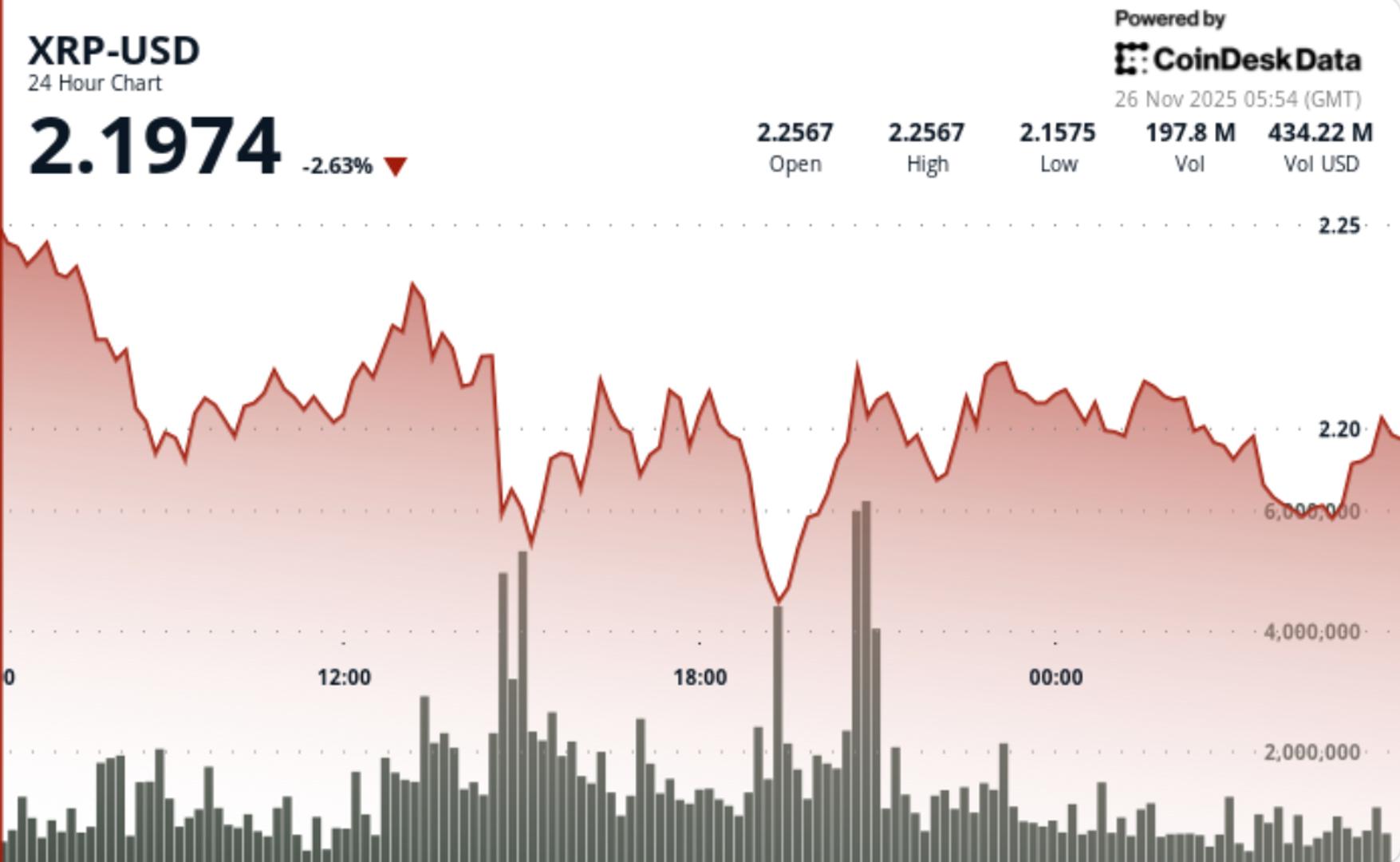

Ether and galore altcoins besides faced higher speech inflows, and respective tokens returned to bear-market lows arsenic selling unit widened.

What This Means Next

Liquidity is contiguous but it is parked successful stablecoins, and large holders are inactive moving assets toward exchanges. A meaningful rally volition apt request either dense buying request oregon a wide catalyst that draws those stablecoins backmost into hazard assets.

For now, the marketplace sits successful a waiting mode: a abbreviated rally could continue, but a deeper dip remains imaginable arsenic positions get cleared and sellers implicit their rotations.

Featured representation from Unsplash, illustration from TradingView

43 minutes ago

43 minutes ago

English (US)

English (US)