Serum, a decentralized speech protocol connected the Solana blockchain, saw its SRM tokens soar successful digital-asset markets Tuesday, arsenic cardinal backers of the task rallied astir an exigency fork successful effect to the caller hack of Sam Bankman-Fried’s ailing FTX exchange.

The assemblage forked the task – blockchain–speak for fundamentally copying the underlying bundle codification and starting afresh – aft warnings that information whitethorn person been compromised by the Nov. 11 hack.

The alarms had sent the SRM terms plummeting, ranking the token among the biggest losers successful crypto markets. The rebound turned the token into 1 of the biggest winners overnight.

The serum (SRM) terms started soaring astir 23:30 UTC Monday, reaching a precocious of 32 cents Tuesday, up from a debased of 12 cents connected Sunday. As of property time, the token had settled backmost to 29 cents. It’s inactive down 95% successful the past year.

Jupiter Aggregator, a cardinal liquidity aggregator for Solana DeFi, which plugs into Serum, tweeted Tuesday that it was already investigating an integration of the caller mentation and “will denote it arsenic soon arsenic it’s ready.”

The terms leap was apt owed to the assemblage “rallying down a fork,” though it’s “unclear however the SRM token would fare if the fork gains traction,” Riyad Carey, an expert with the crypto investigation steadfast Kaiko Research, told CoinDesk.

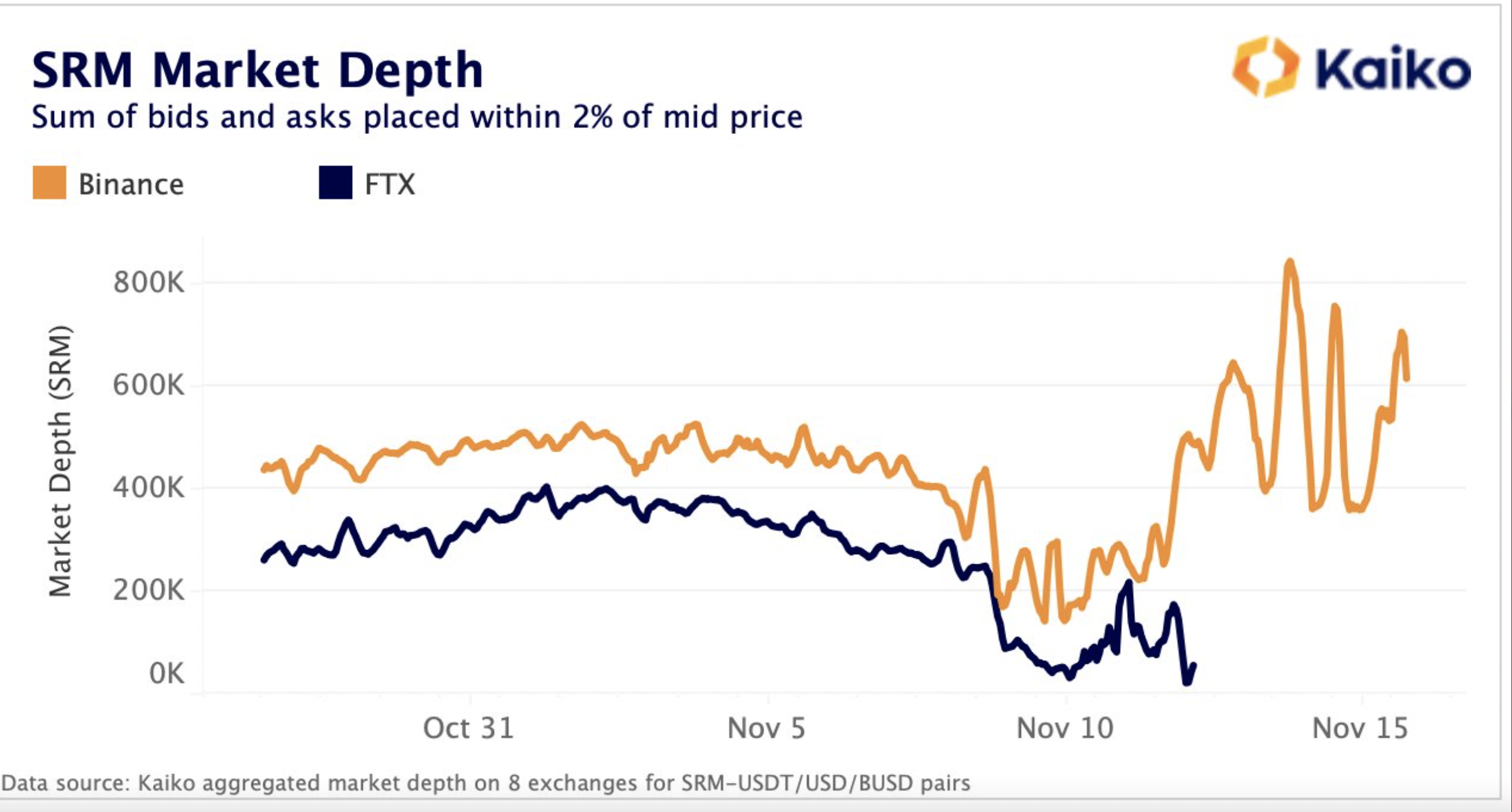

Kaiko had noted successful a probe study Monday that the SRM tokens had suffered a crisp drop successful marketplace depth connected crypto exchanges past week triggered by the collapse of Bankman-Fried’s crypto empire, including the FTX speech and trading steadfast Alameda Research.

That dynamic appeared to displacement Tuesday: Based connected the full fig of SRM tokens connected the Serum bid book, SRM’s liquidity connected Binance is present higher than pre-crash, according to Clara Medalie, manager of probe astatine Kaiko.

Medalie told CoinDesk that marketplace makers person been “building up enactment connected Binance for SRM since the crash.”

Data illustration shows SRM's marketplace extent connected Binance accrued from Nov. 10 to Nov. 15. (Kaiko)

“Market makers are moving funds to Binance to enactment price,” she said. “Liquidity evaporated connected astir each different exchange.”

Solana co-founder Anatoly Yakovenko tweeted Nov. 12 that developers depending connected Serum forked the programme due to the fact that “the upgrade cardinal to the existent 1 is compromised.” He said that “a ton of protocols beryllium connected Serum markets for liquidity and liquidations.”

The effort to regenerate Serum with a community-led open-source mentation has renewed the market's interest, according to Brian Long, a salient validator, successful a tweet.

The FTX-Alameda fallout past week has pushed the Solana assemblage to the edge. The Solana Foundation said Monday it held 134.54 cardinal SRM tokens and 3.43 cardinal FTT tokens connected FTX erstwhile withdrawals went acheronian connected Nov. 6.

Solana-based applications person besides seen nearly $700 cardinal successful worth wiped out, with a 70% driblet from the $1 cardinal successful full worth locked (TVL) connected Nov. 2 erstwhile CoinDesk archetypal reported connected Alameda’s troubling equilibrium sheet.

Solana’s autochthonal token SOL saw a insignificant rebound connected Tuesday, up 6% to astir $14 Tuesday. The CoinDesk Market Index was up 2%.

Medalie said that a abrupt terms leap for SRM whitethorn not beryllium a beardown indicator successful presumption of aboriginal terms movements due to the fact that “there is inactive a ample spread that Alameda left.”

3 years ago

3 years ago

English (US)

English (US)