The beneath is an excerpt from a caller year-ahead study written by the Bitcoin Magazine PRO analysts. Download the full study here.

Bitcoin Magazine PRO sees incredibly beardown fundamentals successful the Bitcoin web and we are laser-focused connected its marketplace dynamic successful the discourse of macroeconomic trends. Bitcoin aims to go the satellite reserve currency, an concern accidental that cannot beryllium understated.

In our year-ahead report, we analyzed 7 notable factors that we urge investors wage attraction to successful the coming months.

Convicted Bitcoin Investors

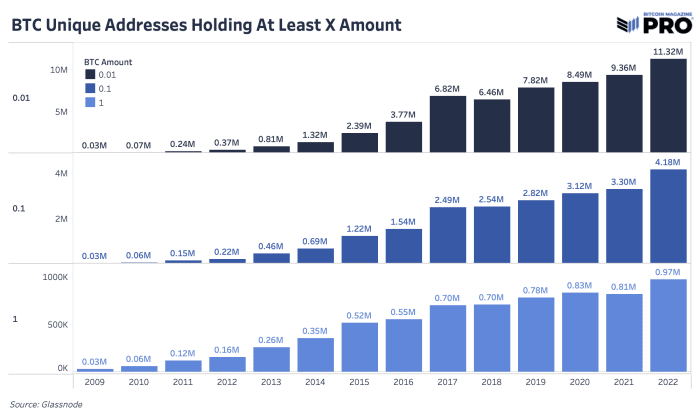

We tin enactment capitalist condemnation into position by looking astatine the fig of unsocial Bitcoin addresses holding astatine slightest 0.01, 0.1 and 1 bitcoin. This information shows that bitcoin adoption continues to turn with a increasing fig of unsocial addresses holding astatine slightest these amounts of bitcoin. While it is wholly imaginable for idiosyncratic users to clasp their bitcoin successful aggregate addresses, the maturation of unsocial Bitcoin addresses holding astatine slightest 0.01, 0.1 and 1 bitcoin bespeak that much users than ever earlier are buying bitcoin and holding it successful self-custody.

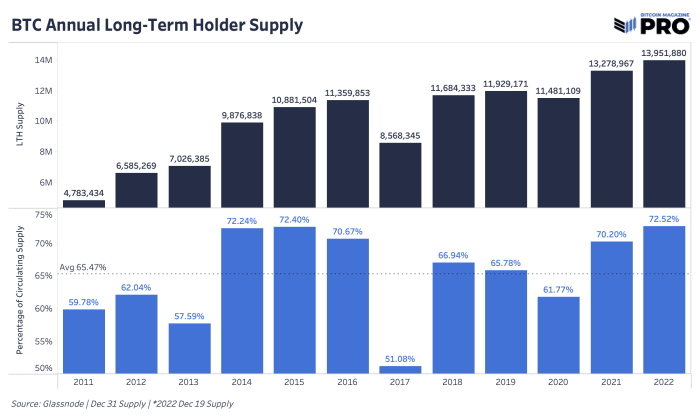

Another promising metric is the magnitude held by semipermanent holders, which has accrued to astir 14 cardinal bitcoin. Long-term holder proviso is calculated utilizing a threshold of a 155-day holding period, aft which dormant coins go progressively improbable to beryllium spent. As of now, 72.49% of the bitcoin successful circulation is not apt to beryllium sold astatine these prices.

There is simply a ample subset of bitcoin investors who are accumulating the integer plus nary substance the price. In a December 2022 interrogation connected “Going Digital,” Head of Market Research Dylan LeClair said, “You person radical each implicit the satellite that are acquiring this plus and you person a immense and increasing cohort of radical that are price-agnostic accumulators.”

With a increasing fig of unsocial addresses holding bitcoin and specified a important magnitude of bitcoin being held by semipermanent investors, we are optimistic for bitcoin’s advancement and complaint of adoption. There are galore variables that show the imaginable for asymmetric returns arsenic request for bitcoin increases and adoption increases worldwide.

Total Addressable Market

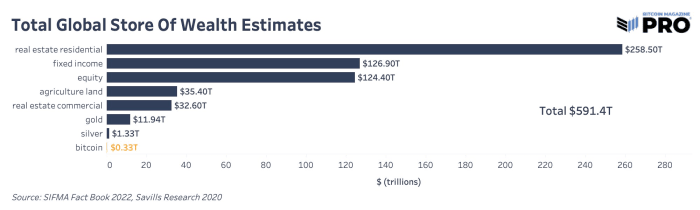

During monetization, a currency goes done 3 phases successful order: store of value, mean of speech and portion of account. Bitcoin is presently successful its store-of-value signifier arsenic demonstrated by the semipermanent holder metrics above. Other assets that are often utilized arsenic stores of worth are existent estate, golden and equities. Bitcoin is simply a amended store of worth for galore reasons: it is much liquid, easier to access, transport and secure, easier to audit and much finitely scarce than immoderate different plus with its hard-cap bounds of 21 cardinal coins. For bitcoin to get a larger stock of different planetary stores of value, these properties request to stay intact and beryllium themselves successful the eyes of investors.

As readers tin see, bitcoin is simply a tiny fraction of planetary wealth. Should bitcoin instrumentality adjacent a 1% stock from these different stores of value, the marketplace headdress would beryllium $5.9 trillion, putting bitcoin astatine implicit $300,000 per coin. These are blimpish numbers from our viewpoint due to the fact that we estimation that bitcoin adoption volition hap gradually, and past suddenly.

Transfer Volume

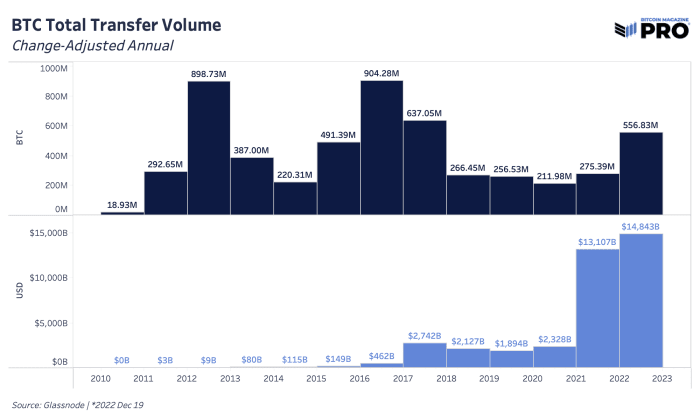

When looking astatine the magnitude of worth that was cleared connected the Bitcoin web passim its history, determination is simply a wide upward inclination successful USD presumption with a heightened request for transferring bitcoin this year. In 2022, determination was a change-adjusted transportation measurement of implicit 556 cardinal bitcoin settled connected the Bitcoin network, up 102% from 2021. In USD terms, the Bitcoin web settled conscionable shy of $15 trillion successful worth successful 2022.

Bitcoin’s censorship absorption is an highly invaluable diagnostic arsenic the satellite enters into a play of deglobalization. With a marketplace capitalization of lone $324 billion, we judge bitcoin is severely undervalued. Despite the driblet successful price, the Bitcoin web transferred much worth successful USD presumption than ever before.

Rare Opportunity In Bitcoin’s Price

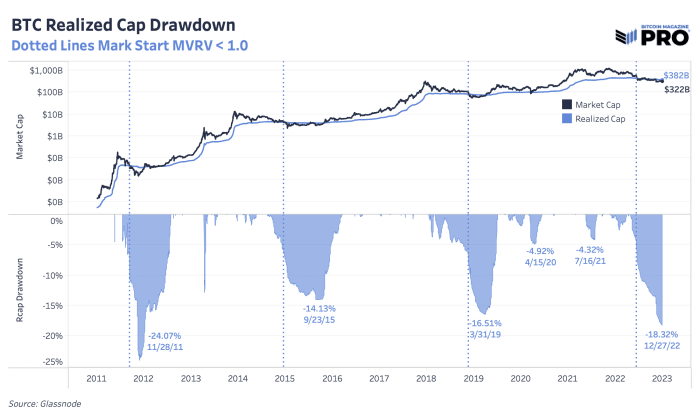

By looking astatine definite metrics, we tin analyse the unsocial accidental investors person to acquisition bitcoin astatine these prices. The bitcoin realized marketplace headdress is down 18.8% from all-time highs, which is the second-largest drawdown successful its history. While the macroeconomic factors are thing to support successful mind, we judge that this is simply a uncommon buying opportunity.

Relative to its history, bitcoin is astatine the signifier of the rhythm wherever it’s astir arsenic inexpensive arsenic it gets. Its existent marketplace speech complaint is astir 20% little than its mean outgo ground on-chain, which has lone happened astatine oregon adjacent the section bottommost of bitcoin marketplace cycles.

Current prices of bitcoin are successful uncommon territory for investors looking to get successful astatine a debased speech rate. Historically, purchasing bitcoin during these times has brought tremendous returns successful the agelong term. With that said, readers should see the world that 2023 apt brings astir bitcoin’s archetypal acquisition with a prolonged economical recession.

Macroeconomic Environment

As we determination into 2023, it’s indispensable to admit the authorities of the geopolitical scenery due to the fact that macro is the driving unit down economical growth. People astir the satellite are experiencing a monetary argumentation lag effect from past year’s cardinal slope decisions. The U.S. and EU are successful recessionary territory, China is proceeding to de-dollarize and the Bank of Japan raised its people complaint for output curve control. All of these person a ample power connected superior markets.

Nothing successful fiscal markets occurs successful a vacuum. Bitcoin’s ascent done 2020 and 2021 — portion akin to erstwhile crypto-native marketplace cycles — was precise overmuch tied to the detonation of liquidity sloshing astir the fiscal strategy aft COVID. While 2020 and 2021 was characterized by the insertion of further liquidity, 2022 has been characterized by the removal of liquidity.

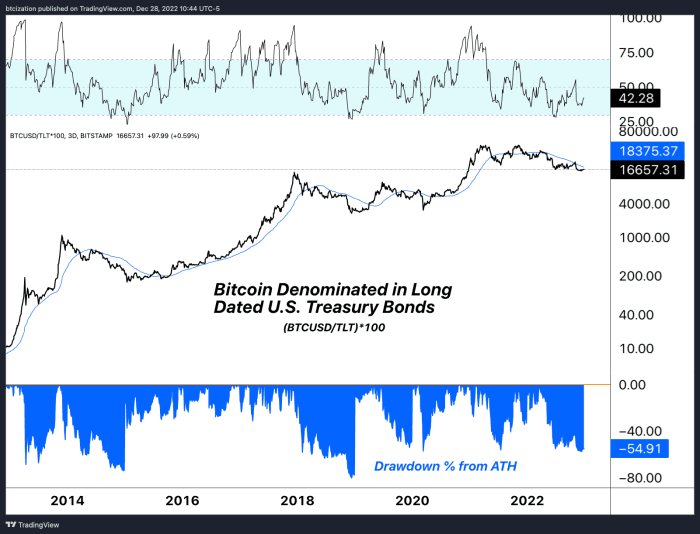

Interestingly enough, erstwhile denominating bitcoin against U.S. Treasury bonds (which we judge to beryllium bitcoin’s largest theoretical rival for monetary worth implicit the agelong term), comparing the drawdown during 2022 was alternatively benign compared to drawdowns successful bitcoin’s history.

As we wrote successful “The Everything Bubble: Markets At A Crossroads,” “Despite the caller bounce successful stocks and bonds, we aren’t convinced that we person seen the worst of the deflationary pressures from the planetary liquidity cycle.”

In “The Bank of Japan Blinks And Markets Tremble,” we noted, “As we proceed to notation to the sovereign indebtedness bubble, readers should recognize what this melodramatic upward repricing successful planetary yields means for plus prices. As enslaved yields stay astatine elevated levels acold supra caller years, plus valuations based connected discounted currency flows fall.” Bitcoin does not trust connected currency flows, but it volition surely beryllium impacted by this repricing of planetary yields. We judge we are presently astatine the 3rd slug constituent of the pursuing playing out:

Bitcoin Mining And Infrastructure

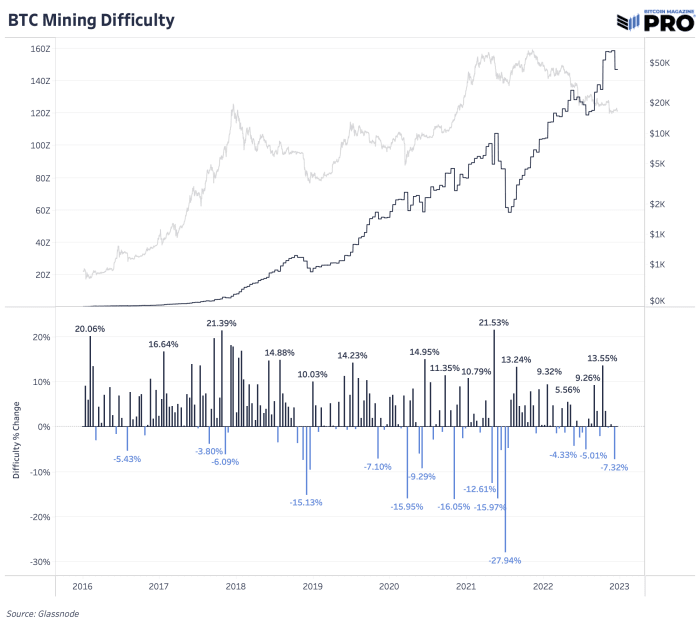

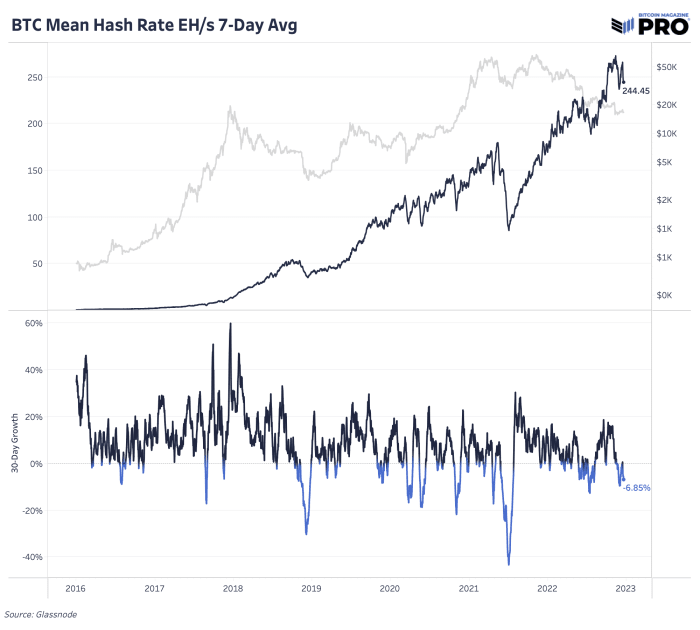

While the multitude of antagonistic manufacture and worrying macroeconomic factors person had a large dampening connected bitcoin’s price, looking astatine the metrics of the Bitcoin web itself archer different story. The hash complaint and mining trouble gives a glimpse into however galore ASICs are dedicating hashing powerfulness to the web and however competitory it is to excavation bitcoin. These numbers determination successful tandem and some person astir exclusively gone up successful 2022, contempt the important driblet successful price.

By deploying much machines and investing successful expanded infrastructure, bitcoin miners show that they are much bullish than ever. The past clip the bitcoin terms was successful a akin scope successful 2017, the web hash complaint was one-fifth of existent levels. This means that determination has been a fivefold summation successful bitcoin mining machines being plugged successful and ratio upgrades to the machines themselves, not to notation the large investments successful facilities and information centers to location the equipment.

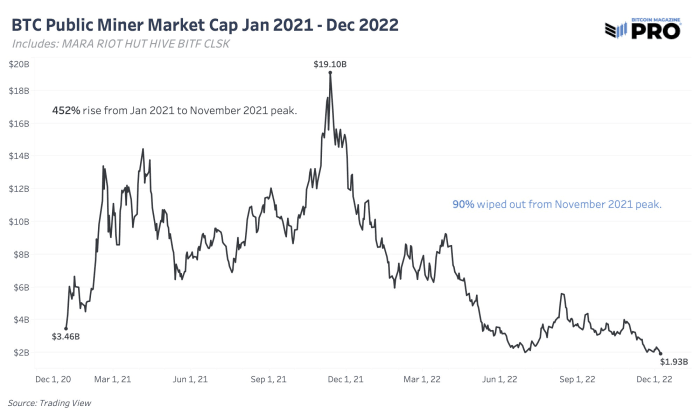

Because the hash complaint accrued portion the bitcoin terms decreased, miner gross took a beating this twelvemonth aft a euphoric emergence successful 2021. Public miner banal valuations followed the aforesaid way with valuations falling adjacent much than the bitcoin price, each portion the Bitcoin network’s hash complaint continued to rise. In the “State Of The Mining Industry: Survival Of The Fittest,” we looked astatine the full marketplace capitalization of nationalist miners which fell by implicit 90% since January 2021.

We expect much of these companies to look challenging conditions due to the fact that of the skyrocketing planetary vigor prices and involvement rates mentioned above.

Increasing Scarcity

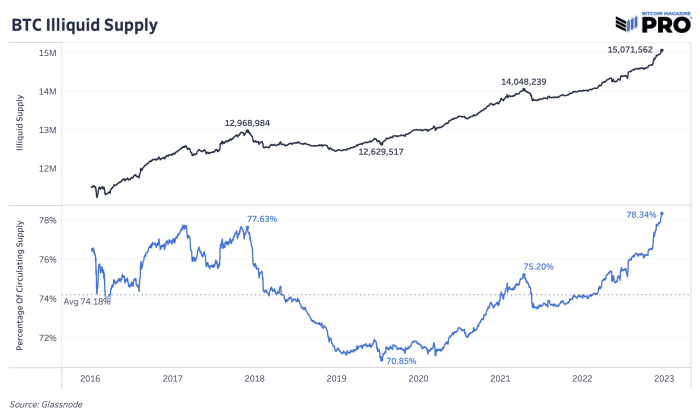

One mode to analyse bitcoin’s scarcity is by looking astatine the illiquid proviso of coins. Liquidity is quantified arsenic the grade to which an entity spends their bitcoin. Someone that ne'er sells has a liquidity worth of 0 whereas idiosyncratic who buys and sells bitcoin each the clip has a worth of 1. With this quantification, circulating proviso tin beryllium breached down into 3 categories: highly liquid, liquid and illiquid supply.

Illiquid proviso is defined arsenic entities that clasp implicit 75% of the bitcoin they deposit to an address. Highly liquid proviso is defined arsenic entities that clasp little than 25%. Liquid proviso is betwixt the two. This illiquid proviso quantification and analysis was developed by Rafael Schultze-Kraft, co-founder and CTO of Glassnode.

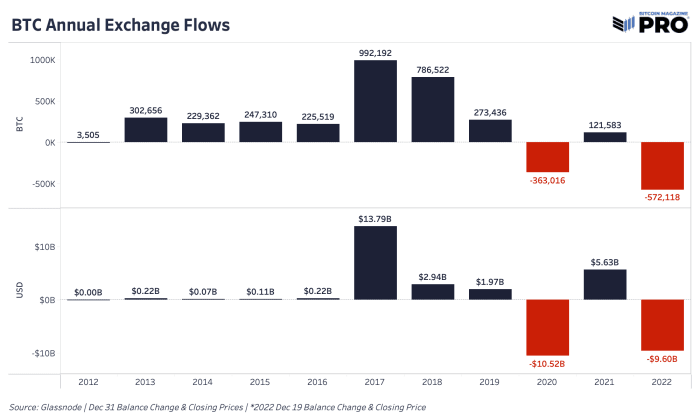

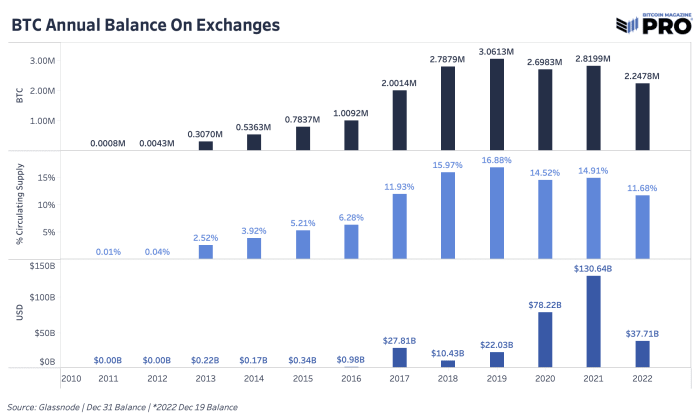

2022 was the twelvemonth of getting bitcoin disconnected exchanges. Every caller large panic became a catalyst for much individuals and institutions to determination coins into their ain custody, find custody solutions extracurricular of exchanges oregon merchantability disconnected their bitcoin entirely. When centralized institutions and counterparty risks are flashing red, radical unreserved for the exit. We tin spot immoderate of this behaviour done bitcoin outflows from exchanges.

In 2022, 572,118 bitcoin worthy $9.6 cardinal near exchanges, marking it the largest yearly outflow of bitcoin successful BTC presumption successful history. In USD terms, it was 2nd lone to 2020, which was driven by the March 2020 COVID crash. 11.68% of bitcoin proviso is present estimated to beryllium connected exchanges, down from 16.88% backmost successful 2019.

These metrics of an progressively illiquid proviso paired with historical amounts of bitcoin being withdrawn from exchanges — ostensibly being removed from the marketplace — overgarment a antithetic representation than what we’re seeing with the factors extracurricular of the Bitcoin network’s purview. While determination are unanswered questions from a macroeconomic perspective, bitcoin miners proceed to put successful instrumentality and on-chain information shows that bitcoin holders aren’t readying to relinquish their bitcoin anytime soon.

Conclusion

The varying factors elaborate supra springiness a representation for wherefore we are semipermanent bullish connected the bitcoin terms going into 2023. The Bitcoin web continues to adhd different artifact astir each 10 minutes, much miners support investing successful infrastructure by plugging successful machines and semipermanent holders are unwavering successful their conviction, arsenic shown by on-chain data.

With bitcoin’s ever-increasing scarcity, the proviso broadside of this equation is fixed, portion request is apt to increase. Bitcoin investors tin get up of the request curve by averaging successful portion the terms is low. It’s important for investors to instrumentality the clip to larn however Bitcoin works to afloat recognize what it is they are investing in. Bitcoin is the archetypal digitally autochthonal and finitely scarce bearer asset. We urge readers larn astir self-custody and retreat their bitcoin from exchanges. Despite the antagonistic quality rhythm and driblet successful bitcoin price, our bullish condemnation for bitcoin’s semipermanent worth proposition remains unfazed.

For the afloat report, travel this nexus to subscribe to Bitcoin Magazine PRO.

2 years ago

2 years ago

English (US)

English (US)