The Ethereum (ETH) Shanghai upgrade is owed to merchandise March, enabling withdrawals from beacon concatenation and allowing ETH presently staked successful ETH 2.0 validators to beryllium unstaked.

With implicit 70% of ETH stakers presently at a loss with their ETH inaccessible, the Shanghai upgrade volition alteration stakers entree to their ETH and determine whether to merchantability astatine a nonaccomplishment oregon clasp semipermanent until backmost successful profit.

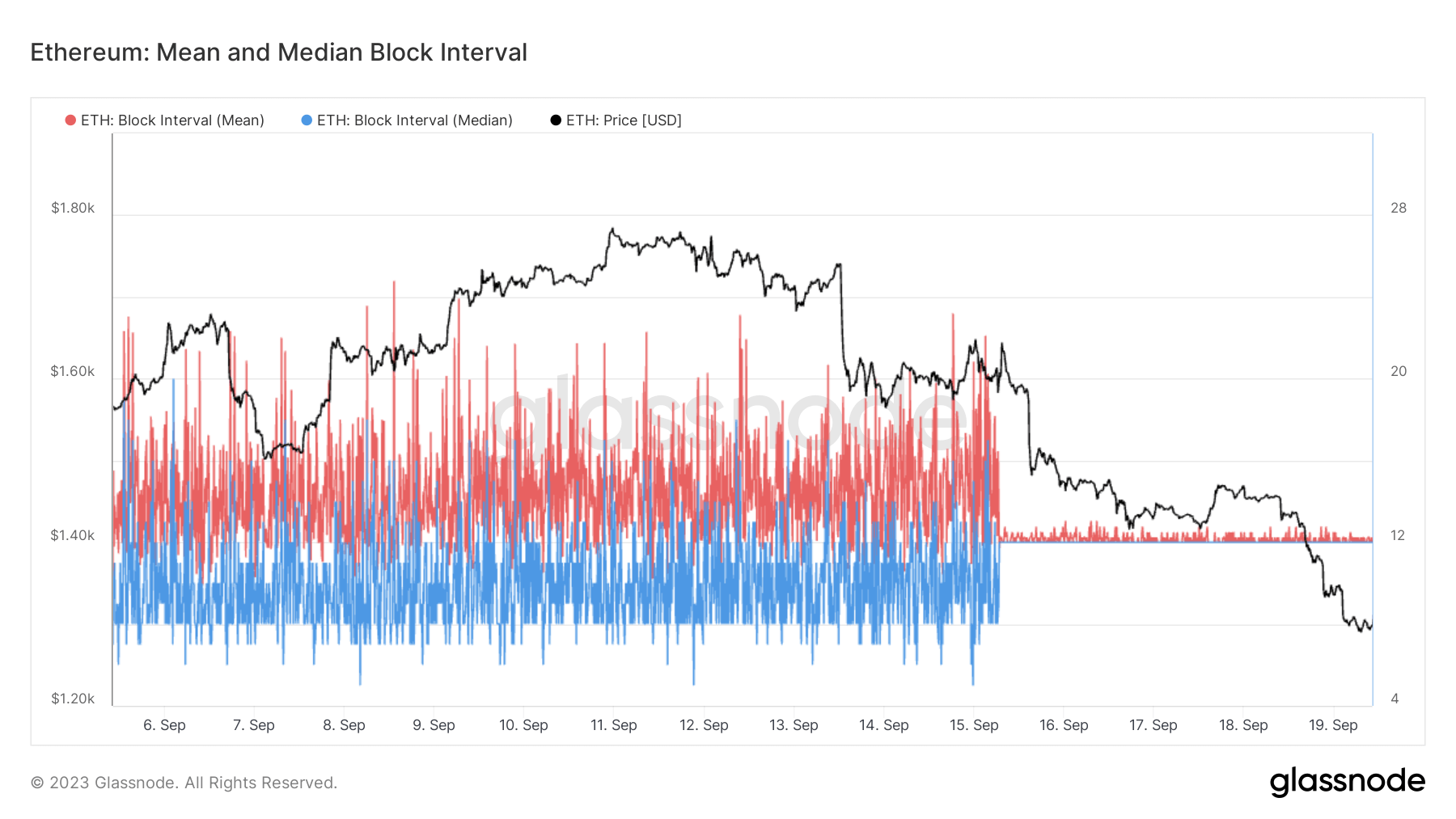

Ethereum: Mean and Median Block Interval – (Source: Glassnode.com)

Ethereum: Mean and Median Block Interval – (Source: Glassnode.com)Post-ETH merge

Back successful September 2022, the ETH merge took spot successful the Bellatrix upgrade. In the process, artifact validation was taken implicit by the beacon concatenation completing the modulation from Proof of Work (POW) to Proof of Stake (POS).

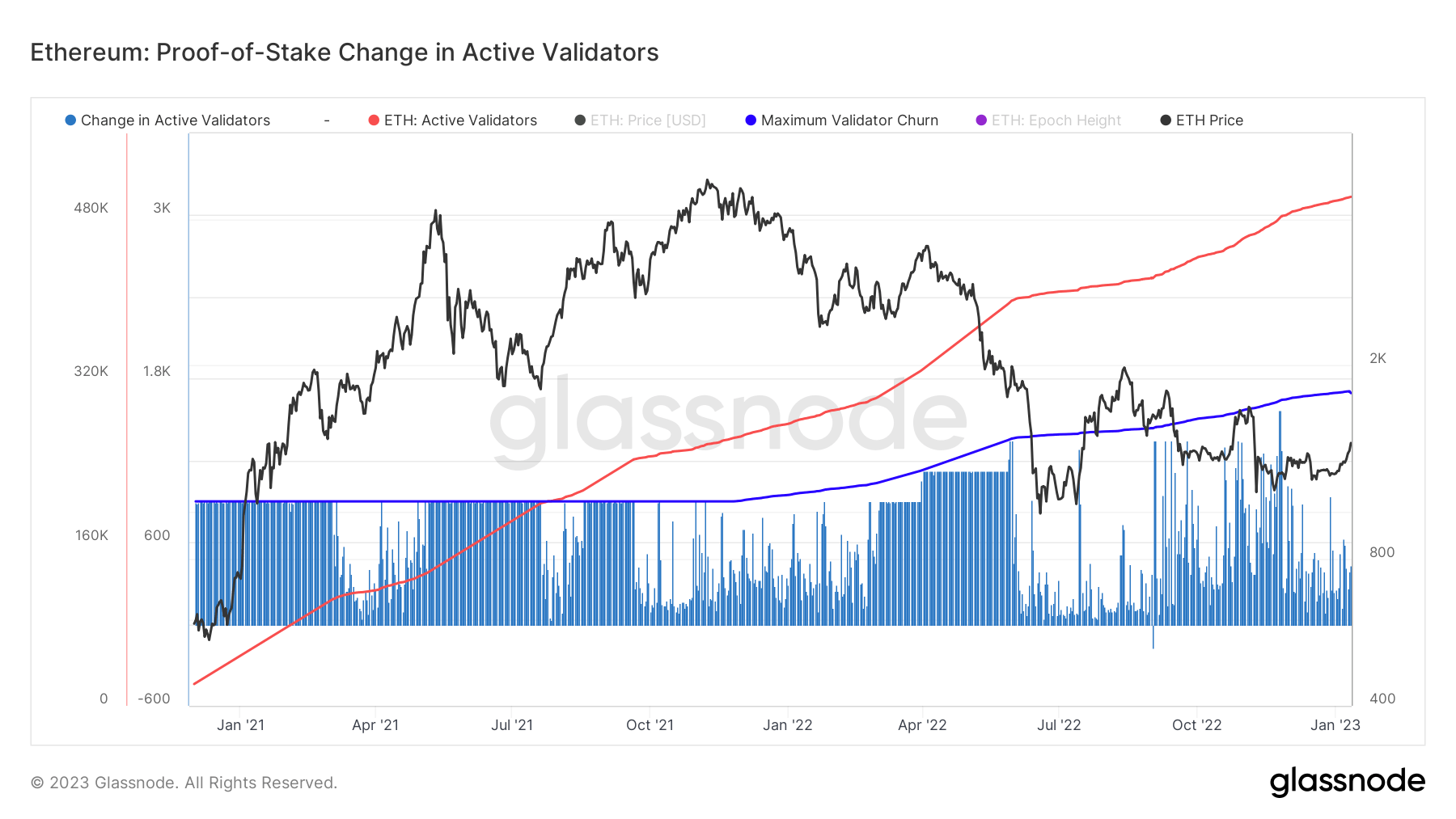

The beacon concatenation is organized by validators who person deposited 32 ETH earlier being capable to statesman operations. Currently, the fig of beacon concatenation validators has reached 500,000 — with a caller burst successful caller progressive validators — with a full of implicit 16 cardinal ETH staked successful the ETH 2.0 deposit contract.

Ethereum: Proof-of-Stake Change successful Active Validators – (Source: Glassnode.com)

Ethereum: Proof-of-Stake Change successful Active Validators – (Source: Glassnode.com)New ETH credentials format

Validators who privation to retreat their staking rewards indispensable guarantee their withdrawal credentials are updated to the caller “0x01” standardized format. The aforesaid prerequisite exists for validators who privation to halt validating oregon exit their afloat balance.

Currently, astir 300,000 validators person yet to update their credentials from “0x00” portion astir 200,000 validators person already updated connected the beacon chain.

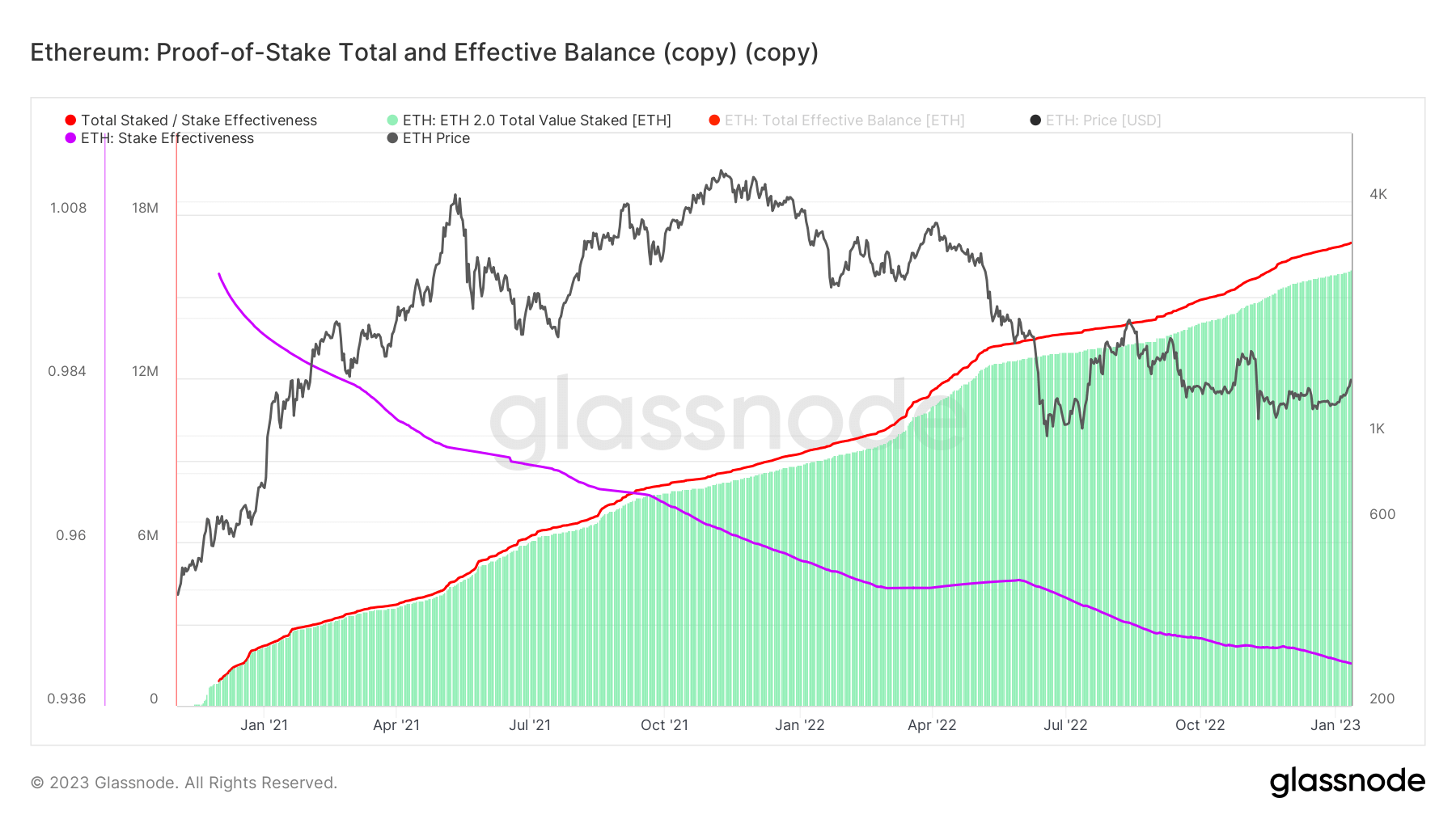

Of the 500,000 full validators, the implicit 16 cardinal ETH they person staked represents astir 13% of the full ETH proviso — which volition alteration arsenic clip goes connected arsenic the effect of:

- Slashing — successful the lawsuit of malicious behavior.

- Revenue earned from issuance and fees.

- Inactivity leak — if validators volition artifact oregon attestations.

- New deposits and, eventually, withdrawals.

Ethereum: Proof-of-Stake Total and Effective Balance – (Source: Glassnode.com)

Ethereum: Proof-of-Stake Total and Effective Balance – (Source: Glassnode.com)Liquid Staking Derivatives

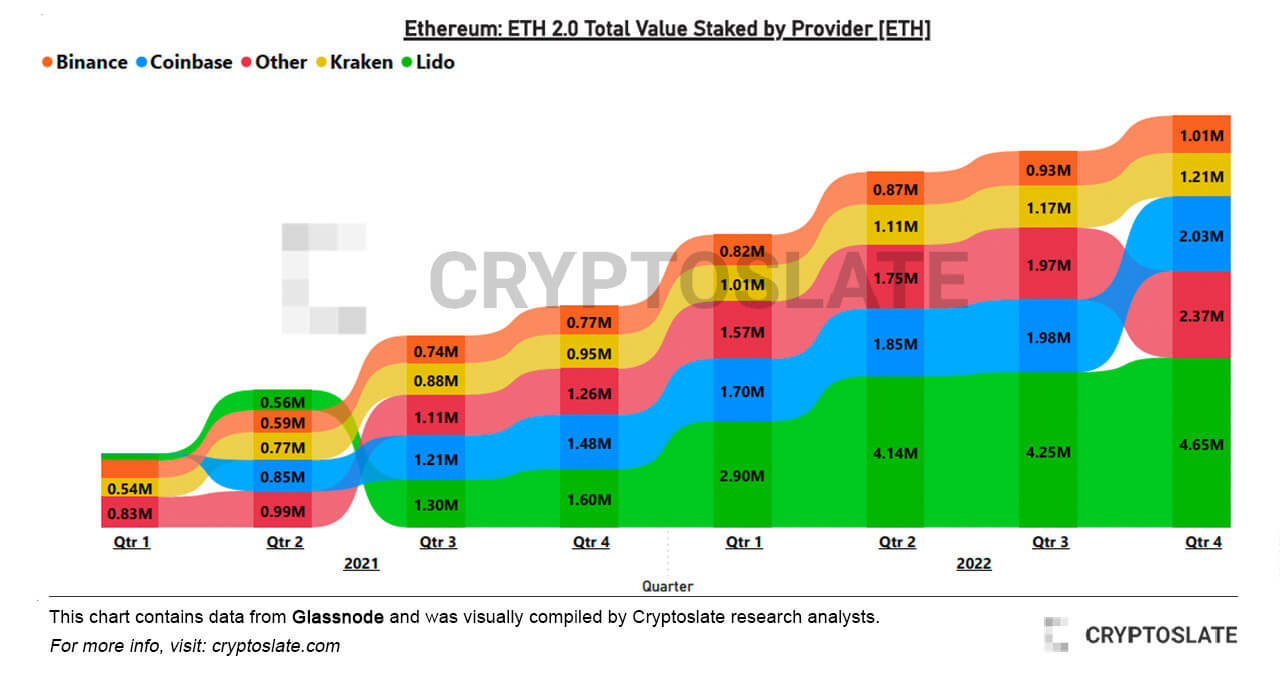

Due to the quality of staked ETH, it is an untradeable plus erstwhile staked. As such, galore providers emerged that allowed ETH to beryllium staked successful instrumentality for a tradeable plus representing a stock of the staked ETH — known arsenic Liquid Staking Derivatives (LSD).

To date, Lido is by acold the largest LSD provider, with a marketplace holdings magnitude of astir 5 cardinal ETH. However, presently staking providers specified arsenic Lido, Coinbase and Binance power ample segments of the ETH marketplace — revealing issues with centralization.

Ethereum: ETH 2.0 Total Value Staked by Provider [ETH] – Source: CryptoSlate.com

Ethereum: ETH 2.0 Total Value Staked by Provider [ETH] – Source: CryptoSlate.comAs an plus geared towards decentralization, ETH holdings amassed by the aforementioned ETH staking providers lend to the communicative that ETH is becoming excessively centralized — and yet controlled by companies with the largest holdings.

With the integration of the upcoming Shanghai upgrade, ETH investors and validators alike volition beryllium gearing up to retreat staked ETH successful favour of positions that let the stock and worth of their staked ETH to beryllium returned successful the signifier of LSDs.

The station Shift toward Liquid Staking Derivatives expected aft ETH Shanghai upgrade appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)