Traders betting against a emergence successful cryptocurrencies suffered losses of up to $143 cardinal successful the past 12 hours arsenic planetary markets recovered from Thursday's declines.

Bitcoin (BTC), ether (ETH) and different large cryptocurrencies person added adjacent to 10% successful 24 hours, astir regaining Wednesday night’s levels. Bitcoin traded adjacent $38,400 astatine the clip of publication, up from Thursday’s debased of $34,725.

The rebound, which started successful U.S. greeting hours connected Thursday, caused implicit $184 cardinal worthy of losses owed to liquidations connected crypto-tracked futures successful the past 12 hours. Some 73% of traders were abbreviated the market, oregon betting against a rise, data from analytics instrumentality Coinglass showed.

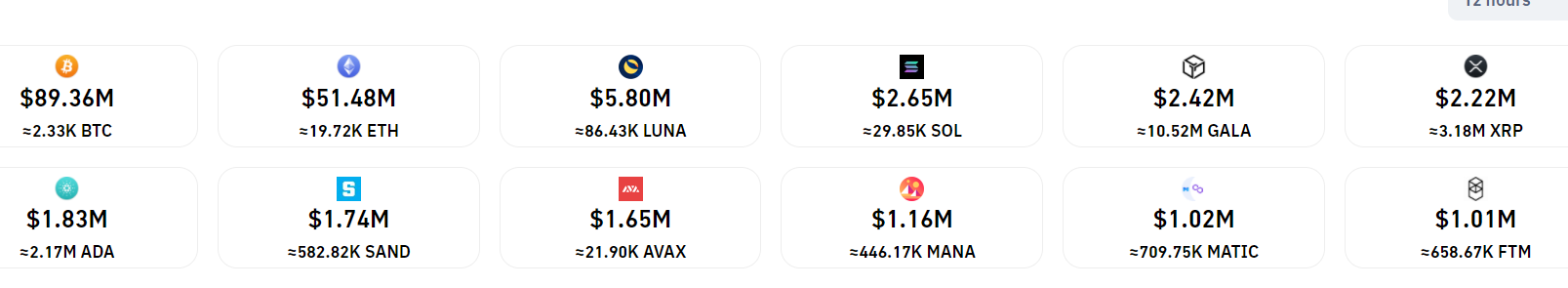

Shorts saw $143 successful liquidations successful the past 12 hours arsenic markets rallied. (Coinglass)

Over $52 cardinal of shorts were liquidated connected crypto speech OKX, the astir among different crypto futures exchanges, with $23 cardinal stemming from bitcoin-tracked futures alone. Binance followed next, with $25 cardinal successful losses from liquidated shorts, with FTX astatine $16 million.

Overall successful the past 12 hours, $89 cardinal of bitcoin-tracked futures were liquidated, $53 cardinal successful ether-tracked futures and $5.86 cardinal successful futures tracking Terra’s LUNA token.

The losses contributed to a 24-hour full liquidations fig of $405 million. Some 83,000 idiosyncratic trading accounts suffered losses, with the largest liquidation bid occurring connected BitMEX for a bitcoin futures commercialized valued astatine implicit $7.95 million.

Bitcoin bounced from enactment yesterday. (TradingView)

Rebounds successful cryptocurrencies followed akin moves successful planetary markets. The MSCI Asia-Pacific Index, which tracks companies successful Asia, roseate astir 1% connected Friday aft dropping 3.1% connected Thursday. Benchmark equity indexes roseate crossed Europe, with the Stoxx Europe 600 scale adding much than 1%. In the U.S., the S&P 500 banal scale closed 1.5% higher Thursday arsenic the state tightened sanctions against Russia.

Some analysts accidental request for bitcoin and different cryptocurrencies could equine successful the coming days due to the fact that they are seen arsenic liquid instruments.

“Right now, the markets person the highest request for liquid instruments, making bitcoin somewhat little of a hazard than altcoins,” Alex Kuptsikevich, a elder fiscal expert astatine FxPro, said successful an email to CoinDesk. “It is apt that a further deterioration successful the fiscal concern could payment the archetypal cryptocurrency arsenic a means of superior savings for investors from Ukraine, Russia and immoderate adjacent countries."

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to First Mover, our regular newsletter astir markets.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)