The support of the archetypal spot Bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC) connected Jan. 10 was a important milestone successful the crypto market. However, the milestone led to adjacent much important volatility successful Bitcoin’s terms and on-chain activity.

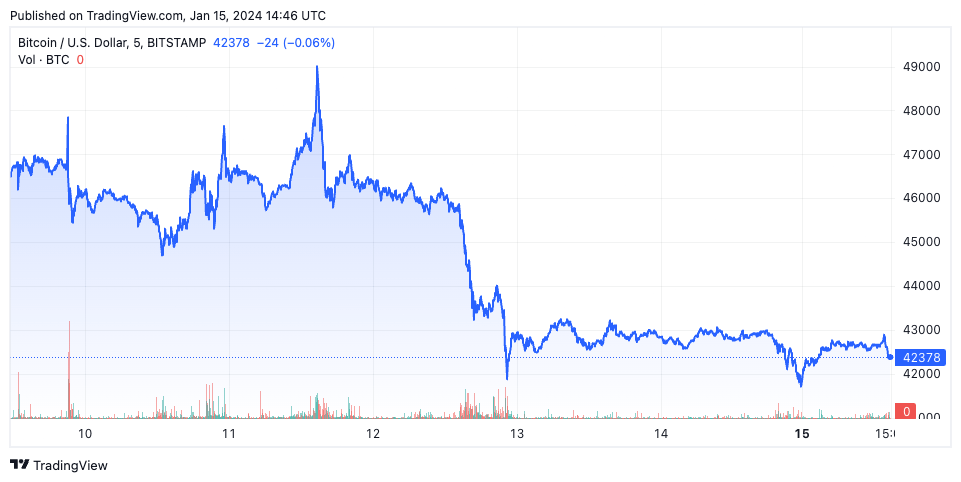

Initially, Bitcoin’s terms showed a affirmative absorption to the quality of the ETF approval, climbing to $46,608 connected Jan. 10. By Jan. 11, the terms declined to $46,393, and a much pronounced driblet occurred connected Jan. 12, erstwhile the terms fell to $42,897. This downward inclination continued implicit the pursuing days, culminating successful a terms of $41,769 connected Jan. 14.

Graph showing the terms of Bitcoin from Jan. 9 to Jan. 14, 2024 (Source: CryptoSlate BTC)

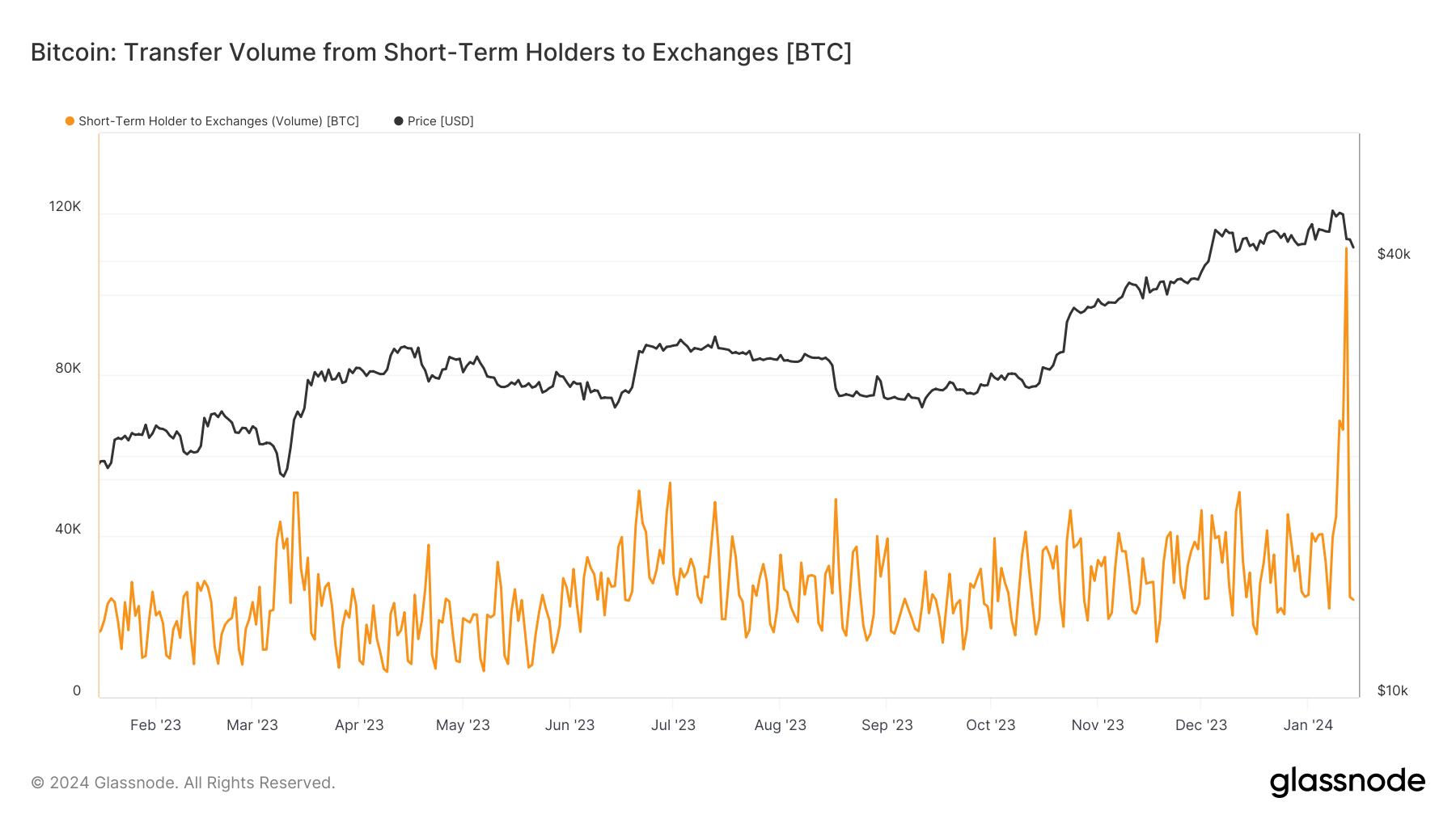

Graph showing the terms of Bitcoin from Jan. 9 to Jan. 14, 2024 (Source: CryptoSlate BTC)The activities of short-term holders, peculiarly their transactions to exchanges, amusement wherever astir of the volatility came from. A important summation successful the measurement of Bitcoin sent to exchanges was observed, peculiarly connected Jan. 12, erstwhile short-term holders transferred 111,476 BTC to exchanges, marking the highest level since May 19, 2021. This spike indicates a sizeable sell-off by addresses that person held their BTC for little than 155 days.

Graph showing the transportation measurement from short-term holders to exchanges from Jan. 16, 2023, to Jan. 14, 2024 (Source: Glassnode)

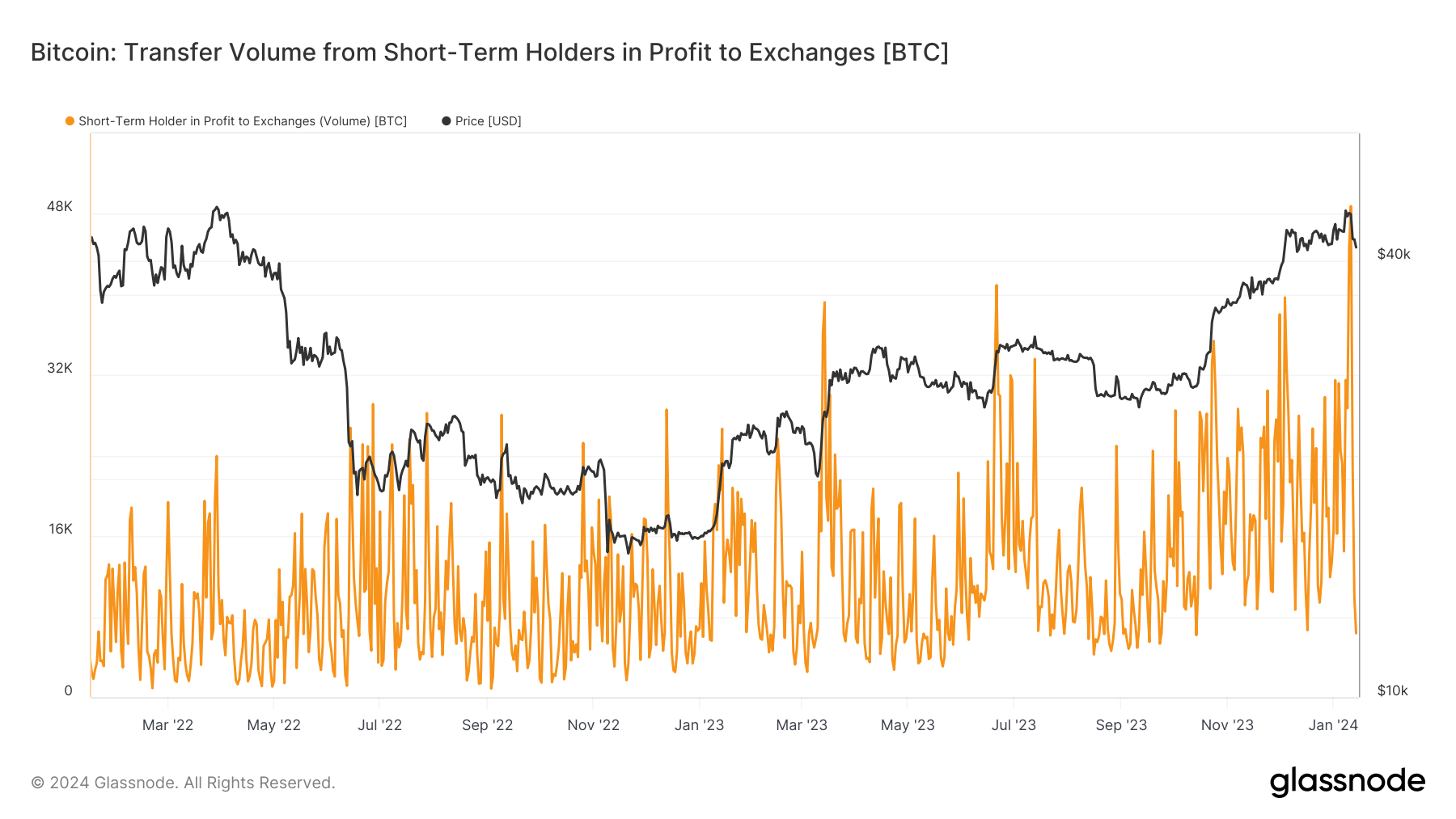

Graph showing the transportation measurement from short-term holders to exchanges from Jan. 16, 2023, to Jan. 14, 2024 (Source: Glassnode)Further investigation of short-term holders’ positions successful nett and nonaccomplishment shows the grade of profit-taking during the volatility. On Jan. 11, the measurement of Bitcoin held by short-term holders successful nett sent to exchanges reached its peak.

Graph showing the transportation measurement from short-term holders successful nett to exchanges from Jan. 16, 2022, to Jan. 14, 2024 (Source: Glassnode)

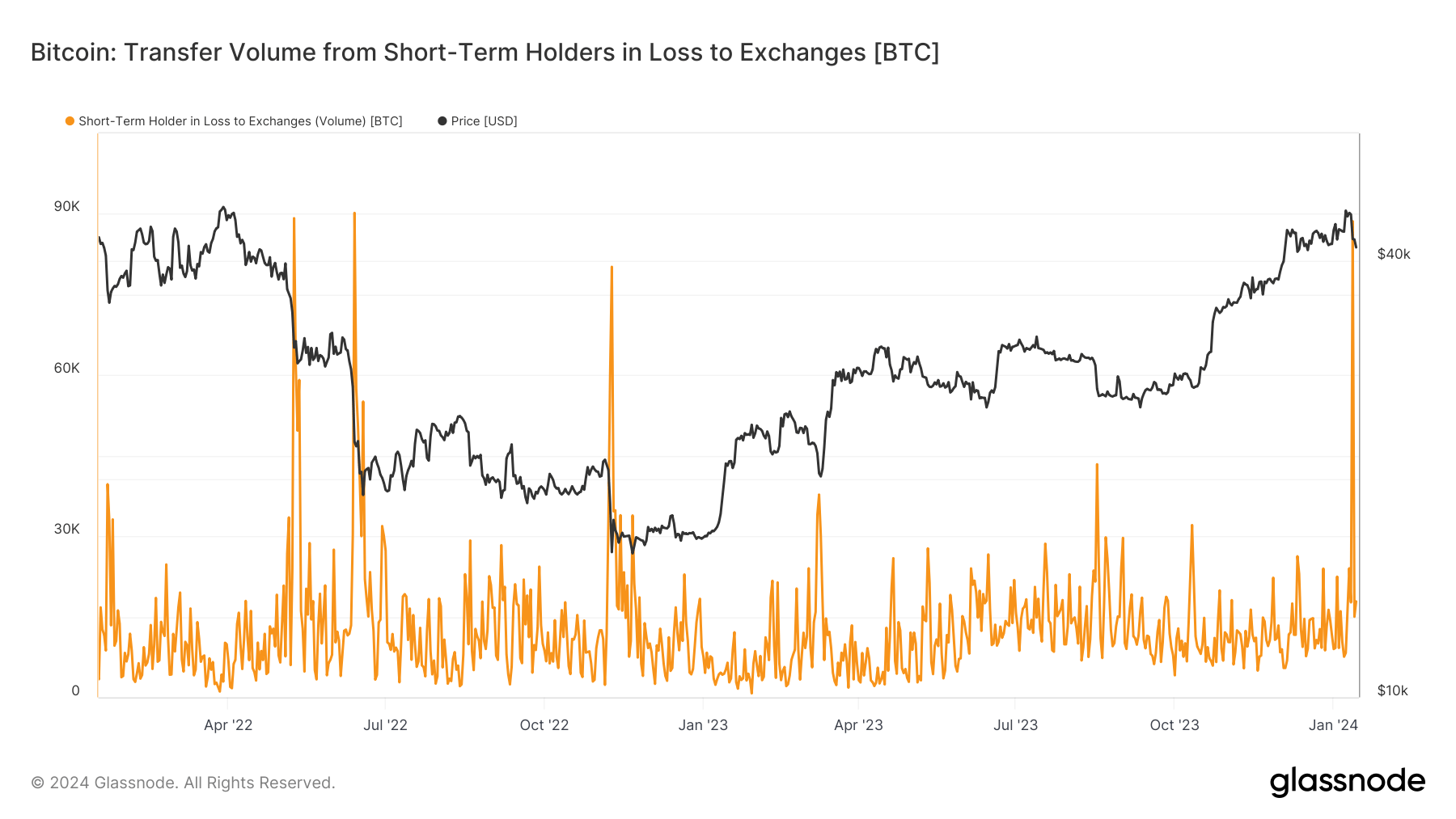

Graph showing the transportation measurement from short-term holders successful nett to exchanges from Jan. 16, 2022, to Jan. 14, 2024 (Source: Glassnode)Conversely, the pursuing time saw a highest successful Bitcoin held by short-term holders successful nonaccomplishment being transferred to exchanges. These movements suggest a speedy displacement successful marketplace sentiment — from taking profits to cutting losses — arsenic the terms started to fall.

Graph showing the transportation measurement from short-term holders successful nonaccomplishment to exchanges from Jan. 16, 2022, to Jan. 14, 2024 (Source: Glassnode)

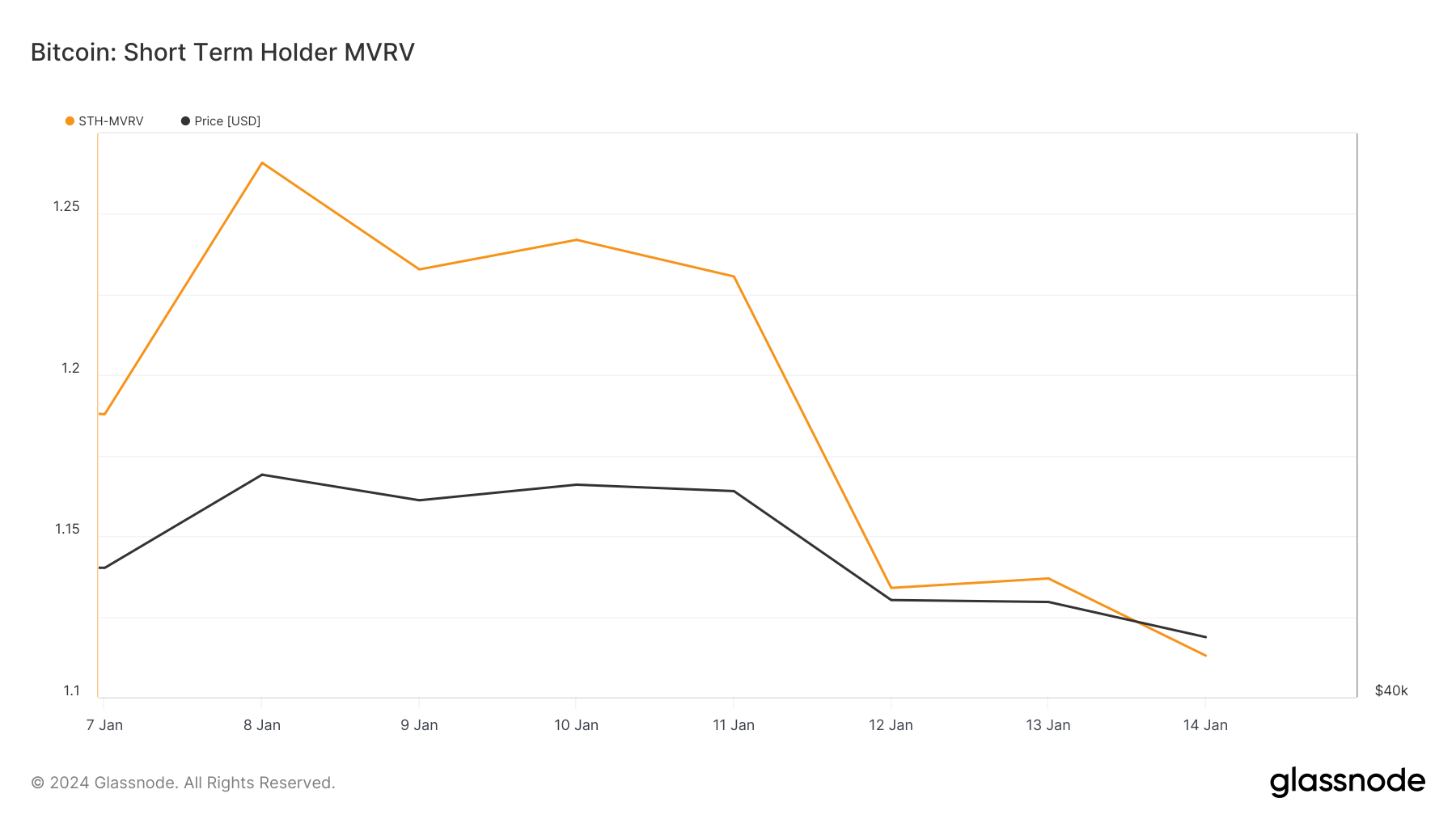

Graph showing the transportation measurement from short-term holders successful nonaccomplishment to exchanges from Jan. 16, 2022, to Jan. 14, 2024 (Source: Glassnode)The Market Value to Realized Value (MVRV) ratio helps america recognize the profitability of these short-term holdings. MVRV compares the marketplace worth (the terms astatine which BTC past moved) with the realized worth (when BTC was past bought).

Typically, a precocious MVRV ratio suggests that holders are successful nett and whitethorn beryllium inclined to sell, portion a little MVRV indicates minimal nett oregon losses. During this period, the MVRV ratio saw a downward trend, reflecting a alteration successful the profitability of short-term holdings, perchance contributing to the selling unit observed successful the market.

Graph showing the short-term holder MVRV ratio from Jan. 7 to Jan. 14, 2024 (Source: Glassnode)

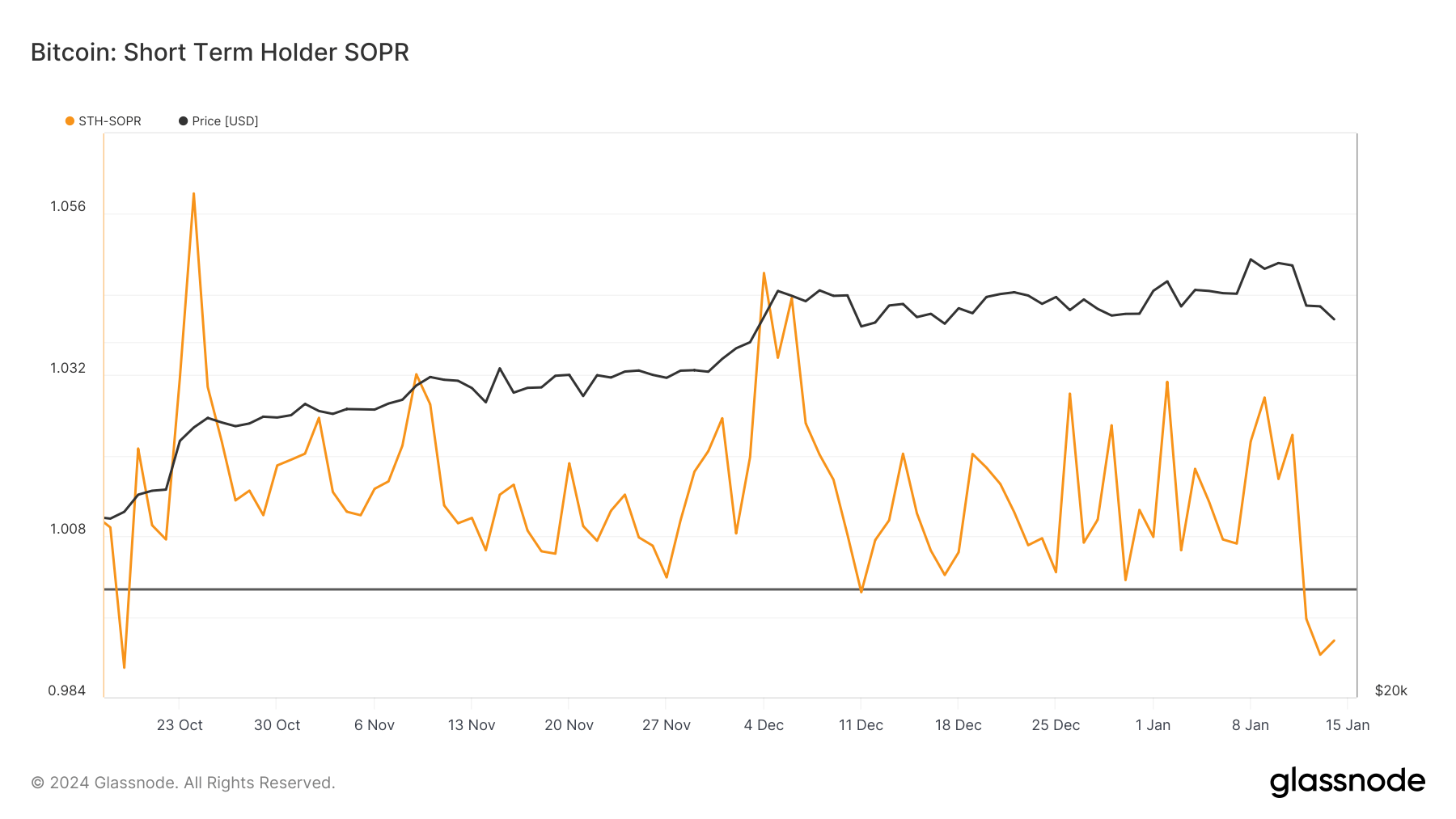

Graph showing the short-term holder MVRV ratio from Jan. 7 to Jan. 14, 2024 (Source: Glassnode)Another pivotal on-chain metric is the Spent Output Profit Ratio (SOPR), which assesses the nett ratio of spent outputs. When the SOPR is supra 1, it implies that coins are being sold astatine a profit. In contrast, a SOPR beneath 1 indicates that coins are sold astatine a loss.

Notably, the short-term holders’ SOPR fell beneath 1 connected Jan. 12 and 13. This is important arsenic it signals a alteration successful marketplace sentiment, with holders apt selling Bitcoin astatine a nonaccomplishment successful effect to the declining prices.

Graph showing the short-term holder SOPR from Oct. 18, 2023, to Jan. 14, 2024 (Source: Glassnode)

Graph showing the short-term holder SOPR from Oct. 18, 2023, to Jan. 14, 2024 (Source: Glassnode)The short-term information surrounding the SEC’s support of the archetypal spot Bitcoin ETFs reveals a Bitcoin marketplace that is highly reactive to regulatory developments. The archetypal affirmative anticipation of the support rapidly shifted to panic, characterized by the important sell-off from short-term holders.

This behaviour is reflected successful the important magnitude of Bitcoin moved to exchanges, particularly connected Jan. 12, and the declining MVRV ratio. The driblet successful the SOPR beneath 1 shows however rapidly and aggressively short-term holders respond to marketplace volatility.

The station Short-term holders thrust Bitcoin’s post-ETF volatility appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)