Bitcoin‘s swift ascent supra $64,000 has enactment astir of the manufacture green. Alongside the rest of the market, Bitcoin reversed weeks of antagonistic show upon quality of the assassination attempt of erstwhile US President Donald Trump.

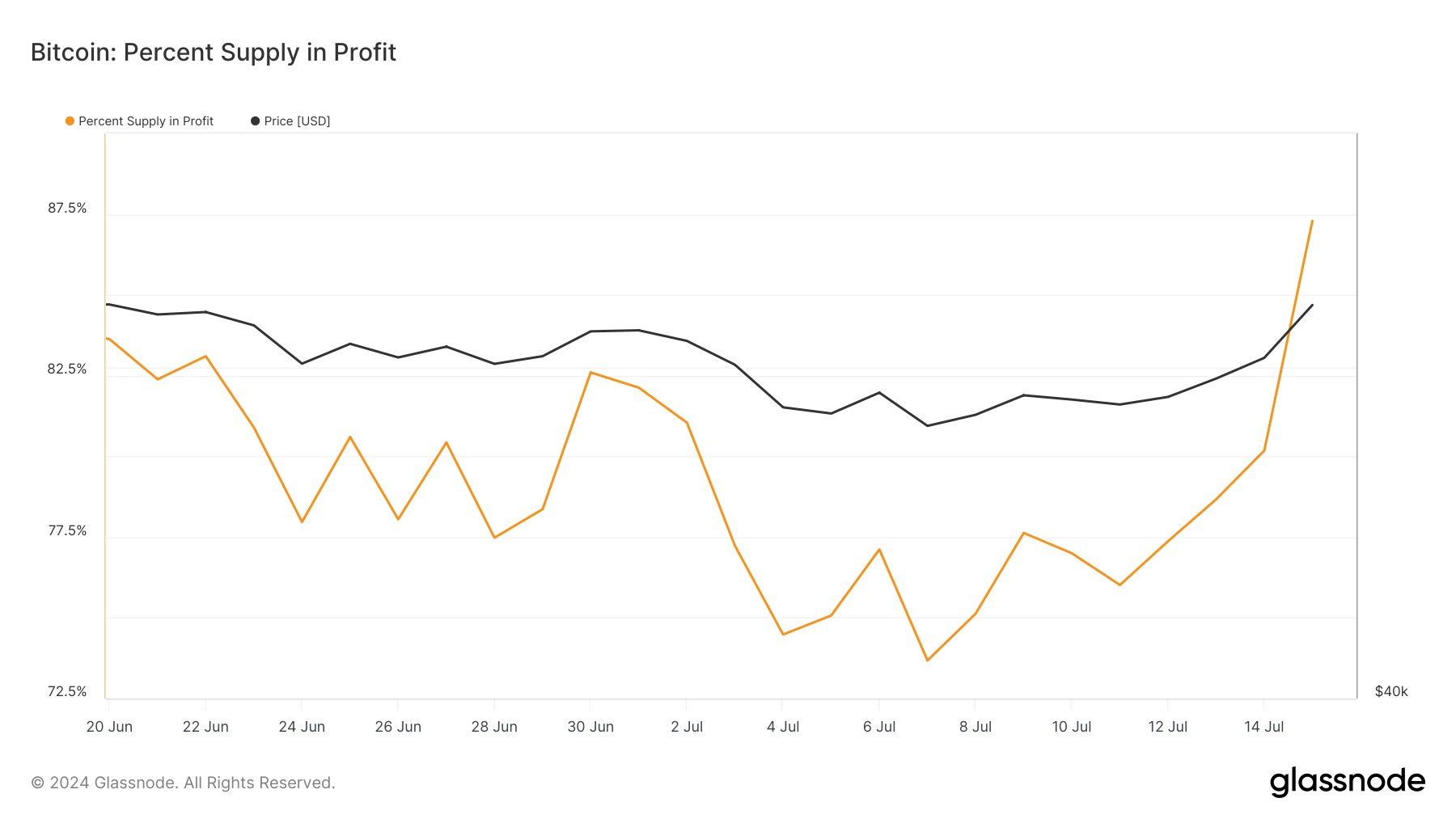

The market’s summation successful profitability tin beryllium seen done the percent of Bitcoin’s proviso successful profit. While the metric is simple, it provides a wide snapshot of the market’s wellness and shows the organisation of gains and losses.

Data from Glassnode showed the percent of proviso successful nett accrued from 73.67% connected July 7 to implicit 87.29% by July 15. It represents a important summation and confirms the grade of the affirmative sentiment successful the market. This could perchance promote further buying unit arsenic the marketplace becomes much profitable for a ample conception of short-term holders.

Graph showing the percent of Bitcoin’s proviso successful nett from June 20 to July 15, 2024 (Source: Glassnode)

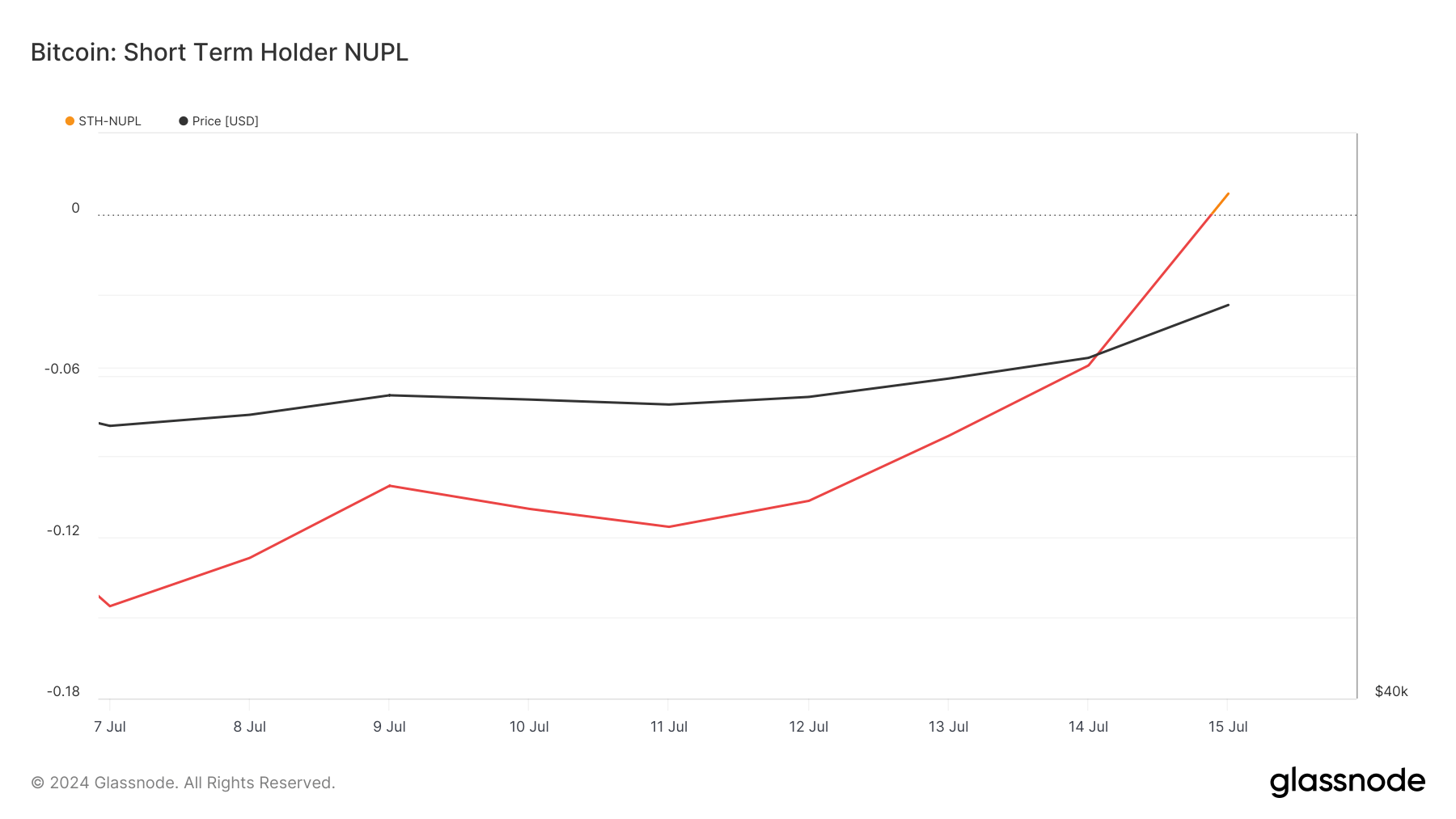

Graph showing the percent of Bitcoin’s proviso successful nett from June 20 to July 15, 2024 (Source: Glassnode)The profitability and sentiment of short-term holders (STHs) are champion assessed done the nett unrealized profit/loss (NUPL). NUPL measures the quality betwixt the marketplace worth and the outgo ground of held coins, offering a real-time gauge of whether the cohort is successful a authorities of nett oregon loss. For STHs, who thin to beryllium much delicate to terms fluctuations and marketplace changes, a affirmative NUPL indicates a favorable environment, perchance reducing selling unit and fostering a much unchangeable market. Conversely, a antagonistic NUPL mightiness awesome distress among short-term traders, expanding the likelihood of selling and marketplace volatility.

Data from Glassnode showed that NUPL turned affirmative connected July 15 arsenic BTC crossed $64,000. It represents a culmination of a gradual summation we’ve seen implicit the past week oregon so, with STH NUPL expanding from -0.1456 to 0.0076. This is simply a captious indicator of marketplace betterment and increasing optimism among caller buyers. It suggests that the marketplace is absorbing caller request effectively, and short-term traders are opening to spot affirmative returns connected their investments.

Graph showing the nett unrealized profit/loss (NUPL) for short-term holders from July 7 to July 15, 2024 (Source: Glassnode)

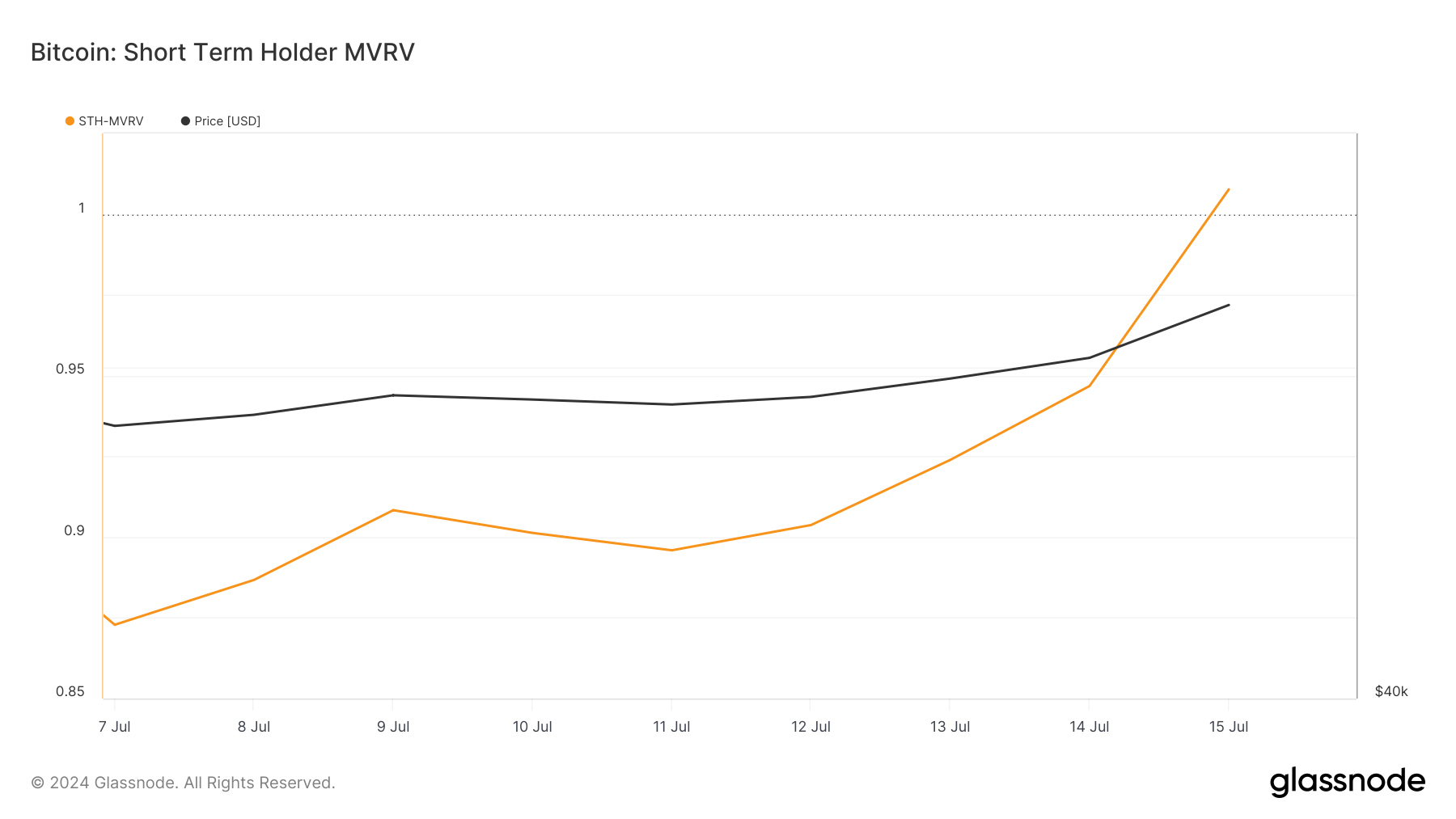

Graph showing the nett unrealized profit/loss (NUPL) for short-term holders from July 7 to July 15, 2024 (Source: Glassnode)Market worth to realized worth (MVRV) is different captious metric for assessing STH profitability. It compares Bitcoin’s marketplace worth to its realized value, providing a ratio that reflects the existent marketplace conditions comparative to the outgo ground of caller investments. An MVRV ratio supra 1 indicates that the marketplace worth is higher than the realized value, suggesting that investors, connected average, are successful profit. For STHs, a rising MVRV ratio indicates expanding profitability, which tin boost assurance and trim the selling pressure.

Like the STH SOPR, the STH MVRV accrued from 0.8728 connected July 7 to 1.0076 connected July 15. This metric moving supra 1 for the archetypal clip since June 20 indicates that short-term holders’ marketplace worth present exceeds their outgo basis. This crossover constituent is simply a bullish signal, often suggesting that the marketplace is recovering and short-term holders are gaining assurance arsenic their holdings go profitable.

Graph showing the marketplace worth to realized worth (MVRV) ratio for short-term holders from July 7 to July 15, 2024 (Source: Glassnode)

Graph showing the marketplace worth to realized worth (MVRV) ratio for short-term holders from July 7 to July 15, 2024 (Source: Glassnode)The betterment we’ve seen successful some NUPL and MVRV ratios shows a important displacement successful the profitability of short-term holders. The accordant emergence successful these terms and profitability metrics creates a coagulated instauration for the bullish inclination to proceed successful the coming weeks. As much STHs determination into profit, the imaginable selling unit they make mightiness decrease, allowing for a much sustained terms increase.

However, a crisp terms correction tin perchance hitch distant this unrealized nett and propulsion STHs backmost into the red. The reactive quality of this cohort means immoderate antagonistic quality could flip the inclination and make losses.

The station Short-term holders retrieve gains arsenic 87% of Bitcoin’s proviso present successful profit appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)