The short-to-long-term realized worth (SLRV) ratio is an often-overlooked metric that provides nuanced insights into capitalist sentiment. The ratio compares the percent of Bitcoin that was past moved wrong a abbreviated timeframe (24 hours) against the percent moved successful a longer timeframe (6-12 months) to amusement whether the marketplace leans much towards hodling oregon trading.

However, the SLRV ratio unsocial usually isn’t capable to place broader trends, arsenic determination are important regular variations successful the metric. Applying and analyzing the ratio done moving averages, particularly the 30-day elemental moving mean (SMA) and the 150-day SMA, allows america to get a wide representation of sustained marketplace trends.

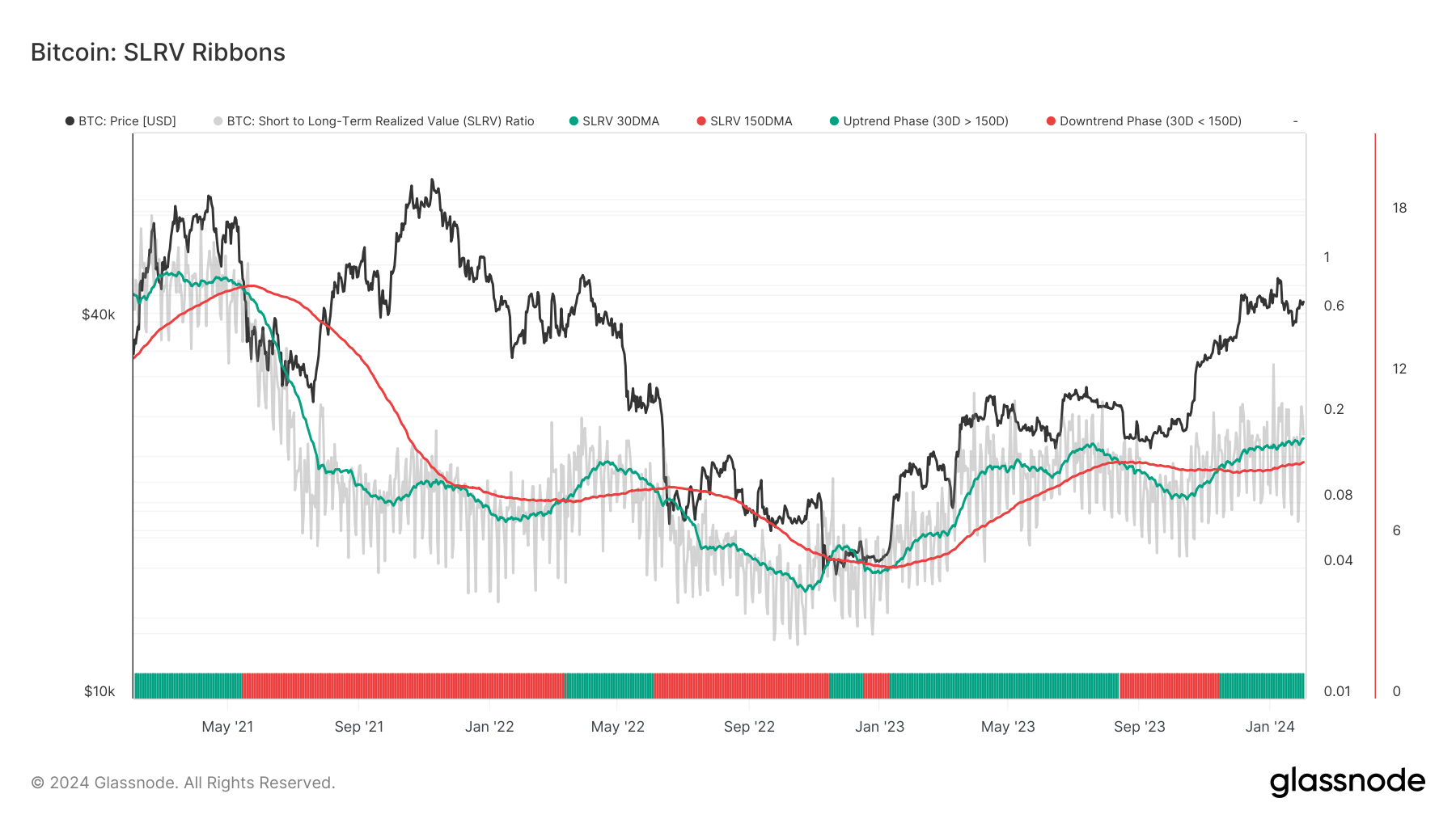

On Feb. 1, the SLRV 30D SMA reached its highest level since July 2021 arsenic Bitcoin’s terms crossed $43,000. This highest represents a continuation of a affirmative uptrend that began connected Nov. 14, 2023, erstwhile the SLRV 30D SMA crossed supra the 150D SMA.

Graph showing the SLRV 30D SMA (green) and the SLRV 150D SMA (red) from February 2021 to February 2024 (Source: Glassnode)

Graph showing the SLRV 30D SMA (green) and the SLRV 150D SMA (red) from February 2021 to February 2024 (Source: Glassnode)The SLRV 30D SMA reaching levels not seen successful 2 and a fractional years shows a important summation successful short-term transactional enactment comparative to semipermanent holding. This could beryllium attributed to a myriad of antithetic factors, but it’s usually a effect of terms volatility. The emergence successful short-term transactional measurement often correlates with heightened marketplace speculation arsenic investors and traders unreserved to capitalize connected terms movements. It tin bespeak a marketplace driven by bullish sentiment oregon accrued speculative involvement spurred by caller marketplace developments.

The instauration and adoption of spot Bitcoin ETFs successful the U.S. astir apt played a important role. The highly-anticipated trading merchandise has pushed Bitcoin into the mainstream, bringing institutions and precocious investors from tradfi into the market. Aside from having a intelligence effect connected the marketplace and boosting capitalist assurance successful BTC, these ETFs besides supply liquidity to Bitcoin. This accrued liquidity tin origin higher trading volumes, arsenic investors tin enter and exit their positions successful Bitcoin done the ETFs much quickly, causing spikes successful the SLRV 30D SMA arsenic a result.

It’s not conscionable the emergence successful the SLRV 30D SMA that shows a alteration successful marketplace sentiment. Its sustained presumption supra the 150D SMA since mid-November shows that short-term transactional enactment not lone spiked but maintained a higher level implicit an extended period.

The durability of this trend, which is connected its mode to participate its 3rd consecutive month, shows that marketplace enactment isn’t a short-lived speculative burst but a much entrenched behaviour signifier among investors.

Historically, short-term SMAs crossing supra semipermanent SMAs person been utilized arsenic a method indicator for affirmative momentum and imaginable bullish trends successful assorted assets, including Bitcoin. The extended play wherever the SLRV 30D SMA remains supra the 150D SMA could amusement a broader marketplace modulation from risk-off to risk-on allocations, wherever investors are much consenting to prosecute successful speculative investments oregon allocate a larger information of their portfolio to Bitcoin.

The station Short-term trading measurement peaks arsenic Bitcoin crosses $43,000 appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)