Acquiring bitcoin by immoderate means indispensable is not a motivation stance. Trading altcoins successful bid to stack much sats does not acceptable with Bitcoin Maximalism.

This is an sentiment editorial by Will Schoellkopf, writer of “The Bitcoin Dog,” and big of the “It’s So Early!” Bitcoin podcast.

When it comes to stacking sats, the ends bash not warrant the means.

It seems to maine that immoderate alleged Bitcoin Maximalists deliberation it’s OK to beryllium Bitcoin Maximalist-ish oregon to beryllium almost a Bitcoin Maximalist. As a Bitcoiner who believes successful freedom, who americium I to judge? Still, anyone who is astir but not rather a Bitcoin Maximalist ought to intermission and bespeak connected if they truly deliberation their way from fiat to bitcoin is furthering a satellite with hyperbitcoinization if it is done “by immoderate means necessary.”

Author’s note: My purpose is not to onslaught anyone personally. I volition usage circumstantial people’s tweets for my examples, but my intent is to respectfully situation atrocious ideas, not onslaught people. Healthy statement of ideas successful bully religion helps Bitcoin, truthful I anticipation they understand. They whitethorn beryllium of dependable motivation character, but a toxic Bitcoin Maximalist indispensable telephone retired their actions that whitethorn beryllium hindering hyperbitcoinization.

The atrocious ideas are:

- Trading altcoins to bargain much bitcoin.

- Removing laser eyes to grow absorption elsewhere.

- Removing laser eyes owed to an over-emphasized absorption connected BTC/USD price.

To beryllium a Bitcoin Maximalist, you don’t person to store a immense percent of your nett worthy successful bitcoin. On the contrary, it’s precise important to marque definite you person capable fiat to wage your rent! But for the astir maximalists, they’ll accidental that the vast bulk of their cryptocurrency holdings are successful bitcoin. This is not maximalism. This is diversification of a crypto portfolio.

If you genuinely judge that yet lone 1 instrumentality tin service arsenic a wealth for the world, past arsenic a Bitcoin Maximalist, you cognize the lone 1 worthy holding is bitcoin. Moreover, if you admit to others that you privately dabble successful different cryptocurrencies, past you’re sending mixed messages. To beryllium a toxic Bitcoin Maximalist, you cannot disregard your ain proposal and bargain altcoins arsenic well.

(Source)

(Source)

Will Clemente whitethorn accidental helium lone trades alts truthful that helium tin stack much sats, but it hurts the suckers connected the different broadside of the commercialized giving up their bitcoin for his altcoins. He volition person fixed the task capitalists that tally these altcoins what they want: exit liquidity. Toxic Bitcoin Maximalists bash not springiness a mendacious content that altcoins person capable on-chain activity, person galore progressive participants oregon are utilized for transactions. They bash not springiness ICO-funded task capitalists the restitution of dumping their liquidity connected unsuspecting users without a extremity oregon purpose. Instead of wasting their clip connected method investigation looking astatine charts for altcoins, toxic Bitcoin Maximalists further hyperbitcoinization.

(Source)

(Source)

As Anthony Pompliano wrote successful a caller contented of “The Pomp Letter”:

“The information is that it is truly hard to beryllium an autarkic idiosyncratic who thinks critically if your individuality is tied to a fiscal asset. How tin you earnestly measure an plus if you person it successful your bio? Are you truly consenting to alteration your caput if you person caller accusation if your full individuality is tied to something? Maybe. But it decidedly makes it harder. As I told a person months ago, it is hard to spot with laser eyes on.”

The full constituent of Bitcoin Maximalism is you bash not alteration your caput due to the fact that you admit Bitcoin arsenic a zero-to-one invention. Toxic Bitcoin Maximalists deterioration their laser eyes due to the fact that they cognize determination is nary mode to further decentralization by immoderate means different than proof-of-work bitcoin. While it tin beryllium worthwhile to larn however proof-of-stake ether and different tokens signifier consensus, it can’t beryllium ignored that they are fatally flawed compared to bitcoin. There won’t beryllium different bootstrapped, decentralized blockchain that tin service arsenic a wealth for the world, ever! Pomp said it is “hard to spot with laser eyes on,” but it seems similar helium whitethorn spot greater worth pushing mattresses onto his followers alternatively of promoting Bitcoin!

(Source)

(Source)

Additionally, salient bitcoin traders similar Dylan LeClair person removed their laser eyes, but adjacent if LeClair isn’t buying oregon selling altcoins, he’s fixed up connected “laser ray to $100k.” This signals not lone a deficiency of assurance successful the bitcoin price, but successful bitcoin overall. He whitethorn align with the Bitcoin Maximalist viewpoint, but helium falls abbreviated of being a toxic maximalist since helium isn’t keeping his laser eyes on, knowing that the worth of Bitcoin is bound to proceed increasing implicit time. Besides, turning laser eyes on/off further compares bitcoin to the equities markets and its bull and carnivore cycles. Bitcoin is not an equity. It’s a once-in-a-civilization monetary gyration for the world.

(Source)

(Source)

(Source)

(Source)

As Bitcoin Gandalf says, “Bitcoin is not an investment.” Bitcoin is simply a savings vehicle, a savings technology! Do not instrumentality your eyes disconnected the timechain. When you store the worth of your hard work, your energy, your beingness unit successful bitcoin, past you volition yet beryllium financially free! Do not hold for bottoms that you volition apt mistime trying to catch. Follow the proposal I gave my daughter, and diligently prevention successful bitcoin!

(Source)

(Source)

I had asked CryptoDogSkyNet (now BitcoinDogSkyNet) wherefore helium buys altcoins, and helium ended up abandoning his thesis, but you tin larn without buying and selling. You tin adjacent mint your ain NFTs to larn however to instrumentality them connected Bitcoin, but bash not get suckered into buying arsenic a mode to learn. Learn by building, not giving distant your sats. There is lone 1 blockchain decentralized with the top web effects to beryllium money, and Bitcoin Maximalists cognize which it is!

(Source)

(Source)

As Michael Saylor says, “Laser eyes proclaim a exertion to warrant the quality rights of life, liberty and property. Laser eyes transmission enactment adjacent arsenic they support from dilutive distraction. Laser eyes awesome intent to marque Bitcoin an instrumentality of economical empowerment.” Fix the money, hole the world.

(Source)

(Source)

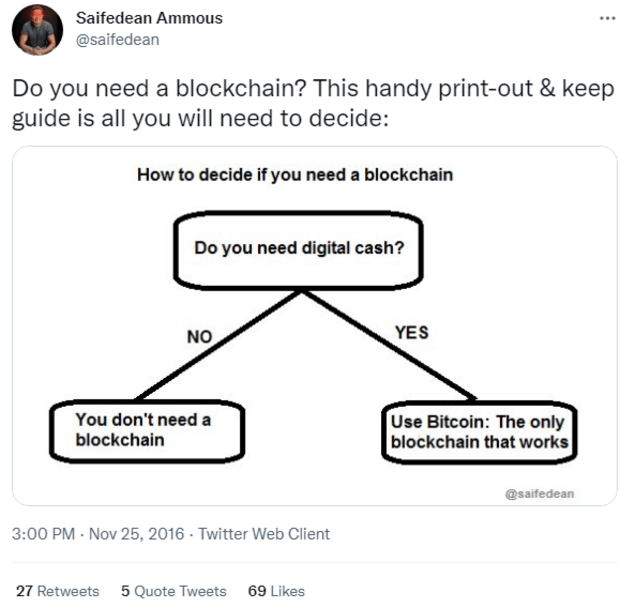

Dr. Saifedean Ammous’ elemental flowchart helps punctual america of each the reasons we could person to request a blockchain. The lone intent for the astir inefficient database ever created is integer cash, and the blockchain to usage is the lone 1 that works: Bitcoin.

(Source)

(Source)

While Saylor’s punctuation is famous, it’s done a disservice to the almost-Bitcoin-Maximalists. They request to perceive the afloat quote:

“Which 1 is the champion crypto asset?”

“Well Bitcoin’s the champion crypto asset.”

“What’s the 2nd best?”

“There is nary 2nd best. There is nary 2nd champion crypto asset. There’s a crypto asset, and it’s called Bitcoin.”

Don’t get confused. There are nary different crypto assets. There are nary different blockchains that tin reliably enforce decentralized integer spot rights. The ends don’t warrant the means. Don’t beryllium a hypocrite. Don’t supply liquidity to altcoins for the involvement of buying much bitcoin and halt trying to clip the bottom. Stack sats, enactment humble. Ascend towards a hyperbitcoinized aboriginal and clasp toxic Bitcoin Maximalism!

This is simply a impermanent station by Will Schoellkopf. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc. oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)