In the dynamic realm of Bitcoin, the quality to discern patterns and trends from earthy information is invaluable. Glassnode’s latest report, “Exhaustion and Apathy,” serves arsenic a beacon, illuminating the intricate nuances of the existent authorities of the market. Let’s delve deeper into the numbers and their implications.

Historic Lows In Bitcoin Volatility

The overarching taxable of Glassnode’s findings is the unprecedented stagnation successful Bitcoin’s volatility. The information reveals that the integer plus has been trading wrong a remarkably constrictive $29,000 to $30,000 range. Historically, Bitcoin has been synonymous with volatility, making this existent signifier an anomaly.

The study underscores this by highlighting the Bollinger Bands’ tightness, noting, “The precocious and little Bollinger Bands are presently separated by conscionable 2.9%.” Such constricted question has been a rarity successful Bitcoin’s tumultuous history.

Meanwhile, the dynamics betwixt short-term holders (STH) and semipermanent holders (LTH) connection a captivating narrative. Glassnode’s information indicates a important displacement successful wealthiness betwixt these 2 cohorts. The STH’s wealthiness has burgeoned by +$22B this year, portion the LTH has witnessed a near-identical simplification of -$21B. This displacement is not simply astir numbers but besides astir marketplace sentiment and strategy.

Bitcoin Long-/Short Term Realized Cap | Source: Glassnode

Bitcoin Long-/Short Term Realized Cap | Source: GlassnodeThe outgo ground further elucidates this dynamic. The STH outgo ground has surged by +59% YTD, settling astatine $28.6k. In stark contrast, the LTH outgo ground lingers considerably lower, astir $20.3k. This divergence suggests that caller marketplace entrants mightiness beryllium paying a premium, perchance owed to FOMO (Fear of Missing Out) oregon speculative behavior.

Glassnode’s exploration into spending patterns successful this debased volatility situation is besides peculiarly enlightening. The information suggests that successful specified periods, the bulk of coins moved on-chain person a outgo ground that hews intimately to the spot rate, resulting successful minuscule realized profits oregon losses.

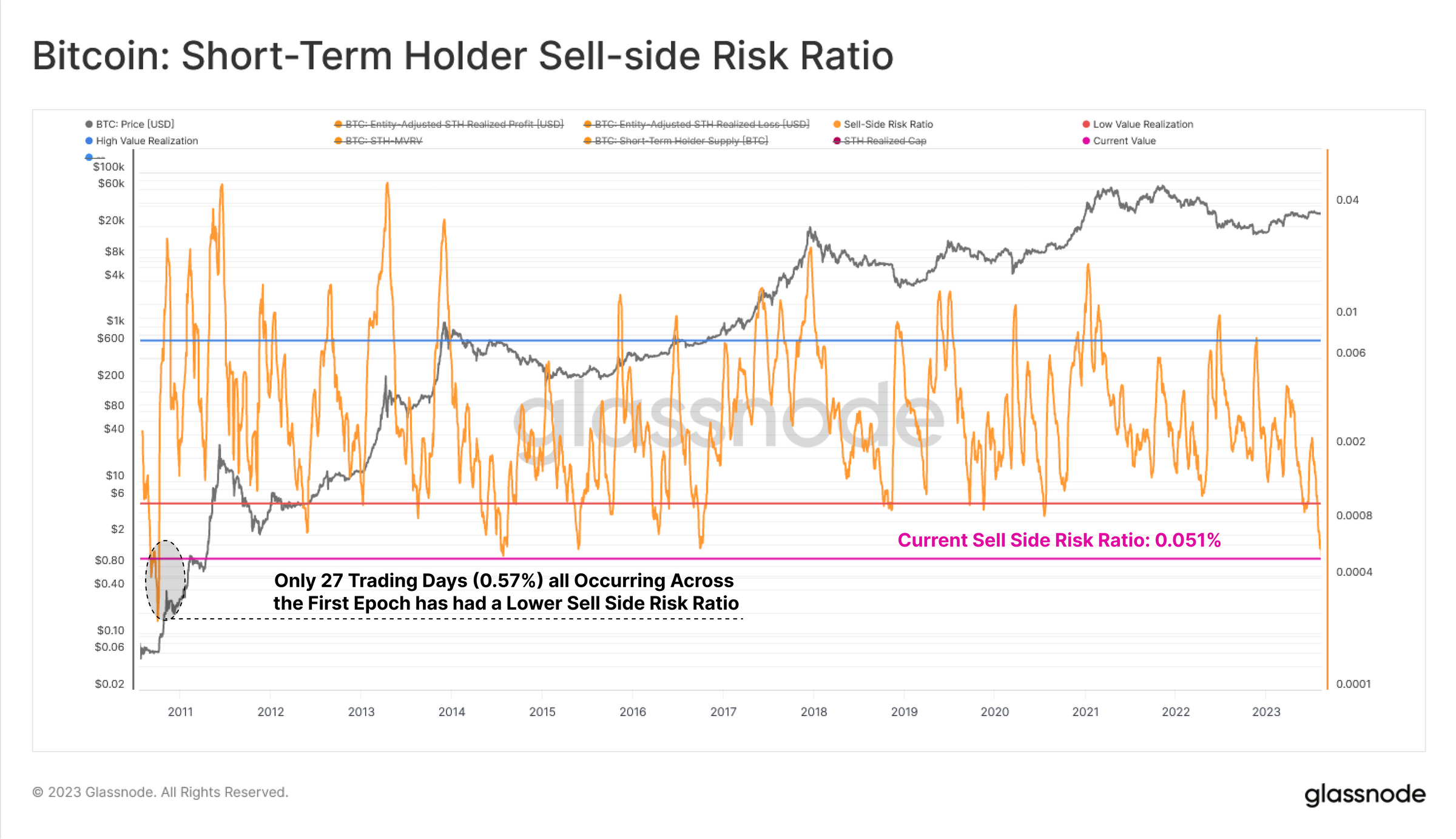

The Sell-Side Risk Ratio, a pivotal metric successful this context, is languishing astatine an all-time low. To enactment it successful perspective, less than 27 trading days (0.57%) person recorded a worth little than the existent one, signaling a marketplace teetering connected the borderline of a imaginable volatility resurgence.

Bitcoin STH Sell Side Risk Ratio | Source: Glassnode

Bitcoin STH Sell Side Risk Ratio | Source: GlassnodeSegmented View Of BTC’s Supply

The report’s segmented investigation of Bitcoin’s supply, based connected ‘investor holding time,’ offers a layered knowing of marketplace behavior. The ‘Hot Supply,’ representing the astir progressive coins, constitutes a specified 2.8% of each invested worth successful BTC. This suggests a marketplace dominated by holders alternatively than traders.

The ‘Warm Supply,’ spanning from a week to six months, has seen a humble uptick year-to-date, present accounting for astir 30% of Bitcoin’s wealth. This segment’s behaviour is important arsenic it often acts arsenic a span betwixt short-term reactions and semipermanent convictions.

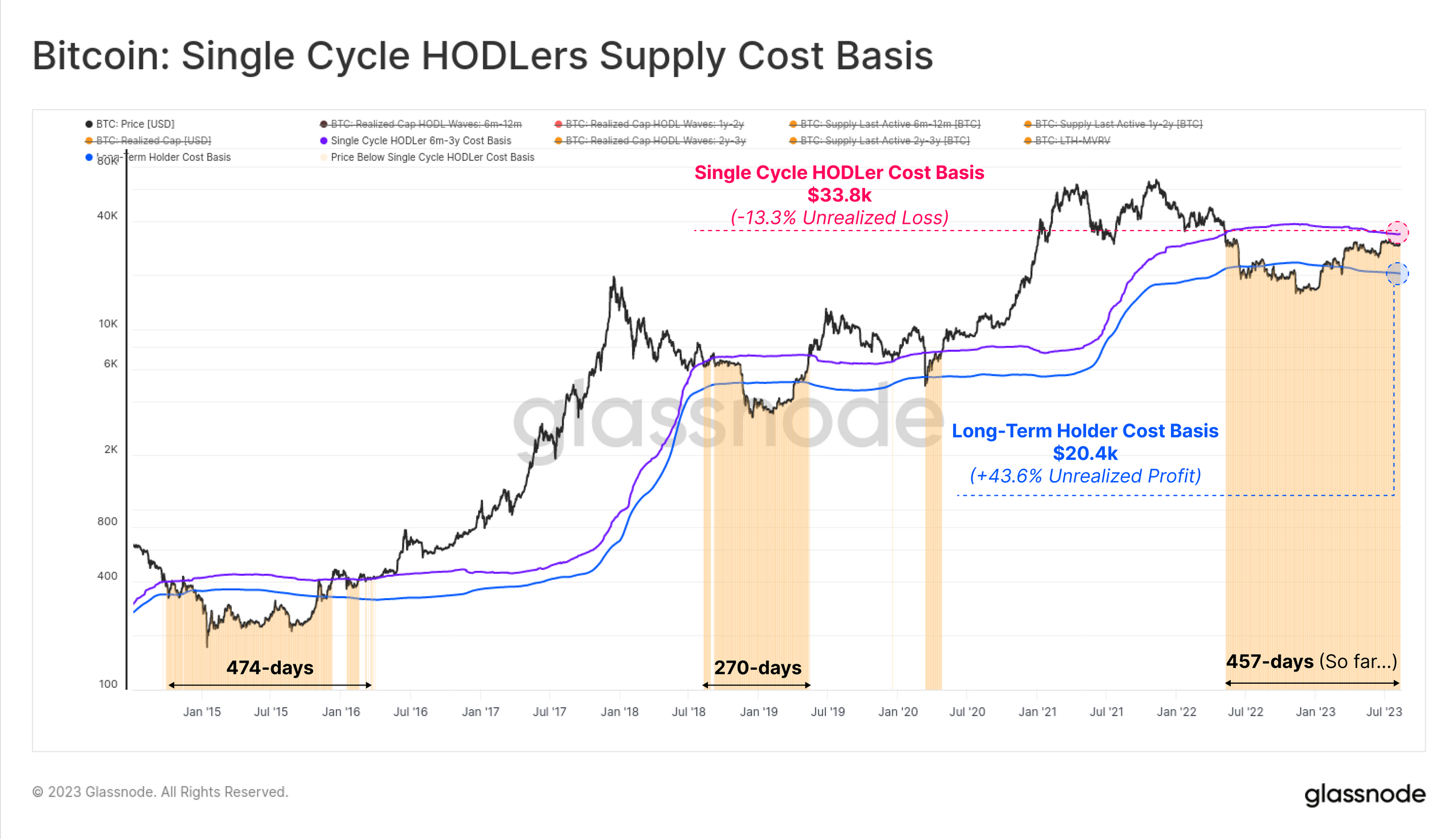

The ‘Single-Cycle Long-Term Holders,’ those entrenched successful the 2020-23 cycle, are the behemoths, holding a staggering 63% of the invested capital. Their outgo basis, arsenic per Glassnode, stands astatine $33.8k, indicating an mean unrealized nonaccomplishment of -13.3%.

Single Cycle HODLers Supply Cost Basis | Source: Glassnode

Single Cycle HODLers Supply Cost Basis | Source: GlassnodeIn juxtaposition, the classical LTH cohort, which includes the long-dormant and heavy HODLed supply, boasts a outgo ground of $20.4k, translating to an unrealized nett of +43.6%. This stark opposition underscores the lingering interaction of the 2022 carnivore marketplace and the cautious optimism of aboriginal adopters.

In conclusion, Glassnode’s data-driven insights overgarment a nuanced representation of the Bitcoin market. The dominance of semipermanent holders, the historical lows successful volatility, and the evident capitalist apathy each converge to suggest a marketplace successful a authorities of stasis. The numbers bespeak a marketplace that’s waiting, possibly for a Goldman Foresees Q2 2024 Fed Rate Cut: A Boost For Bitcoin? oregon a important event, to find its adjacent direction.

At property time, Bitcoin was trading conscionable supra the 50-day EMA.

BTC terms continues flimsy downward trajectory, 1-day illustration | Source BTCUSD connected TradingView.com

BTC terms continues flimsy downward trajectory, 1-day illustration | Source BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)