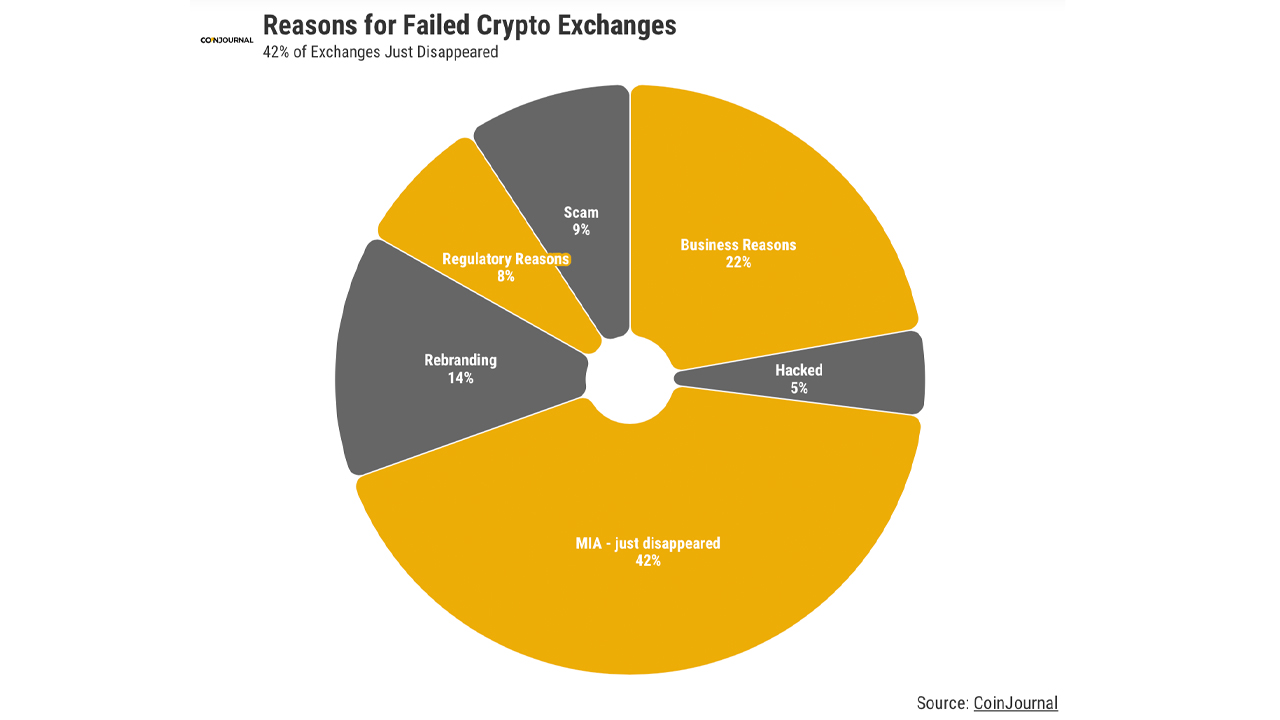

Just recently, coinjournal.net published a study that shows the fig of cryptocurrency exchanges that person failed during the past 8 years. Interestingly, the researcher’s information shows that 42% of failed crypto plus trading platforms disappeared without a trace, giving users nary mentation arsenic to wherefore the speech unopen down.

During the Past 8 Years, Research Shows Only 22% of Failed Crypto Exchanges Have Left Due to Actual Business-Related Reasons

- A study that covers failed integer currency exchanges indicates that 42% of each the exchanges that person failed since 2014 person fixed nary reasons arsenic to wherefore the concern faltered and the trading platforms fundamentally disappeared from the manufacture without overmuch notice.

- 22% of the failed crypto exchanges during the past 8 years near owed to existent business-related reasons, according to coinjournal.net’s research. 9% of the trading platforms turned retired to beryllium outright scams and fraudulent businesses from the get-go.

- “Following 23 exchanges going nether successful 2018, this fig exploded upwards by 252% successful 2019, earlier expanding a further 17% successful 2020,” coinjournal.net’s study explains. “Remaining astatine the aforesaid level successful 2021, this twelvemonth determination has yet been improvement, with a 55% simplification successful failures if the remainder of the twelvemonth follows the archetypal six months.”

- In a remark sent to Bitcoin.com News, Dan Ashmore, a CFA and cryptocurrency information expert astatine coinjournal.net, explained that metrics similar these should beryllium cleaned up. “If cryptocurrency is to beryllium taken earnestly and afloat found itself, it needs to proceed to cleanable up its representation and permission damning statistic similar these behind,” Ashmore remarked.

- Furthermore, the study notes that portion 2022 has not ended, it is expected that the twelvemonth volition spot a 55% autumn successful wide crypto speech failures. “In regards to the magnitude simply vanishing into bladed air, 1 could expect this to little – regularisation is inactive acold behind, but it has astatine slightest made advancement and should marque it much hard for exchanges to vanish without a trace,” the coinjournal.net study adds.

- The study comes astatine a clip erstwhile a myriad of crypto companies person been suffering financially from the crypto winter. Layoffs person been spreading across the crypto manufacture during the past fewer months arsenic thousands of crypto employees person been fto go.

- Moreover, 3 important insolvencies person pushed Celsius, Three Arrows Capital (3AC), and Voyager Digital to record for bankruptcy protection. At slightest fractional of a twelve integer currency platforms person frozen withdrawals.

- This past Wednesday, the trading level Zipmex paused withdrawals and said it was suffering from “financial difficulties [from] of our cardinal concern partners” caused by the crypto marketplace downturn.

- Following the pause, the Thailand Securities and Exchange Commission (SEC) has asked Zipmex wherefore it has paused withdrawals successful a letter published connected Wednesday.

What bash you deliberation astir the probe study published by coinjournal.net? Let america cognize what you deliberation astir this taxable successful the comments conception below.

3 years ago

3 years ago

English (US)

English (US)