DBS Bank of Singapore plans to motorboat over-the-counter (OTC) crypto options trading and structured notes for organization clients successful Q4 2024, according to a Sept. 17 statement.

This determination positions DBS arsenic the archetypal Asian-headquartered slope to connection fiscal products tied to the worth of Bitcoin and Ethereum, the 2 largest integer assets by marketplace capitalization.

According to the bank, the crypto options and structured notes products volition lone beryllium disposable to eligible organization investors and accredited clients of DBS Private Bank and DBS Treasures Private Client.

New crypto offerings

The slope revealed that its caller products physique connected its existing crypto services done DBS Digital Exchange (DDEx).

The caller products springiness clients much ways to prosecute with integer assets arsenic investors tin present perchance gain a output connected fiat currency oregon instrumentality transportation of underlying crypto.

Also, Bitcoin and Ethereum holders astatine DBS summation further benefits. They tin present hedge against marketplace swings and perchance make returns done assorted options strategies.

Jacky Tai, caput of trading and structuring astatine DBS Group, highlighted the rising request for integer assets among nonrecreational investors. He explained however these caller products broaden the bank’s integer plus services.

He said:

“These fiscal products are an enlargement of the bank’s worth proposition to supply clients trusted institutional-grade entree to the integer plus ecosystem. Now, our clients person an alternate transmission to physique vulnerability to the plus people and incorporated precocious concern strategies to amended negociate their integer plus portfolios.”

For example, a lawsuit disquieted astir Bitcoin’s terms swings could bargain a enactment option. This allows them to merchantability Bitcoin astatine a acceptable terms successful the future, adjacent if the marketplace terms falls beneath that level.

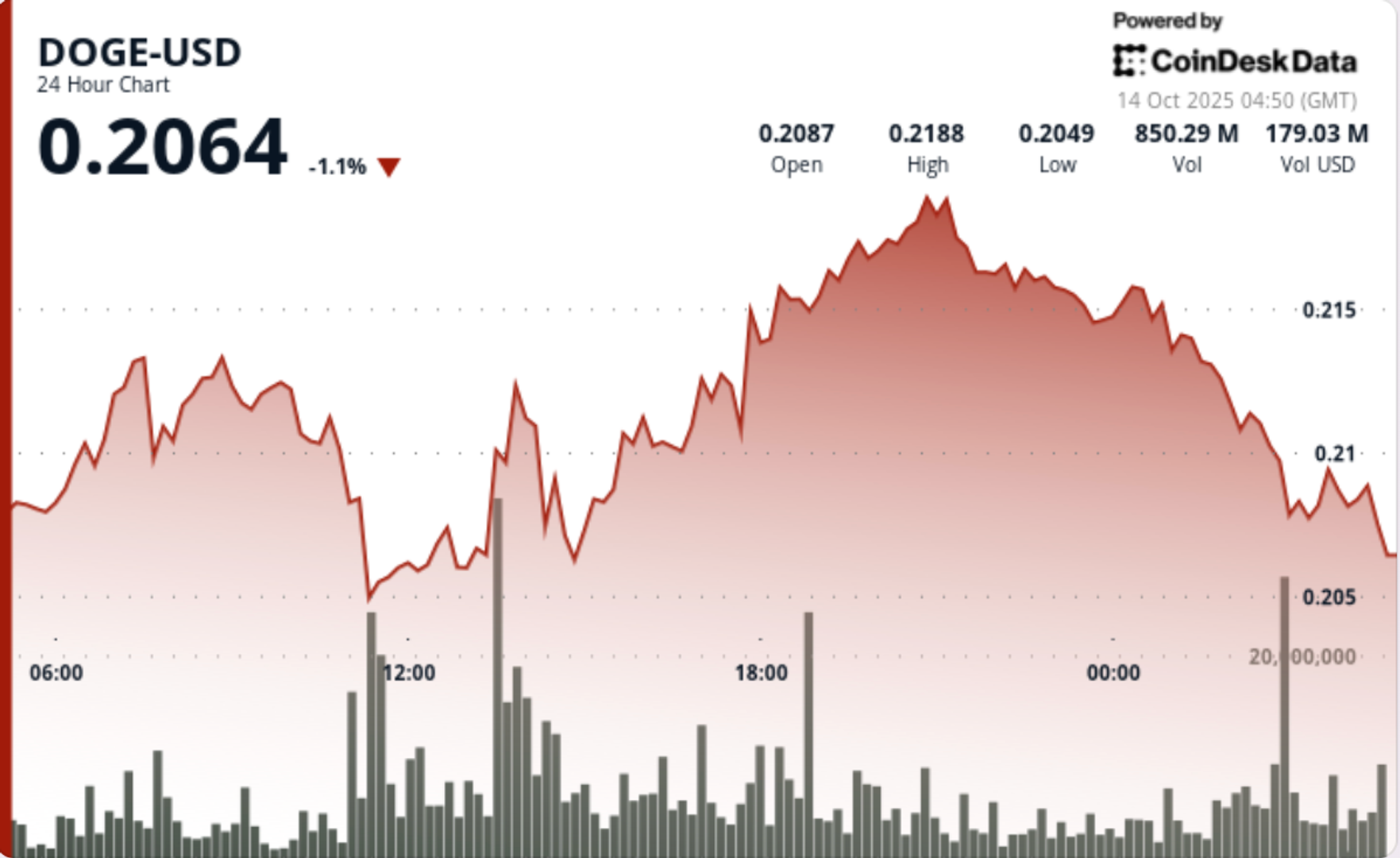

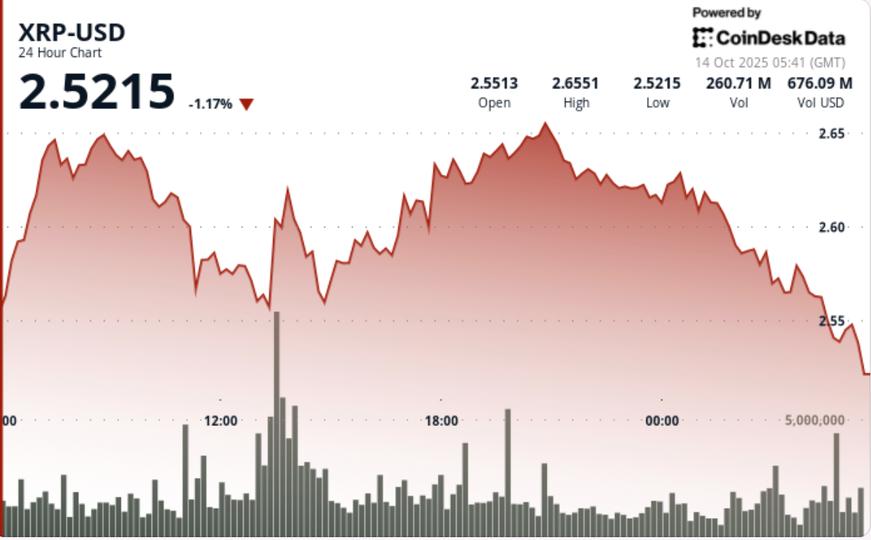

Crypto trading boom

DBS besides reported important maturation successful crypto trading volumes connected its integer exchange.

In the archetypal 5 months of 2024, trading measurement for integer outgo tokens connected DDEx tripled compared to the aforesaid play successful 2023. The fig of progressive trading clients grew by 36%, portion integer assets nether custody accrued by 80%.

The slope credited this maturation to a nett inflow of deposits from clients seeking safe, bank-grade platforms for custody and trading of integer assets.

The station Singapore’s DBS Bank to connection Bitcoin and Ethereum options trading appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)