Crypto mid-caps are struggling. While immoderate integer plus investors whitethorn question hidden gems and aboriginal powerhouses successful the adjacent tier of marketplace capitalization and liquidity, that pursuit has mostly not been rewarded. Furthermore, mid-caps person delivered importantly higher volatility. Less reward, much risk. What gives?

Is this a reflector of “Mag 7” dominance in equities, a deficiency of promising assets successful the mid tier oregon conscionable the aboriginal of concern taking longer to carnivore effect than we antecedently thought?

You're speechmaking Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor. Sign up here to get it successful your inbox each Wednesday.

We specify our size segments utilizing the CoinDesk 20 and CoinDesk 80 indices. CoinDesk 20 captures the show of apical integer assets with immoderate constraints to beforehand adoption successful a fig of places and products — specifically, nary memecoins, entree to U.S. investors, prime speech listings and liquidity successful circumstantial pairs. CoinDesk 80 captures the adjacent 80 assets extracurricular of CoinDesk 20 — inactive reasonably ample and inactive measurably liquid with less restrictions and much trading pairs allowed. In different words, the mid-caps.

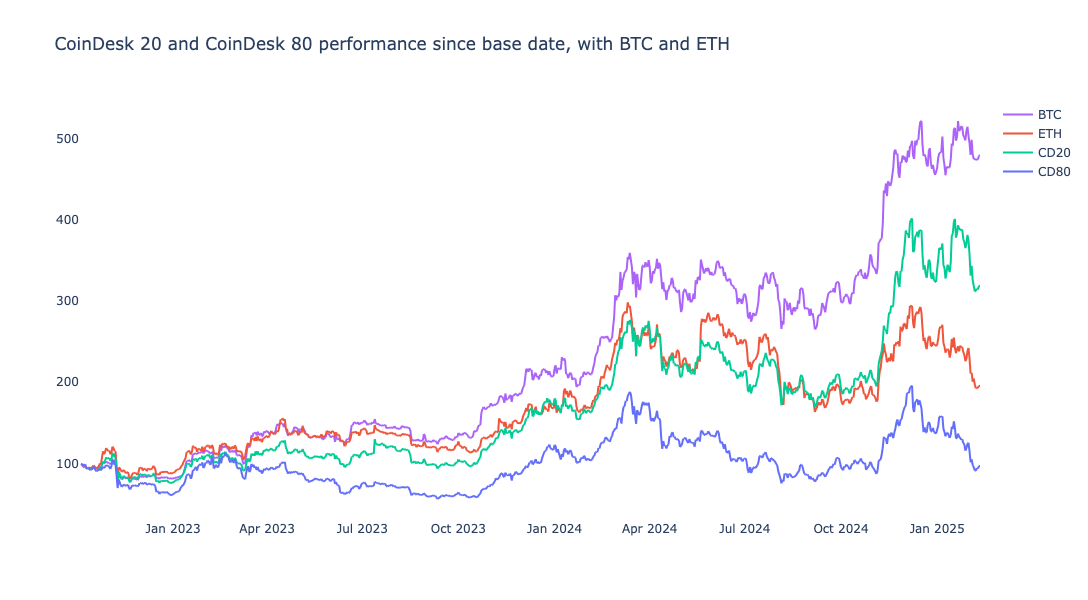

Both indices person a basal day of Oct. 4, 2022 and a basal worth of 1000. As of this writing, CoinDesk 20 sits astatine astir 3200. CoinDesk 80 sits astatine 970. You work that right: the CoinDesk 20 scale has delivered a 320% instrumentality since its basal date, portion the CoinDesk 80 scale has mislaid 3%.

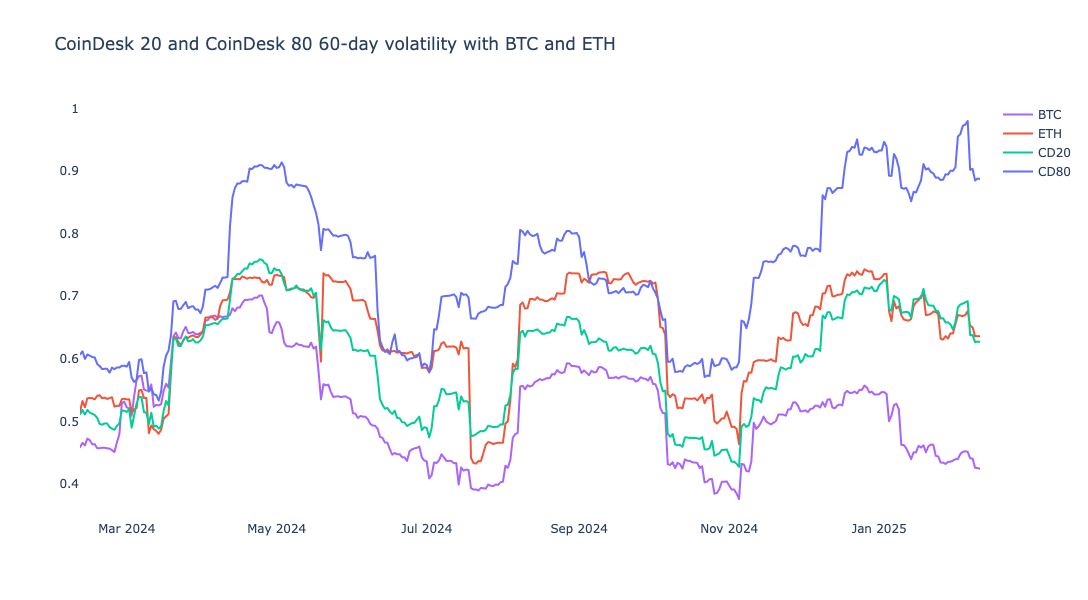

The volatility of CoinDesk 80 sits good supra that of CoinDesk 20, though its patterns travel those of the different scale and majors bitcoin and ether.

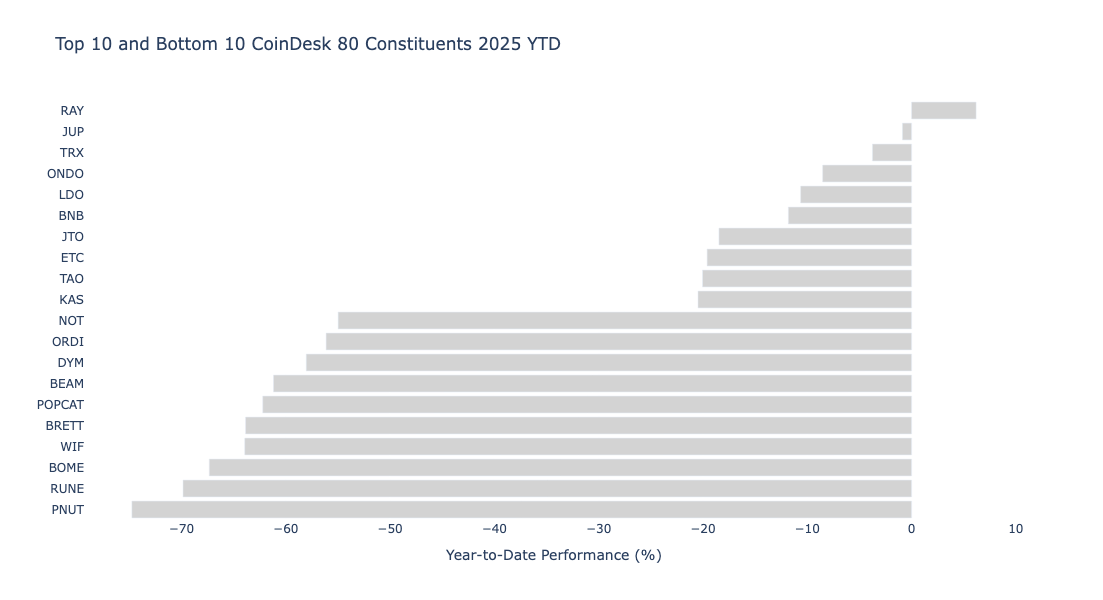

What are these hard integer assets successful the mid-cap segment? Ill-conceived platforms? Frivolous projects? Not really. Although determination are immoderate highly volatile memecoins successful the premix (I’m looking astatine you, PNUT), galore constituents are household names.

If we constrictive our presumption to year-to-date show of existent constituents (CoinDesk 80 was reconstituted connected Jan. 31) we spot that lone 1 constituent is up connected the year, yet galore of the leaders (and laggards) are names we person known for immoderate time.

Of course, pinpointing the underlying origin of the mid-cap underperformance is conscionable arsenic hard successful crypto arsenic successful different plus classes. Although size is 1 of the 3 classical Fama-French factors (suggesting that small-cap equities should outperform), it has not ever been demonstrated successful performance.

We fishy that portion the crypto assemblage volition commercialized conscionable astir anything, it tends to put successful the biggest, the longest-tenured and the astir acquainted names. Regulatory accommodations (e.g., ETFs) volition besides travel this pattern, starring to a broader acceptable of investors.

Does this suggest that a large-cap tilt successful integer plus investing — the inverse of the Fama-French size origin — volition present excess returns? We shall see, but successful the meantime, we tin support an oculus connected the values of CoinDesk 20 and CoinDesk 80.

7 months ago

7 months ago

English (US)

English (US)