Tracking the changes successful the proviso held by entities with assorted Bitcoin balances provides penetration into capitalist behaviour and imaginable terms movements. Each class of holder—from idiosyncratic retail investors to ample institutions—plays a chiseled relation successful the crypto ecosystem, and their corporate actions tin importantly power the wide market.

Changes successful the proviso organisation among antithetic wallet sizes tin beryllium a beardown indicator of marketplace sentiment. For instance, tiny entities accumulating BTC often suggests accrued retail involvement and perchance a bullish sentiment among idiosyncratic investors who whitethorn presumption existent prices arsenic charismatic for introduction oregon concern expansion. Redistribution by larger entities could correspond assorted strategies oregon responses to the market, including profit-taking, portfolio rebalancing, oregon reactions to regulatory oregon economical changes. This enactment is important arsenic it mightiness correspond organization oregon experienced investors’ perspectives, which tin beryllium a bellwether for broader marketplace moves.

The attraction of Bitcoin successful ample wallets, oregon its dispersal crossed a broader scope of smaller holders, affects the liquidity and volatility of the market. A precocious attraction successful a fewer wallets tin pb to accrued volatility if these entities determine to determination ample portions of their holdings. Conversely, a much distributed basal of tiny and mean holders tin heighten marketplace stableness and liquidity, arsenic income oregon purchases are little apt to interaction the terms drastically.

Understanding which marketplace segments are increasing oregon shrinking tin supply insights into however outer factors interaction antithetic types of investors.

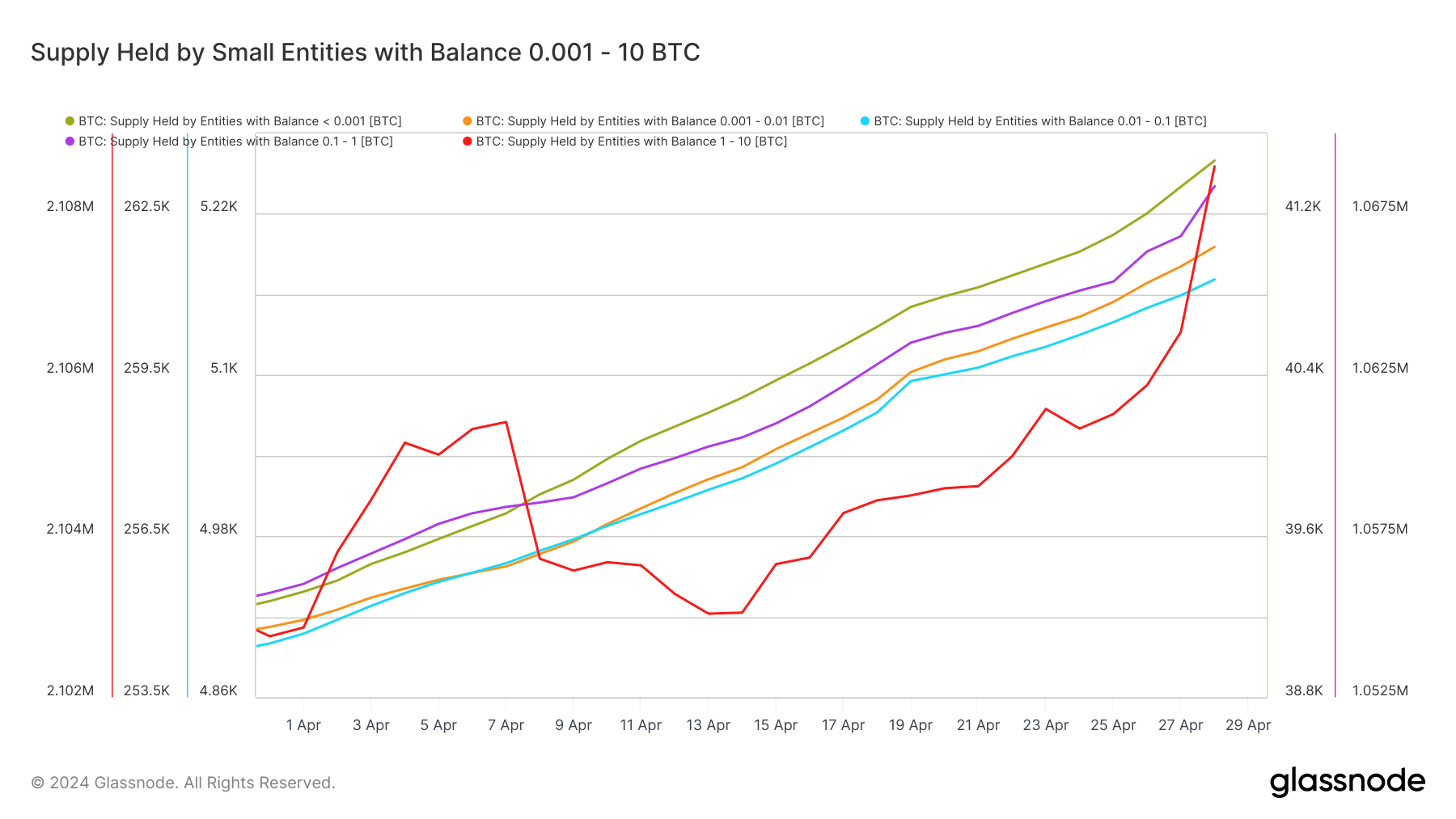

Data from Glassnode showed an summation successful the proviso of Bitcoin held crossed each categories of smaller entities, ranging from entities with a equilibrium of little than 0.0001 BTC to balances up to 10 BTC. Entities with a equilibrium betwixt 0.01 – 0.1 BTC saw the largest summation successful their Bitcoin holdings. This group’s proviso accrued from 254,503.7 BTC to 261,281.4 BTC. It represents an summation of 6,777.7 BTC, the highest implicit summation among the smaller entity groups observed implicit the past 30 days.

Graph showing the proviso held by tiny entities with balances ranging from <0.001 BTC to 10 BTC from March 31 to April 28, 2024 (Source: Glassnode)

Graph showing the proviso held by tiny entities with balances ranging from <0.001 BTC to 10 BTC from March 31 to April 28, 2024 (Source: Glassnode)This important summation could bespeak a increasing assurance among what mightiness beryllium considered “casual” investors—individuals who are not conscionable dipping their toes successful the Bitcoin marketplace but are perchance utilizing it arsenic a insignificant yet meaningful constituent of their crypto holdings. The summation crossed each of these entities indicates they are accumulating. With Bitcoin’s terms dropping from $73,000 to $63,000 implicit the past month, the timing supports the conception that these investors are buying the dip, apt viewing little prices arsenic an charismatic introduction point. This behaviour is diagnostic of retail investors and smaller marketplace participants who whitethorn comprehend semipermanent worth astatine little terms points.

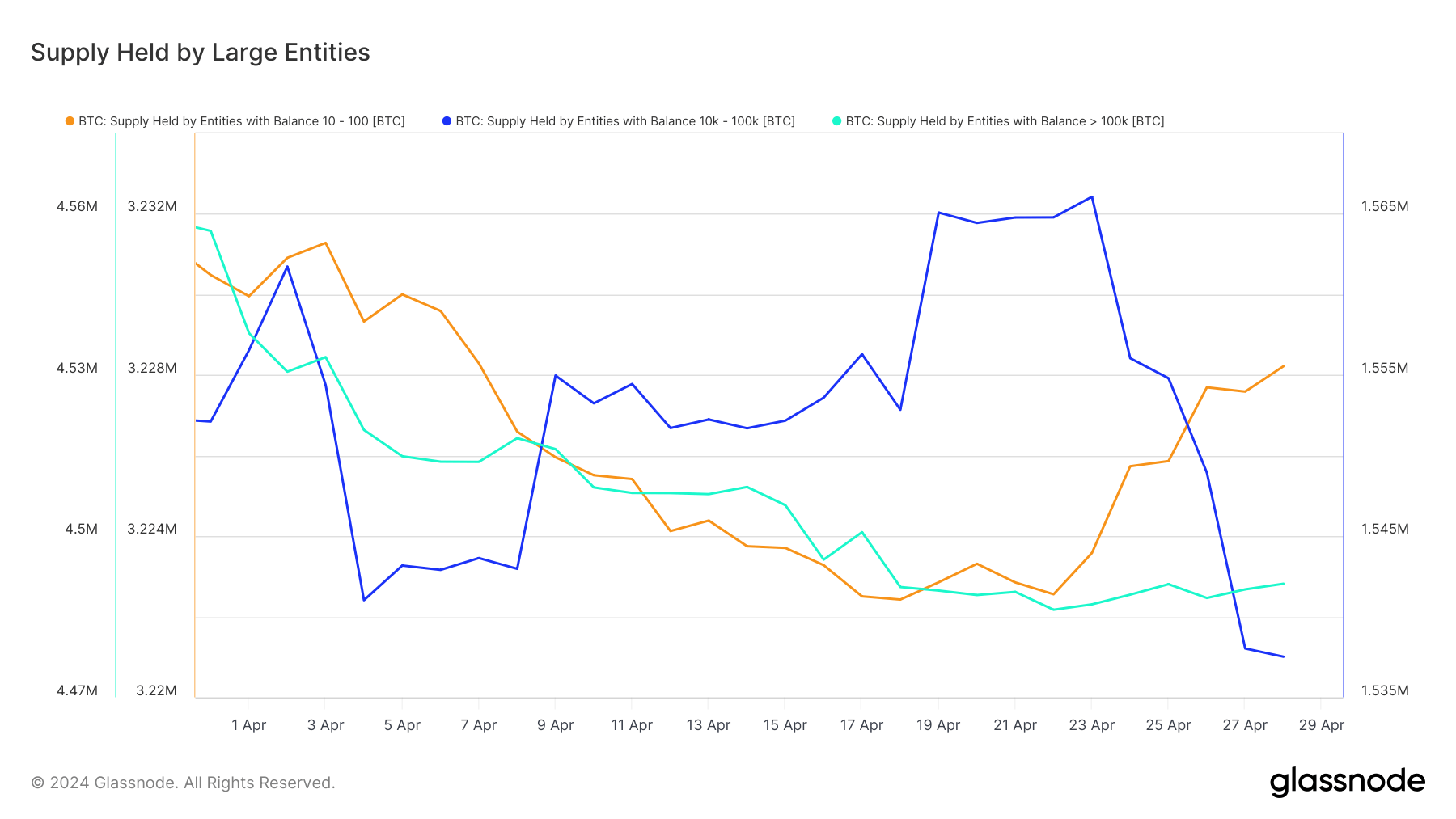

Conversely, larger entities showed mixed changes successful their balances, with astir showing decreases implicit the past 30 days.

Graph showing the proviso held by ample entities with balances ranging from 10 BTC to implicit 100K BTC from March 31 to April 28, 2024 (Source: Glassnode)

Graph showing the proviso held by ample entities with balances ranging from 10 BTC to implicit 100K BTC from March 31 to April 28, 2024 (Source: Glassnode)The simplification successful holdings among the largest entities could beryllium attributed to respective factors, including the selling pressures from ETF outflows, notably from products similar GBTC, and miners selling their holdings to recognize profits oregon screen operational costs amidst a lower-price environment. The question successful ample balances aligns with organization behavior, wherever adjustments successful holdings tin beryllium strategical oregon a effect to marketplace conditions.

The station Small Bitcoin holders are accumulating adjacent arsenic prices fall appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)