Ethereum has reclaimed the $3,150 level aft a volatile stretch, offering a uncommon motion of spot successful an different uncertain market. The broader crypto scenery remains sharply divided: immoderate analysts reason that ETH and the remainder of the marketplace inactive look downward continuation, perchance mounting caller section lows, portion others judge this correction is simply a reset earlier a overmuch larger bull cycle—possibly extending into 2026.

Yet 1 awesome stands retired intelligibly amid the noise: astute whales are unanimously going agelong connected ETH. On-chain information shows that respective of the astir profitable and accordant whale traders—each with tens of millions successful realized gains—have opened important agelong positions, collectively exceeding hundreds of millions of dollars. Their coordinated behaviour indicates assurance that Ethereum’s caller lows correspond accidental alternatively than danger.

This alignment among top-performing whales introduces a compelling counterpoint to bearish narratives. While retail sentiment remains fragile, the astir blase marketplace participants look to beryllium positioning for a larger determination ahead. As Ethereum stabilizes supra $3,150, the question present becomes whether whale condemnation volition beryllium to beryllium early—or correct.

Top Performers Load Up connected Ethereum

According to Hyperdash data shared by Lookonchain, immoderate of the astir palmy and influential whales successful the marketplace are aggressively accumulating Ethereum—sending a beardown awesome that high-conviction players expect upside ahead.

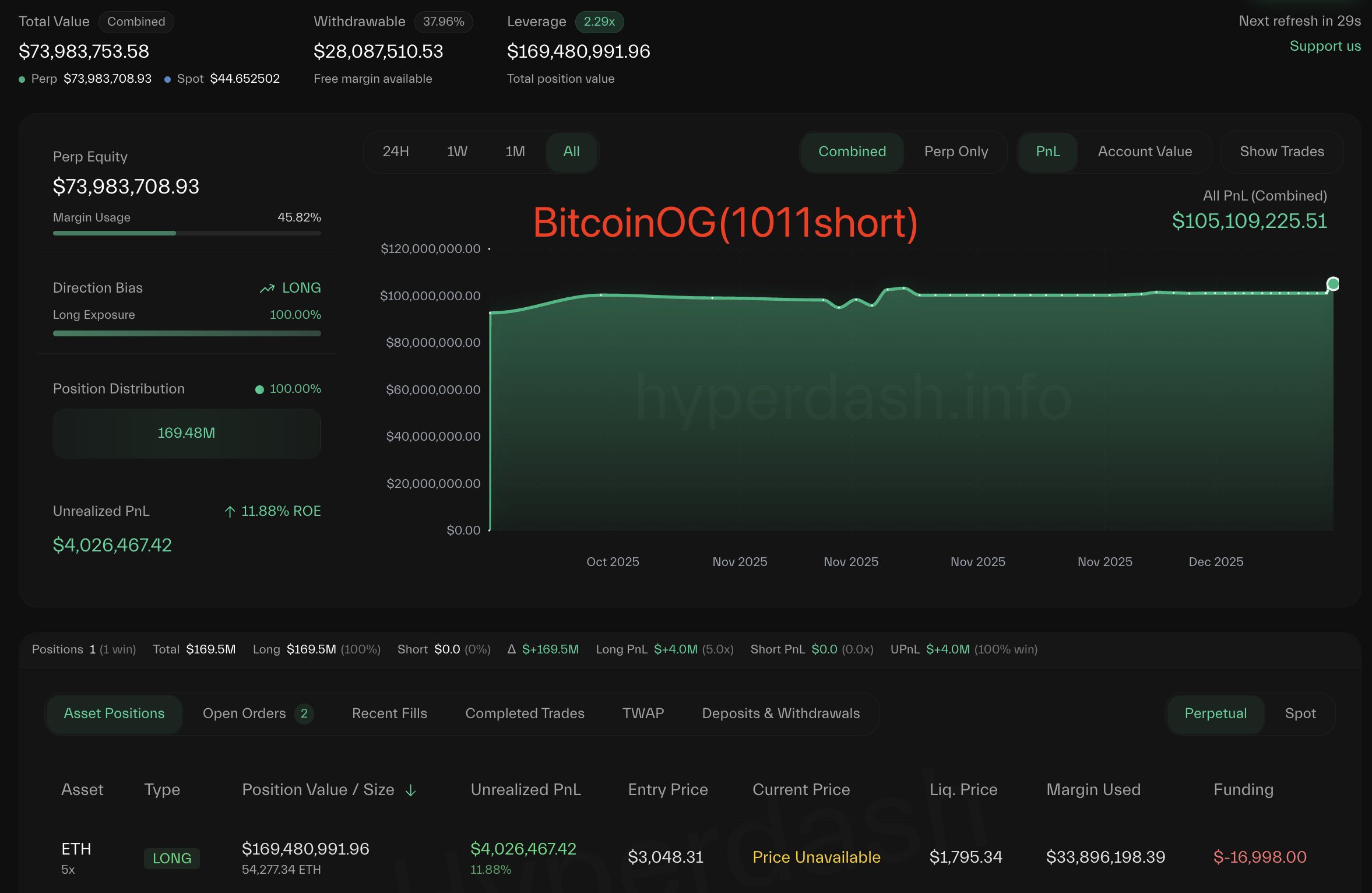

One of the astir notable is BitcoinOG, the trader wide recognized for shorting the marketplace during the convulsive 10/10 crash, a determination that earned him important credibility. With a full realized PNL of $105 million, BitcoinOG is present positioned firmly connected the bullish side, holding 54,277 ETH worthy astir $169.48 million.

BitcoinOG Ethereum Position | Source: Hyperdash

BitcoinOG Ethereum Position | Source: HyperdashAnother large subordinate is the well-known Anti-CZ whale, named for his humanities signifier of taking the other broadside of positions favored by Binance laminitis Changpeng Zhao. With an awesome $58.8 cardinal successful full PNL, this whale is presently agelong 62,156 ETH—a monolithic $194 cardinal position. His trades person often been aboriginal indicators of wide marketplace direction, adding value to this displacement toward bullish exposure.

Finally, pension-usdt.eth, a consistently profitable whale code with $16.3 cardinal successful realized gains, is long 20,000 ETH valued astatine $62.5 million.

Taken together, these positions bespeak a unified stance among top-performing whales: contempt marketplace uncertainty, they are positioning for Ethereum strength.

Weekly Structure Shows Early Signs of Stabilization

Ethereum’s play illustration reveals a marketplace attempting to regain its footing aft a crisp multi-week diminution from the $4,500 region. The caller reclaim of $3,150 is simply a meaningful development, arsenic this level aligns intimately with anterior play enactment from mid-2024 and sits conscionable supra the 50-week moving average—an country that often acts arsenic a trend-defining zone. ETH concisely dipped beneath this portion during the November selloff, but buyers stepped successful aggressively, producing a beardown play wick that signals request astatine little levels.

ETH consolidates astir captious level | Source: ETHUSDT illustration connected TradingView

ETH consolidates astir captious level | Source: ETHUSDT illustration connected TradingViewDespite this betterment attempt, ETH remains beneath cardinal absorption levels. The 20-week and 100-week moving averages are positioned supra the existent terms and converging, creating a portion of imaginable rejection unless momentum strengthens. For now, ETH is trading successful a transitional structure: nary longer trending downward aggressively, but not yet showing a confirmed bullish reversal connected precocious timeframes.

Volume patterns besides enactment this interpretation. Selling measurement has diminished compared to the capitulation phase, portion caller greenish candles amusement mean but dependable buying interest—suggesting accumulation alternatively than afloat risk-on behavior.

If ETH tin found consecutive play closes supra $3,200–$3,300, the illustration opens the doorway for a retest of the $3,600–$3,800 range. Failure to clasp $3,150, however, risks different determination toward $2,800 support.

Featured representation from ChatGPT, illustration from TradingView.com

2 months ago

2 months ago

English (US)

English (US)