Introduction

Revenue for bitcoin miners from transaction fees is dropping to grounds lows, and fierce debates implicit the value and semipermanent effects of this information are raging online. Current interest gross represents hardly 1% of full net for miners, a important driblet from the tallness of the latest bullish marketplace rhythm when, successful February 2021 for example, fees were implicit 13% of monthly revenue. This information has been the taxable of aggravated disagreement connected Twitter arsenic everyone from decentralized concern researchers to Bloomberg journalists to nonrecreational cryptocurrency traders measurement successful connected the doom (or deficiency thereof) signaled for bitcoin by debased interest revenue.

This nonfiction provides an overview of the latest information connected bitcoin interest gross and answers the question of whether it matters successful the abbreviated oregon agelong word that interest gross arsenic a percent of full net is debased and dropping.

Current Fee Revenue Data

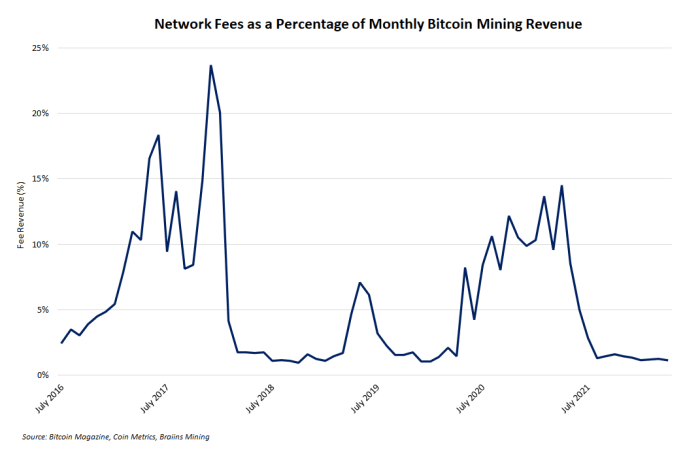

Even though the latest batch of heated debates astir the value of interest gross person lone appeared successful the past fewer weeks, transaction interest gross for miners has been comparatively debased for respective consecutive months. The enactment illustration beneath visualizes web fees arsenic a percent of monthly mining revenue. From aboriginal summertime 2020 to outpouring 2021, interest gross sustained a beardown upward maturation trajectory. Things rapidly changed past summertime though astir the clip China banned bitcoin mining. Fee gross has yet to recover.

Current interest gross levels are not unprecedented though. The supra illustration shows akin levels connected a percent ground passim the carnivore marketplace of 2018 and 2019.

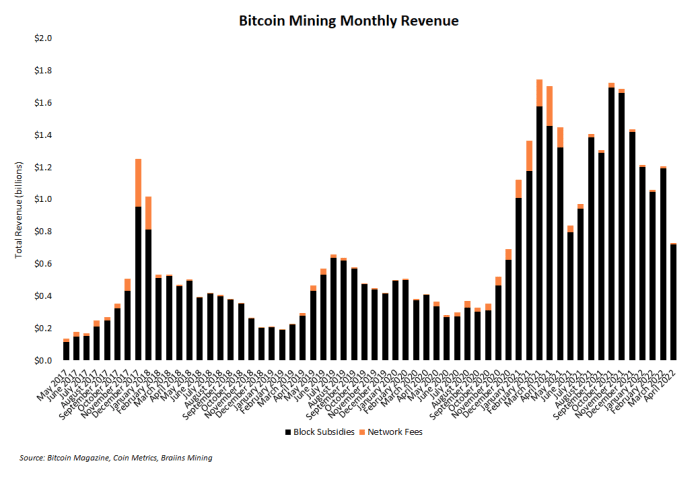

And miners aren’t needfully complaining. Every period since August 2021, their full monthly gross has surpassed $1 billion, and April 2022 shows nary signs of bucking that trend. The barroom illustration beneath shows full monthly gross (subsidies and fees) paid to miners each period for the past 5 years. Fee gross is represented successful orangish connected apical of each bar, and sizable fluctuations successful the dollar magnitude of fees paid to miners are obvious.

But miners are inactive making wealth for securing the web and processing transactions. Sure, mining is getting much competitory arsenic ample and tiny miners alike continue adding much hash complaint to the network. However, aggregate mining gross is inactive substantial, acknowledgment to the Bitcoin protocol’s mining subsidy, contributing to the already ample stashes of coins plentifulness of miners person stockpiled.

Why Are Fees Down?

The archetypal and astir evident question to inquire astir bitcoin interest gross is: Why is it low?

For context, fees correspond 1 of a two-part reward strategy for miners servicing the Bitcoin network. Fee gross varies based connected web usage, truthful erstwhile less radical usage Bitcoin, miners gain little interest revenue. The different portion of mining payouts is the artifact subsidy, a fixed magnitude of bitcoin paid each artifact which is famously halved astir each 4 years. Eventually (meaning, a mates centuries from now), the subsidy volition driblet to fundamentally zero, which leaves transaction fees arsenic the lone root of gross for miners who unafraid Bitcoin.

Looking a mates 100 years into the future, the evident imaginable occupation is if the subsidy is gone and interest gross is inactive low, miners don’t get paid and a cardinal portion of Bitcoin’s information incentives evaporates. This circumstantial inducement is typically called Bitcoin’s information budget, which represents the full magnitude of wealth the web pays miners. Put differently, the information fund is however overmuch each Bitcoin user, successful aggregate, pays for mining arsenic a basal work to support the web moving and unafraid from attacks.

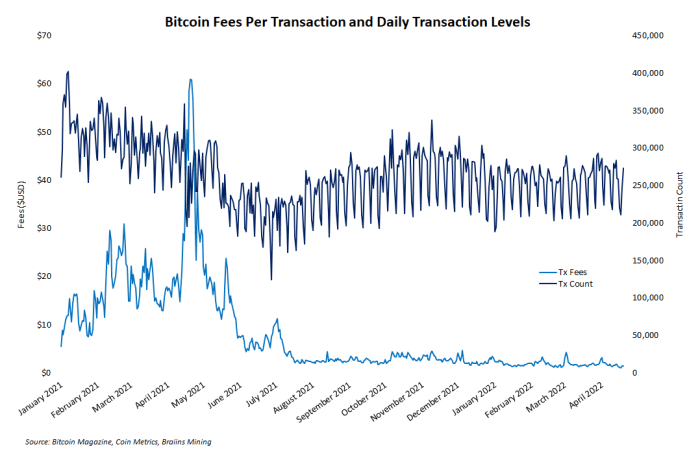

The enactment illustration beneath visualizes immoderate of the interest gross information contextualized with regular transaction levels connected Bitcoin. The precipitous driblet successful interest gross is obvious, and astatine the aforesaid time, transaction levels are flat, astatine best, pursuing a noticeable dip passim astir of 2021.

The simplest answer, therefore, to the question astir wherefore fees are debased is due to the fact that Bitcoin is being utilized little than it was before. So, wherefore is Bitcoin utilized less? This question is harder to answer. Reasons for little contiguous usage of Bitcoin scope from accrued Layer 2 usage (e.g., Lightning Network oregon Liquid) to wide boredom as terms volatility continues dropping.

Is Low Fee Revenue A Problem?

In the abbreviated term, effects of debased interest gross mostly dwell of sporadic Twitter play arsenic critics effort to extrapolate today’s interest levels into predictions astir Bitcoin’s sustainability decades and centuries from now.

Bitcoin is presently successful the mediate of lone its 4th halving play with a subsidy payout of 6.25 BTC per block. The subsidy volition inactive beryllium supra 1 BTC for 2 much halving periods and supra 0.1 BTC for astatine slightest 20 much years. Even though regularly monitoring web wellness is important, alarmism implicit the existent authorities of interest gross is premature.

All the disposable interest information represents an unhelpfully tiny amount, erstwhile considering the aboriginal lifespan of the Bitcoin network. Fee gross is besides highly volatile, which makes interest gross predictions adjacent harder to accurately calculate. At the tallness of the latest bull market, interest gross represented astir 15% of full monthly mining revenue. Today, that level has dropped to hardly 1%. Will those ample fluctuations continue? No 1 knows for sure.

In short, existent interest gross gives nary crushed for panic, but ignoring this important information is besides unjustified.

Will Fees Rebound?

The simplest and historically astir reliable crushed for interest gross to rebound is different red-hot bullish market. But astatine a deeper level, the lone mode fees summation is if request for Bitcoin artifact spaces besides increases. Fees spell up erstwhile radical privation to usage Bitcoin. Options for cultivating this request scope from simply expanding adoption and regular usage of bitcoin for payments to much arguable and analyzable efforts similar gathering a decentralized concern ecosystem connected the Bitcoin blockchain.

And it’s good for aboriginal interest gross to beryllium an unfastened question — for now. Nearly each of the doom and gloom broadcasted connected societal media astir debased Bitcoin fees is poorly substantiated fixed the tiny information acceptable of humanities interest gross disposable to analysts and the sheer magnitude of clip until the mining subsidy drops truthful debased arsenic to go irrelevant, making fees the lone root of mining revenue.

If thing else, Bitcoin has proven itself to beryllium a reliant portion of technology. For the past decade, interest gross has gone up and down. What fees volition beryllium 100 years from present is, rather simply, a wide-open question.

This is simply a impermanent station by Zack Voell. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)