ETH devs link successful Amsterdam

This past Monday capped disconnected the last time of Devconnect – a week-long gathering for Ethereum developers organized by the Ethereum Foundation (EF). The league successful Amsterdam overlapped with 4/20 (or April 20, seemingly a moving vacation successful Ethereum-land), but the existent gully was the adept talks connected everything from maximum extractable value (ooh) to applied zero-knowledge technology (ahh).

The Devconnect itinerary was jam-packed with panels and presentations featuring everyone from Ethereum co-founder Vitalik Buterin to pseudonymous crypto-sage Hasu.

This nonfiction primitively appeared successful Valid Points, CoinDesk’s play newsletter breaking down Ethereum’s improvement and its interaction connected crypto markets. Subscribe to get it successful your inbox each Wednesday.

The league besides aligned with the merchandise of the Ethereum Foundation’s 2022 yearly report, marking the archetypal clip the enactment has publically disclosed a summary of its finances.

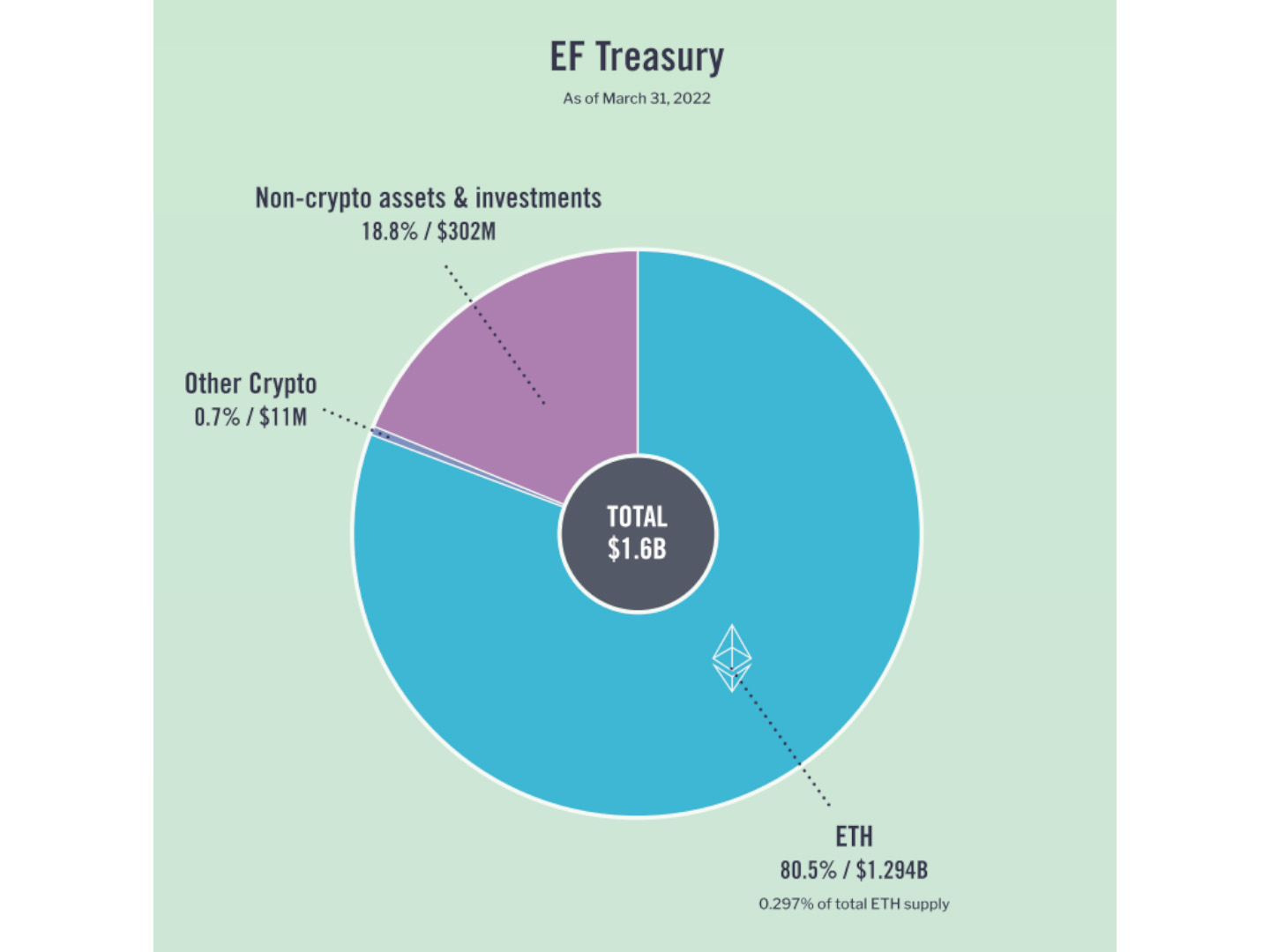

In the report, the non-profit steward of the Ethereum ecosystem disclosed that it holds astir 0.3% of each ether (ETH). While there’s been a bully spot of reporting connected this number, you could person conscionable looked up the EF’s Ethereum code yourself if ever you wanted to cognize however overmuch ETH was successful the organization’s treasury.

What’s much absorbing is that successful summation to $1.3 cardinal successful ETH and $11 cardinal successful different cryptocurrencies, the EF disclosed that it holds $300 cardinal successful non-crypto investments.

Ethereum Foundation Treasury arsenic of March 31, 2022 (Ethereum Foundation) (Ethereum Foundation)

While it would beryllium casual to poke amusive astatine the Ethereum Foundation for holding immoderate of its treasury successful cold, hard, government-issued cash, I don’t hold with the Twitter critics who accidental this signals the EF doesn’t person religion successful ETH arsenic a existent store of value.

It’s not anti-Ethereum to admit that ETH inactive suffers from comparatively precocious volatility, truthful having a clump of fiat connected manus to put and wage the bills makes consciousness connected a applicable level.

Mind you, the Ethereum Foundation hasn’t ever been truthful flush with cash. Crypto writer Laura Shin recorded the Ethereum Foundation’s rocky fiscal past successful her precocious published (and highly entertaining) past of Ethereum, “The Cryptopians.”

The Ethereum Foundation, which is registered arsenic a Swiss non-profit, was formed successful 2014 to negociate the archetypal ETH token organisation lawsuit and service arsenic an authoritative hub for Ethereum ecosystem development.

Around 3 cardinal ETH (or 5% of the archetypal ETH supply) went to a semipermanent EF endowment, according to crypto research steadfast Messari, but – arsenic Shin notes successful her publication – a ample information of that ETH was sold successful Ethereum’s earlier years to support the fledgling task afloat.

Throughout its aboriginal history, the Ethereum Foundation was seemingly plagued by fiscal mismanagement, capable to astir imperil the full project.

While $300 cardinal is simply a full batch of fiat, a divers concern portfolio could spell a agelong mode toward helping the EF (and possibly Ethereum arsenic a whole) upwind the tempest should ETH ever instrumentality a large deed to its price.

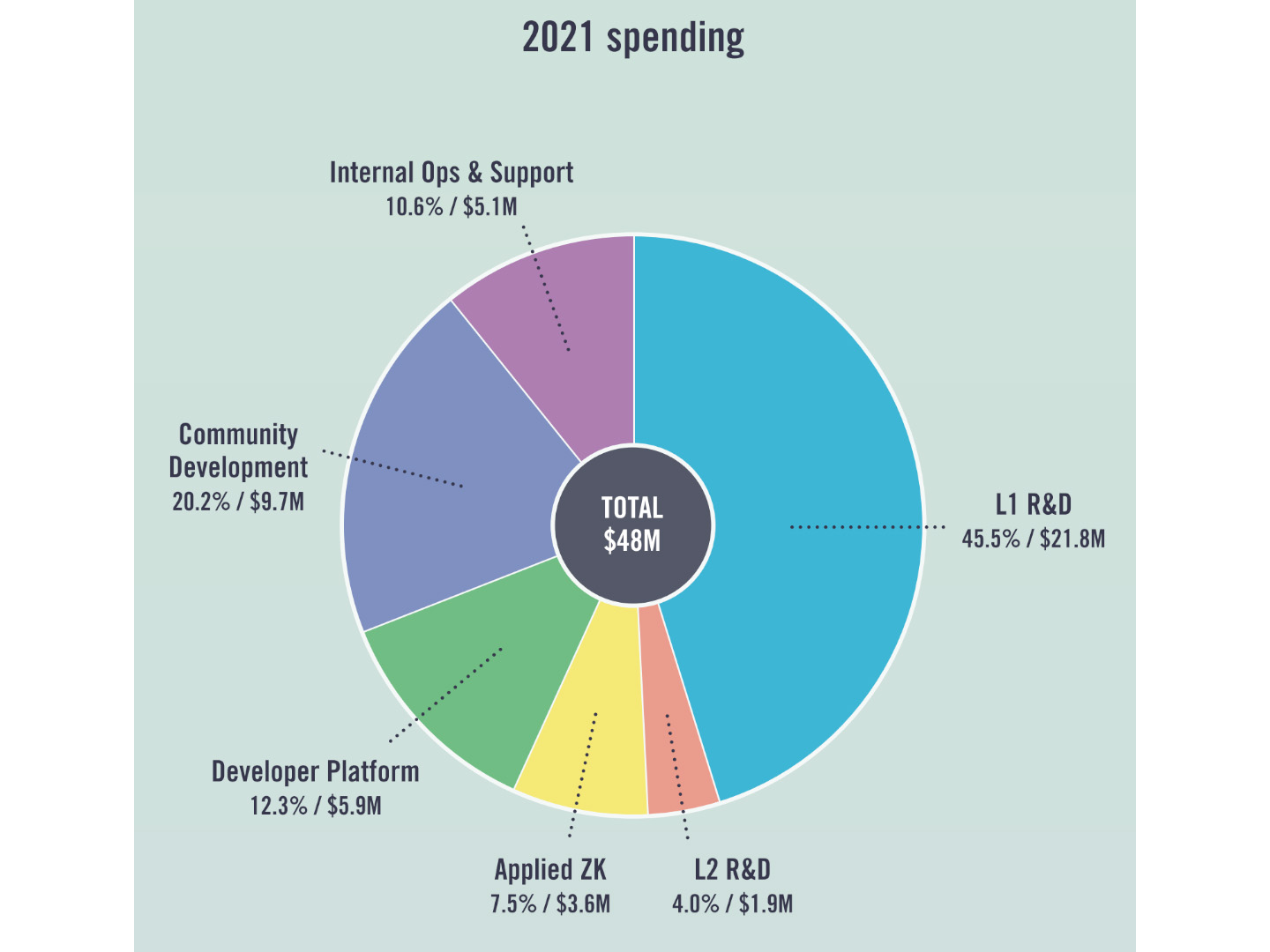

In summation to providing a breakdown of the EF treasury, the study includes details connected however the treasury has been utilized to spur ecosystem maturation implicit the past year.

The EF said it spent $48 cardinal past twelvemonth to proceed its ngo of increasing the Ethereum ecosystem. “Approximately $20 cardinal of this full was successful the signifier of outer spending, which includes grants, delegated domain allocations, 3rd enactment funding, bounties, and sponsorships,” according to the report. “The remaining $28 cardinal was utilized to money teams and projects wrong the EF community.”

Ethereum Foundation 2021 Spending (Ethereum Foundation) (Ethereum Foundation)

In its report, the EF spoke astir however it has partnered with third-party organizations similar Gitcoin to usage quadratic backing to reward grants to nationalist goods projects.

In Ethereum development, “public goods” notation to infrastructure which benefits the broader Ethereum ecosystem and improvement community. Organizations similar Gitcoin grant grants to nationalist goods according to a assemblage vote. They usage “quadratic funding” – a elemental mathematical look – to guarantee the largest projects don’t tally distant with each of the funding.

Keep an oculus retired for a aboriginal variation of this newsletter to perceive a spot much astir my thoughts connected the advantages (and disadvantages) of what Gitcoin calls an “optimal” method of nationalist goods funding.

EF study aside, nary Ethereum newsletter tin extremity without immoderate notation of The Merge – Ethereum’s upcoming displacement successful statement mechanisms.

As Devconnect was wrapping up this past weekend, developers could beryllium recovered huddled together successful conference rooms to show the 2nd shadiness fork of the Ethereum mainnet. If you’ve been pursuing on the past fewer weeks, you whitethorn callback proceeding astir shadiness forks, which are similar signifier runs of Ethereum’s modulation into a proof-of-stake network.

Ethereum halfway developer Tim Beiko gives a much elaborate overview of shadiness forks successful his Ethereum Roadmap FAQ – a coagulated sojourn if you’re looking for a much in-the-weeds update connected however the Merge is progressing.

Per Beiko’s FAQ: “TL;DR: a shadiness fork is simply a caller devnet created by forking a unrecorded web with a tiny fig of nodes. The shadiness fork keeps the aforesaid authorities & history, and tin truthful replay transactions from the main network.”

As for wherefore shadiness forks are important, Beiko explains that they “allow america to spot however nodes respond erstwhile The Merge happens utilizing lone a tiny fig of nodes and without disrupting the canonical chain.”

Ethereum developers person been moving shadiness forks connected Ethereum testnets for the past respective weeks, and they ran the archetypal shadiness fork connected Ethereum’s mainnet astir 2 weeks ago.

A mainnet shadiness fork is similar the Mount Everest of shadiness forks, simulating however the web volition respond nether the astir realistic (read: astir complicated) conditions.

While the past 2 mainnet forks person been “successful” – meaning the web was capable to successfully modulation from proof-of-work to proof-of-stake – node operators person tally into issues that inactive request to beryllium addressed earlier the existent Merge takes spot (hopefully sometime aboriginal this year).

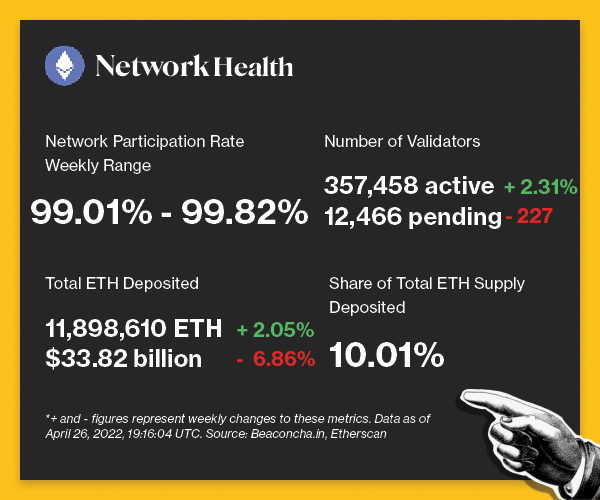

The pursuing is an overview of web enactment connected the Ethereum Beacon Chain implicit the past week. For much accusation astir the metrics featured successful this section, cheque retired our 101 explainer connected Eth 2.0 metrics.

Valid Points Network Health 4.26 (Sage D. Young)

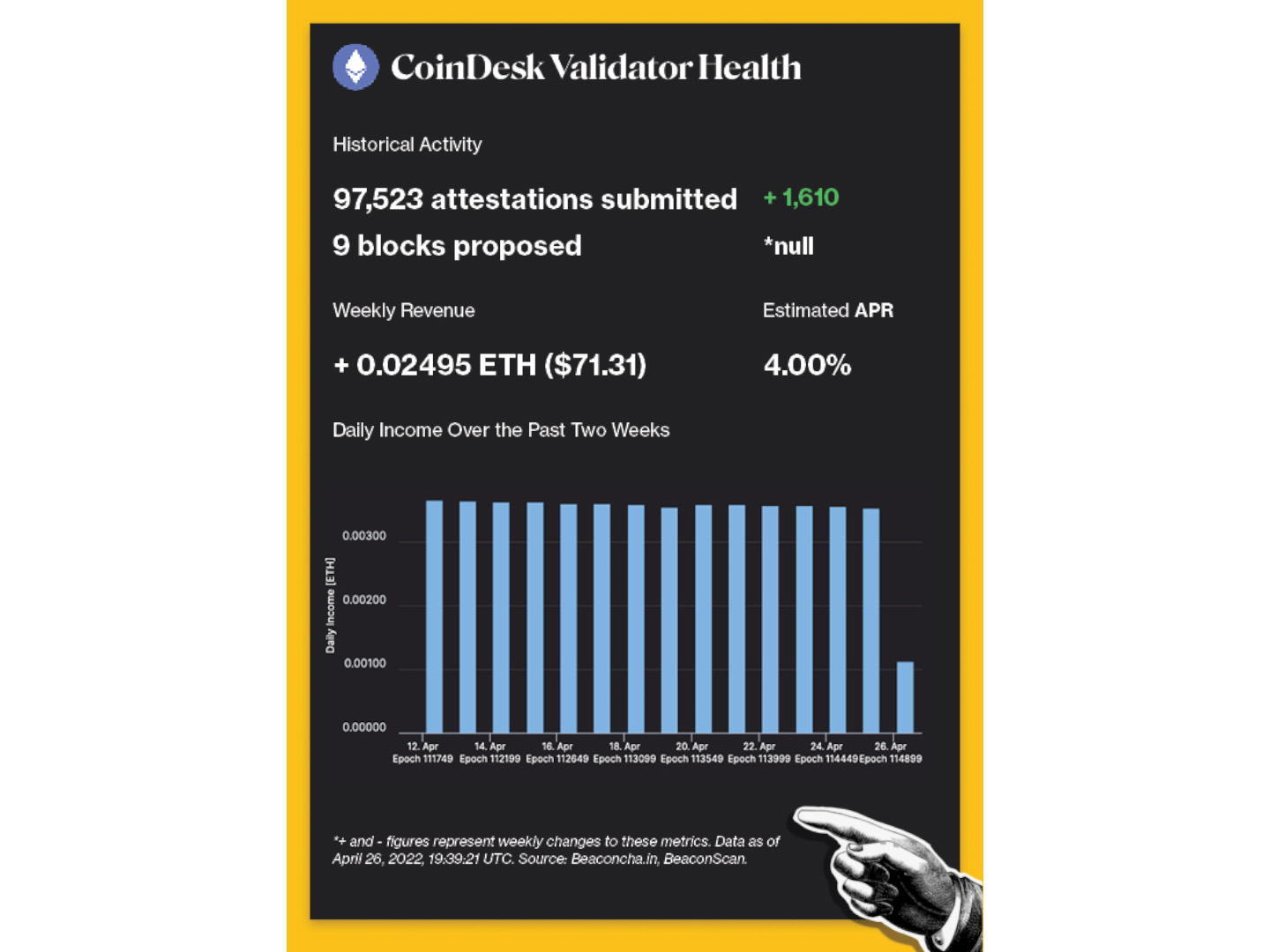

CoinDesk Validator Health 4.26 (Sage D. Young)

Disclaimer: All profits made from CoinDesk’s Eth 2.0 staking task volition beryllium donated to a foundation of the company’s choosing erstwhile transfers are enabled connected the network.

Fireblocks, a cryptocurrency custody specialist, saw $500 cardinal deployed into Terra DeFi successful the archetypal week.

WHY IT MATTERS: Fireblocks gave organization customers entree to Terra, the blockchain ecosystem and issuer of UST, the largest stablecoin aft USDT and USDC. Consequently, organization customers stampeded into decentralized concern (DeFi). Fireblocks CEO Michael Shaulov said pent-up request from members of the company’s aboriginal entree program, including crypto hedge funds, task superior firms and precocious net-worth individuals, has been “crazy.” Read much here.

WHY IT MATTERS: In the latest section of the Elon Musk-Twitter saga, Tesla and SpaceX’s main enforcement reached a woody to bargain Twitter astatine a $44 cardinal valuation. “Twitter is the integer municipality quadrate wherever matters captious to the aboriginal of humanity are debated,” said Musk. Twitter’s autarkic committee chair, Bret Taylor said, “the projected transaction volition present a important currency premium, and we judge it is the champion way guardant for Twitter’s stockholders.” Read much here.

WHY IT MATTERS: While determination isn’t a nonstop correlation betwixt dogecoin’s terms and Musk’s acquisition, Musk has repeatedly endorsed the meme coin. In a tweet connected April 9, helium suggested utilizing dogecoin payments for the Twitter Blue premium service. Moreover, Tesla already accepts DOGE payments connected its online merchandise store, and Musk has indicated helium worked with dogecoin developers to amended its efficiency. Read much here.

WHY IT MATTERS: Many Russians overseas were unbanked soon aft the Feb. 24 penetration erstwhile Visa and Mastercard stopped processing payments for Russian cards. The deficiency of accepted options spurred cryptocurrency adoption for Russian emigrés globally. For immoderate Russian emigrés, cryptocurrency was their backup enactment fixed that thing other worked. Read much here.

Residents successful Buenos Aires, the superior of Argentina, volition soon beryllium capable to wage their taxes utilizing cryptocurrencies, according to Mayor Horacio Rodríguez Larreta and Secretary of Innovation and Digital Transformation Deigo Fernández.

WHY IT MATTERS: This is the latest measurement Buenos Aires is taking to integrate cryptocurrency into their society. The announcement follows Buenos Aires’ achromatic insubstantial presumption backmost successful March that projected a blockchain-based integer individuality level that aims to springiness the city’s residents power implicit their idiosyncratic data. Read much here.

Valid Points Factoid 4.27 (Sage D. Young)

Valid Points incorporates accusation and information astir CoinDesk’s ain Ethereum validator successful play analysis. All profits made from this staking task volition beryllium donated to a foundation of our choosing erstwhile transfers are enabled connected the network. For a afloat overview of the project, cheque retired our announcement post.

You tin verify the enactment of the CoinDesk Eth 2.0 validator successful existent clip done our nationalist validator key, which is:

0xad7fef3b2350d220de3ae360c70d7f488926b6117e5f785a8995487c46d323ddad0f574fdcc50eeefec34ed9d2039ecb.

Search for it connected immoderate Eth 2.0 artifact explorer site.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)