With Bitcoin down immoderate 20% from its year-to-date high, it’s often adjuvant to zoom retired and look astatine the broader picture. I person a saved illustration of each the tokens listed successful the Coinbase and Binance lawsuits filed (C&B suits) connected June 6 and June 5, 2023, respectively, and their prices arsenic denominated successful Bitcoin.

For context, some Binance and Coinbase are presently defending their positions successful U.S. courts. The cardinal contented successful some lawsuits is whether the crypto assets offered by these exchanges should beryllium classified arsenic securities and, therefore, autumn nether SEC regulation.

The tokens described arsenic imaginable securities successful the abovementioned lawsuits included Alogrand, Solana, Cardano, Near, Filecoin, and others, arsenic shown successful the illustration below. Let’s analyse however these assets person performed compared to Bitcoin implicit the past 8 months and past look astatine immoderate of the standout tokens’ show successful dollar terms.

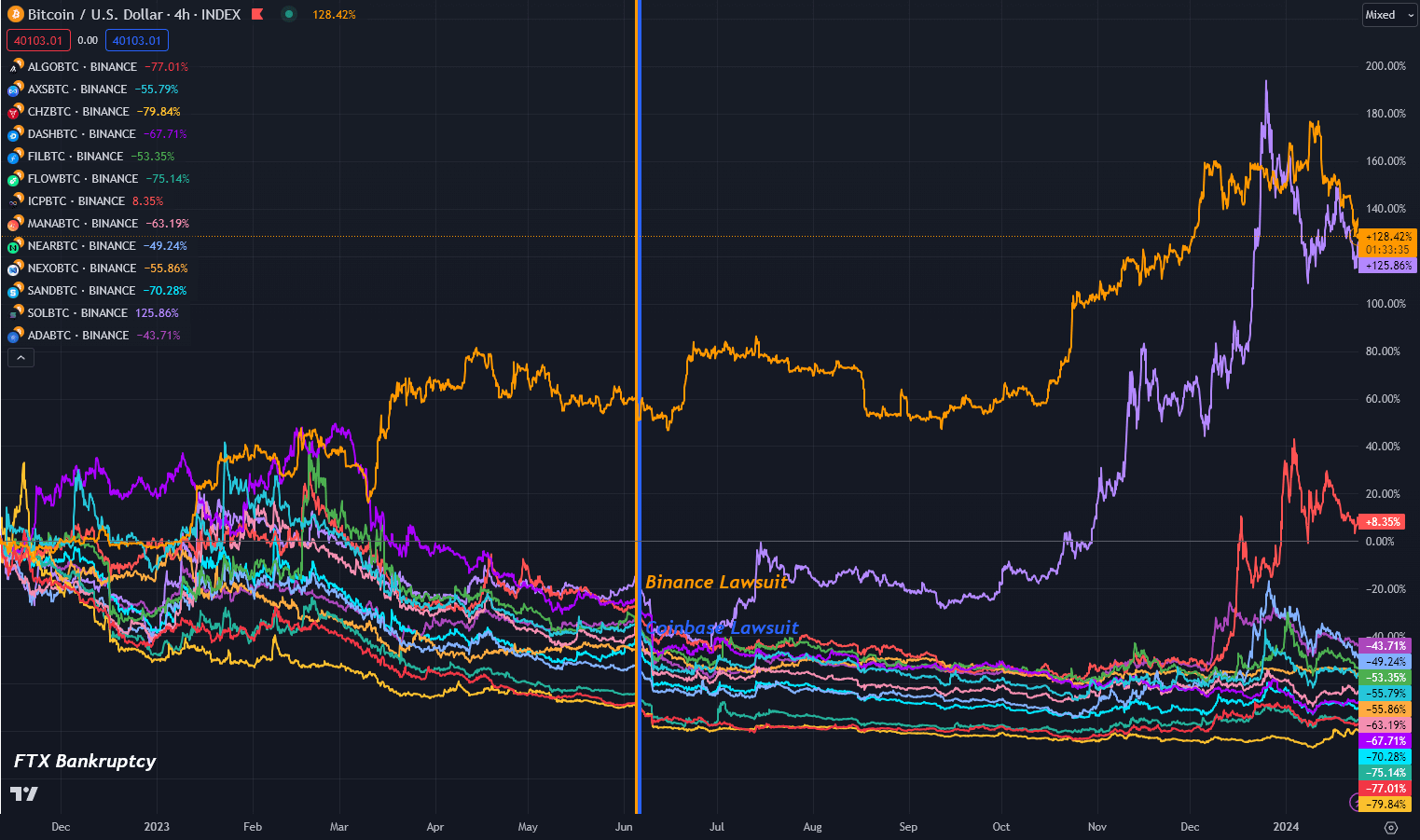

For context, we’ll archetypal look astatine the show of this cohort of integer assets since the achromatic swan lawsuit that preceded the C&B suits, namely the bankruptcy filing and consequent illness of FTX. The speech filed for Chapter 11 bankruptcy connected Nov. 11, 2023, erstwhile Bitcoin was priced astir $16,900. Since then, it has soared by astir 140% against the dollar, with lone 2 assets outperforming it.

Solana and ICP saw increases successful their terms successful BTC terms, expanding 116% and 9% respectively. All different tokens listed arsenic imaginable securities declined against Bitcoin betwixt -41% and -80%

Token show since the FTX collapse

Token show since the FTX collapseThe champion was Cardano, which mislaid 41% of its worth against Bitcoin; the worst was Chilliz, which declined -80%. In dollar terms, Cardano is up 50%, portion Chilliz is down -53%, showcasing the spot of Bitcoin implicit the past 15 months.

Performance since Coinbase and Binance SEC lawsuits.

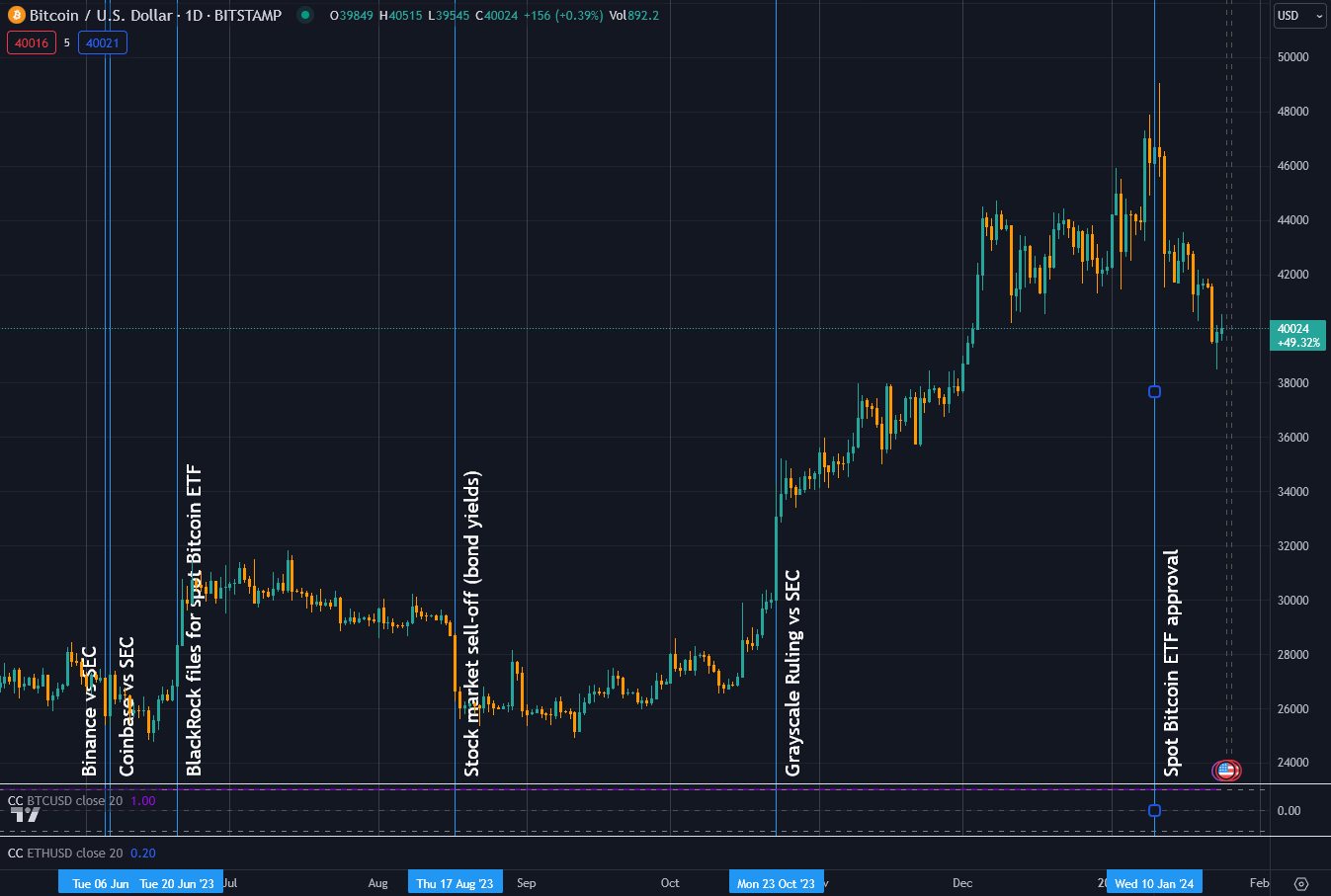

When Binance and Coinbase were deed with SEC lawsuits wrong a time of each different past June, the marketplace reeled from the interaction of the 2 astir salient names successful crypto exchanges being truthful straight targeted. On June 5, erstwhile Binance was served, Bitcoin fell to $25,300 from astir $26,800. However, connected the time Coinbase was served, it regained its worth earlier dilatory bleeding retired to astir $25,00 mid-way done the money.

On June 20, 2023, BlackRock filed its exertion for a spot successful Bitcoin ETF, which saw Bitcoin’s terms elevate to implicit $30,000 until a banal marketplace sell-off successful August reversed the gains. From there, it traded sideways until Grayscale’s triumph successful tribunal against the SEC, erstwhile the terms took disconnected toward its eventual 2-year precocious of $49,000 connected the time the spot Bitcoin ETFs launched. At this peak, Bitcoin was up 90% since the C&B suits.

Events affecting Bitcoin terms since Coinbase lawsuit

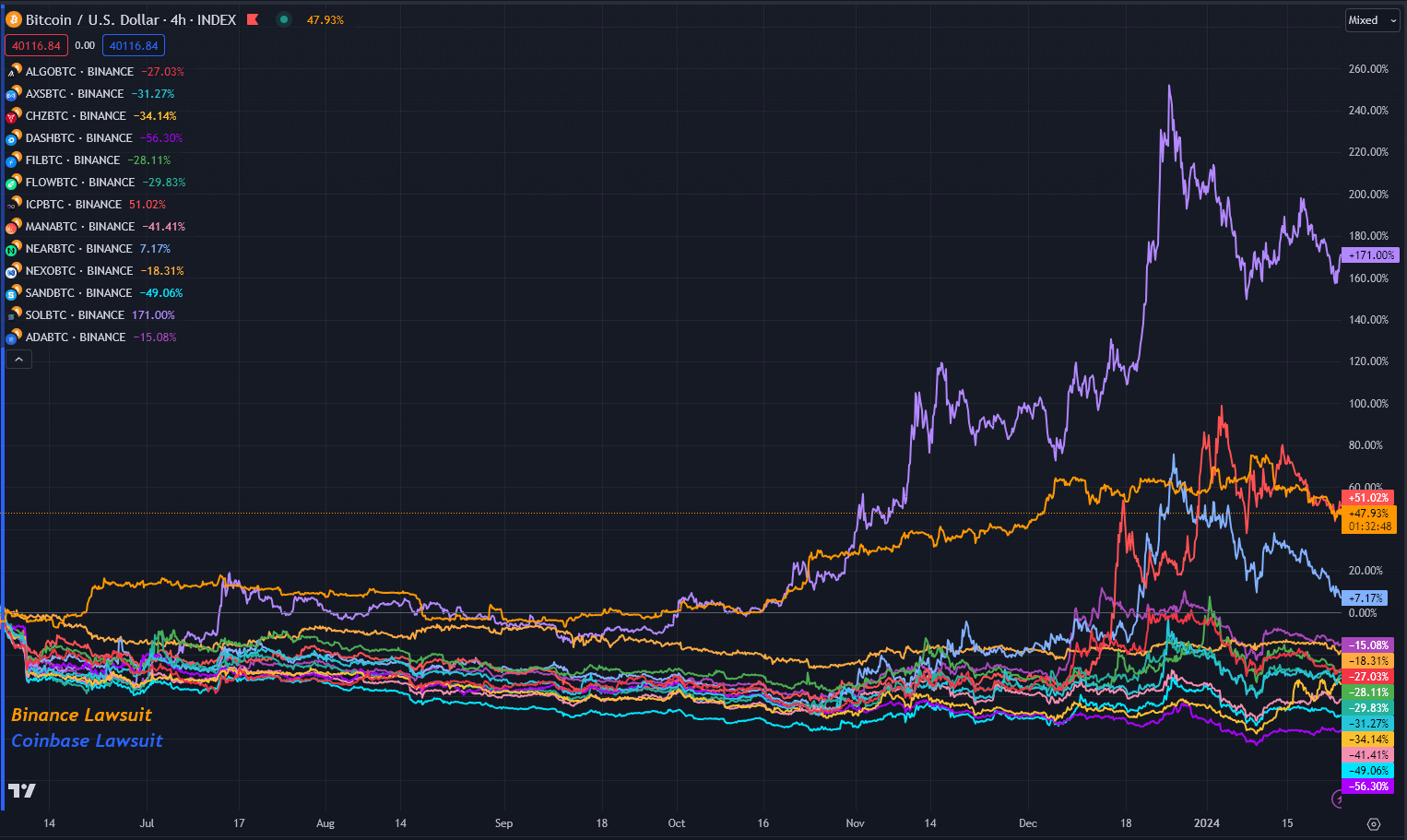

Events affecting Bitcoin terms since Coinbase lawsuitAs of property time, having retraced somewhat, Bitcoin is up 47% since the C&B suits, with 3 assets having performed better. Solana and ICP outdid Bitcoin, this clip by 169% and 49%, respectively. However, Near Protocol is besides up 8% connected Bitcoin.

Token show since Binance and Coinbase lawsuits

Token show since Binance and Coinbase lawsuitsAll different tokens threatened with categorization arsenic a Security fell against Bitcoin wrong the timeframe, the worst present Dash declining -56%, with the slightest affected being Cardano, down -15%.

Notably, against the dollar, Solana, ICP, and Near are up 286%, 265%, and 145%, respectively, implicit the aforesaid timeframe. Moreover, adjacent the biggest loser against Bitcoin, Dash, is up 4%, and Cardano is up 87% against the dollar.

tokens vs. dollar terms since suits

tokens vs. dollar terms since suitsWhen you terms everything successful dollars successful crypto, you tin miss that your assets person declined successful Bitcoin terms.

Binance and Coinbase support their positions successful court.

Although astir of the manufacture has been focused connected ETFs this year, Binance’s lawsuit was heard connected Jan. 22 successful a Washington courtroom, with Judge Amy Berman Jackson of the District of Columbia presiding, and Coinbase appeared successful a New York tribunal connected Jan. 17, with Judge Katherine Polk Failla overseeing the proceedings.

The SEC’s statement against Binance focused connected Binance’s BUSD stablecoin and BNB token, suggesting that astatine slightest the BNB token mightiness person initially been sold arsenic an concern contract. Binance’s defence challenged the applicability of the Howey trial to cryptocurrencies and disputed the SEC’s comparisons to different tribunal cases, specified arsenic Zakinov v. Ripple Labs.

Coinbase besides contested the relevance of the Howey trial for cryptocurrencies. The SEC’s wide attack raised concerns astir extending the explanation of securities to encompass categories typically extracurricular its purview, specified arsenic collectibles. Judge Failla acknowledged the complexity of the contented and deferred her decision.

Elliott Stein, a elder litigation expert astatine Bloomberg, assessed a 70% likelihood of the SEC’s June 2023 suit against Coinbase being dismissed. However, a triumph for the SEC successful either lawsuit could person important implications for the cryptocurrency industry. It could mandate crypto exchanges to dainty integer tokens arsenic securities, fundamentally altering however these assets are handled and regulated successful the U.S.

The outcomes of these cases volition acceptable precedents for the aboriginal regularisation of integer assets successful the state and volition apt person a tangible interaction connected the tokens named successful the C&B suits.

The station Solana and ICP up implicit 49% against Bitcoin since SEC labeled them arsenic securities appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)